February 28, 2025

Castle Minerals (ASX:CDT) is dedicated to advancing its Kpali and Kandia gold projects in Ghana’s Upper West region, a significantly under-explored yet highly prospective geological setting within the West African gold belt. The company is committed to identifying, exploring, and developing economically viable gold deposits by leveraging the region’s rich mineral endowment and proven mining history.

Castle’s portfolio is anchored by its flagship Kpali and Kandia gold projects, both demonstrating significant potential for resource expansion and economic development. Castle aims to delineate and grow its resource base, positioning itself as a key player in Ghana’s emerging gold sector. The company’s dedication to sustainable exploration practices and strong community partnerships further strengthens its ability to operate effectively and responsibly in the region.

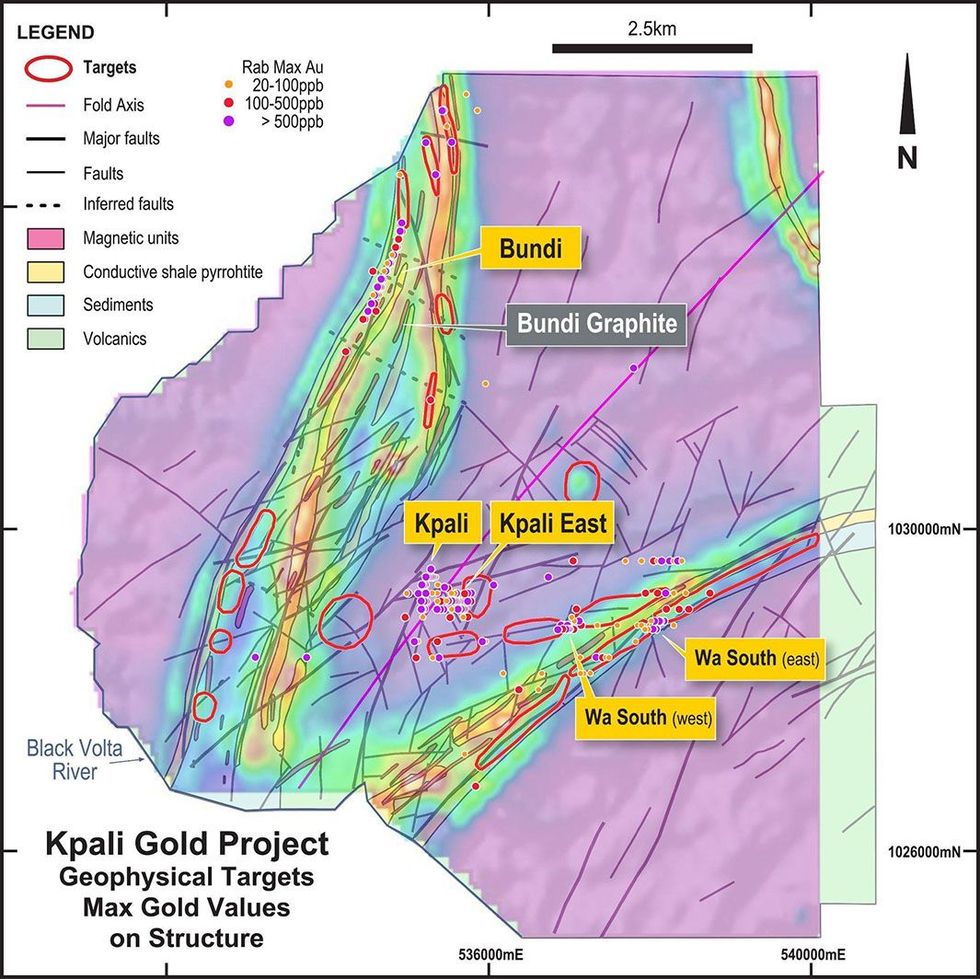

The Kpali gold project, a key focus of Castle Minerals, is located 30 km west of Sawla in Ghana’s Upper West region. It includes the Kpali and Bundi prospects within the 170 sq km Degbiwu prospecting license (PL 10/26), surrounded by the 1,033 sq km Gbiniyiri retention license (RL 8/27). The licenses’ western boundaries follow the Black Volta River, bordering Burkina Faso.

Company Highlights

- 100 percent ownership of a 2,686 sq km strategic landholding in Ghana’s highly prospective Upper West region.

- Flagship Kpali and Kandia gold projects with high-grade gold mineralization and significant resource expansion potential.

- Strong management team with a proven track record in West African gold discoveries and project development.

- Proximity to the multi-million-ounce Black Volta gold project, enhancing economic potential and development synergies.

- Robust exploration pipeline with systematic drilling programs aimed at resource expansion and near-term development.

- Commitment to sustainable and responsible exploration practices, with strong community and government engagement.

- Positioned to capitalize on the growing global demand for gold through disciplined exploration and strategic partnerships.

This Castle Minerals profile is part of a paid investor education campaign.*

Click here to connect with Castle MInerals (ASX:CDT) to receive an Investor Presentation

CDT:AU

The Conversation (0)

01 October 2025

Cote D'Ivoire Soils Underway and Ghana Auger Well Advanced

Castle Minerals (CDT:AU) has announced Cote D'Ivoire Soils Underway and Ghana Auger Well AdvancedDownload the PDF here. Keep Reading...

01 September 2025

Target Defining Auger Campaign Commenced at Kandia

Castle Minerals (CDT:AU) has announced Target Defining Auger Campaign Commenced at KandiaDownload the PDF here. Keep Reading...

31 August 2025

CDT moves to 100% Mineralis to secure Cote d'Ivoire Earn-In

Castle Minerals (CDT:AU) has announced CDT moves to 100% Mineralis to secure Cote d'Ivoire Earn-InDownload the PDF here. Keep Reading...

21 August 2025

Castle to Acquire Extensive Cote d'Ivoire Footprint

Castle Minerals (CDT:AU) has announced Castle to Acquire Extensive Cote d'Ivoire FootprintDownload the PDF here. Keep Reading...

19 August 2025

Trading Halt

Castle Minerals (CDT:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

16h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

18h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

22h

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00