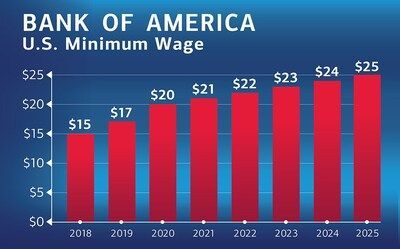

The increase delivers on a pledge to hit $25 by 2025

Today, Bank of America announced it has raised its U.S. minimum hourly wage to $25 per hour. With the increase, the minimum annualized salary for full-time employees in the U.S. will rise to more than $50,000 . The increase, which goes into effect in early October, applies to all full-time and part-time hourly positions in the U.S., affecting thousands of employees across the nation and helping to fuel the growth of the American economy and create job opportunities that strengthen the communities the company serves.

A national leader

- This is the company's latest move, after steadily increasing over the last several years, from under $15 per hour to $25 per hour

- It builds on the bank's history of being a national leader in establishing a competitive minimum rate of pay for U.S. hourly employees

- With the increase to $25 , starting salary for full-time U.S. employees at the bank will have gone up by more than $20,000 since 2017

Joining the bank at the minimum wage is a launchpad for a long-term career. From onboarding and professional development to tuition assistance and career mobility, the company is committed to a workplace where every teammate has the opportunity to grow and succeed.

"Our strong and rising minimum starting salary provides opportunities for our teammates to build a long-term career at Bank of America," said Sheri Bronstein , Chief People Officer, Bank of America . "Competitive compensation is one of the many ways we are helping to drive American economic growth and opportunity."

Competitive pay, industry-leading benefits

As a further investment in the team, 97% of Bank of America employees have received awards beyond regular compensation, mostly in the form of Bank of America restricted common stock. Nearly $5.8 billion has been awarded since the program's inception in 2017.

Bank of America also offers industry-leading benefits and employee programs for all. Additional benefits include, but are not limited to:

- An award-winning onboarding, education and professional development organization, The Academy

- 26 weeks of parental leave; 16 are fully paid

- An industry-leading sabbatical program, offering 4-6 weeks of paid time off based on tenure

- Back up child and adult care program, as well as for eligible teammates, a reimbursement program for childcare expenses

- U.S. health plans include no-cost wellness visits, preventative medications, virtual care and onsite screenings

- Personalized support for employees and their families navigating critical life events through our Life Event Services team

Through an ongoing investment in skills-based training and a culture rooted in opportunity, many teammates who started their careers at a minimum wage salary rise to roles where they lead, mentor, provide for their families and give back to their communities.

Bank of America's leadership as a global employer of choice has been recognized by many external organizations, including LinkedIn's Top Companies in the U.S., Fortune's 100 Best Companies to Work For list for seven consecutive years and People Magazine's 100 Companies That Care. These recognitions reflect Bank of America's continuous focus on providing a Great Place to Work for all teammates.

Bank of America

Bank of America is one of the world's leading financial institutions, serving individual consumers, small and middle-market businesses and large corporations with a full range of banking, investing, asset management and other financial and risk management products and services. The company provides unmatched convenience in the United States , serving approximately 69 million consumer and small business clients with approximately 3,700 retail financial centers, approximately 15,000 ATMs (automated teller machines) and award-winning digital banking with approximately 59 million verified digital users. Bank of America is a global leader in wealth management, corporate and investment banking and trading across a broad range of asset classes, serving corporations, governments, institutions and individuals around the world. Bank of America offers industry-leading support to approximately 4 million small business households through a suite of innovative, easy-to-use online products and services. The company serves clients through operations across the United States , its territories and more than 35 countries. Bank of America Corporation stock is listed on the New York Stock Exchange (NYSE: BAC).

For more Bank of America news, including dividend announcements and other important information, visit the Bank of America newsroom and register for news email alerts .

Reporters may contact

John Yiannacopoulos , Bank of America

Phone: 1.646.855.2314

john.yiannacopoulos@bofa.com

![]() View original content to download multimedia: https://www.prnewswire.com/news-releases/bofa-raises-us-minimum-hourly-wage-to-25-increasing-starting-salary-to-more-than-50k-302558680.html

View original content to download multimedia: https://www.prnewswire.com/news-releases/bofa-raises-us-minimum-hourly-wage-to-25-increasing-starting-salary-to-more-than-50k-302558680.html

SOURCE Bank of America Corporation