Cascadia Minerals Ltd. ("Cascadia") (TSX-V:CAM) (OTCQB:CAMNF) is pleased to provide 2025 exploration results from its 100%-owned road-accessible Rosy Property in south-central Yukon. The Rosy Property hosts widespread gold-silver bearing epithermal quartz-carbonate veins likely related to the adjacent Red Mountain Molybdenum Deposit.

Highlights

- Prospecting in 2025 extended the mineralized footprint at Rosy, returning the highest gold grade ever sampled on the property: 45.40 g/t gold and 10.1 g/t silver;

- Numerous additional rock samples returned high-grade gold and silver including 24.20 g/t gold with 39.4 g/t silver in float, 13.85 g/t gold with 5.9 g/t silver in outcrop, and 2.32 g/t gold with 302 g/t silver in float;

- Prospecting and mapping have outlined a 3.8 km × 2.5 km gold-arsenic ± silver ± antimony soil anomaly and over 35 gold-silver low-sulphidation epithermal quartz-carbonate veins; and

- Historical prospecting has returned very high-grade silver, including a 2016 rock sample which returned 0.31 g/t gold with 1,835 g/t silver.

"With gold and silver prices at record highs, we are excited to scale up work at our road-accessible, royalty-free Rosy Property. The mineralogy, extent and tenor of mineralization at Rosy is clear evidence of a large epithermal gold-silver system," said Graham Downs, President and CEO of Cascadia. "The main target at Rosy has seen minimal historical work, with less than 300 m of drilling. Planning is underway for follow-up work to advance multiple targets at Rosy to the drill stage."

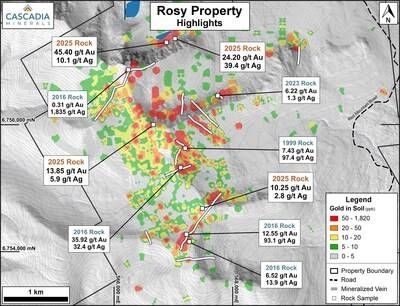

Figure 1 – Rosy Highlights Map

Figure 2 – Rock Photo Highlights

2025 Rosy Exploration

Exploration at Rosy in 2025 was conducted over a five-day field program focused on prospecting and mapping within a 3.8 km × 2.5 km gold-arsenic ± silver ± antimony soil anomaly. A total of 262 rock samples were collected from underexplored areas, expanding the footprint of known mineralization, extending known veins and identifying several new veins. Rock sampling returned widespread gold-silver mineralization across the target area, with 100 rock samples returning greater than 0.50 g/t gold, and 31 samples returning greater than 1.00 g/t gold. Structural orientation information was also collected to improve the understanding of the vein system orientations, including near historical rock samples that returned 35.93 g/t gold with 32.4 g/t silver, and 0.31 g/t gold with 1,835 g/t silver. Highlight results from 2025 prospecting are provided in Table 1 and Figure 1.

| Sample | Gold | Silver (g/t) | Sample |

| H658171 | 45.40 | 10.1 | Float |

| H658573 | 24.20 | 39.4 | Float |

| K073951 | 13.85 | 5.9 | Outcrop |

| H658153 | 10.25 | 2.8 | Outcrop |

| K073953 | 7.96 | 2.4 | Outcrop |

| H658800 | 6.41 | 2.5 | Outcrop |

| H658796 | 2.32 | 302 | Subcrop |

Rosy Property Overview

Cascadia's 64 km2 Rosy Property is located within the Traditional Territory of the Teslin Tlingit Council, 77 km east of Whitehorse. The property is road-accessible via the Red Mountain Tote Road, which extends from the government-maintained South Canol Road. The property hosts widespread gold and silver-bearing veins that are likely associated with the nearby Late Cretaceous Boswell Pluton and Red Mountain Molybdenum Deposit.

Mineralization on the Rosy property is indicative of the distal part of a large hydrothermal system It occurs within low-sulphidation epithermal quartz-carbonate veins as well as altered intrusive rocks. Over 35 gold-silver bearing quartz-carbonate-ankerite-sericite-arsenopyrite-pyrite veins have been mapped on the property and occur with rusty oxidation, faults and fractures, quartz-feldspar porphyry dykes and silica-carbonate-clay altered wall rocks. The mineralized veins vary in size from millimetres to tens of centimetres and typically display crustiform, colloform and cockade textures. Prospecting programs have returned highlight grab samples including 45.40 g/t gold with 10.1 g/t silver, and 0.31 g/t gold with 1,835 g/t silver.

About Cascadia

Cascadia's flagship asset is the 177 km2 Carmacks Project, located within in central Yukon, Canada, 35 km southeast of the past producing Minto Mine. The road-accessible Carmacks Project has a Measured and Indicated Resource containing 651 Mlbs of copper and 302 koz of gold (36.3 million tonnes grading 0.81% copper, 0.26 g/t gold, 3.23 g/t silver and 0.01% molybdenum) or 1.07% copper equivalent. A 2023 preliminary economic assessment demonstrated positive economic potential, with a $330.1 M post-tax NPV(5%) and 38% after-tax IRR at $4.25/lb copper and $2,000/oz gold.

Cascadia also has a pipeline of discovery stage copper-gold properties throughout the Yukon Stikine Terrane including its Catch Property, which hosts a copper-gold porphyry discovery where inaugural drill results returned broad intervals of mineralization (116.60 m of 0.31% copper with 0.30 g/t gold). High-grade copper and gold mineralization is found at surface over 5 km long trend, with grab samples returning peak values of 3.88% copper, 1,065 g/t gold, and 267 g/t silver.

QA/QC

Analytical work was completed by ALS Canada Ltd., with sample preparation for in Whitehorse, Yukon, and geochemical analyses in North Vancouver, British Columbia. Samples were analyzed for gold by the Au-AA23 procedure, which involves fire assay preparation using a 30-gram charge with an atomic absorption spectroscopy finish. Multi-element data for 48 elements was determined by the ME-MS61 procedure, which involves a four-acid digestion followed by inductively coupled plasma – atomic emission spectroscopy ("ICP-AES") and inductively coupled plasma – mass spectrometry. Overlimit values for gold were determined by the Au-GRA21 method, which involves fire assay preparation using a 30-gram charge and a gravimetric finish. Overlimit values for silver were determined by the Ag-OG62 method, which involves a four-acid digest followed by ICP-AES.

Results referenced in this release represent highlight results only, and include results from 2025 and previous years. Below detection values for gold and silver have been encountered in soil and rock samples in these target areas. Readers are cautioned that grab samples are selective by nature and are not necessarily representative of the grade of mineralization on the property.

Copper equivalent calculations for the Carmacks Deposit use metal prices of US$4.00/lb for copper, US$2,500/oz for gold, US$30/oz for silver and US$20/lb for molybdenum. Recovery factors of 82% for copper, 70% for gold, 69% for silver and 70% for molybdenum were used, based on recovery projections from the 2023 PEA study.

The technical information in this news release has been approved by Thomas Hawkins, P.Geo., VP Exploration for Cascadia and a qualified person for the purposes of National Instrument 43-101.

On behalf of Cascadia Minerals Ltd:

Graham Downs, President and CEO

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS NEWS RELEASE.

Cautionary note regarding forward-looking statements:

This press release may contain "forward-looking information" within the meaning of applicable securities laws. Readers are cautioned to not place undue reliance on forward-looking information. Actual results and developments may differ materially from those contemplated by these statements. The statements in this press release are made as of the date of this press release. The Company undertakes no obligation to update forward-looking information, except as required by securities laws.

SOURCE Cascadia Minerals Ltd.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/January2026/26/c4004.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/January2026/26/c4004.html