- Calandrias Norte production in March driving improved production growth.

- Focus for 2024 remains on delivering strong cash flow and rebuilding the balance sheet with exploration focused on mine life extension.

- Management currently developing a longer-term production plan for Argentina.

Cerrado Gold Inc. (TSXV:CERT)(OTCQX:CRDOF) ("Cerrado" or the "Company") announces production results for the first quarter of 2024 ("Q1 2024") from the Minera Don Nicolas Mine in Santa Cruz Province, Argentina ("MDN"). Full first quarter financial results are expected to be released in May 2024

Q1 Operating Highlights

- Q1 2024 production of 11,024 Gold Equivalent Ounces ("GEO").

- Production for March of 5,747 GEO and April expected to be over 6,000 GEO's for the month, with Calandria Norte delivering expected production targets.

- Calandrias Norte contributing higher-grade ore feed to the mill, expected to improve production levels moving forward.

- Production ramp-up from the Las Calandrias heap leap project continues; commercial production expected in Q2 2024.

Operational results presented for Q1 2024 were below expectations in January and February due to lower than expected ore grades in the upper benches of Calandrias Norte and ongoing ramp up issues with the crushing circuit at the Calandrias Sur heap leach operations. Production improved significantly in March with the production of 5,255 GEO from the CIL plant and 492 GEO from the Calandrias Heap leach.

Production returned to expected levels as mining transitioned to lower benches at Calandrias Norte, which has higher grades and better reconciliation to the anticipated mine plan. Performance of the crushing circuit at the Calandrias Sur Heap Leach Project continues to improve, allowing the placement of more ore on the heap leach pad during the latter part of the quarter. Operations in the quarter were also impacted by the fiscal policy changes implemented in the country following the November 2023 general election that imposed not only a significant financial burden on the MDN operation, but also disrupted deliveries of certain supplies and spare parts.

Production is set to ramp-up over the second quarter of 2024, and the Calandrias Heap Leach is expected to achieve nameplate production rates in June. At Calandrias Norte, stripping activities have been completed, and the pit is now beginning to deliver higher grade ore to the CIL plant at Martinetas. Head grades from Calandrias Norte are reconciling well with the model, and grades have increased as the early benches have been mined out and deeper, higher grade levels are accessed.

Mark Brennan, CEO and Chairman commented, "Production in the first quarter was impacted due to lingering issues with the new heap leach facility, resulting in a slower ramp up than initially planned. Further, ore grades were lower than expected in the initial benches at Calandrias Norte. That said, the performance at MDN has begun to show significant improvement in March and April as we accessed higher grade ore from Calandrias Norte, and the leach cycle at Las Calandrias shows a consistent increase in production although at lower than expected rates."

He continued, "It has been a very difficult period for Cerrado and MDN over the past six months, waiting for production at Calandrias Norte and the Heap Leach to ramp up, and we now feel that we have turned the corner. In the near term, the focus at MDN continues to be on generating strong cash flow from our now completed capital investments, which are expected to allow us to rebuild the balance sheet and refocus our efforts on exploration and increasing the overall life of mine at MDN. There remains a terrific opportunity to scale up MDN and develop it into a significant operation much like our neighboring peers."

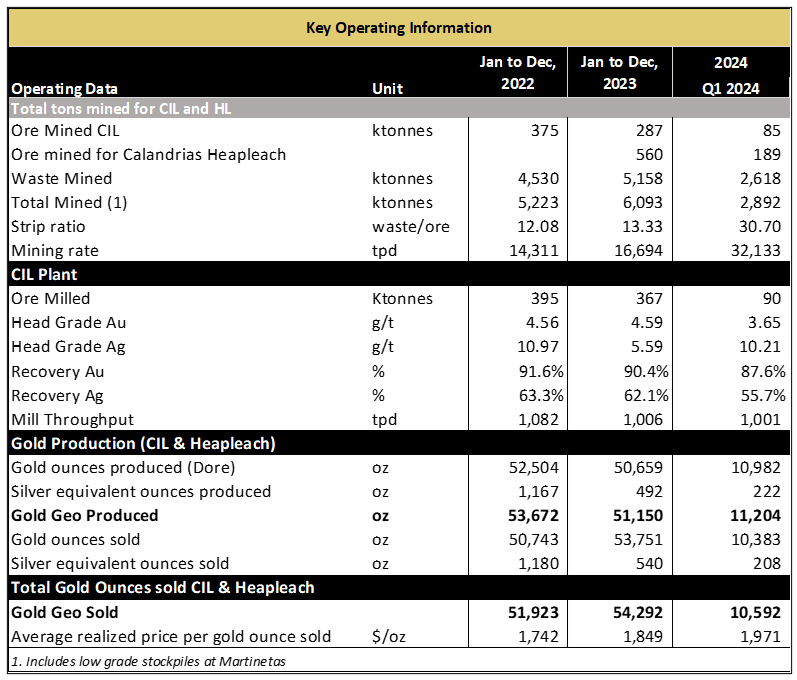

Ore milled and production rates decreased during the first quarter as operations, while normalized, experienced lower grades from the initial benches mined at Las Calandrias Norte and some issues with the commissioning of the crusher at the heap leach operation. Improved production is expected into the second quarter as the crushing circuit continues to operate at or near full capacity, and higher grades from the lower benches at Las Calandrias Norte are now being mined. Total production for the first quarter from the heap leach operation was 1,103 gold ounces and 2,543 silver ounces, with 43% of the gold production from the heap leach coming in March. Please see Table 1. for a summary of key highlights for the first quarter. Sales for the quarter were lower than production due to delays in shipping due to in-country holidays for Easter at the end of March.

Table 1. Key Operating Information

Hedging

Additionally, the Company announces that on April 26, 2024 it has entered into a limited hedging program with Ocean Partners UK Ltd. The hedge is constructed as a zero-cost collar with lower and upper boundaries of US$2,300 and US$2,475 per ounce respectively. The hedging volume is for 2,000 ounces per month for a period of 11 months beginning May 2024 and terminating on March 31th, 2025. The Company is focused on signifigantly reducing the current payables and debt balance in Argentina over the next year and has entered into this hedge to protect a portion of cashflows from a possible reduction in Gold prices over this period.

Review of Technical Information

The scientific and technical information in this press release has been reviewed and approved by Sergio Gelcich, P.Geo., Vice President, Exploration for Cerrado Gold Inc., who is a Qualified Person as defined in National Instrument 43-101.

Mark Brennan

CEO and Co Chairman

Mike McAllister

Vice President, Investor Relations

Tel: +1-647-805-5662

mmcallister@cerradogold.com

About Cerrado

Cerrado Gold is a Toronto-based gold production, development, and exploration company focused on gold projects in South America. The Company is the 100% owner of both the producing Minera Don Nicolás and Las Calandrias mine in Santa Cruz province, Argentina, and the highly prospective Monte Do Carmo development project, located in Tocantins State, Brazil. In Canada, Cerrado Gold is developing it's 100% owned Mont Sorcier Iron Ore and Vanadium project located outside of Chibougamou, Quebec.

In Argentina, Cerrado is maximizing asset value at its Minera Don Nicolas operation through continued operational optimization and is growing production through its operations at the Las Calandrias Heap Leach project. An extensive campaign of exploration is ongoing to further unlock potential resources in our highly prospective land package in the heart of the Deseado Masiff.

In Canada, Cerrado holds a 100% interest in the Mont Sorcier Iron Ore and Vanadium Project, which has the potential to produce a premium iron ore concentrate over a long mine life at low operating costs and low capital intensity. Furthermore, its high grade and high purity product facilitates the migration of steel producers from blast furnaces to electric arc furnaces contributing to the decarbonisation of the industry and the achievement of SDG goals.

For more information about Cerrado, please visit our website at: www.cerradogold.com.

Disclaimer

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

This press release contains statements that constitute "forward-looking information" (collectively, "forward-looking statements") within the meaning of the applicable Canadian securities legislation, all statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements contained in this press release include, without limitation, statements regarding the business and operations of Cerrado. In making the forward- looking statements contained in this press release, Cerrado has made certain assumptions, including, but not limited to the ramp-up of the Calandrias Heap Leach project, stripping activities and head grades at Calandrias Norte, expectations regarding MDN operations and financial performance generally. Although Cerrado believes that the expectations reflected in forward-looking statements are reasonable, it can give no assurance that the expectations of any forward-looking statements will prove to be correct. Known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to general business, economic, competitive, political and social uncertainties. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Except as required by law, Cerrado disclaims any intention and assumes no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward-looking statements or otherwise.

SOURCE: Cerrado Gold Inc.

View the original press release on accesswire.com