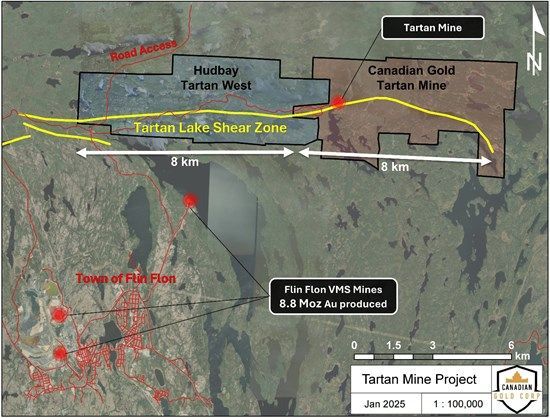

Canadian Gold Corp. (TSXV: CGC) ("Canadian Gold" or the "Company") is pleased to announce that it has entered into an option agreement dated May 15, 2025 (the "Option Agreement") with Hudbay Minerals Inc. ("Hudbay") pursuant to which Hudbay has granted Canadian Gold an option to acquire 100% of the Tartan West property (the "Option") that is immediately adjacent to the Company's Tartan Mine (Fig. 1 & 2), near Flin Flon, Manitoba. This Option, if exercised, significantly expands the outlook for the Company as it looks to add additional high-grade gold resources into the future plan to restart the Tartan Mine.

Rationale For Entering into Option Agreement for the Tartan West Property

Exploration Potential:

- Expands potential ownership of the Tartan Shear Zone along strike to the west by 100%, from 8 to 16 kilometres (Fig. 1).

- Limited historic drilling returned high-grade, near surface gold results. Exploration in the area has been historically focused on the potential for volcanogenic massive sulphide ("VMS") deposits, due to its proximity to the Flin Flon VMS mining camp.

Contemporaneously with the discovery and operation of the Tartan Mine in the 1980's, limited exploration for gold, including drilling, was conducted until 1989. The property has seen limited gold exploration since.

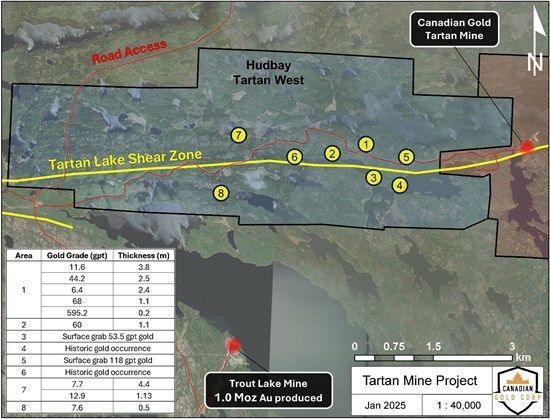

Highlights of the historic drilling include high-grade results: 44.2 gpt gold over 2.5 metres(1), 68.9 gpt gold over 1.1 metres(2), 60.0 gpt over 1.1 metres(3) and 595.2 gpt over 0.2 metres(3). Additional drill assays returned results comparable to the Tartan Mine, including 11.6 gpt gold over 3.8 metres(1), 7.7 gpt gold over 4.4 metres(2), 6.4 gpt gold over 2.4 metres(2) and 12.9 gpt gold over 1.13 metres(2) (Fig. 2).

- High-grade gold surface samples, with no follow-up drilling, returned 118 gpt gold (4) and 53.5 gpt gold (4) (Fig. 2). Much of the project area remains underexplored, especially along the Tartan Shear Zone, which, to the east, hosts the Tartan Mine.

Potential to Leverage Future Infrastructure Investments Over an Expanded Resource Base, Delivering Enhanced Economies of Scale:

- Potential to build a single process facility at the Tartan Mine and source ore from multiple areas along the contiguous Tartan Shear Zone, reducing the capital needed on a per-ounce basis should a decision be made to restart production.

- Ability to access Tartan West mineralization in the future from current and planned Tartan Mine underground infrastructure.

"We are very excited to have been able to work with Hudbay to secure the Option to acquire the Tartan West property. The addition of the Tartan West property would double our land position over the Tartan Shear Zone from 8 to 16 km. We believe the addition of this property would significantly increase the scope and scale of exploration opportunities for the Company. In time, we believe that additional high-grade resources that may be present on this property could deliver significant operational synergies that will bolster the already compelling economics for the restart of the Tartan Mine." - Michael Swistun, CFA, President & CEO of the Company.

Next Steps for Tartan West Project

The Company intends to begin the exploration work at the Tartan West property at the start of the 2025 field season. Initial work will consist of a detailed mapping, prospecting, and sampling program to evaluate and verify the historic high-grade surface showings, which will aid with prioritization of areas for additional work such as trenching, stripping and diamond drilling. The Option Agreement was structured in a way that allows the Company to complete a property-wide review to develop priority drill targets without incurring significant upfront costs.

Terms of the Option Agreement

Under the terms of the Option Agreement and subject to the approval of the TSX Venture Exchange, over a five-year period Canadian Gold will be required to (i) make the following cash and share payments to Hudbay and (ii) make the following work and exploration commitments outlined in Table 1 in order to exercise the Option. Upon exercise of the Option, Canadian Gold will hold a 100% interest in the Tartan West property and Hudbay will also be granted a 2.5% NSR on the Tartan West property. Under the terms of the Option Agreement, certain share payments listed below may be made in cash.

Table 1. Option Terms

| Date | Cash Payments | Share Payments | Work Commitments |

| Upon commencement of the earn-in period | 185,185 | - | |

| 1 Year Anniversary | - | 555,555 | C$100,000 Initial field work program |

| 2 Year Anniversary | - | 1,111,111 | C$250,000 Advanced field work program |

| 3 Year Anniversary | C$150,000 | 1,296,296 | C$800,000 Initial drill program |

| 4 Year Anniversary | C$325,000 | 3,148,148 | C$1,500,000 Secondary drill program |

| 5 Year Anniversary | C$350,000 | 3,703,703 | C$1,700,000 Third drill program |

For Further Information, Please Contact:

Michael Swistun, CFA

President & CEO

Canadian Gold Corp.

(204) 232-1373

info@canadiangoldcorp.com

Qualified Person and QAQC

The scientific and technical information disclosed in this news release was reviewed and approved by Wesley Whymark, P. Geo., Consulting Geologist for the Company, and a Qualified Person as defined under National Instrument 43-101.

The Qualified Person has not completed sufficient work to verify the historical data for the Tartan West property, and it remains uncertain whether further exploration will define a mineral resource on the property. The Company has not independently verified the third-party data referenced and cannot guarantee its accuracy or completeness and investors should therefore use caution in placing reliance on such information. However, the Qualified Person believes that the historical drilling and analytical results referenced were completed to industry standard practices. Overall, the information highlights the exploration potential of the Tartan West property but may not reflect actual results.

Historical Exploration References

(1) Spooner, A.J., 1987. Tout Lake Joint Venture Diamond Drilling. Manitoba Mineral Assessment Report 71523. NTS REF. No. 63K-13SW

(2) Spooner, A.J., 1988. Tout Lake Joint Venture Diamond Drilling. Manitoba Mineral Assessment Report 81737. NTS REF. No. 63K-13SW

(3) Spooner, A.J., 1989. Tout Lake Joint Venture Diamond Drilling. Manitoba Mineral Assessment Report 72046. NTS REF. No. 63K-13SW

(4) Historical scanned paper maps on Company database

About Canadian Gold Corp.

Canadian Gold Corp. is a Canadian-based mineral exploration and development company whose objective is to expand the high-grade gold resource at the past producing Tartan Mine, located in Flin Flon, Manitoba. The historic Tartan Mine currently has a 2017 indicated mineral resource estimate of 240,000 oz gold (1,180,000 tonnes at 6.32 g/t gold) and an inferred estimate of 37,000 oz gold (240,000 tonnes at 4.89 g/t gold). The Company also holds a 100% interest in greenfields exploration properties in Ontario and Quebec adjacent to some of Canada's largest gold mines and development projects, specifically, the Canadian Malartic Mine (QC), the Hemlo Mine (ON) and Hammond Reef Project (ON). McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) holds a 5.7% interest in Canadian Gold, and Robert McEwen, the founder and former CEO of Goldcorp, and Chairman and CEO of McEwen Mining, holds a 32.9% interest in Canadian Gold.

CAUTION REGARDING FORWARD-LOOKING INFORMATION

This news release of the Company contains statements that constitute "forward-looking statements." Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause Canadian Gold's actual results, performance or achievements, or developments in the industry to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements including but not limited to the receipt of regulatory approval for the transactions contemplated by the Option Agreement and the exercise of the Option by the Company.

Figure 1. Location of the Tartan West Property.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3276/252366_8eb885fbb4ae0825_002full.jpg

Figure 2. Location of highlight historic gold occurrences on the Tartan West Property.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3276/252366_8eb885fbb4ae0825_003full.jpg

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/252366