February 28, 2025

Castle Minerals (ASX:CDT) is dedicated to advancing its Kpali and Kandia gold projects in Ghana’s Upper West region, a significantly under-explored yet highly prospective geological setting within the West African gold belt. The company is committed to identifying, exploring, and developing economically viable gold deposits by leveraging the region’s rich mineral endowment and proven mining history.

Castle’s portfolio is anchored by its flagship Kpali and Kandia gold projects, both demonstrating significant potential for resource expansion and economic development. Castle aims to delineate and grow its resource base, positioning itself as a key player in Ghana’s emerging gold sector. The company’s dedication to sustainable exploration practices and strong community partnerships further strengthens its ability to operate effectively and responsibly in the region.

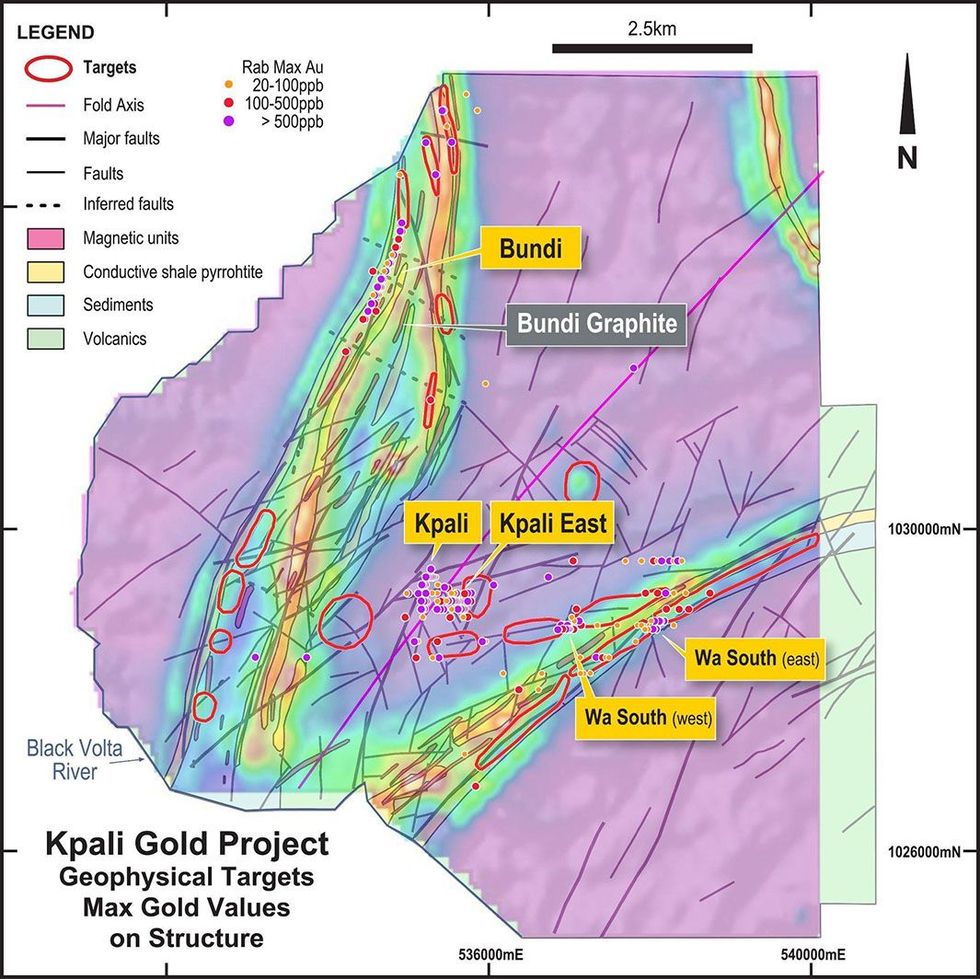

The Kpali gold project, a key focus of Castle Minerals, is located 30 km west of Sawla in Ghana’s Upper West region. It includes the Kpali and Bundi prospects within the 170 sq km Degbiwu prospecting license (PL 10/26), surrounded by the 1,033 sq km Gbiniyiri retention license (RL 8/27). The licenses’ western boundaries follow the Black Volta River, bordering Burkina Faso.

Company Highlights

- 100 percent ownership of a 2,686 sq km strategic landholding in Ghana’s highly prospective Upper West region.

- Flagship Kpali and Kandia gold projects with high-grade gold mineralization and significant resource expansion potential.

- Strong management team with a proven track record in West African gold discoveries and project development.

- Proximity to the multi-million-ounce Black Volta gold project, enhancing economic potential and development synergies.

- Robust exploration pipeline with systematic drilling programs aimed at resource expansion and near-term development.

- Commitment to sustainable and responsible exploration practices, with strong community and government engagement.

- Positioned to capitalize on the growing global demand for gold through disciplined exploration and strategic partnerships.

This Castle Minerals profile is part of a paid investor education campaign.*

Click here to connect with Castle MInerals (ASX:CDT) to receive an Investor Presentation

CDT:AU

The Conversation (0)

01 October 2025

Cote D'Ivoire Soils Underway and Ghana Auger Well Advanced

Castle Minerals (CDT:AU) has announced Cote D'Ivoire Soils Underway and Ghana Auger Well AdvancedDownload the PDF here. Keep Reading...

01 September 2025

Target Defining Auger Campaign Commenced at Kandia

Castle Minerals (CDT:AU) has announced Target Defining Auger Campaign Commenced at KandiaDownload the PDF here. Keep Reading...

31 August 2025

CDT moves to 100% Mineralis to secure Cote d'Ivoire Earn-In

Castle Minerals (CDT:AU) has announced CDT moves to 100% Mineralis to secure Cote d'Ivoire Earn-InDownload the PDF here. Keep Reading...

21 August 2025

Castle to Acquire Extensive Cote d'Ivoire Footprint

Castle Minerals (CDT:AU) has announced Castle to Acquire Extensive Cote d'Ivoire FootprintDownload the PDF here. Keep Reading...

19 August 2025

Trading Halt

Castle Minerals (CDT:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

10h

David Erfle: Gold, Silver Under Pressure, Key Price Levels to Watch

David Erfle, editor and founder of Junior Miner Junky, explains why gold and silver prices took a hit not long after war in the Middle East was announced. While the near term could be volatile, he said the long-term outlook for precious metals is strong. Don't forget to follow us @INN_Resource... Keep Reading...

10h

Tavi Costa: Gold, Silver Stocks to Rerate, "Explosive" Energy, Copper Opportunities

Tavi Costa, CEO of Azuria Capital, explains where he's looking to deploy capital right now, mentioning mining, energy and emerging markets. "When I apply macro analysis into markets, there's a few things that look exceptionally cheap today that could be extremely asymmetric," he commented.... Keep Reading...

11h

One Bullion Advances Toward Drill-Ready Targets at Botswana Gold Assets

One Bullion (TSXV:OBUL,OTCPL:OBULF) CEO and President Adam Berk shared the advantages of working in the mining-friendly jurisdiction of Botswana and big milestones ahead in 2026.Surveys are expected to commence within the next few weeks at the company's Maitengwe and Vumba projects, which will... Keep Reading...

09 March

Byron King: Gold, Silver, Oil/Gas — Stock Ideas and Strategy Now

Byron King, editor at Paradigm Press, shares his approach to the gold and silver sectors as tensions in the Middle East intensify, also touching on oil and gas. Overall he sees hard assets becoming increasingly key as global uncertainty escalates."Own gold, own silver — physically own the metal... Keep Reading...

09 March

Jaime Carrasco: Gold Going "Much Higher," Silver Force Majeure Inevitable

Jaime Carrasco, senior portfolio manager and senior financial advisor at Harbourfront Wealth Management, shares his outlook for gold and silver, saying prices must rise much higher. He also talks about how to build a strong precious metals portfolio. "We're moving from a credit-based economy, a... Keep Reading...

09 March

Garrett Goggin: Gold, Silver in New Era, My Stock Strategy Now

Garrett Goggin, founder of Golden Portfolio, says although gold and silver haven't gone mainstream yet, the metals — and the mining sector overall — have entered a new era. "It's a real mind shift — it's a new era in mining right here," he said.Don't forget to follow us @INN_Resource for... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00