The Conversation (0)

True North Copper Limited (ASX:TNC) (True North, TNC or the Company) is pleased to present its investor presentation.

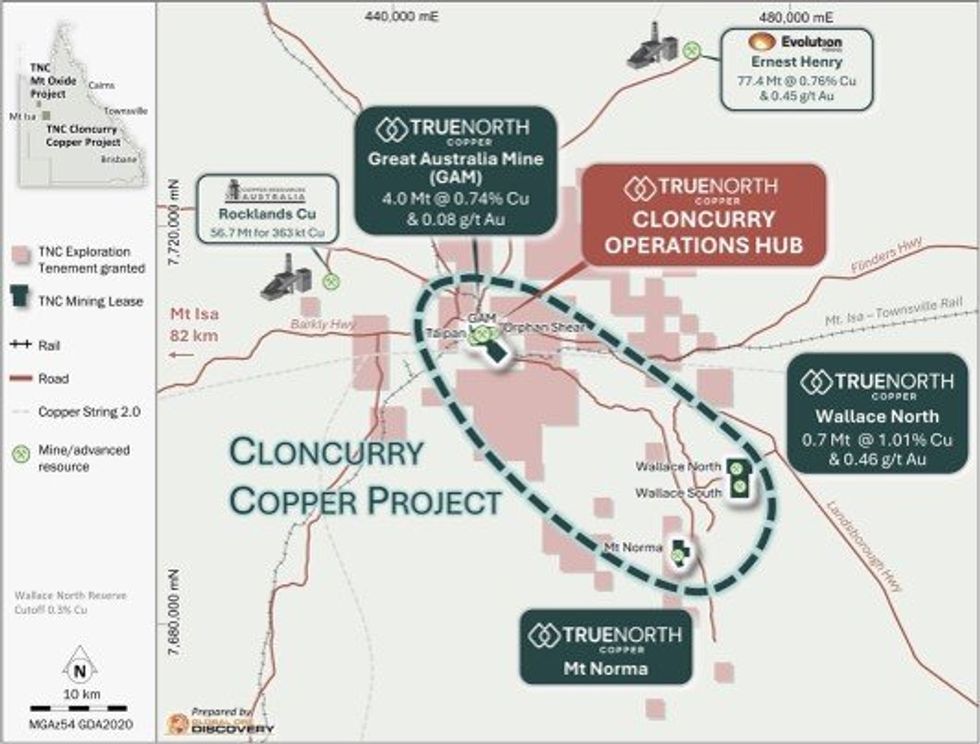

AUSTRALIA’S NEWEST COPPER & CRITICAL MINERALS PRODUCER

TIER 1 JURISDICTION

Click here for the full ASX Release

This article includes content from True North Copper, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

On the path to becoming Australia’s next responsible copper producer