June 22, 2023

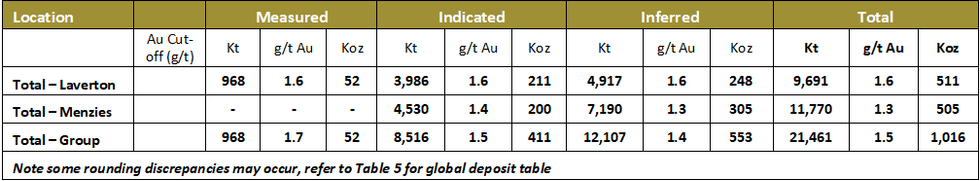

Brightstar Resources Limited (ASX:BTR) (Brightstar) is pleased to announce that the company’s resource base has exceeded 1 million ounces of gold with a significant upgrade to the Cork Tree Well deposit, located 30km north of Laverton in WA’s Goldfields region.

HIGHLIGHTS

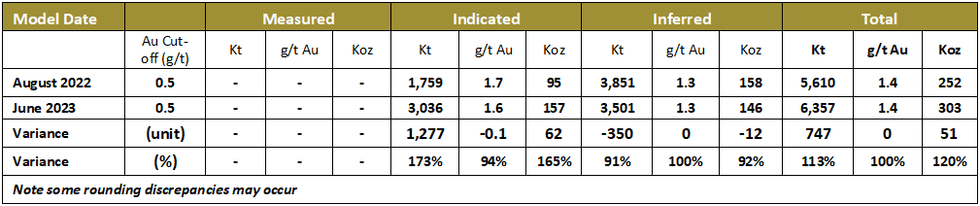

- JORC 2012 Mineral Resource Estimate increased by 20% to 303koz at Cork Tree Well to deliver a combined JORC Resource base of 1.02Moz Au from Laverton & Menzies Gold Projects

- Importantly, the Mineral Resource upgrade represents a 65% increase to the Indicated ounces to 157koz @ 1.6g/t Au

- Two ~6,000m drill programs completed in late 2022 and Q1 20231 delivered the uplift in tonnages and ounces at a discovery cost of

- Updated Cork Tree Well Mineral Resource Estimate completed by independent consultant ABGM Pty Ltd will feed into mining scoping studies underway

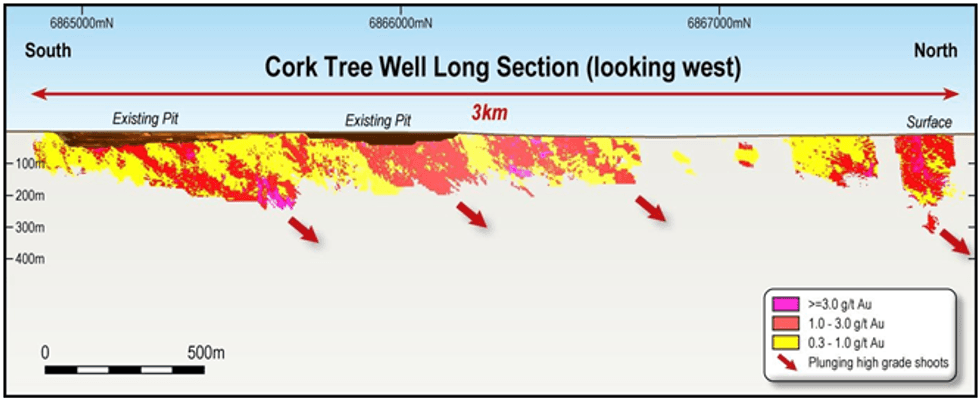

- The Mineral Resource Estimate has also highlighted that the model grade improves at depth and has confirmed the presence of a high-grade plunging shoot within the Cork Tree Well orebody

- This high-grade plunging shoot will continue to be drill tested in the upcoming RC drilling program, targeting depth extensions to the following best intersections within that zone:

- 10m @ 4.5g/t Au from 192m (BTRRC184)

- 22m @ 2.84g/t Au from 127m (BTRRC031)

- 26m @ 2.31g/t Au from 137m (BTRRC026)

- 29m @ 3.1g/t Au from 141m (SDR103602)

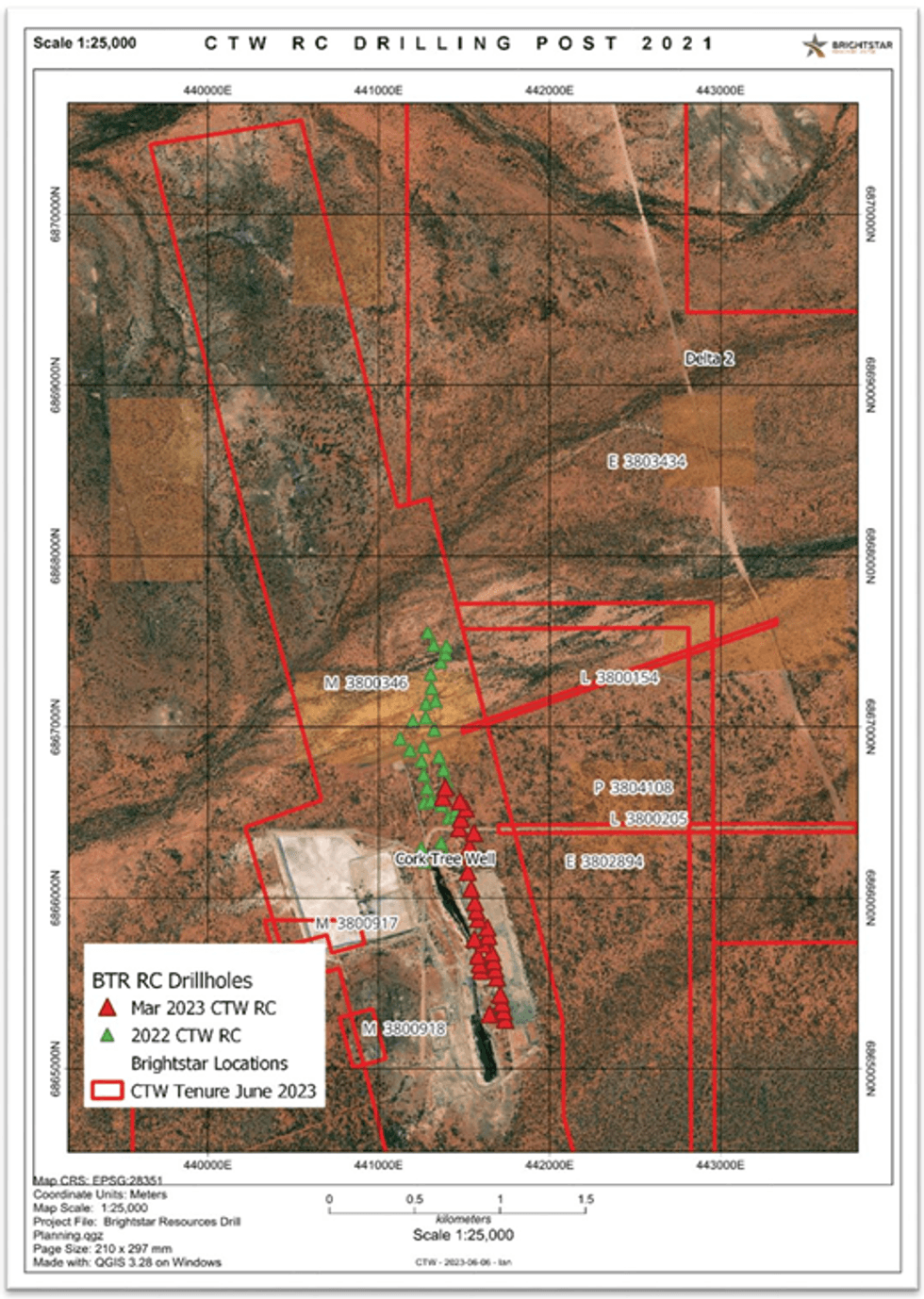

With over 11,000 metres of new drilling completed in late 2022 and early 2023 (refer Figure 2), the infill and extensional programs achieved the aim of identifying new mineralisation outside the previous JORC 2012 Mineral Resource Estimate and increasing confidence in the resource model. This is clearly shown by the Indicated material now accounting for over 50% of the Cork Tree Well Resource to provide a more robust base for mining scoping studies.

Brightstar’s Managing Director, Alex Rovira, commented “We are delighted to see the Cork Tree Well resource grow by over 20%, and more importantly grow our indicated component by 65% to over 3 million tonnes for over 157,000 ounces of gold.

Additionally, the updated Mineral Resource Estimate model has confirmed the presence of a number of higher grade plunging shoots that are open at depth and will be drill tested in upcoming campaigns.

These upgrades have seen Brightstar now control a +1 million ounce resource base with tangible growth shown in just one of our many resources at the Laverton and Menzies Gold Projects. We look forward to updating the market with further news on our drilling at our projects and our scoping study which are both presently underway”.

The updated mineral resource estimate is currently being used for exploration planning purposes in order to target areas that are open down plunge and to ensure sufficient drill density in zones currently classified as Inferred mineralisation to continue to grow the Indicated component of the MRE.

As shown in Tables 1 & 2, Brightstar’s resource at Cork Tree Well has expanded from 252koz to 303koz in less than twelve months, with indicated material increasing by over 1Mt or 62koz driven largely by the targeted resource drilling completed by Brightstar in 2022 and Q1 2023 with inferred material dropping slightly representing a positive conversion of inferred to indicated material which now represents over 50% of in-ground ounces.

ABGM Pty Ltd (ABGM), were engaged by Brightstar to undertake an update for the Mineral Resource Estimate for the Cork Tree Well Gold Deposit following completion of recent drill programs. The following text is a summary of their report issued to Brightstar.

Project Location

The Cork Tree Well Gold Deposit is on Brightstar’s wholly owned tenement M38/346, located 30 km north of Laverton. Access from Laverton is via the Great Central Road for 11km to the Bandya Road turn-off then 23km north on the Bandya Road.

Regional Geology

The Cork Tree Well gold deposit is located in the north Laverton Greenstone Belt on the southern extremity of the Duketon Greenstone Belt (DGB) in the north-eastern sector of the Eastern Goldfields Superterrane of the Yilgarn Craton. Abundant gold mineralisation in the Eastern Goldfields Superterrane has been attributed to the craton wide structural-metamorphic events that took place in the complex protracted structural evolution of the craton, between 2667Ma and 2615Ma.

The Laverton Greenstone Belt has the largest known gold endowment In the Eastern Goldfields Superterrane after the Kalgoorlie region. A narrow approximately 5km wide belt of attenuated north-south trending greenstone links the Duketon and Laverton belts.

The DGB is characterised by a deeply weathered, metamorphosed succession of Archaean mafic, ultramafic, and felsic volcanic rocks with associated volcanogenic sedimentary rocks and thin units of banded chert and banded iron formation. Late-stage high level acid to intermediate sills and dykes and associated small plutons intrude the sequence.

Click here for the full ASX Release

This article includes content from Brightstar Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BTR:AU

Sign up to get your FREE

Brightstar Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

08 January

Brightstar Resources

Emerging gold producer and district-scale resource developer in Western Australia

Emerging gold producer and district-scale resource developer in Western Australia Keep Reading...

04 February

High grade assays continue from Sandstone RC drilling

Brightstar Resources (BTR:AU) has announced High grade assays continue from Sandstone RC drillingDownload the PDF here. Keep Reading...

01 February

Strategic $180M capital raising funds Goldfields development

Brightstar Resources (BTR:AU) has announced Strategic $180M capital raising funds Goldfields developmentDownload the PDF here. Keep Reading...

30 January

Quarterly Activities/Appendix 5B Cash Flow Report

Brightstar Resources (BTR:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Updated Goldfields Feasibility Study

Brightstar Resources (BTR:AU) has announced Updated Goldfields Feasibility StudyDownload the PDF here. Keep Reading...

29 January

Updated Goldfields DFS Presentation

Brightstar Resources (BTR:AU) has announced Updated Goldfields DFS PresentationDownload the PDF here. Keep Reading...

Latest News

Sign up to get your FREE

Brightstar Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00