Canadian Gold Corp. (TSXV: CGC) ("Canadian Gold" or the "Company") is pleased to announce its plans to double the size of its Phase 4 drill program at the Tartan Mine, located near Flin Flon, Manitoba, following McEwen Mining's recent 5.9% equity investment. The Phase 4 program will now total approximately 8,000 metres of diamond drilling in addition to the 23,683 metres completed since the last resource estimate in 2017. The expanded drill program is intended to significantly grow the resource base by targeting high-priority areas within the Main and South Zones.

"Continued drilling success at the South Zone, in particular, would be a game-changer for the Company and could significantly increase the resource at Tartan. The South Zone's proximity to the existing underground ramp and Main Zone would enhance operational efficiency, boost production, and potentially accelerate the Tartan Mine restart." - Michael Swistun, President & CEO.

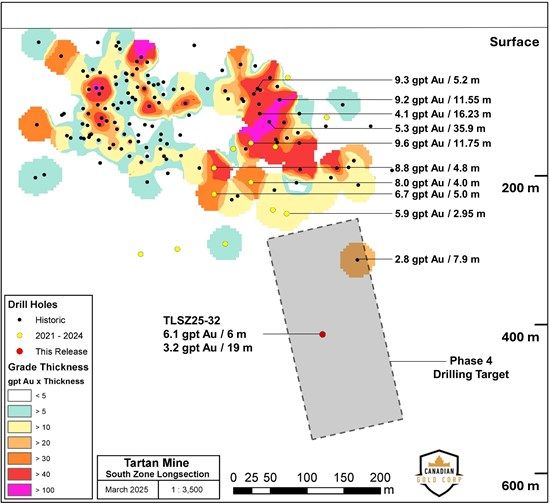

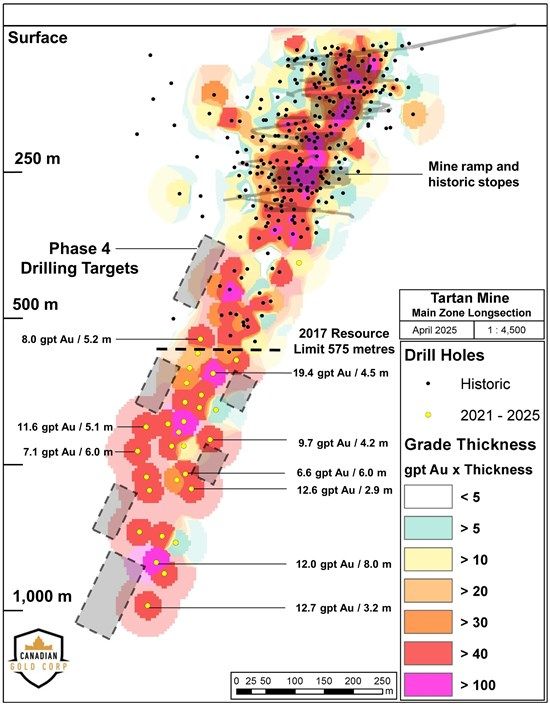

The expanded Phase 4 drill program will target areas where there appears to be excellent potential for growing the resource at the South Zone (Fig. 1) and Main Zone (Fig. 2), specifically, to:

- Expand on the South Zone by targeting its depth extensions where the first deep exploration drill hole, drilled 170 metres vertically below the known mineralization, recently returned 6.1 gpt gold over 6.0 metres. Drilling will also follow up on the newly discovered South Zone Hanging Wall Zone that has returned 29.1 gpt gold over 5.9 metres and 8.4 gpt gold over 2.0 metres.

- Target the deeper extensions of the Main Zone, which remains open for expansion. Limited drilling in this area has returned significant high-grade intercepts, including 12.0 gpt gold over 8.0 metres and 12.7 gpt gold over 3.4 metres.

- Drill Main Zone's Western Flank where recent step-out drilling has intercepted 11.6 gpt gold over 5.1 metres and 7.1 gpt gold over 6.0 metres, extending the mineralization by a total of 60 metres to the west.

- Target the Main Zone's Eastern Flank which returned 19.4 gpt gold over 4.5 metres and 9.7 gpt gold over 4.2 metres.

In addition to the most recent financing, the Company has also received a $300,000.00 grant from the Manitoba Mineral Development Fund ("MMDF") to help fund an updated NI 43-101 Resource Estimate and a Preliminary Economic Study ("PEA") which are anticipated to be completed following Phase 4 drilling. These reports will provide critical data and insight to support the deliberations and decisions on a possible restart of the mine.

For Further Information, Please Contact:

Michael Swistun, CFA

President & CEO

Canadian Gold Corp.

(204) 232-1373

info@canadiangoldcorp.com

Qualified Person

The scientific and technical information disclosed in this news release was reviewed and approved by Wesley Whymark, P. Geo., Consulting Geologist for the Company, and a Qualified Person as defined under National Instrument 43-101.

About Canadian Gold Corp.

Canadian Gold Corp. is a Toronto-based mineral exploration and development company whose objective is to expand the high-grade gold resource at the past producing Tartan Mine, located in Flin Flon, Manitoba. The historic Tartan Mine currently has a 2017 indicated mineral resource estimate of 240,000 oz gold (1,180,000 tonnes at 6.32 g/t gold) and an inferred estimate of 37,000 oz gold (240,000 tonnes at 4.89 g/t gold). The Company also holds a 100% interest in greenfields exploration properties in Ontario and Quebec adjacent to some of Canada's largest gold mines and development projects, specifically, the Canadian Malartic Mine (QC), the Hemlo Mine (ON) and Hammond Reef Project (ON). McEwen Mining Inc. holds a 5.9% interest in Canadian Gold, and Robert McEwen, the founder and former CEO of Goldcorp, and Chairman and CEO of McEwen Mining, holds a 32% interest in Canadian Gold.

CAUTION REGARDING FORWARD-LOOKING INFORMATION

This news release of the Company contains statements that constitute "forward-looking statements." Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause Canadian Gold's actual results, performance or achievements, or developments in the industry to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements.

Figure 1. Tartan Mine - South Zone Longitudinal Section illustrating the areas of Phase 4 drilling.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3276/248043_a57b4170a4c99be4_001full.jpg

Figure 2. Tartan Mine - Main Zone Longitudinal Section illustrating the areas of Phase 4 drilling.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3276/248043_a57b4170a4c99be4_002full.jpg

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/248043