October 21, 2021

Constantine Metal Resources Ltd.(TSXV:CEM) is actively advancing the Palmer copper-zinc-silver-gold-barite project with its joint venture partner, Dowa Metals & Mining Co. Ltd (“Dowa”) where Constantine is the project operator and US $60 million has been spent to date. The Dowa – Constantine partnership was initiated in 2013 and has moved the project to a positive Preliminary Economic Assessment (PEA) in 2019.

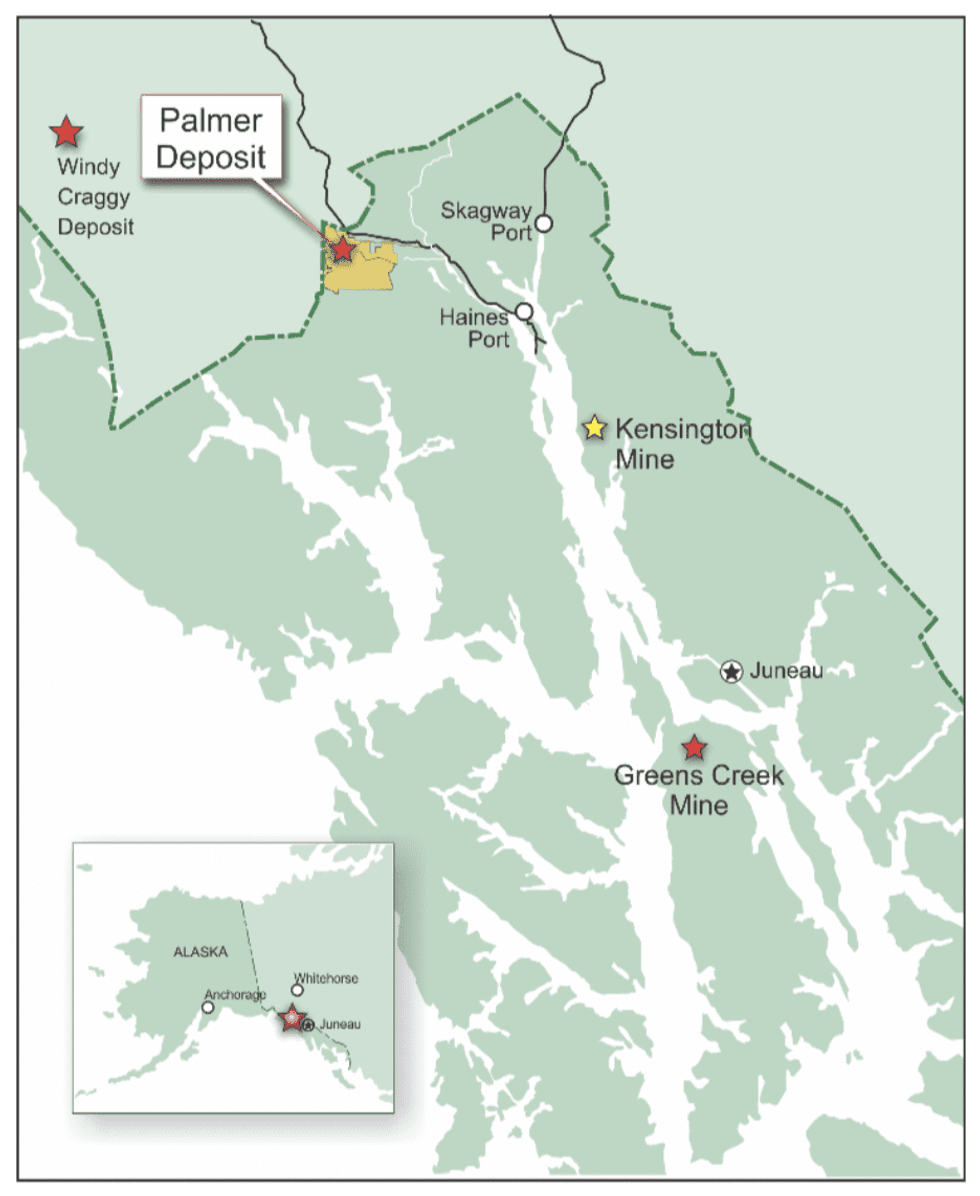

The Palmer property is located in southeast Alaska within a premiere mineral belt that is home to Greens Creek (Hecla Mining), a producing, very high grade, Ag-Zn-Au-Pb mine, the Kensington Gold Mine (Coeur Mining), and the giant world-class Windy Craggy Cu-Zn-Au-Ag deposit. Palmer, Green’s Creek and Windy Craggy are volcanogenic massive sulphide (VMS) deposits that all occur in the same age rocks.

Constantine Metal Resources’ Company Highlights

- Constantine Metal Resources (TSXV:CEM) is a base and precious metal exploration company focused on mining at premier locations in North America.

- The Company is led by a strong management team, providing decades of mining and international business experience

- The flagship Palmer copper-zinc-silver-gold-barite project in southeast Alaska is strategic joint venture with Dowa Metals & Mining, the largest zinc smelting company in Japan that de-risks the project and holds the off-take rights for 100% of the zinc concentrate at arm’s length commercial terms.

- The Palmer project is 60 kilometers by road from a deep seaport, and a local workforce.

- The property has favorable geology for responsible mine design: (1) underground (2) small footprint (3) abundance of carbonate-rich, environmentally benign host rocks. A unique low-sulphide VMS with more barite than pyrite (actually a sulphide-sulphate deposit)

- The deposit is twenty-five weight percent barite that is environmentally inert and has favourable metallurgy to produce by-product drilling muds for the oil and gas industry.

- A 2019, a preliminary economic assessment (PEA) of the project estimates a US$266M after-tax NPV7% at more conservative prices than today and presents a low capex, low operating cost, high margin underground mining operation with attractive environmental attributes. Substituting today’s metal prices at $4.50 copper, $1.40 zinc, $23 silver and $1750 gold, increases the NPV7% significantly.

- In September 2019, Constantine successfully spun-out its gold assets into HighGold Mining Inc. (TSXV: HIGH) where shareholders received 1 HighGold share for every 3 Constantine shares held. The properties included the high-grade Johnson Tract gold project in south-central Alaska and the Munro-Croesus gold property which is renowned for its high-grade mineralization in the Timmins area, Ontario. Currently, HighGold has a market cap of approximately $100 million.

- More recently, the 100% owned Big Nugget Gold project, located 8 kilometers east of the Palmer Project, was recognized as a potential gold lode source area, immediately upstream from the +80,000 ounce gold Porcupine Placer operations; and in May 2021, Constantine announced the acquisition of the Bouse Cu-Au Property in southwest Arizona, that will be explored for its copper-gold potential.

CEM:CA

The Conversation (0)

21 October 2021

Constantine Metal Resources

A Base and Precious Metal Exploration Company with Exceptional Assets

A Base and Precious Metal Exploration Company with Exceptional Assets Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00