- WORLD EDITIONAustraliaNorth AmericaWorld

June 13, 2023

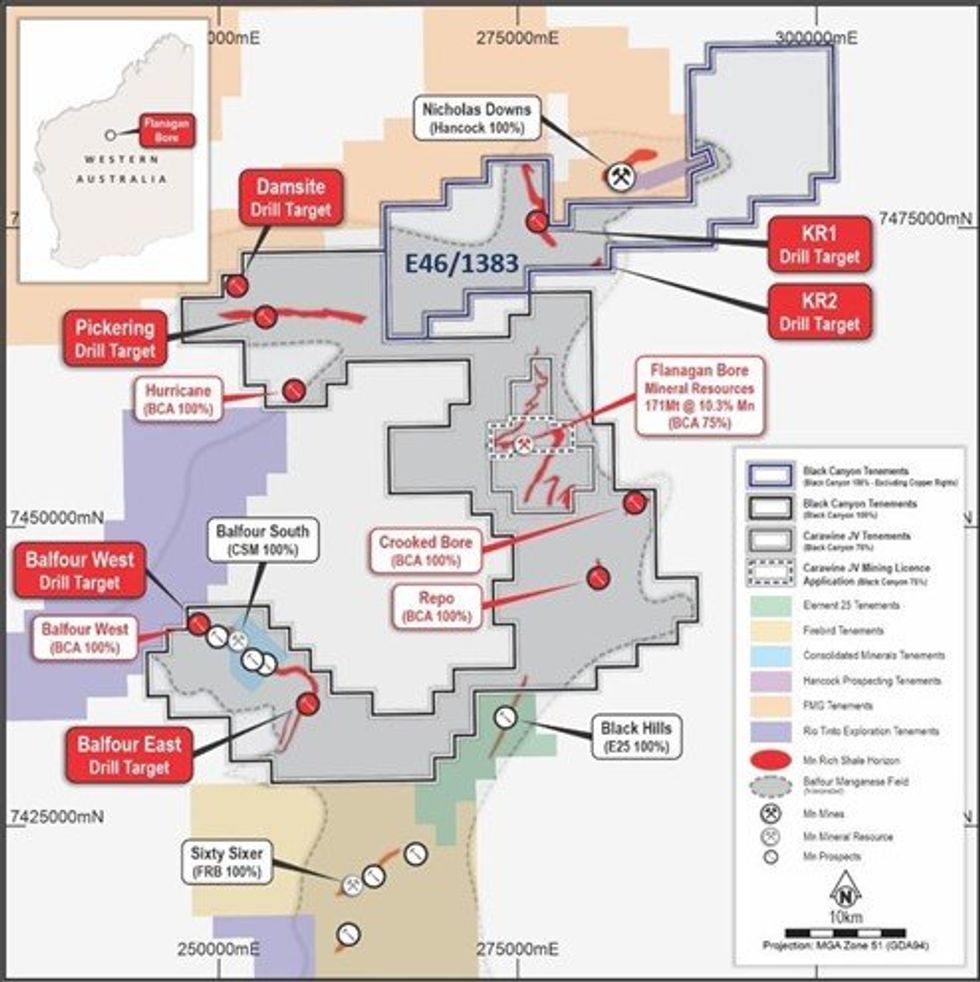

Australian manganese explorer, Black Canyon Limited (Black Canyon or the Company) (ASX:BCA) is pleased to advise that further to its announcement on March 27 2023 it has now completed the 100% acquisition of granted licence E46/1383 (excluding copper rights as outlined below). This acquisition adds a further 351km² to the Company’s prospective manganese portfolio in the eastern Pilbara. Black Canyon’s tenement coverage further consolidates the prospective manganese enriched shale horizon extending across the Balfour Manganese Field that includes Mineral Resources at Flanagan Bore (BCA 75%) and other Mineral Resources at Balfour South, Sixty Sixer, and the past producing manganese mine of Nicholas Downs which are owned by others (Figure 1).

- Black Canyon has completed the 100% acquisition of granted licence E46/1383 (excluding copper rights)

- The strategic acquisition further expands tenure under BCA exploration control over the Balfour Manganese Field by 351km² to total 1,175km².

- The licence contains several outcropping manganese enriched prospects including a significant and continuous zone of mineralisation extending over 5km at KR1.

- No historic drilling has been completed over the outcropping mineralisation providing an opportunity for Black Canyon to discover and deliver additional Mineral Resources.

- The Company has successfully completed Heritage surveys across the targets and received all other approvals to commence a 5,000 to 10,000m RC drill program.

- Multiple drill targets are now ready to be tested in the coming field season.

Black Canyon’s Executive Director Brendan Cummins said: “Our field teams have been very active over the past few months and completed detailed mapping, surface sampling and successfully concluded Heritage Surveys over key targets across the Balfour Manganese field. Based on the work completed to date and our experience in the area we believe there is high potential to discover and delineate substantial Mineral Resources confirming the manganese endowment of this globally significant region. This is similar to the opportunity at Flanagan Bore where the Company made a significant discovery and rapidly delineated mineral resources. The size and scale of the Balfour Manganese Field and the discoveries to date show considerable promise and the completion of this strategic acquisition complements our existing portfolio and contributes to the Company’s overall growth and development strategy”.

Balfour Manganese Field Exploration Drill Program

An initial RC drill program has been designed to drill test several high-quality targets across Black Canyon, 100% owned tenements within the Balfour Manganese Field. Drilling is planned on the following tenements:

1. E46/1383 – at KR1, a previously undrilled 2,500m section of outcropping supergene mineralisation will be drill tested using 200m spaced lines which includes a 900m long section of prominent manganese enriched shale (Figures 2, 3 & 4). At KR2, a previously undrilled subcropping to outcropping 900m long zone of manganese enriched shale will be drill tested.

2. E46/1396 – at the Balfour West target, a 1500m long horizon that is interpreted to be extend from outcropping manganese enriched shales under thin cover will be drill tested. At Balfour East, several wide spaced stratigraphic drill lines are planned to intersect subcropping and thinly covered manganese enriched shales over several kilometres of strike.

3. E46/1404 – at Pickering, a previously undrilled 2,000m long section of the subcropping manganese enriched calcareous shales will be drill tested using 400m spaced lines. The overall length of the Pickering target is 10,000m. At the Damsite prospect, a previously undrilled 500m long subcropping to outcropping zone of manganese enriched shale will be drill tested.

A total of 5,000 to 10,000m of RC drilling is planned for the coming field season across the three tenements with assay results to follow. Refer to ASX announcement 14 February 2023 (Exploration and Manganese Sulphate Update) and 27 March 2023 (Black Canyon acquires strategic tenement within the prospective Balfour Manganese Field) for further information on the drill targets.

Click here for the full ASX Release

This article includes content from Black Canyon, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BCA:AU

The Conversation (0)

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00