May 27, 2025

Blue Sky Uranium (TSXV:BSK,OTC:BKUCF) provides investors with a compelling opportunity to gain exposure to the uranium market through its strategic foothold in Argentina’s emerging uranium sector. Backed by a substantial resource base, robust project economics, and a strong joint venture partnership, the company has a clear pathway to potential production.

Blue Sky Uranium is positioning itself as a leading force in uranium exploration and development in Argentina. As part of the renowned Grosso Group—pioneers in Argentine mineral exploration since 1993 and contributors to four major mineral discoveries—Blue Sky leverages decades of in-country expertise and well-established local partnerships.

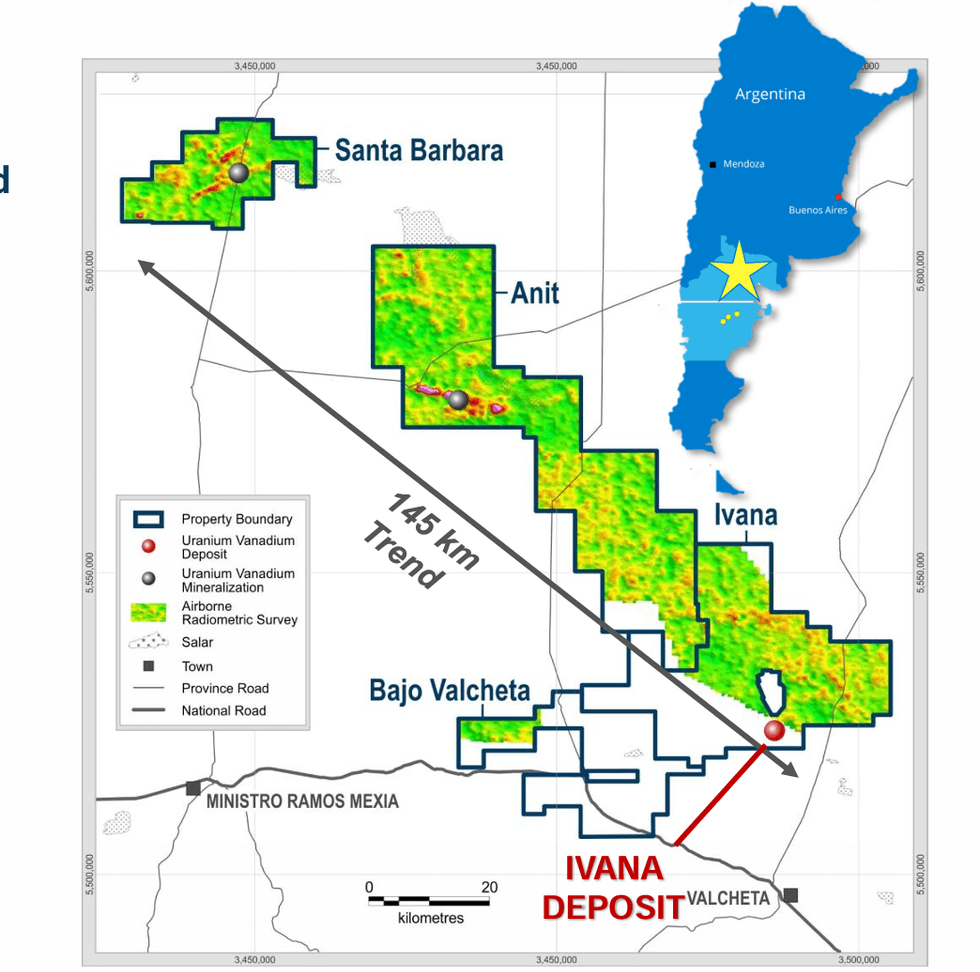

The company’s flagship Amarillo Grande Project is a unique, company-led discovery marking Argentina’s newest uranium-vanadium district. Spanning over 145 kilometers and covering more than 300,000 hectares in Rio Negro Province, this district-scale project hosts the largest NI 43-101-compliant uranium resource in Argentina at its Ivana deposit. With this strategic asset, Blue Sky is well-positioned to become the country’s first domestic uranium supplier, supporting a growing nuclear energy program that currently relies entirely on imported fuel.

Company Highlights

- Significant Uranium Resource: Controls the largest NI 43-101 compliant uranium resource in Argentina with 17 Mlbs U3O8 in indicated resources and 3.8 Mlbs in inferred resources, plus valuable vanadium credits.

- Positive Economics: 2024 PEA shows robust economics with after-tax NPV8 percent of US$227.7 million and 38.9 percent IRR at base case uranium price of US$75/lb.

- Low-cost Production Potential: Near-surface mineralization with no blasting required, hosted in loosely consolidated sediments, making for potentially low mining costs.

- Strategic JV Partnership: Secured an earn-in agreement with COAM to advance the Ivana deposit with no funding required by Blue Sky through development. COAM will spend up to US$35 million to earn up to a 49.9 percent interest, and can further earn up to 80 percent by funding development costs to production (up to US$160 million).

- Strong Uranium Market Fundamentals: Global uranium market faces supply deficits with increasing demand from nuclear power generation, with prices strengthening significantly since 2023.

- Domestic Market Opportunity: Argentina has three operational nuclear plants with others under construction or planned, yet imports all uranium for fuel. National legislation guarantees purchase of domestically produced uranium.

- ISR Project Pipeline: New projects in the Neuquen Basin provide future growth through potential in-situ recovery operations, a method that produces 57 percent of the world's uranium with minimal environmental impact.

This Blue Sky Uranium profile is part of a paid investor education campaign.*

Click here to connect with Blue Sky Uranium (TSXV:BSK) to receive an Investor Presentation

BSK:CA

Sign up to get your FREE

Blue Sky Uranium Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

04 November 2025

Blue Sky Uranium

Argentina’s emerging uranium resource developer

Argentina’s emerging uranium resource developer Keep Reading...

15h

Eagle Energy Metals and Spring Valley Acquisition Corp. II Announce Closing of Business Combination

Eagle Energy Metals Corp. (“Eagle”), a next-generation nuclear energy company with rights to the largest conventional, measured and indicated uranium deposit in the United States, today announced that it has completed its business combination with Spring Valley Acquisition Corp. II (OTC: SVIIF)... Keep Reading...

23 February

Basin Energy Hits 1,112 ppm TREO, Fast Tracks 2026 Uranium and REE Strategy at Sybella-Barkly

Basin Energy (ASX:BSN) is moving to accelerate its 2026 exploration efforts following "exciting" results from its maiden drilling program at the Sybella-Barkly project in Queensland. In a recent interview, Managing Director Pete Moorhouse revealed that the company has confirmed a significant... Keep Reading...

19 February

Drilling Confirms Potential REE System at Sybella Barkly

Basin Energy (BSN:AU) has announced Drilling Confirms Potential REE System at Sybella BarklyDownload the PDF here. Keep Reading...

18 February

Niger’s Seized Uranium Remains in Geopolitical Limbo

A stockpile of 1,000 metric tons of uranium seized from a French-operated mine in Niger is now sitting at a military airbase in Niamey that was recently attacked by Islamic State militants, raising fresh concerns over security and the material’s uncertain future.The uranium, which is processed... Keep Reading...

12 February

Deep Space Energy Secures US$1.1 Million to Advance Lunar Power and Satellite Resilience Goals

Latvian startup Deep Space Energy announced it has raised approximately US$1.1 million in a combination of private investment and public funding to advance a radioisotope-based power generator designed to operate on the Moon.The company closed a US$416,500 pre-seed round led by Outlast Fund and... Keep Reading...

Latest News

Sign up to get your FREE

Blue Sky Uranium Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00