November 18, 2024

Athena Gold Corporation (CSE:ATHA)(OTCQB:AHNR) ("Athena" or the "Company") is pleased to report high-grade gold samples from its reconnaissance surface sampling program at its newly acquired Laird Lake project, located in Ontario's prolific Red Lake Gold District. The Laird Lake project, spanning 4,158 hectares and covering >10 km of Balmer-Confederation Assemblage contact, represents an underexplored portion of the Red Lake Gold District. The project is road-accessible and lies approximately 10 km west of West Red Lake Gold Mines' flagship Madsen mine, and 34 km northwest of Kinross Gold's Great Bear project.

" We are extremely pleased that our recent expansion into Ontario is already starting to bear fruit. To our knowledge, sample F733057, returning 56.5 g/t Au, is in line with some of the highest-grade surface grab samples publicly reported in the Red Lake Gold District," stated John Power, President & CEO of Athena Gold.

Highlights:

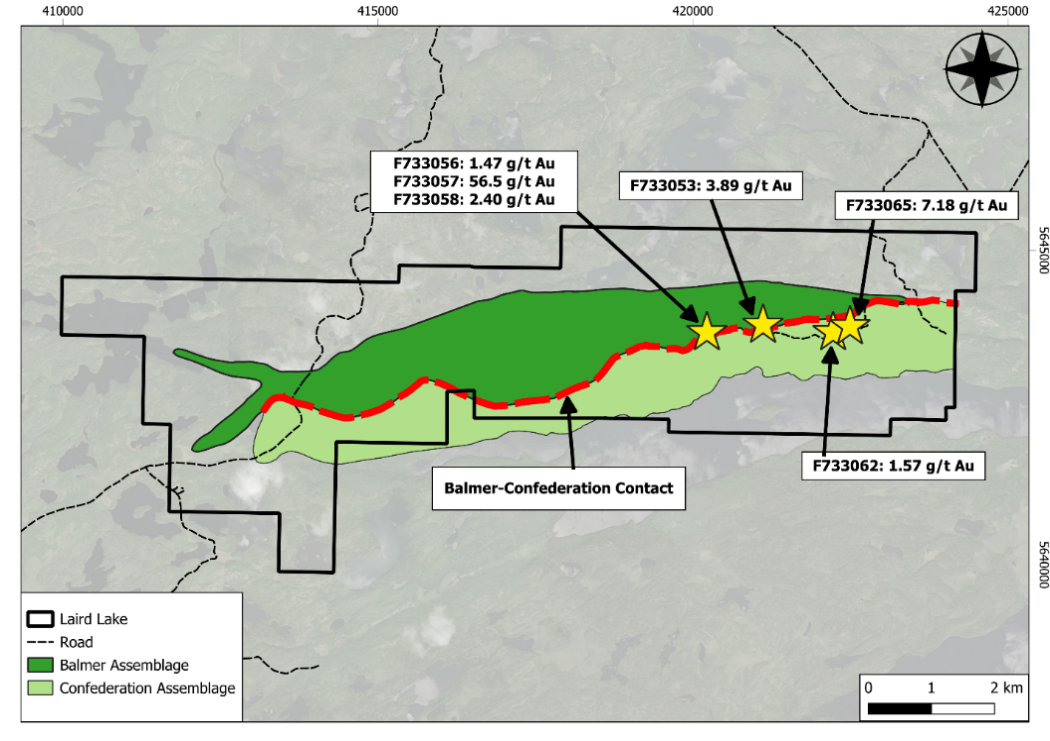

- An initial six surface grab samples taken at the Laird Lake project in July 2024 confirmed mineralization over 2.2 km of strike length along the contact between the Balmer and Confederation Assemblages (Figure 1). Mineralization is open along strike to the east and west.

- The Balmer-Confederation contact is believed to serve as a major structural control for gold mineralization in the Red Lake Gold District, with >90% of all gold ever mined in the camp occurring within approximately 300 m of this contact.

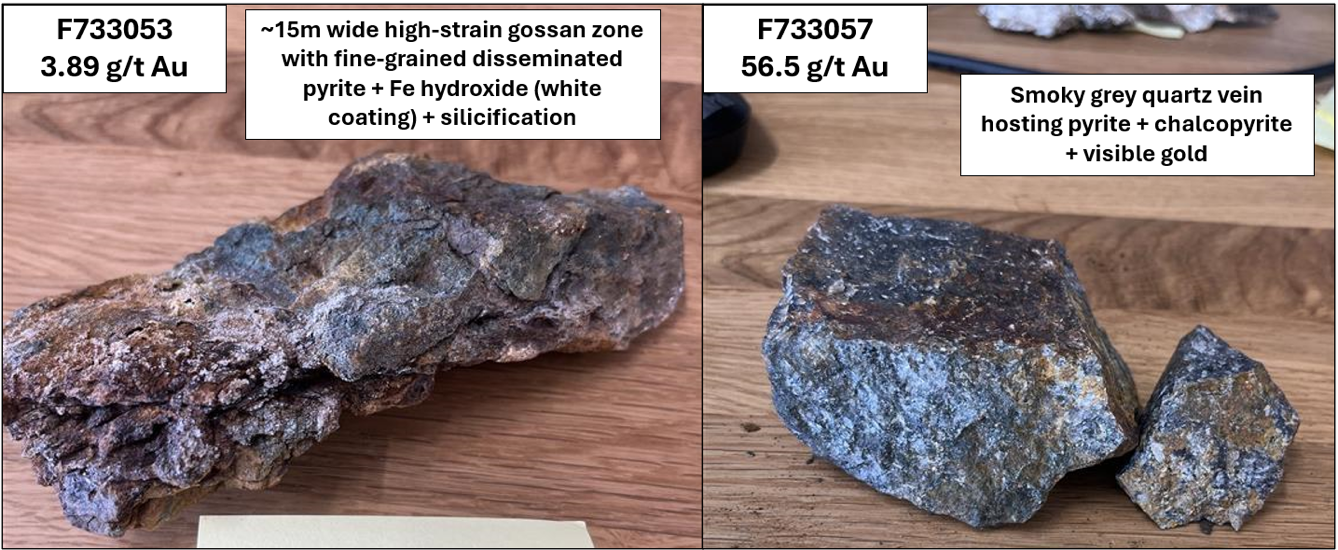

- The highest-grade sample returned up to 56.5 g/t Au collected from a smoky quartz vein with blebby pyrite, chalcopyrite, and traces of visible gold (Figure 3).

- Grab sample assays from additional prospecting work conducted in October 2024 remain pending, with results expected to be received by year-end.

- The recent reconnaissance prospecting program is expected to guide a property-wide geochemistry survey, scheduled to commence in H1/2025, the results of which are anticipated to provide targets for Athena's initial drill program at Laird Lake.

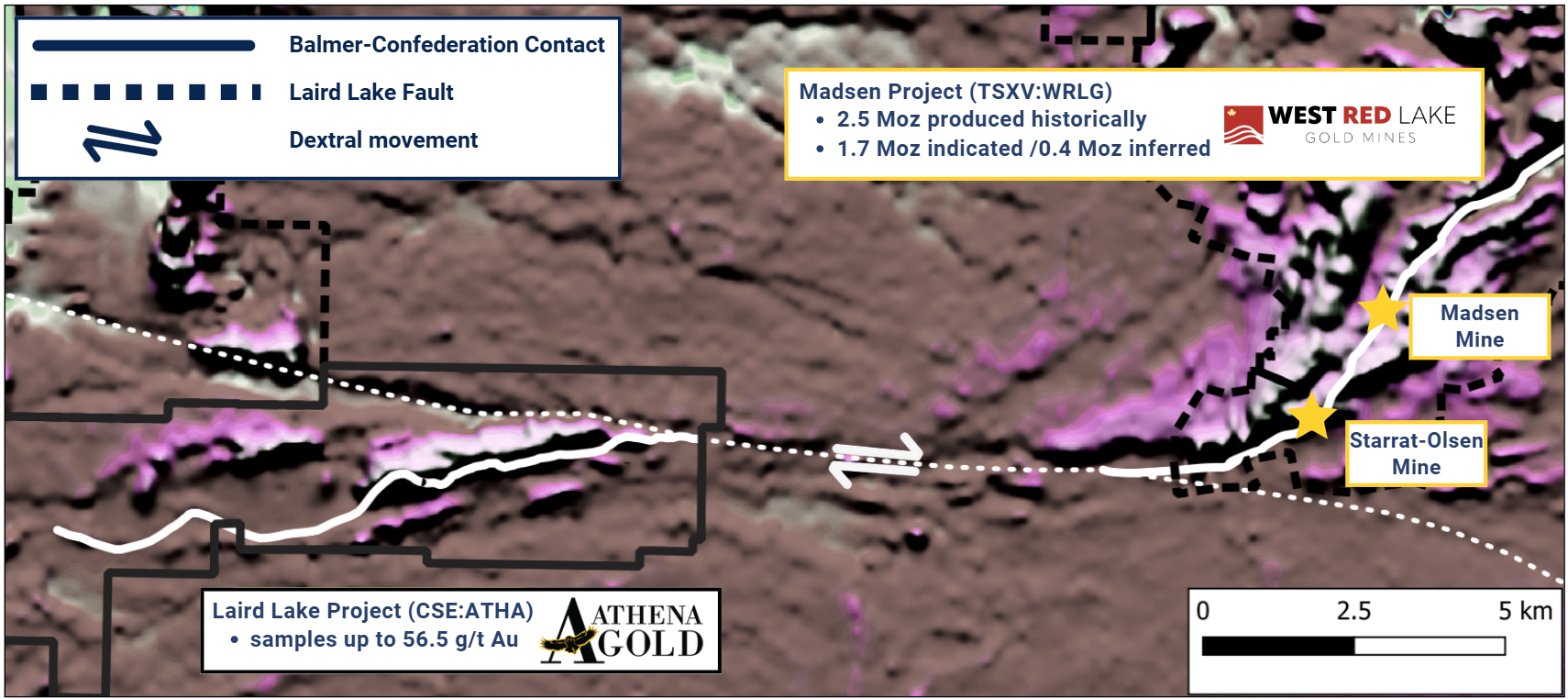

- A recently completed MSc. thesis on the Laird Lake project, suggested that Laird Lake represents the continuation of the same mineralized structure found at both the Madsen and Starratt-Olsen gold mines [i] now owned by West Red Lake Gold (2.5 Moz past-production, 1.7 Moz indicated, 0.4 Moz inferred) [ii] and was later displaced as far as 10 km west (Figure 2).

Figure 1: Map of Laird Lake, showing recent grab samples from July 2024 reconnaissance sampling program.

Figure 2: Map of Laird Lake and Madsen, showing mapped Balmer-Confederation contact and dextral Laird Lake Fault.

Geology:

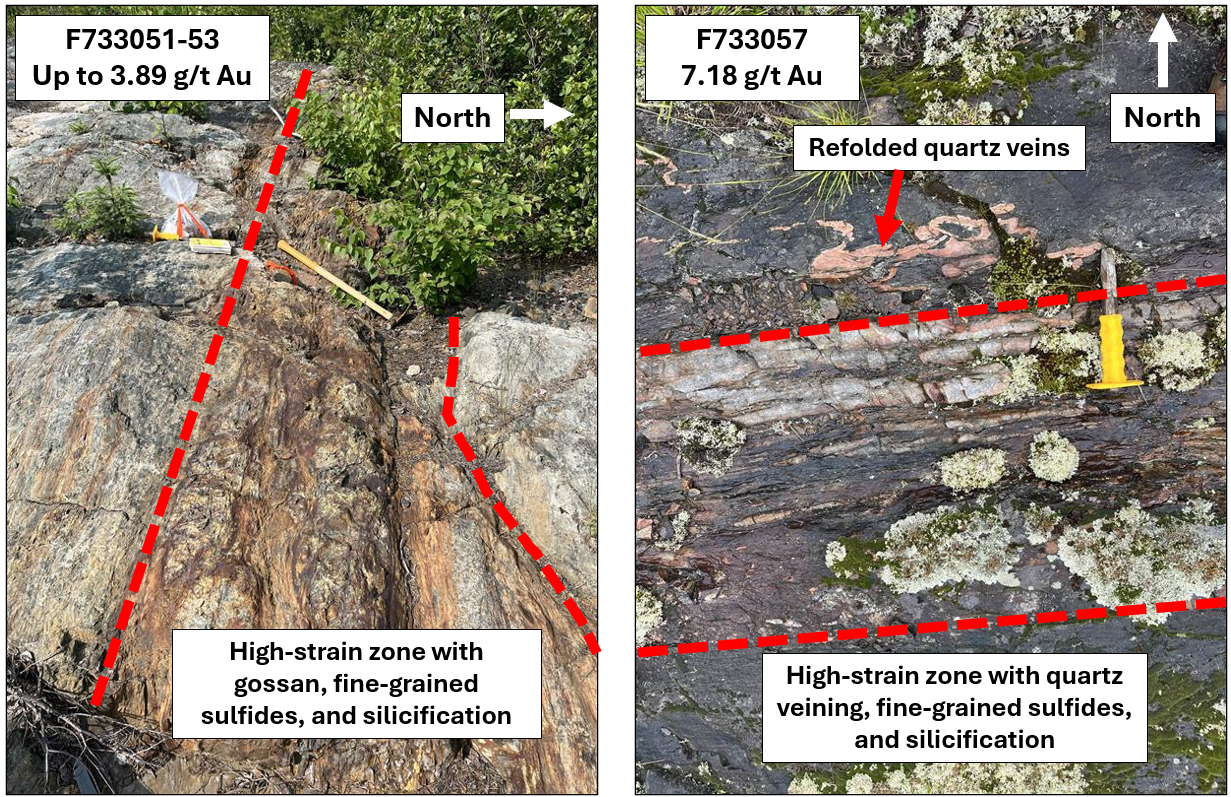

Gold mineralization observed at Laird Lake occurs in discrete quartz veins hosted in volcanic rock, localized high-strain zones consisting of silicification and disseminated sulfides, and in more broad zones of strongly deformed banded iron formation up to 15 m wide characterized by gossan, fine-grained disseminated sulfides, and silicification. Gold-bearing zones exhibit a general east-west orientation and occur in both Balmer and Confederation Assemblage rocks. The initial grab sample results are described in detail below:

- A sample of smoky quartz vein hosted in Balmer Assemblage volcanic rock containing blebby pyrite, chalcopyrite, and visible gold returned 56.5 g/t Au (F733057). This sample was taken approximately 50 m north of the contact with the Confederation Assemblage and was the most western sample collected. Two additional samples of gossaned and silicified volcanic host rock collected adjacent to the high-grade quartz vein returned 1.47 g/t Au and 2.40 g/t Au (F733056 and F733058, respectively).

- A sample of strongly deformed banded iron formation (BIF) from the Balmer Assemblage containing fine-grained disseminated pyrite, and silicification returned 3.89 g/t Au (F733053), and was collected from an outcrop approximately 15 m in width and characterized by a strong overall deformation fabric with several high-strain zones of gossan, fine-grained pyrite, and silicification throughout. The outcrop is located approximately 60 m north of the Balmer-Confederation contact.

- A sample of sulfide-bearing quartz vein hosted in the Confederation Assemblage returned 1.57 g/t Au (F733062). This sample was collected approximately 225 m south of the Balmer-Confederation contact.

- A sample of sulfide-bearing quartz vein hosted in a high-strain zone within Confederation Assemblage returned 7.18 g/t Au (F733065). The high-strain zone is characterized by silicification, fine-grained disseminated sulfides, and lesser gossan. Refolded quartz veins were noted along the contact of the high-strain zone and volcanic host rock. This sample was collected approximately 180 m south of the Balmer-Confederation contact eastern-most sample collected.

Figure 3: Photographs of grab samples F733053 (left) and F733057 (right) from July 2024 prospecting at Laird Lake.

Figure 4: Photographs of outcrops for samples F733051-53 (left) and F733057 (right) from July 2024 at Laird Lake.

Future Drill Testing:

Laird Lake has been subject to only very limited historical exploration work, largely because the Balmer-Confederation contact was only mapped on Laird Lake in recent times as part of a MSc. research thesis. Importantly, >90% of all gold ever mined in the Red Lake Gold District is estimated to occur within 300 m of this contact. Athena's initial work programs are focused on understanding structural controls and potential splays off this contact that may host high-grade gold mineralization. Additional assays from the follow-up program that took place in October 2024 remain pending, with results expected by year-end. Athena plans to conduct a property wide gold-in-till geochemistry program in Spring 2025. Historical, high-resolution airborne magnetic and electromagnetic surveys highlighted several prospective targets within the Balmer Assemblage that have yet to be tested will be included in future drilling on the property, in addition to other targets generated from prospecting and geochemical programs.

About Our Laird Lake Project

The 4,158 ha Laird Lake property is situated 20km to the southwest of the town of Red Lake, Ontario. Red Lake is a prolific gold mining town in Northwestern Ontario that has seen over 30 Moz of gold produced. Importantly, >90% of the gold has come from within 300 m of the contact between the Balmer and Confederation Assemblages. The Laird Lake property is considered underexplored for gold, relative to much of the surrounding Red Lake Greenstone Belt, despite possessing over 10 km of strike length of the known gold-bearing contact between Balmer and Confederation Assemblage rocks. Also important is being nearby to several major gold production and exploration sites in the region:

- 34km to the Great Bear project (Kinross - 2.7 Moz indicated, and 3.9 Moz inferred) [iii];

- 11 km to the Madsen Mine (West Red Lake Gold - 1.7 Moz indicated, and 0.4 Moz inferred); and

- 28 km to the Red Lake Mine (Evolution Mining - 7.2 Moz indicated, and 4.5 Moz inferred) [iv].

Limited exploration activity at Laird Lake has demonstrated high-grade gold mineralization occurs in both Balmer and Confederation Assemblage rocks over several kilometers in proximity to the main Balmer-Confederation contact. The highest gold grades on the property show a strong correlation to high-strain zones characterized by the presence of silicification, disseminated sulfides, and gossan. The Laird Lake property is dominated by mafic to ultramafic metavolcanic rocks as well as lesser banded iron formation of the Balmer and Confederation Assemblages. Felsic to ultramafic intrusive units are also present throughout the property, most notably of which include the Killala-Baird Batholith to the north, and the Medicine Stone Lake Batholith to the south.

QA/QC

Analytical work for rock samples was completed by AGAT Laboratories, with sample preparation and geochemical analyses completed in Thunder Bay, Ontario. Samples were crushed before a 250-gram split was pulverized to better than 85% passing 75 microns. Rock samples were analyzed for gold by fire assay using a 50-gram charge with an atomic absorption spectroscopy finish. If assay results exceeded 10.0 g/t gold, the sample rejects are analyzed by 50-gram fire assay with a gravimetric finish. Sampling and analytical procedures are subject to a Quality Assurance and Quality Control program that includes duplicate samples and analytical standards.

Qualified Person

Technical information in this news release has been reviewed and approved by Benjamin Kuzmich, P.Geo., a geoscientist and qualified person for the purposes of National Instrument 43-101.

About Athena Gold Corporation

Athena is engaged in the business of mineral exploration and the acquisition of mineral property assets. Its objective is to locate and develop economic precious and base metal properties of merit and to conduct additional exploration drilling and studies on such projects.

For further information about Athena Gold Corporation, please visit www.athenagoldcorp.com .

On Behalf of the Board of Directors

John C. Power

Chief Executive Officer and President

Email: johnpower@athenagoldcorp.com

Forward-Looking Statements

This press release contains forward-looking statements and forward-looking information (collectively, "forward-looking statements") within the meaning of applicable Canadian and US. securities laws. All statements, other than statements of historical fact, included herein including, without limitation, statements regarding future exploration plans, future results from exploration, and the anticipated business plans and timing of future activities of the Company, are forward looking statements. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are typically identified by words such as: "believes", "will", "expects", "anticipates", "intends", "estimates", ''plans", "may", "should", ''potential", "scheduled", or variations of such words and phrases and similar expressions, which, by their nature, refer to future events or results that may, could, would, might or will occur or be taken or achieved. In making the forward-looking statements in this press release, the Company has applied several material assumptions, including without limitation, that there will be investor interest in future financings, market fundamentals will result in sustained precious metals demand and prices, the receipt of any necessary permits, licenses and regulatory approvals in connection with the future exploration and development of the Company's projects in a timely manner.

The Company cautions investors that any forward-looking statements by the Company are not guarantees of future results or performance, and that actual results may differ materially from those in forward-looking statements as a result of various risk factors as disclosed in the final long form prospectus of the Company dated August 31, 2021.

Readers are cautioned not to place undue reliance on forward-looking statements. The Company undertakes no obligation to update any of the forward-looking statements in this press release or incorporated by reference herein, except as otherwise.

[i] Geology and Geochemistry of the Laird Lake Property and Associated Gold Mineralization - https://www.lakeheadu.ca/programs/departments/geology/about/msc-theses/summaries/node/47164

[ii] Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate - https://westredlakegold.com/wp-content/uploads/2024/04/26Apr24_-_PureGold_Mine_NI_43-101_Technical_Report_-_WRLG.pdf

[iii] Great Bear Gold ProjectPreliminary Economic Assessment - https://s2.q4cdn.com/496390694/files/doc_downloads/2024/09/Great_bear/Kinross-Great-Bear-PEA-TR-REVISED-FINAL-Sep-9-2024.pdf

[iv] Evolution Mining Mineral Resource and Ore Reserve Statement, December 2023 - https://evolutionmining.com.au/reservesresources/

ATHA:CNX

The Conversation (0)

09 January 2025

Athena Gold

High-grade gold exploration in Ontario and Nevada

High-grade gold exploration in Ontario and Nevada Keep Reading...

16h

Flow Metals to Acquire the Monster IOCG Project in Yukon

Flow Metals Corp. (CSE: FWM) ("Flow Metals" or the "Company") is pleased to report that it has entered into an option agreement dated February 9, 2026 (the "Option Agreement") with Go Metals Corp. ("Go Metals") to acquire the Monster IOCG project (the "Monster Project"), located approximately 90... Keep Reading...

09 February

Investor Presentation

Aurum Resources (AUE:AU) has announced Investor PresentationDownload the PDF here. Keep Reading...

09 February

Dr. Adam Trexler: Physical Gold Market Broken, Crisis Unfolding Now

Dr. Adam Trexler, founder and president of Valaurum, shares his thoughts on gold, identifying a key issue he sees developing in the physical market. "There's a crisis in the physical gold market," he said, explaining that sector participants need to figure out how to serve investors who want to... Keep Reading...

09 February

Trevor Hall: Bull Markets Don’t Always Mean Big Returns

Clear Commodity Network CEO and Mining Stock Daily host Trevor Hall opened his talk at the Vancouver Resource Investment Conference (VRIC) with a strong message: It is still possible to go broke in a bull market.“I want to start with the simple but uncomfortable truth: most investors don't lose... Keep Reading...

09 February

How Near-term Production is Changing the Junior Gold Exploration Model

Junior gold companies have traditionally been defined by exploration: identifying prospective ground, drilling to delineate a resource and, ideally, monetising that discovery through a sale or joint venture with a larger producer. While this model has delivered success in the past, changing... Keep Reading...

09 February

Gold Exploration in Guinea: An Emerging Opportunity in West Africa

While much of West Africa’s gold exploration spotlight has historically fallen on countries like Ghana and Mali, Guinea is increasingly emerging as a quiet outlier — a country with proven gold endowment, expansive underexplored terrain and a growing number of active exploration programs. Despite... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00