October 16, 2023

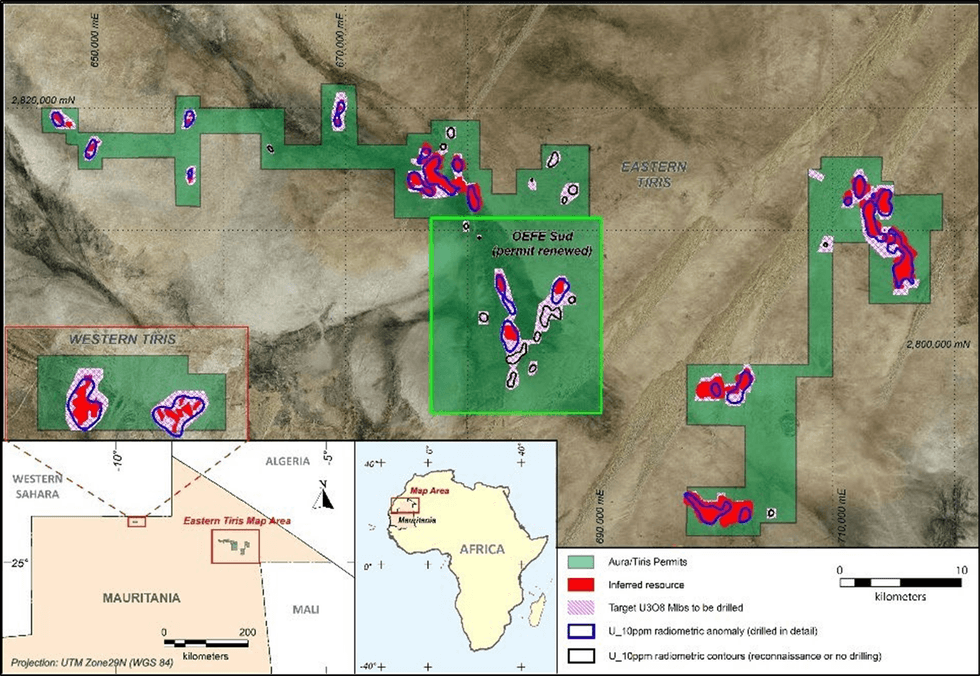

Aura Energy Limited (ASX: AEE, AIM: AURA) (“Aura” or “the Company”) is pleased to announce it has acquired additional radiometric survey data, reviewed historical drilling results, and identified strong indications of mineralisation extensions on Aura’s existing tenements that could significantly expand Aura’s current Tiris Project (“Project”) 58.9 Mlbs U₃O₈ resource.

KEY POINTS:

- Aura identifies an Exploration Target aimed to expand the existing 58.9 Mlbs U3O8 Tiris Project Resource (113Mt at grade of 236ppm U3O8), which was defined at an exploration cost of ~US$0.20 per lb U3O8.

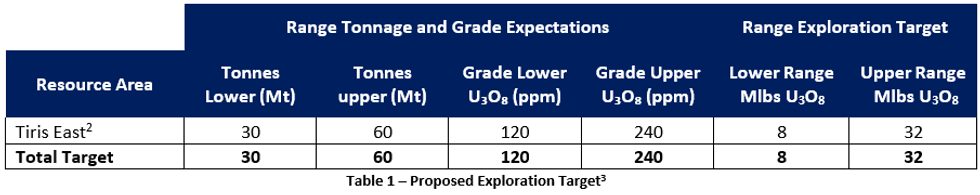

- Preliminary work has identified seven Exploration Targets in Tiris East as extensions of the existing resources 30 – 60 Mt at 120 - 240 ppm U3O8 for 8 - 32 Mlbs U3O8.

- The new Exploration Targets highlight the potential for the Tiris Project to achieve world-class scale.

- Exploration Target will be tested with a 15,500m drilling exploration program planned to commence imminently.

- Proving up additional resources is likely to expand the ore available to the Tiris Project and potentially facilitate modular expansion. The Front-End Engineering Design (FEED) study is 80% complete, and pre- construction activities will commence at the Tiris Project.

Aura has signed contracts for an exploration program of 15,500m air core drilling over approximately 78 km2 on existing tenements, aiming to significantly increase the Inferred Mineral Resource at the Tiris Project in Mauritania by extending the existing resources. The mobilisation of the drilling contractor commenced on October 16th, with the program commencing soon after.

The potential quantity of the Exploration Target is conceptual in nature. There has been insufficient exploration of these targets to estimate a Mineral Resource, and it is uncertain whether this exploration effort will result in an estimation of a Mineral Resource.

Aura Managing Director David Woodall said,

“Aura’s strategy is to be development-ready in relation to our Tiris Project, and this strategy is progressing and accelerated as we aim to expand our mineral resource.

The near-term, low-cost, producer status of our Tiris Project was confirmed by our March 2023 Enhanced Definitive Feasibility Study1. Further resource expansion towards 100m lbs of U3O8 progresses the project towards a global scale and reinforces the potential for Mauritania to be a material producer in the near term. The robust economics of our Tiris Uranium Project will be further enhanced by increasing our mineral resources and reserves. Due to the modular nature of the project, we see outstanding opportunities to grow the annual production capacity of the project to 3.5Mlb per annum, equivalent to the planned back-end plant capacity.”

“To that end, Aura will commence key pre-construction activities, including the geotechnical drilling of the proposed plant site, and allow some trial mining to provide valuable data in the production planning for the Tiris operation once developed.”

The exploration program will be conducted on existing granted tenements targeting the expansion of the Mineral Resources at the Tiris Project. It will focus on the Exploration Target shown in Table 1 below.

Exploration Target Estimate

A significant level of exploration has previously been undertaken by Aura on the currently held tenements, resulting in a Global Mineral Resource Estimate (MRE) of 113Mt at an average grade of 236ppm U3O8 containing 58.9 Mlbs U3O84, which was reported in a market announcement (“Major Resource Upgrade at Aura Energy’s Tiris Project”), dated 14th February 2023. The MRE has been based on 21,990 metres of drilling in 5,619 holes for a total project cost of US$11.9M or US$0.20 per lb U3O8.

Click here for the full ASX Release

This article includes content from Aura Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

AEE:AU

The Conversation (0)

02 June 2023

Aura Energy

Fast-tracking the Tiris Uranium Project to support a clean, decarbonized future

Fast-tracking the Tiris Uranium Project to support a clean, decarbonized future Keep Reading...

19 February

Drilling Confirms Potential REE System at Sybella Barkly

Basin Energy (BSN:AU) has announced Drilling Confirms Potential REE System at Sybella BarklyDownload the PDF here. Keep Reading...

18 February

Niger’s Seized Uranium Remains in Geopolitical Limbo

A stockpile of 1,000 metric tons of uranium seized from a French-operated mine in Niger is now sitting at a military airbase in Niamey that was recently attacked by Islamic State militants, raising fresh concerns over security and the material’s uncertain future.The uranium, which is processed... Keep Reading...

12 February

Deep Space Energy Secures US$1.1 Million to Advance Lunar Power and Satellite Resilience Goals

Latvian startup Deep Space Energy announced it has raised approximately US$1.1 million in a combination of private investment and public funding to advance a radioisotope-based power generator designed to operate on the Moon.The company closed a US$416,500 pre-seed round led by Outlast Fund and... Keep Reading...

05 February

Ranger Uranium Mine Rehabilitation Gets Green Light from Australia

Minister for Resources and Northern Australia Madeleine King has issued a new rehabilitation authority to Energy Resources Australia (ASX:ERA) for the continuation of rehabilitation activities at the Ranger uranium mine in the Northern Territory.“This new authority means that Energy Resources... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00