November 05, 2024

Red Mountain Mining Limited (“RMX” or the “Company”) is pleased to advise that it has received gold results for 91 rock grab samples collected during September from the Company’s 100%-owned Flicka Lake prospect in Ontario, Canada. The rock chip sampling was carried out in parallel with a soil sampling program. Approximately 400 locations were visited within the Flicka Lake claims and 91 rock grab samples and 283 soil samples were collected and submitted for multielement geochemical analysis, including gold by Flame Assay and a base metal suite by four acid digest with ICP-OES finish. Soil results assay results are expected before the end of November.

HIGHLIGHTS

- Gold results from 91 rock chip samples collected from Flicka Lake received

- Bonanza grade values confirmed for the Flicka Zone:

- Flicka Vein #2 returned values of 24.2ppm (24.2 g/t Au) and 19.4ppm (19.4 g/t Au)

- Flicka Vein #3 returned a peak value of 9.35ppm (9.35 g/t Au)

- Results supported by historical desktop study as announced last week

- 0.514ppm (0.514 g/t Au) returned for a pyritic vein sample 800m WSW of Flicka Zone, along the strike of the main shear, highlighting the potential for strike extension of high grade mineralisation

- Soil assay results are expected to be received before the end of November

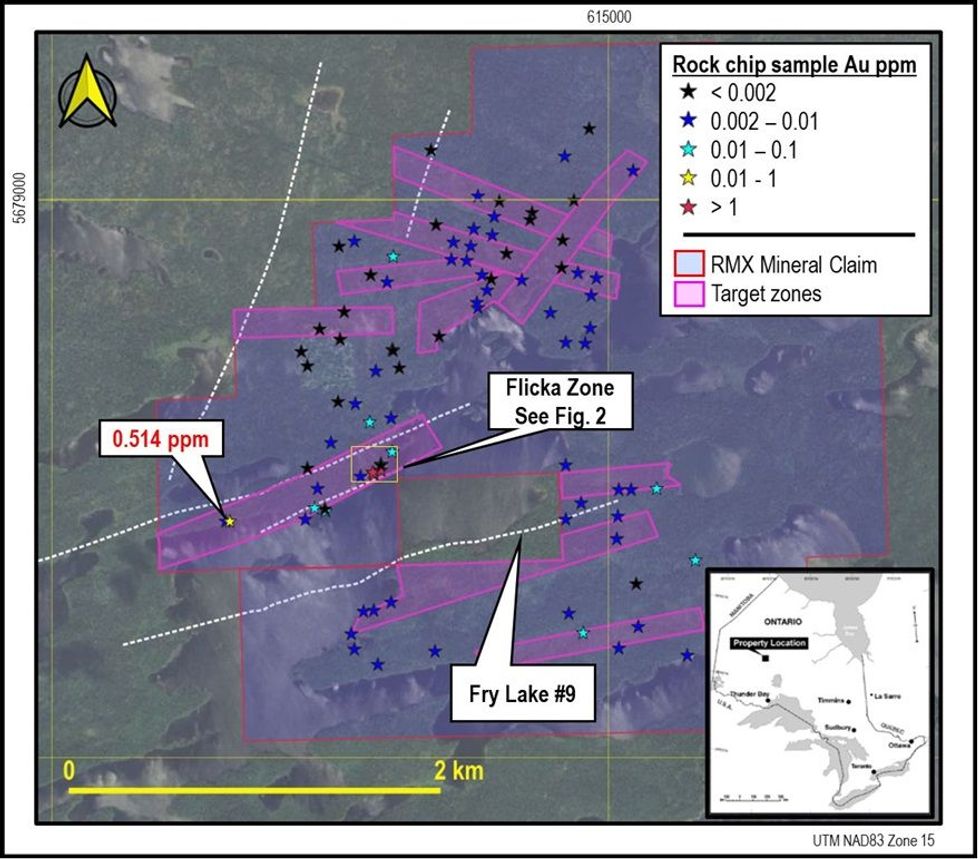

As outlined in RMX’s ASX announcement of 30 October 2024, the rock and soil sampling program was designed to test ten target zones defined using available geological and geophysical data for the Flicka Lake tenement. Zones sampled included the Flicka Zone, previously identified and sampled by Troon Ventures in the early 2000s.

High gold grades for the Flicka Zone confirmed by rock chip sample results

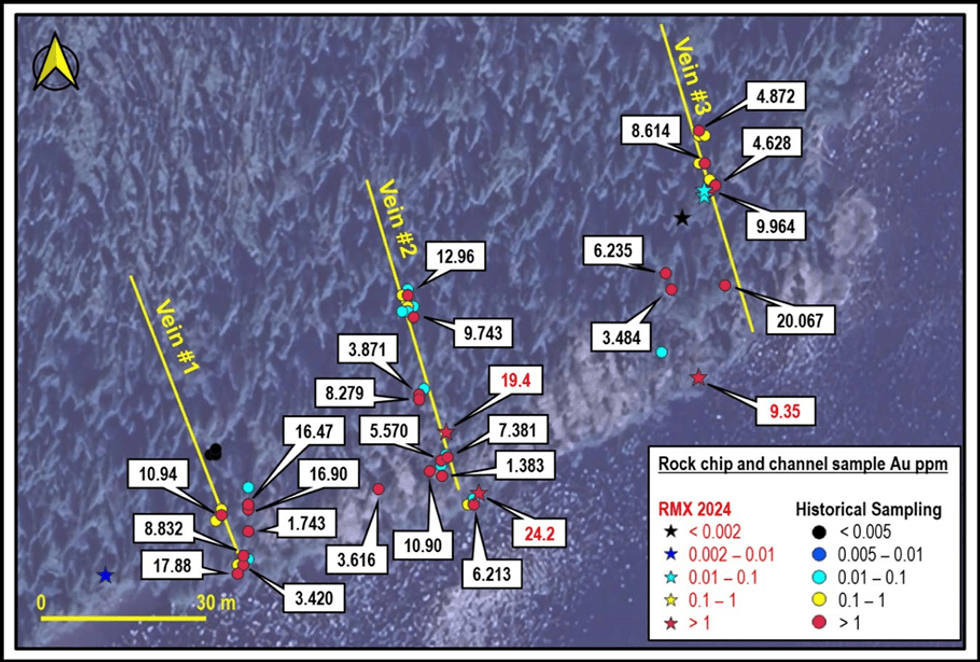

The gold values returned for the 91 rock chip samples are shown on Figure 1 and Figure 2 and listed on Table 1. The best results were obtained from Vein #2 and Vein #3 of the Flicka Zone, with peak values of:

- 24.2ppm (24.2 g/t Au) (Sample 1292085) and 19.4ppm (19.4 g/t Au) (Sample 1292094, shown in Figure 3) from Vein #2.

- 9.35ppm (9.35 g/t Au) (Sample1292086) from Vein #3.

The RMX rock chip results are consistent with historical rock chip and channel sampling results reported by Troon Ventures for the Flicka Zone (Figure 2) that range up to 16.88ppm (16.88 g/t Au) for Vein #1, 12.96ppm (12.96 g/t Au) for Vein #2 and 20.067ppm (20.067 g/t Au) for Vein #3 (refer to RMX ASX Announcement 30 October 2024).

The gold results to date from the Flicka Zone veins are comparable to the recorded grade of the Golden Patricia Mine (refer to Figure 4), a steeply dipping narrow quartz vein system averaging only 40cm in width that is located approximately 25km NE of the Flicka Lake project area. Between 1987 and 1997, Golden Patricia produced 0.62Moz of gold from 1.22Mt of ore averaging 14.4ppm (14.4 g/t Au)1.

An additional pyritic vein sample, located ~800m WSW of the Flicka Zone along the strike of and striking approximately parallel to the main Flicka Zone shear (Figure 1) returned a value of 0.514ppm (0.514 g/t Au), which highlights the potential for the high-grade mineralisation sampled at the Flicka Zone to persist along the shear system.

Next steps

Following receipt of soil geochemistry and full base metal rock chip sample results, expected during November, RMX will evaluate the full dataset to prioritise targets within the Flicka Lake claims for further surface sampling, where justified and drill testing during the 2025 Canadian field season.

Click here for the full ASX Release

This article includes content from Red Mountain Mining, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

18h

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The Toronto-based miner said its board has authorized preparations for an IPO of a new entity that would house its premier North American gold operations,... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

05 February

TomaGold Borehole EM Survey Confirms Berrigan Deep Zone

Survey also validates significant mineralization and unlocks new targets Highlights Direct correlation with mineralization : The modeled geophysical plates explain the presence of semi-massive to massive sulfides intersected in holes TOM-25-009 to TOM-25-015. Priority target BER-14C :... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00