B2Gold Corp. (TSX: BTO) (NYSE: BTG) (NSX: B2G) ("B2Gold" or the "Company") is pleased to announce additional positive exploration drilling results from the Anaconda Area located approximately 25 kilometers north of the Fekola Mine, confirming continuity of the Mamba Main Zone, which remains open down plunge.

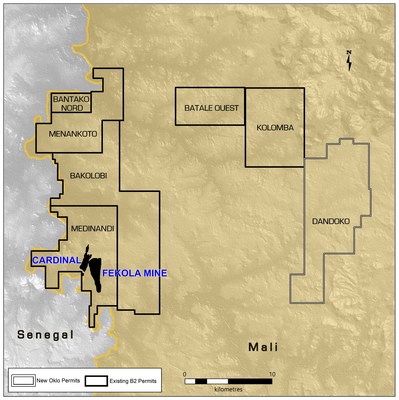

The Anaconda Area , comprised of the Menankoto and Bantako North permits, forms part of the Fekola complex (the "Fekola Complex"), which also includes the Fekola Mine and the adjacent Cardinal Zone, the Bakolobi permit, and the Dandoko permit (subject to completion of the Oklo Resources Ltd. transaction).

Exploration Highlights

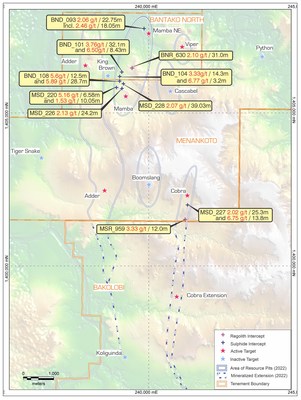

- High grade results from the Mamba Main Zone, including hole BND_108 with 5.89 grams per tonne ("g/t") gold over 28.70 meters ("m") from 455.45 m , hole BND_101 with 3.76 g/t gold over 32.08 m from 299.00 m , and hole BND_104 with 3.33 g/t gold over 14.30 m from 362.70 m , which collectively confirm and extend the continuity of the high grade sulphide mineralization of the sulphide shoot to over 700 m down plunge, providing a strong indication of the potential for Fekola-style bodies of sulphide mineralization, which remain open at depth.

- Strong initial results from the Cobra Zone, located 2 kilometers east of the Mamba Zone, including hole MSD_227 with 2.02 g/t gold over 25.30 m from 201.70 m , and 6.75 g/t gold over 13.80 m from 244.40 m , confirming the potential for economic grade and width combinations in the sulphide mineralization. The Company believes that the Cobra Zone may extend onto the Bakolobi permit and are currently drilling this extension target.

- Ongoing drilling by the Company on the Anaconda Area to infill and extend the saprolite Mineral Resource area and to follow up on the sulphide mineralization, including the Mamba and Adder zones as well as several other targets below the saprolite mineralization, continues to generate positive drill results in both saprolite and sulphide domains and demonstrates strong potential to further increase the updated March 2022 Anaconda Area Mineral Resource estimate.

2022 Mali Exploration Drilling Program

In 2022, B2Gold is conducting an approximately 161,000 m drill program on the Fekola Complex with a budget of approximately $35 million , including drill programs on the Fekola North deposit to further test the underground mineralization potential, and on the Anaconda Area , including the Mamba, Adder, Anaconda , Cascabel, Viper, and Cobra zones. To date in 2022, B2Gold has completed approximately 116,000 m of combined diamond, reverse circulation and aircore drilling on targets near the Fekola Mine and the Anaconda Area . In addition, approximately 9,000 m of drilling has been completed to date on the newly acquired Bakolobi permit.

Click here to view Figure 1. Fekola Complex Overview

Anaconda Area Exploration

Mamba Zone

Ongoing exploration in the Anaconda Area continues to generate positive drill results in both saprolite and sulphide domains and demonstrates upside potential to the updated Anaconda Area Mineral Resource estimate, constrained within a conceptual pit shell at a gold price of $1,800 per ounce, which included an initial Indicated Mineral Resource estimate of 32,400,000 tonnes at 1.08 g/t gold for a total 1,130,000 ounces of gold, and an Inferred Mineral Resource estimate of 63,700,000 tonnes at 1.12 g/t gold for 2,280,000 ounces of gold.

Drilling targeting the deeper portions of the Mamba Main sulphide shoot has been particularly successful, as demonstrated by the results of holes BND_108, BND_101, and BND_104, confirming the continuity of the high grade sulphide mineralization and extending the Mamba Main sulphide shoot to over 700 m down plunge. The results from holes MSD_228 and MSD_226 suggest that multiple high grade sulphide shoots may be present in the Mamba Zone. Ongoing drilling will continue to test the potential for Fekola-style, south plunging bodies of sulphide mineralization, which remain open down plunge.

Click here to view Figure 2. Mamba Long Section

Approximately 1.2 kilometers north of the Mamba Main sulphide shoot, hole BND_093 returned 2.06 g/t gold over 22.75 m from 199.55 m , demonstrating additional sulphide potential at Mamba NE which is hosted in a separate northeast-trending structure from the Mamba Main mineralization.

Three drill rigs are currently drilling the Mamba Zone, with approximately 16,000 m to be completed during the remainder of 2022.

Select results from the Mamba Zone exploration drilling include:

| HoleID | From | To | Meters | Gold (g/t) | Domain |

| BND_093 | 199.55 | 222.30 | 22.75 | 2.06 | Sulphide |

| incl | 203.25 | 221.30 | 18.05 | 2.46 | Sulphide |

| BND_101 | 299.00 | 331.08 | 32.08 | 3.76 | Sulphide |

| incl | 313.16 | 331.08 | 17.92 | 4.70 | Sulphide |

| and | 339.10 | 345.60 | 6.50 | 8.43 | Sulphide |

| incl | 340.07 | 345.60 | 5.53 | 9.79 | Sulphide |

| BND_104 | 362.70 | 377.00 | 14.30 | 3.33 | Sulphide |

| incl | 364.40 | 375.30 | 10.90 | 4.22 | Sulphide |

| BND_108 | 395.55 | 408.05 | 12.50 | 5.60 | Sulphide |

| and | 455.45 | 484.15 | 28.70 | 5.89 | Sulphide |

| incl | 457.80 | 482.00 | 24.20 | 6.90 | Sulphide |

| BNR_630 | 63.00 | 94.00 | 31.00 | 2.10 | Saprolite |

| MSD_220 | 544.60 | 551.18 | 6.58 | 5.16 | Sulphide |

| MSD_228 | 184.07 | 223.10 | 39.03 | 2.07 | Sulphide |

| incl | 184.80 | 192.10 | 7.30 | 5.08 | Sulphide |

| and | 238.10 | 261.25 | 23.15 | 1.28 | Sulphide |

| MSD_226 | 191.10 | 215.30 | 24.20 | 2.13 | Sulphide |

| and | 261.30 | 282.80 | 21.50 | 0.70 | Sulphide |

| and | 326.85 | 337.07 | 10.22 | 1.76 | Sulphide |

Note: S aprolite composites are reported above a 0.2 g/t gold cutoff and sulphide composites above 0.6 g/t gold cutoff, applying a maximum internal dilution of 5 m .

Cobra Zone (2 kilometers east of the Mamba Zone)

The Cobra Zone has over 8 kilometers of known strike extent, from Menankoto South to the southern end of the Bakolobi permit. The Cobra Zone is being targeted as a source of additional sulphide mineralization within the Anaconda Area . Recent drilling highlights include hole MSD_227, which intersected 2.02 g/t gold over 25.30 m (approximately 20 m true width) from 201.70 m , and 6.75 g/t gold over 13.80 m from 244.40 m , confirming the potential for economic grade and width combinations in the sulphide mineralization. Closer to surface, hole MSR_959 intersected 3.33 g/t gold over 12.00 m from 107.00 m in saprolite mineralization. The Company believes that the Cobra Zone may extend onto the Bakolobi permit and are currently drilling this extension target.

Click here to view Figure 3 - Menankoto - Bakolobi Drill Targets

Select results from the Cobra Zone exploration drilling include:

| HoleID | From | To | Meters | Gold (g/t) | Domain |

| MSD_227 | 145.60 | 160.40 | 14.80 | 1.47 | Sulphide |

| and | 201.70 | 227.00 | 25.30 | 2.02 | Sulphide |

| incl | 203.50 | 208.15 | 4.65 | 5.92 | Sulphide |

| and | 244.40 | 258.20 | 13.80 | 6.75 | Sulphide |

| MSR_959 | 107.00 | 119.00 | 12.00 | 3.33 | Saprolite |

| MSR_1025 | 33.00 | 47.00 | 14.00 | 1.92 | Saprolite |

| MSR_1026 | 7.00 | 34.00 | 27.00 | 0.82 | Saprolite |

| MSR_1027 | 98.00 | 108.00 | 10.00 | 1.54 | Sulphide |

| incl | 98.00 | 104.00 | 6.00 | 2.30 | Sulphide |

Note: S aprolite composites are reported above a 0.2 g/t gold cutoff and sulphide composites above 0.6 g/t gold cutoff, applying a maximum internal dilution of 5 m .

Three drill rigs are currently drilling the Cobra Zone, with approximately 18,000 m to be completed during the remainder of 2022.

2022 Fekola and West Mali Regional Exploration

For the remainder of 2022, the Company will focus on follow up drilling to extend the known sulphide mineralization at the Anaconda Area, including the Mamba, Cobra and Adder zones, and several other targets below the saprolite mineralization, with approximately 45,000 m to be completed overall.

In April 2022, the Company acquired the Bakolobi permit, which is located between the Menankoto South permit and the Medinandi permit, covering an area of 100 km 2 and providing approximately 25 kilometers of contiguous exploration potential along the prolific Senegal-Mali Shear Zone. An initial 9,000 m of aircore drilling and reverse circulation drilling has been completed since the acquisition. Drilling is focused on the southward extension of known resources in the Adder Zone and will also test the southward extension of sulphide mineralization on the Cobra Zone. The Company believes that the Bakolobi permit is a highly prospective area that has the potential to provide for the near-term addition of both saprolite and sulphide hosted gold deposits.

B2Gold's acquisition of Oklo Resources Limited and its flagship Dandoko project, which is anticipated to be completed on September 19, 2022 , will extend the footprint of B2Gold's exploration in Mali to over 1,700 km 2 and add the Dandoko project's JORC 2012 compliant Measured and Indicated Mineral Resource estimate of 8.70 million tonnes at 1.88 g/t gold for 528,000 ounces of gold and an Inferred Mineral Resource estimate of 2.63 million tonnes at 1.67 g/t gold for 141,000 ounces of gold, to B2Gold's rapidly growing Mineral Resource inventory in the region. The Company believes there is strong potential to extend the mineralization at the Dandoko project. Initial drilling on the Dandoko project is expected to commence in the fourth quarter of 2022.

Anaconda Development Update

In 2022, the Company budgeted $33 million for development of infrastructure for Phase I saprolite mining at the Anaconda Area , including road construction. Based on the updated Mineral Resource estimate and B2Gold's preliminary planning, the Company has demonstrated that a pit situated on the Anaconda Area could provide selective higher grade saprolite material (average grade of 2.2 g/t gold) to be trucked to and fed into the Fekola mill at a rate of 1.5 million tonnes per annum. With the anticipated closing of the acquisition of Oklo and its flagship Dandoko project on September 19, 2022 , the Company is currently evaluating its options for the timing and sourcing of material on a regional basis from all deposits within the Fekola Complex area (including Fekola, Cardinal, Dandoko, Bakalobi and the Anaconda Area ). This updated evaluation is expected to be completed by the end of 2022, with first saprolite production now anticipated in the second quarter of 2023. Subject to obtaining all necessary permits and completion of a final development plan, the Company intends to commence its planned Phase I infrastructure development in the fourth quarter of 2022. Trucking of selective higher grade saprolite material to the Fekola mill would increase the ore processed and annual gold production from the Fekola mill, with the potential to add an average of approximately 80,000 to 100,000 ounces of gold per year to the Fekola mill's annual production.

Based on the updated Mineral Resource estimate and the 2022 exploration drilling results, the Company has commenced a Phase II scoping study to review the project economics of constructing a stand-alone mill near the Anaconda Area . Subject to receipt of a positive Phase II scoping study, the Company expects that the saprolite material would continue to be trucked to and fed into the Fekola mill during the construction period for the Anaconda Area stand-alone mill.

QA/QC on Sample Collection and Assaying

The primary laboratories for Fekola are SGS Laboratories in Bamako, Mali and Bureau Veritas Laboratories in Abidjan, Cote d'Ivoire . Periodically, exploration samples will be analyzed at the Fekola Mine laboratory. At each laboratory, samples are prepared and analyzed using 50-gram fire assay with atomic absorption finish and/or gravimetric finish. Umpire assays are used to monitor lab performance monthly.

Quality assurance and quality control procedures include the systematic insertion of blanks, standards and duplicates into the core, reverse circulation and aircore drilling sample strings. The results of the control samples are evaluated on a regular basis with batches re-analyzed and/or resubmitted as needed. All results stated in this announcement have passed B2Gold's quality assurance and quality control protocols.

About B2Gold Corp.

B2Gold is a low-cost international senior gold producer headquartered in Vancouver, Canada . Founded in 2007, today, B2Gold has operating gold mines in Mali , Namibia and the Philippines and numerous exploration and development projects in various countries including Mali , Colombia , Finland and Uzbekistan . B2Gold forecasts total consolidated gold production of between 990,000 and 1,050,000 ounces in 2022.

Qualified Persons

Tom Garagan , Senior Vice President of Exploration at B2Gold, a qualified person under NI 43-101, has reviewed and approved the information contained in this news release.

ON BEHALF OF B2GOLD CORP.

"Clive T. Johnson"

President and Chief Executive Officer

For more information on B2Gold please visit the Company website at www.b2gold.com or contact:

| Michael McDonald | Cherry DeGeer |

| VP, Investor Relations & Corporate Development | Director, Corporate Communications |

| +1 604-681-8371 | +1 604-681-8371 |

The Toronto Stock Exchange and NYSE American LLC neither approve nor disapprove the information contained in this news release.

Production guidance presented in this news release reflect total production at the mines B2Gold operates on a 100% project basis. Please see our Annual Information Form dated March 30, 2022 for a discussion of our ownership interest in the mines B2Gold operates.

This news release includes certain "forward-looking information" and "forward-looking statements" (collectively "forward-looking statement") within the meaning of applicable Canadian and United States securities legislation, including: projections; outlook; guidance; forecasts; estimates; statements regarding future or estimated financial and operational performance, gold production and sales, revenues and cash flows, and capital costs (sustaining and non-sustaining) and operating costs, and including, without limitation: statements regarding the Transaction, including, without limitation, the completion of the Oklo transaction, including receipt of all necessary regulatory approvals, including from the TSX and NYSE MKT, and the satisfaction of conditions; total consolidated gold production of between 990,000 and 1,050,000 ounces in 2022. All statements in this news release that address events or developments that we expect to occur in the future are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, although not always, identified by words such as "expect", "plan", "anticipate", "project", "target", "potential", "schedule", "forecast", "budget", "estimate", "intend" or "believe" and similar expressions or their negative connotations, or that events or conditions "will", "would", "may", "could", "should" or "might" occur. All such forward-looking statements are based on the opinions and estimates of management as of the date such statements are made.

Forward-looking statements necessarily involve assumptions, risks and uncertainties, certain of which are beyond B2Gold's control, including risks associated with or related to: the duration and extent of the COVID-19 pandemic, the effectiveness of preventative measures and contingency plans put in place by the Company to respond to the COVID-19 pandemic, including, but not limited to, social distancing, a non-essential travel ban, business continuity plans, and efforts to mitigate supply chain disruptions; escalation of travel restrictions on people or products and reductions in the ability of the Company to transport and refine doré; the volatility of metal prices and B2Gold's common shares; changes in tax laws; the dangers inherent in exploration, development and mining activities; the uncertainty of reserve and resource estimates; not achieving production, cost or other estimates; actual production, development plans and costs differing materially from the estimates in B2Gold's feasibility and other studies; the ability to obtain and maintain any necessary permits, consents or authorizations required for mining activities; environmental regulations or hazards and compliance with complex regulations associated with mining activities; climate change and climate change regulations; the ability to replace mineral reserves and identify acquisition opportunities; the unknown liabilities of companies acquired by B2Gold; the ability to successfully integrate new acquisitions; fluctuations in exchange rates; the availability of financing; financing and debt activities, including potential restrictions imposed on B2Gold's operations as a result thereof and the ability to generate sufficient cash flows; operations in foreign and developing countries and the compliance with foreign laws, including those associated with operations in Mali , Namibia , the Philippines and Colombia and including risks related to changes in foreign laws and changing policies related to mining and local ownership requirements or resource nationalization generally, including in response to the COVID-19 outbreak; remote operations and the availability of adequate infrastructure; fluctuations in price and availability of energy and other inputs necessary for mining operations; shortages or cost increases in necessary equipment, supplies and labour; regulatory, political and country risks, including local instability or acts of terrorism and the effects thereof; the reliance upon contractors, third parties and joint venture partners; the lack of sole decision-making authority related to Filminera Resources Corporation, which owns the Masbate Project; challenges to title or surface rights; the dependence on key personnel and the ability to attract and retain skilled personnel; the risk of an uninsurable or uninsured loss; adverse climate and weather conditions; litigation risk; competition with other mining companies; community support for B2Gold's operations, including risks related to strikes and the halting of such operations from time to time; conflicts with small scale miners; failures of information systems or information security threats; the ability to maintain adequate internal controls over financial reporting as required by law, including Section 404 of the Sarbanes-Oxley Act; compliance with anti-corruption laws, and sanctions or other similar measures; social media and B2Gold's reputation; risks affecting Calibre having an impact on the value of the Company's investment in Calibre, and potential dilution of our equity interest in Calibre; as well as other factors identified and as described in more detail under the heading "Risk Factors" in B2Gold's most recent Annual Information Form, B2Gold's current Form 40-F Annual Report and B2Gold's other filings with Canadian securities regulators and the U.S. Securities and Exchange Commission (the "SEC"), which may be viewed at www.sedar.com and www.sec.gov , respectively (the "Websites"). The list is not exhaustive of the factors that may affect B2Gold's forward-looking statements

B2Gold's forward-looking statements are based on the applicable assumptions and factors management considers reasonable as of the date hereof, based on the information available to management at such time. These assumptions and factors include, but are not limited to, assumptions and factors related to B2Gold's ability to carry on current and future operations, including: the duration and effects of COVID-19 on our operations and workforce; development and exploration activities; the timing, extent, duration and economic viability of such operations, including any mineral resources or reserves identified thereby; the accuracy and reliability of estimates, projections, forecasts, studies and assessments; B2Gold's ability to meet or achieve estimates, projections and forecasts; the availability and cost of inputs; the price and market for outputs, including gold; foreign exchange rates; taxation levels; the timely receipt of necessary approvals or permits; the ability to meet current and future obligations; the ability to obtain timely financing on reasonable terms when required; the current and future social, economic and political conditions; and other assumptions and factors generally associated with the mining industry.

B2Gold's forward-looking statements are based on the opinions and estimates of management and reflect their current expectations regarding future events and operating performance and speak only as of the date hereof. B2Gold does not assume any obligation to update forward-looking statements if circumstances or management's beliefs, expectations or opinions should change other than as required by applicable law. There can be no assurance that forward-looking statements will prove to be accurate, and actual results, performance or achievements could differ materially from those expressed in, or implied by, these forward-looking statements. Accordingly, no assurance can be given that any events anticipated by the forward-looking statements will transpire or occur, or if any of them do, what benefits or liabilities B2Gold will derive therefrom. For the reasons set forth above, undue reliance should not be placed on forward-looking statements.

![]() View original content to download multimedia: https://www.prnewswire.com/news-releases/b2gold-announces-positive-exploration-drill-results-from-the-anaconda-area-at-the-fekola-complex-301625076.html

View original content to download multimedia: https://www.prnewswire.com/news-releases/b2gold-announces-positive-exploration-drill-results-from-the-anaconda-area-at-the-fekola-complex-301625076.html

SOURCE B2Gold Corp.

![]() View original content to download multimedia: https://www.newswire.ca/en/releases/archive/September2022/15/c2334.html

View original content to download multimedia: https://www.newswire.ca/en/releases/archive/September2022/15/c2334.html