May 14, 2024

Colibri Resource Corporation (TSXV: CBI) ("Colibri" or the "Company") is pleased to report that the co-owner of its Pilar Gold & Silver Project in Sonora, Mexico, Tocvan Ventures (51% interest) has announced the results from the initial four of fifteen holes drilled to date in the ongoing Phase 4 RC drill program. Hole JES-24-77 was drilled in the 4-T Trend area and is reported to be the longest and highest-grade gold intersection to date outside of the Main Zone. Colibri owns a 49% interest in the Pilar Gold & Silver Project.

Highlights from Tocvan Pilar News Release – May 14th, 2024:

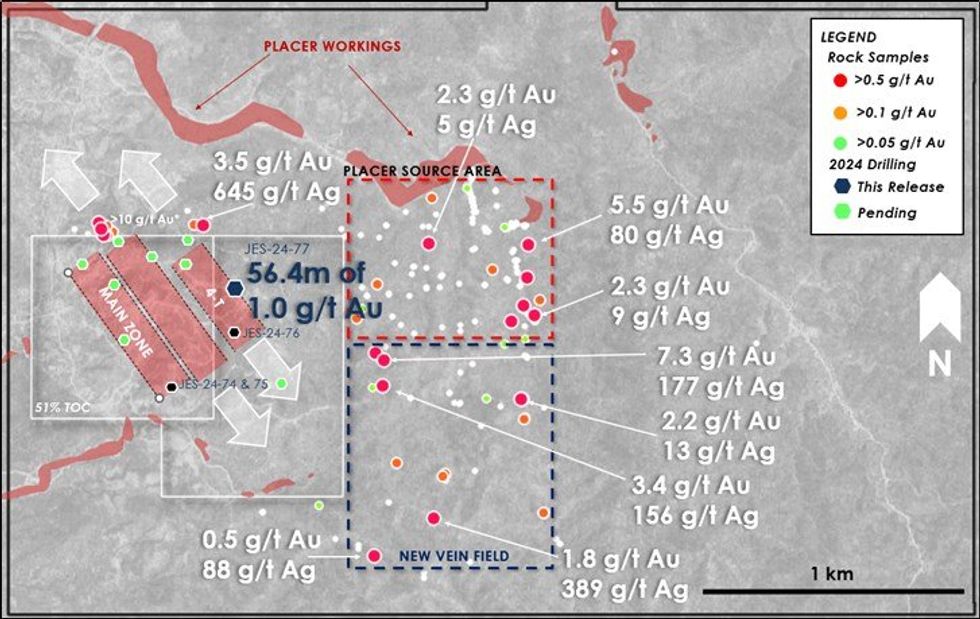

- Best Intersection to date from 4-T Trend (400 meters East of Main Zone) in Drillhole JES-24-77

- Drilling Intersects 56.4 meters of 1.0 g/t Au, 18.3 meters from Surface in Drillhole JES-24-77

- Including 9.2 meters of 5.3 g/t Au, 27.5 meters from surface

- Top 5 Drill Result from Tocvan Programs to Date

- 1. JES-20-32, 94.6m of 1.6 g/t Au and 9 g/t Ag (RC)

- 2. JES-22-59, 116.9m of 1.2 g/t Au and 7 g/t Ag (Core)

- 3. JES-22-62, 108.6m of 0.8 g/t Au and 3 g/t Ag (Core)

- 4. JES-20-36, 24.2m of 2.5 g/t Au and 73 g/t Ag (RC)

- 5. NEW - JES-24-77, 56.4m of 1.0 g/t Au and 1 g/t Ag (RC)

- Result of JES-24-77 Opens Up Resource Potential Along Eastern Corridor

- Additional Results Pending

For full details please see the Tocvan Ventures news release dated May 14th, 2024 below:

Calgary, Alberta – May 14, 2024 – Tocvan Ventures Corp. (CSE: TOC) (OTCQB: TCVNF) (FSE: TV3) (the "Company"), is pleased to announce first drill results from its 2024 Reverse Circulation (RC) drill program at its road accessible Pilar Gold-Silver project in mine-friendly Sonora, Mexico. A total of 1,825.4 meters has been drilled to date in 15 drillholes.

Results today are highlighted by drillhole JES-24-77 which returned 56.4 meters of 1.0 g/t Au from 18.3 meters vertical depth, including 9.2 meters of 5.3 g/t Au. The entire length of the hole returned anomalous gold values averaging 76.3 meters of 0.8 g/t Au. A high-grade center to the mineralized zone returned 5.3 g/t Au and 3 g/t Ag over 9.2 meters, including 1.5 meters of 26.7 g/t Au. Like the Main Zone, the 4-T trend is exposed at surface along a rounded ridge top, allowing the potential for a low strip ratio during early development. The hole tested near-surface mineralization and was stopped at 76.3 meters, mineralization at 4-T remains open at depth. Results for eleven drill holes are currently pending analysis, including holes further northwest, along the 4-T trend.

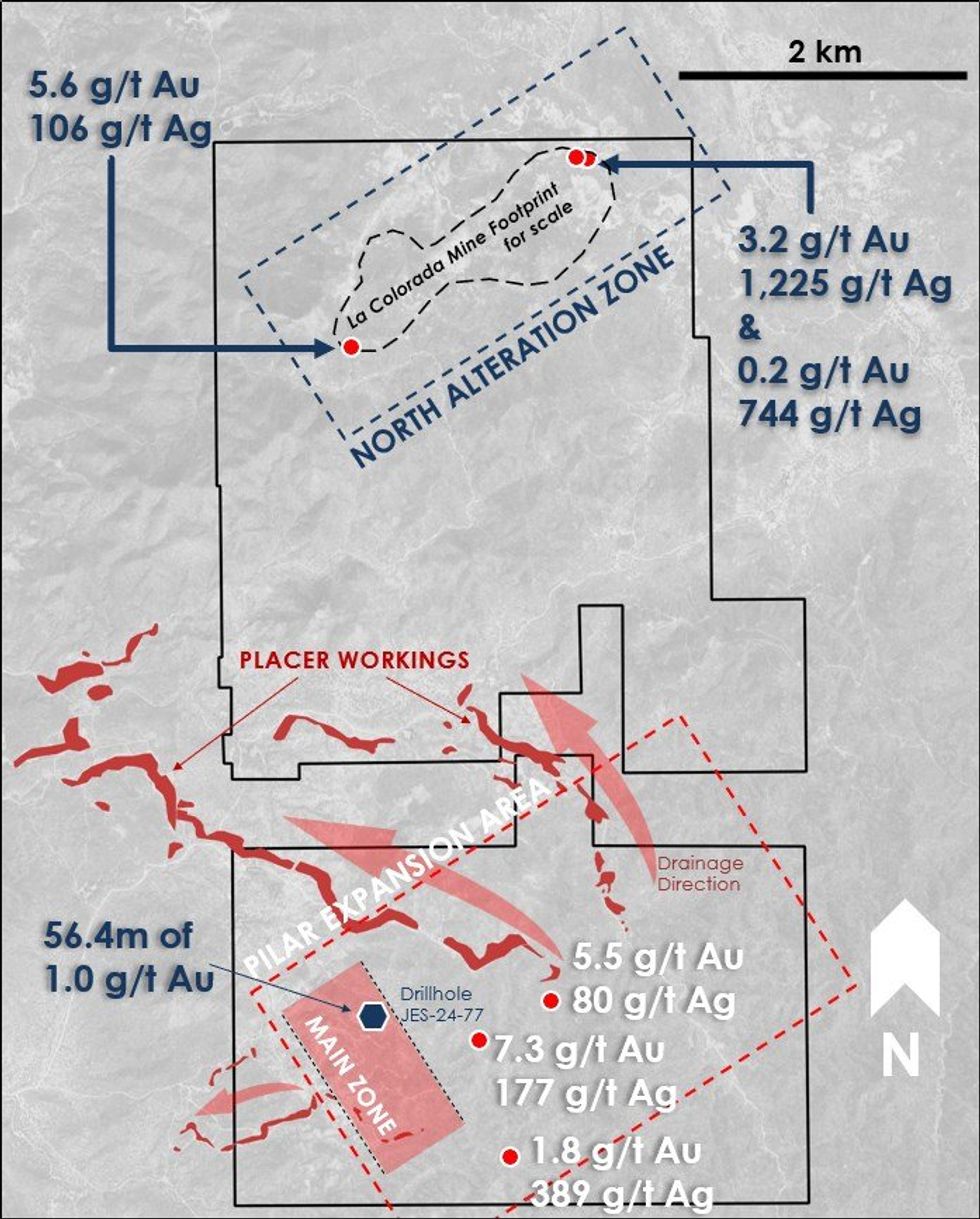

"We are extremely excited with the results today highlighting the additional resource potential that exists along the several parallel trends to the Main Zone which we believe can be tied together into a sizable area," commented Brodie Sutherland, CEO. "Today's results are the best from the 4-T Trend to date and rank as a top five drill intersect in Tocvan's history of drilling at Pilar. Gold mineralization intersected in hole JES-24-77 is close to surface, projecting to workings exposed along a low rolling ridgeline much like the Main Zone. This allows for low-strip ratio potential in future mine development, reducing costs for extraction. We are confident the 4-T Trend will continue to develop into another key resource area for Pilar, being just 400 meters from the heart of our Main Zone. Part of our bulk sample was extracted from 4-T adding to that confidence of resource viability. More results from the trend are pending. As for our exploration drill targets, it is still early in testing these areas and the data available suggests more work is needed to fully evaluate and target mineralization. Surface mapping and geochemistry strongly suggests the known trends extend to the southeast and northwest, while new trends have yet to be tested. Recent sampling across the expansion area supports this thesis, indicating much more is to be uncovered."

In addition, three exploration holes on the southeastern flanks of known mineralization (JES-24-74, 75 and 76) are also included in this release, testing known areas of significant surface mineralization. Although anomalous intervals were encountered, no significant mineralization has been recorded yet.

Discussion of Results

JES-24-77

The drillhole targeted near surface mineralization vertically below the Four Trench (4-T) prospect. The Prospect gets its name from four trenches completed historically across a known area of artisanal underground workings. The prospect was first drilled in 1996 by Santa Catalina, a Lundin Company evaluating Pilar. First drilling hit 7.5 meters of 3.3 g/t Au and 31 g/t Ag in drillhole K-16 (hole was stopped at 7.5m). Follow-up drilling over 15 years later by a private operator returned 30.5 meters of 0.7 g/t Au (JESP-18). In 2021, Tocvan drilled 15.3 meters of 1.1 g/t Au along the same ridgeline 300 meters to the northwest. The result released today from JES-24-77 is the most significant result along the 4-T trend drilled to date and ranks as the fifth best drill result ever from the over 60 drillholes Tocvan has completed thus far at Pilar. JES-24-77 was a vertical drillhole testing the down-dip projection of surface mineralization, successfully intersecting several zones of low-grade gold and silver and one high-grade zone. Follow-up work is to be completed along this developing trend.

Exploration Drill Results

Drillholes JES-24-74 and 75 tested an area southeast of the Main Zone where local surface mineralization hosted along structures and veins had returned 5.1 g/t Au and 24 g/t Ag. Although no significant mineralization was recorded in these holes, anomalous values of silver warrant further investigation. Drillhole JES-24-76 tested the southernmost flank of the 4-T trend, alteration and veining was recorded in logging although no significant mineralization was recorded.

Table 1. Summary of Drill Results Released Today from Pilar Project Drill Hole JES-24-77.

All interval lengths are drilled widths.

| Hole ID | From (m) | To (m) | Width (m) | Au (g/t) | Ag (g/t) |

| JES-24-77 | 0.00 | 76.25 | 76.25 | 0.75 | 0.91 |

| including | 18.30 | 74.73 | 56.43 | 1.00 | 1.10 |

| including | 27.45 | 36.60 | 9.15 | 5.25 | 2.51 |

| including | 35.08 | 36.60 | 1.52 | 26.79 | 4.92 |

Table 2. Drillhole locations released today.

| Hole ID | Azimuth | Dip | Depth (m) | Easting | Northing | Elevation (m) |

| JES-24-74 | 243 | 45 | 125.05 | 617666 | 3144245 | 421 |

| JES-24-75 | 060 | 45 | 128.10 | 617670 | 3144243 | 421 |

| JES-24-76 | 000 | 90 | 91.50 | 617927 | 3144475 | 437 |

| JES-24-77 | 000 | 90 | 76.25 | 617897 | 3144687 | 447 |

About the Pilar Property

The Pilar Gold-Silver property has returned some of the regions best drill results. Coupled with encouraging gold and silver recovery results from metallurgical test work, Pilar is primed to be a potential near-term producer. Pilar is interpreted as a structurally controlled low-sulphidation epithermal system hosted in andesite rocks. Initially three primary zones of mineralization were identified on the original property from historic surface work and drilling and are referred to as the Main Zone, North Hill and 4-T. Each trend remains open to the southeast and north and new parallel zones have been discovered. Structural features and zones of mineralization within the structures follow an overall NW-SE trend of mineralization. Mineralization extends along a 1.2-km trend, only half of that trend has been drill tested so far. The Company has now expanded its interest in the area by consolidating 22 square-kilometers of highly prospective ground where it has already made significant surface discoveries.

Pilar Drill Highlights:

- 2022 Phase III Diamond Drilling Highlights include (all lengths are drilled thicknesses):

- 116.9m @ 1.2 g/t Au, including 10.2m @ 12 g/t Au and 23 g/t Ag

- 108.9m @ 0.8 g/t Au, including 9.4m @ 7.6 g/t Au and 5 g/t Ag

- 63.4m @ 0.6 g/t Au and 11 g/t Ag, including 29.9m @ 0.9 g/t Au and 18 g/t Ag

- 2021 Phase II RC Drilling Highlights include (all lengths are drilled thicknesses):

- 39.7m @ 1.0 g/t Au, including 1.5m @ 14.6 g/t Au

- 47.7m @ 0.7 g/t Au including 3m @ 5.6 g/t Au and 22 g/t Ag

- 29m @ 0.7 g/t Au

- 35.1m @ 0.7 g/t Au

- 2020 Phase I RC Drilling Highlights include (all lengths are drilled thicknesses):

- 94.6m @ 1.6 g/t Au, including 9.2m @ 10.8 g/t Au and 38 g/t Ag;

- 41.2m @ 1.1 g/t Au, including 3.1m @ 6.0 g/t Au and 12 g/t Ag ;

- 24.4m @ 2.5 g/t Au and 73 g/t Ag, including 1.5m @ 33.4 g/t Au and 1,090 g/t Ag

- 15,000m of Historic Core & RC drilling. Highlights include:

- 61.0m @ 0.8 g/t Au

- 21.0m @ 38.3 g/t Au and 38 g/t Ag

- 13.0m @ 9.6 g/t Au

- 9.0m @ 10.2 g/t Au and 46 g/t Ag

Pilar Bulk Sample Summary:

- 62% Recovery of Gold Achieved Over 46-day Leaching Period

- Head Grade Calculated at 1.9 g/t Au and 7 g/t Ag; Extracted Grade Calculated at 1.2 g/t Au and 3 g/t Ag

- Bulk Sample Only Included Coarse Fraction of Material (+3/4" to +1/8")

- Fine Fraction (-1/8") Indicates Rapid Recovery with Agitated Leach

- Agitated Bottle Roll Test Returned Rapid and High Recovery Results: 80% Recovery of Gold and 94% Recovery of Silver after Rapid 24-hour Retention Time

Additional Metallurgical Studies:

- Gravity Recovery with Agitated Leach Results of Five Composite Samples Returned

- 95 to 99% Recovery of Gold

- 73 to 97% Recovery of Silver

- Includes the Recovery of 99% Au and 73% Ag from Drill Core Composite at 120-meter depth.

Quality Assurance / Quality Control

RC samples were shipped for sample preparation to ALS Limited in Hermosillo, Sonora, Mexico and for analysis at the ALS laboratory in North Vancouver. The ALS Hermosillo and North Vancouver facilities are ISO 9001 and ISO/IEC 17025 certified. Gold was analyzed using 50-gram nominal weight fire assay with atomic absorption spectroscopy finish. Over limits for gold (>10 g/t), were analyzed using fire assay with a gravimetric finish. Silver and other elements were analyzed using a four-acid digestion with an ICP finish. Over limit analyses for silver (>100 g/t) were re-assayed using an ore-grade four-acid digestion with ICP-AES finish. Control samples comprising certified reference samples and blank samples were systematically inserted into the sample stream and analyzed as part of the Company's robust quality assurance / quality control protocol.

Brodie A. Sutherland, CEO for Tocvan Ventures Corp. and a qualified person ("QP") as defined by Canadian National Instrument 43-101, has reviewed and approved the technical information contained in this release.

ABOUT COLIBRI RESOURCE CORPORATION:

Colibri is a Canadian-based mineral exploration company listed on the TSX-V (CBI) and is focused on acquiring, exploring, and developing prospective gold & silver properties in Mexico. The Company holds five high potential precious metal projects: 1) 100% of EP Gold Project in the significant Caborca Gold Belt which has delivered highly encouraging exploration results and is surround by Mexico's second largest major producer of gold on four sides, 2) 49% Ownership of the Pilar Gold & Silver Project which is believed to hold the potential to be a near term producing mine, and 3) three highly prospective interests in the Sierra Madre (Diamante Gold & Silver Project, Jackie Gold & Silver Project, and Mezquite Gold & Silver Project.

For more information about all Company projects please visit: www.colibriresource.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Notice Regarding Forward-Looking Statements:

This news release contains "forward-looking statements". Statements in this press release which are not purely historical are forward-looking statements and include any statements regarding beliefs, plans, expectations or intentions regarding the future. Actual results could differ from those projected in any forward-looking statements due to numerous factors. These forward-looking statements are made as of the date of this news release, and the Company assumes no obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those projected in the forward-looking statements. Although the Company believes that the plans, expectations, and intentions contained in this press release are reasonable, there can be no assurance that they will prove to be accurate.

CBI:CA

The Conversation (0)

13 February

Filing of Initial Prospectus

Panther Metals Plc (LSE: PALM), the exploration company focused on mineral projects in Canada, is pleased to announce that it has filed a preliminary non-offering prospectus (the "Prospectus") with the Ontario Securities Commission (the "Commission") and has applied to the Canadian Securities... Keep Reading...

12 February

Keith Weiner: Silver Being Remonetized "With a Vengeance" as Gold Rises

Keith Weiner, founder and CEO of Monetary Metals, shares his outlook for gold and silver in 2026, saying that while he expects higher prices there will be volatility. He also outlines his thoughts on the role of precious metals in the monetary system. Don’t forget to follow us @INN_Resource for... Keep Reading...

12 February

The True Value of Olympic Gold: Beyond Metal and Market Prices

As organizers award the medals for the Milan Cortina 2026 Winter Olympics, fans and spectators alike may have pondered a singular question at some point: how much is an Olympic gold medal actually worth?The short answer is far less—and far more—than most people assume.Don’t forget to follow us... Keep Reading...

12 February

Tajiri Discovers Potentially Economic Gold Mineralization in Multiple Trenches at Yono Property Including: 12m@ 2.4 g/t; 20m@ 1.4g/t; 8m@ 1.0g/t; 18m@ 0.8g/t & 4m@ 5.5g/t Gold; Bordered by G Mining Ventures Oko West and G2 Goldfields Oko Properties, Guyana

Tajiri Resources Corp. (TSXV: TAJ) ("Tajiri" or the "Company") is pleased to report results from its ongoing Phase II trenching program at the majority owned Yono Project, Guyana, which indicate three significant gold zones potentially hosting economic mineralisation. All results are given in... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Filing of Initial Prospectus

13 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00