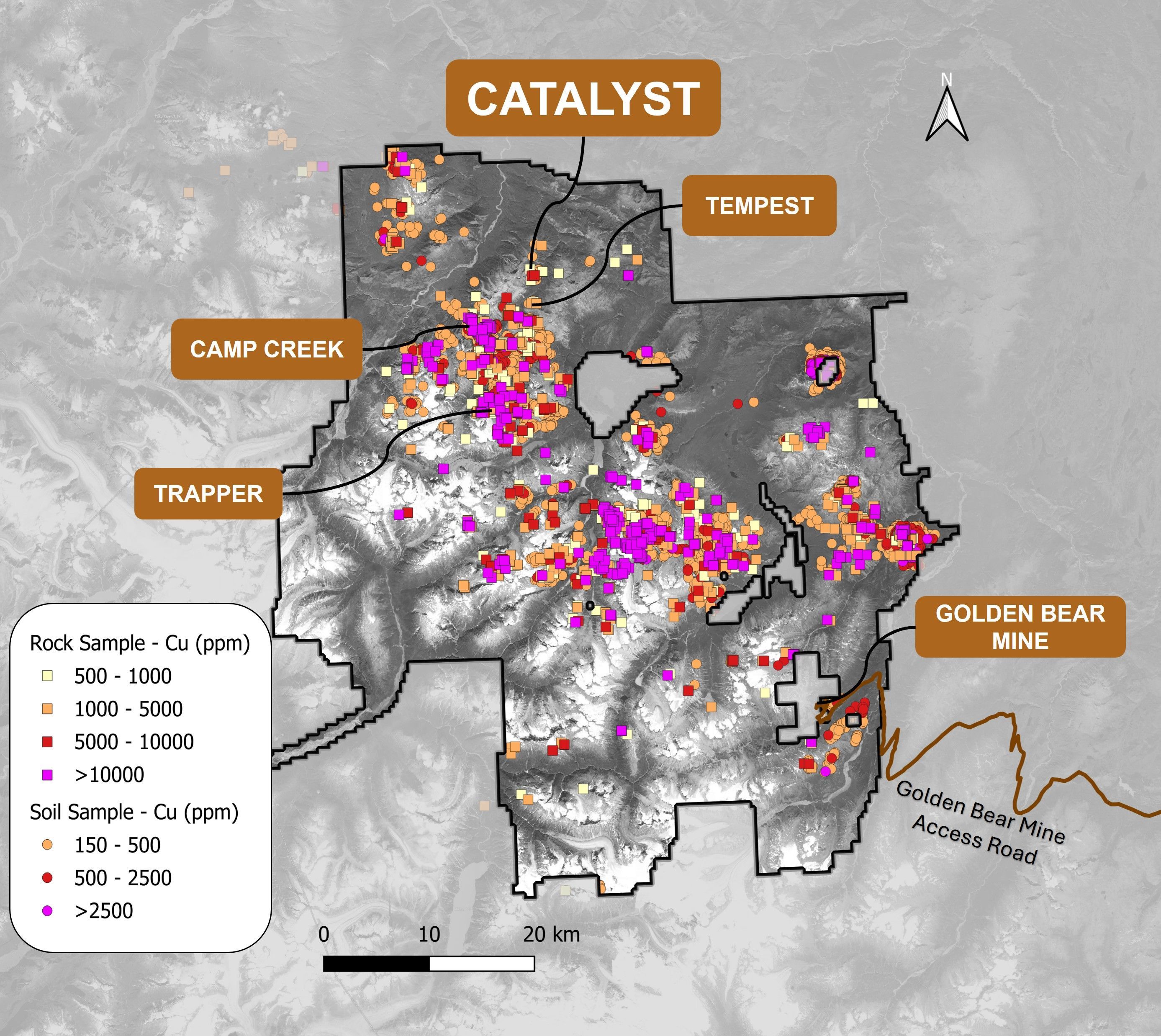

Brixton Metals Corporation (TSX-V: BBB, OTCQB: BBBXF) (the " Company " or " Brixton ") is pleased to announce that it has begun drilling at the newly identified Catalyst Copper-Gold Porphyry Target at its wholly owned Thorn Project located in NW British Columbia, Canada. The Thorn Project is an underexplored copper-gold porphyry district with several large-scale exploration target areas identified. Drilling is ongoing at its Trapper Gold Target and a second drill is now operational at the Catalyst Target.

Highlights

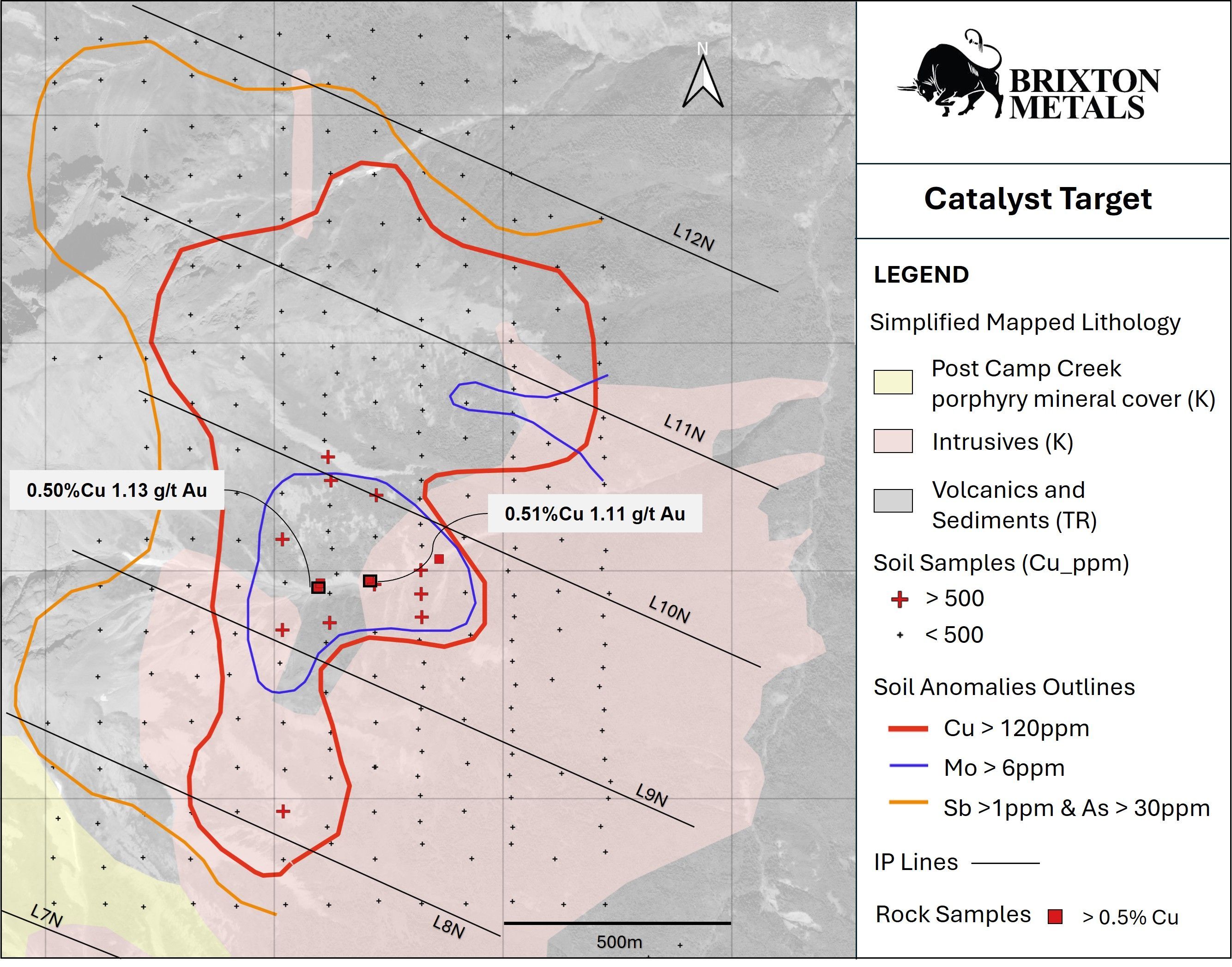

- A 2 km by up to 1 km copper-in-soil anomaly has been confirmed and refined, supported by soil geochemistry showing a classic calc-alkalic porphyry zonation: from a central Cu-Mo zone with depleted Zn, outward to Cu-Te-Se, and further to distal As-Sb anomalies.

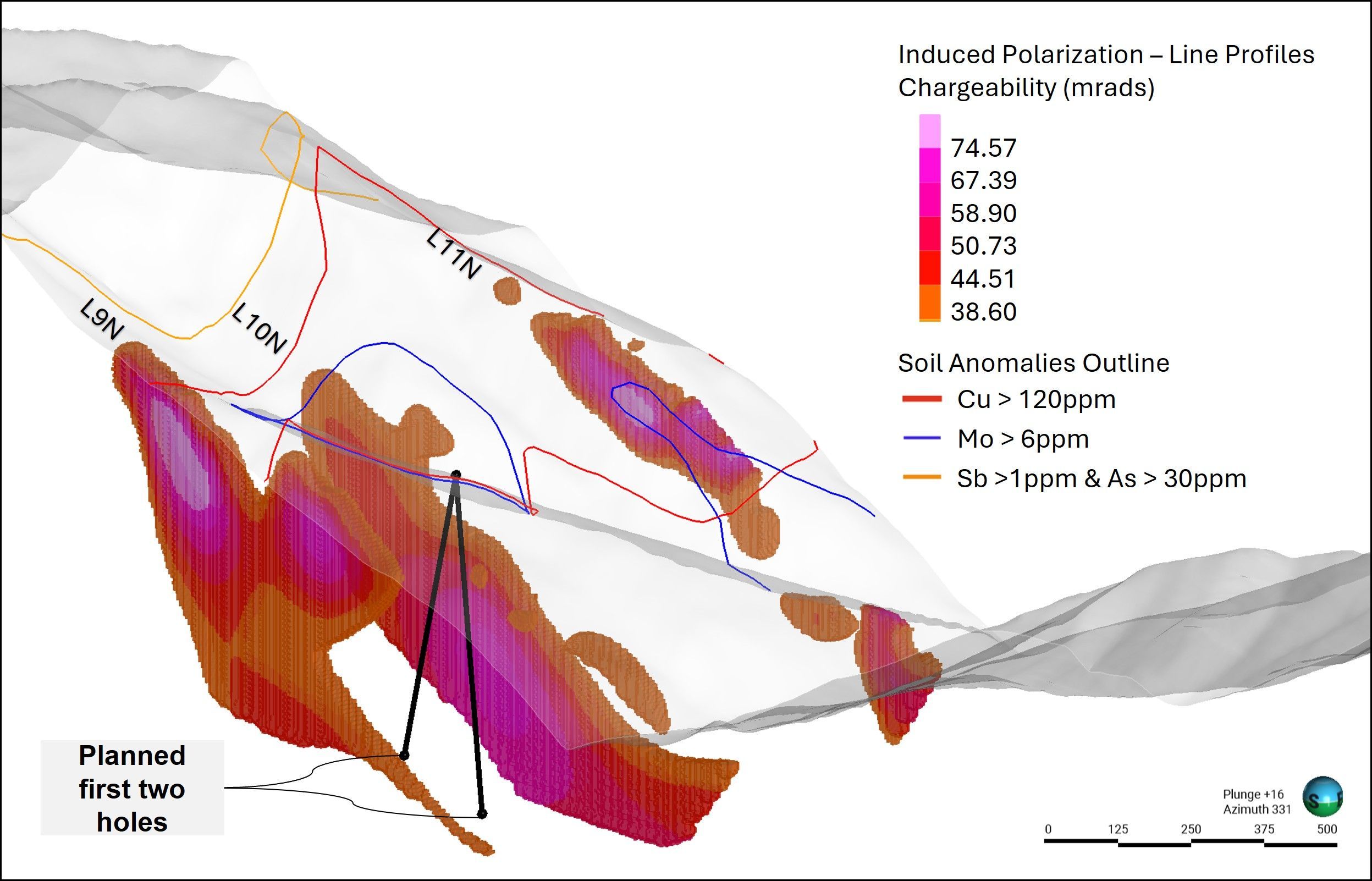

- IP geophysical survey results reveal strong shallow conductivity and intense chargeability features at depth, closely aligning with expected porphyry-style alteration zones.

- Initial drilling will test depths to 500 meters, focusing on the copper-in-soil anomaly, gold-copper in surface rock samples, mapped surface phyllic and chlorite alteration zones, with chargeability signatures suggesting potential copper-gold porphyry mineralization.

Chairman, CEO, Gary R. Thompson stated, " The new Catalyst and Tempest Porphyry Targets have very quickly become exciting drill ready targets. The use of XRF analysis on soils has dramatically reduced the time to drill readiness. We are keen to see what kind of copper-gold grades Catalyst can generate from our initial drilling. In addition to the potential at the Catalyst Target both, the Trapper Gold Targets and the Camp Creek Gold Targets continue to shine brightly . To date in 2025, Brixton has drilled a total of 4,029m: 2,160m at Camp Creek over 12 holes and 1,869m at Trapper over 10 holes with most of these results pending. "

Figure 1. Thorn Targets and Copper Porphyry Targets within the Camp Creek Corridor.

About the Catalyst Copper-Gold Target

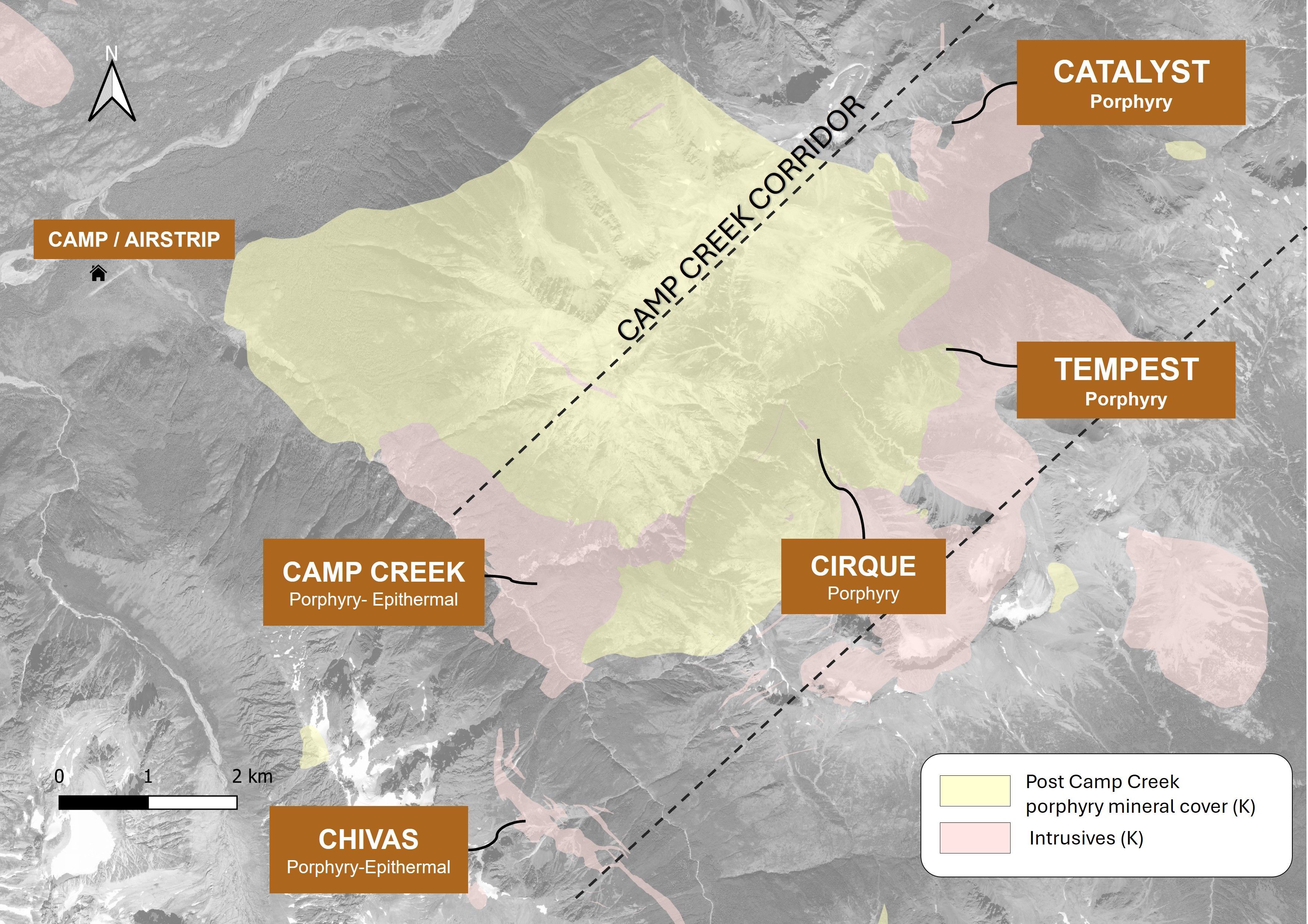

The Catalyst Porphyry Target is located approximately 6 km northeast from the Camp Creek Porphyry system, within a NE-SW corridor hosting several underexplored porphyry-style prospects.

The Catalyst Target was significantly expanded to a 2 km x 1 km copper-in-soil anomaly, with real-time XRF analysis revealing a classic zonation pattern typical of porphyry systems, centered molybdenum with depleted zinc, transitioning outward through copper-tellurium-selenium, and flanked by distal arsenic-antimony anomalies. The soil geochemical anomaly was expanded by a combination of XRF and ICP-MS analysis.

Geological mapping correlates the copper anomaly with outcropping feldspar porphyritic units, showing moderate phyllic alteration (quartz-sericite-pyrite) and moderate to strong chlorite-hematite-pyrite alteration. Phyllic alteration extends over 2 km, grading into propylitic assemblages (chlorite-epidote-pyrite-carbonates). Veining as stockworks and sheeted veins with sericite haloes within the central zone include quartz + pyrite ± chalcopyrite + chlorite + hematite ± bornite.

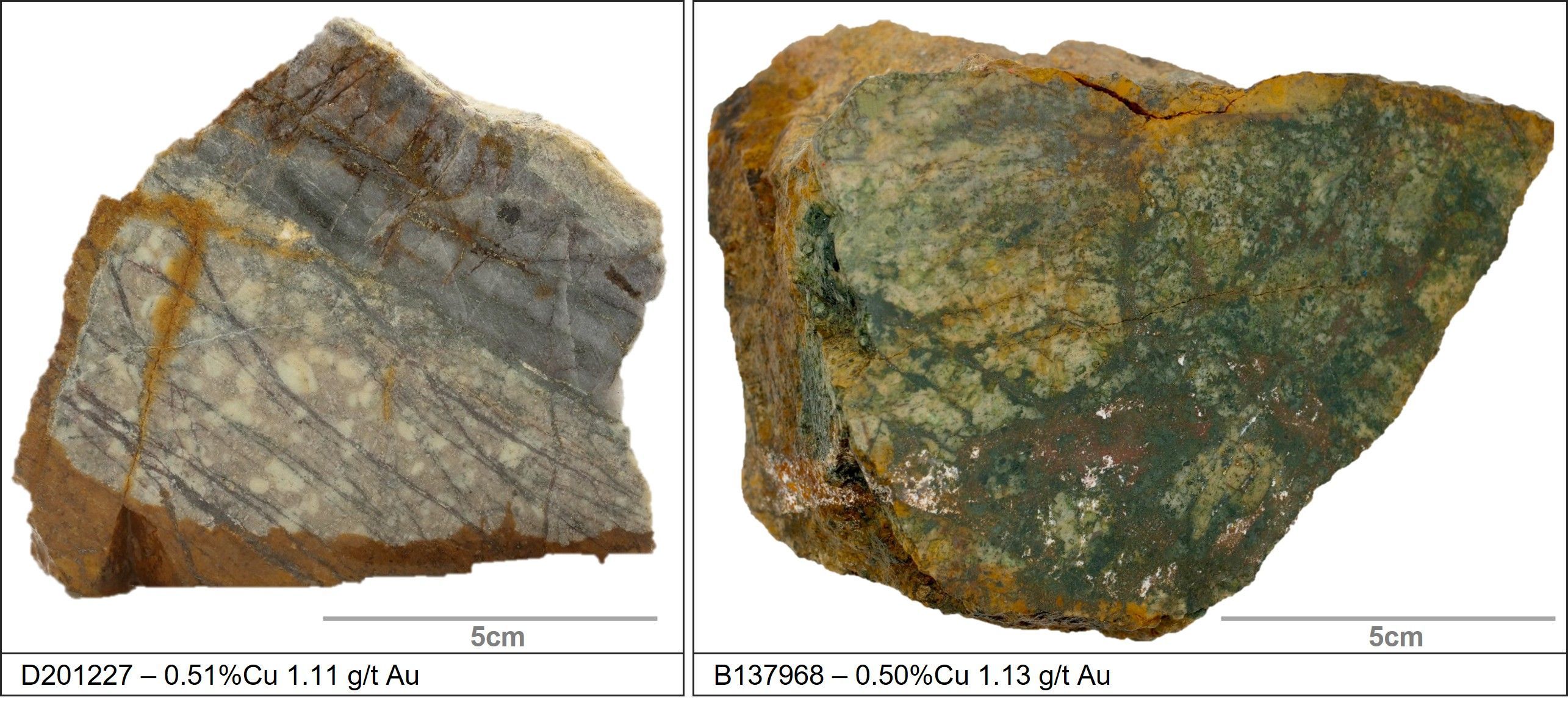

Initial ICP-MS assays from surface rock chip-samples within the anomaly returned encouraging values of ~0.5% Cu and 1 g/t Au, for both styles of alteration phyllic and chlorite, consistent with potential porphyry mineralization.

Figure 2. Updated Soil Geochemistry Map for the Catalyst Target.

Recent induced polarization (IP) geophysics has outlined shallow conductive zones with extensive chargeability anomalies, coincident with both the surface geochemistry and mapped alteration. These features are interpreted as indicative of a phyllic halo and will be the focus of first-phase drill testing, targeting higher-grade copper mineralization at depth.

Figure 3. IP Geophysical Profiles of the Catalyst Target Area.

Figure 4. Surface Rock Samples from the Catalyst Target. Sample D201227 - phyllic altered feldspar porphyry with parallel quartz + chalcopyrite + pyrite veins. Sample B137968 – chlorite altered volcanoclastic rock with stockwork veins of chlorite + hematite + pyrite + chalcopyrite.

Technical Note: Soil sample analysis at the Catalyst Target is being performed using in-house XRF facilities, enabling rapid, real-time geochemical screening to support field operations. Comparative analysis with laboratory-based ICP-MS assays has confirmed consistent results across key elements, including Cu, As, Sb, Te, Se, and W. Standard QA/QC protocols, such as blanks, duplicates, and certified reference standards, are routinely employed to ensure data integrity.

Given the strong correlation between XRF and laboratory data, the company will continue to utilize this accelerated workflow throughout the exploration season to expedite evaluation of additional targets across the project area.

Qualified Person (QP)

Ms. Madeline Berry, P.Geo., is a Project Geologist for the Company who is a qualified person as defined by National Instrument 43-101. Ms. Berry has verified the referenced data and analytical results disclosed in this press release and has approved the technical information presented herein.

About Brixton Metals Corporation

Brixton Metals is a Canadian exploration company focused on the advancement of its mining projects. Brixton wholly owns four exploration projects: Brixton's flagship Thorn copper-gold-silver-molybdenum Project, the Hog Heaven copper-silver-gold Project in NW Montana, USA, which is optioned to Ivanhoe Electric Inc., the Langis-HudBay silver-cobalt-nickel Project in Ontario and the Atlin Goldfields Project located in northwest BC which is optioned to Eldorado Gold Corporation. Brixton Metals Corporation shares trade on the TSX-V under the ticker symbol BBB , and on the OTCQB under the ticker symbol BBBXF . For more information about Brixton, please visit our website at www.brixtonmetals.com .

On Behalf of the Board of Directors

Mr. Gary R. Thompson, Chairman and CEO

info@brixtonmetals.com

For Investor Relations inquiries please contact: Mr. Michael Rapsch, Vice President Investor Relations. email: michael.rapsch@brixtonmetals.com or call Tel: 604-630-9707

Follow us on:

LinkedIn | Twitter/X | Facebook | Instagram

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Information set forth in this news release may involve forward-looking statements under applicable securities laws. Forward-looking statements are statements that relate to future, not past, events. In this context, forward-looking statements often address expected future business and financial performance, and often contain words such as "anticipate", "believe", "plan", "estimate", "expect", and "intend", statements that an action or event "may", "might", "could", "should", or "will" be taken or occur, including statements that address potential quantity and/or grade of minerals, potential size and expansion of a mineralized zone, proposed timing of exploration and development plans, or other similar expressions. All statements, other than statements of historical fact included herein including, without limitation, statements regarding the use of proceeds. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the following risks: the need for additional financing; operational risks associated with mineral exploration; fluctuations in commodity prices; title matters; and the additional risks identified in the annual information form of the Company or other reports and filings with the TSXV and applicable Canadian securities regulators. Forward-looking statements are made based on management's beliefs, estimates and opinions on the date that statements are made and the Company undertakes no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except as required by applicable securities laws. Investors are cautioned against attributing undue certainty to forward-looking statements.

Photos accompanying this announcement are available at:

https://brixtonmetals.com/wp-content/uploads/2025/07/Fig-1a-NR-24July2025-scaled.jpg

https://brixtonmetals.com/wp-content/uploads/2025/07/Fig-1b-NR-24July2025-scaled.jpg

https://brixtonmetals.com/wp-content/uploads/2025/07/Fig-2-NR-24July2025-scaled.jpg

https://brixtonmetals.com/wp-content/uploads/2025/07/Fig-3-NR-24July2025.jpg

https://brixtonmetals.com/wp-content/uploads/2025/07/Fig-4-NR-24July2025-scaled.jpg