August 05, 2024

Proceeds of successful capital raising will help fund follow up work to refine drilling targets

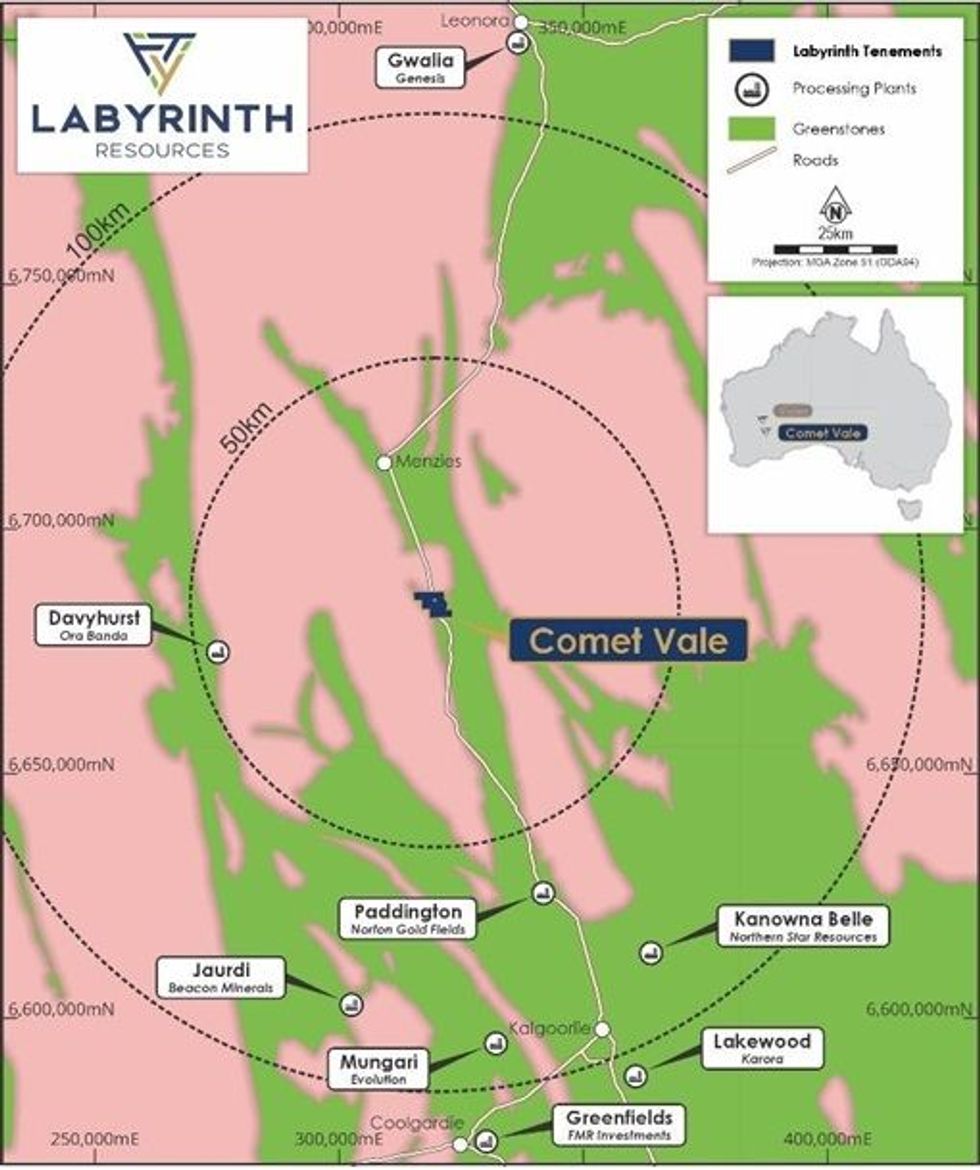

Labyrinth Resources Limited (ASX: LRL) (‘Labyrinth’ or ‘the Company’) is pleased to report highly promising gold and copper assays from soil sampling and rock chips at its Comet Vale Project in WA (see Figure 1).

More than 500 soil samples and 11 rock chip samples were collected. These results, combined with historic data, have defined several compelling drilling targets outside the mine area at Comet Vale.

In July 2024, Labyrinth entered into an option to acquire 100% of the property from Sand Queen Gold Mines Pty Ltd (‘SQGM’). The additional 49% interest has been the key to commencing dedicated exploration activity. Labyrinth intends to use some of the proceeds of its recent successful capital raising to undertake further exploration work with the aim of refining the targets ahead of a drilling campaign.

Labyrinth Chief Executive Jennifer Neild said: “We have strategically positioned ourselves in the prolific Goldfields region of Western Australia, with proven gold assets that have the potential for further high-grade mineralisation.”

“These assays are indicative of this potential. We are seeing cohesive trends in both primary and associated indicator elements. The overlap of these anomalies have added weight to positions of interpreted faults and have established several high priority target areas.”

“We now have extensive data that Comet Vale may host a large mineralised system with areas of high-grade gold and potentially copper.”

Details of sampling results:

The two campaigns of soil sampling were the first full geochemical analysis completed at Comet Vale. On the eastern side of the highway, a small number of rock chips were taken to support mapping observations. Many of the higher grades exist around Long Tunnel Prospect, where shallow tungsten and gold workings exist. It is unknown the extent of activites, refer to Table 2 for a summary.

- High Au, Cu, Co, Ag and Ni rock chips (Table 1) included:

- 63.1g/t Au, 3.27 % Cu and 59g/t Ag (SE of Long Tunnel);

- 13.9g/t Au, 0.35% Cu and 0.36 % Ni (South of Long Tunnel);

- 2.62g/t Au in a 3m wide, N-S quartz reef, within porphyry and ultramafic schist (Figure 6);

- 2.10g/t Au, 17.57% Fe and 1.14% S (gossan SW of Long Tunnel); and

- 0.25% Cu, 0.38% Ni, 0.04% Co and 1.4g/t Ag (New gossan, chalcopyrite and bornite sighted).

- “Golden Triangle” - High Au, Cu and W are concentrated at the cross-section of the Rambo Trend and Long Tunnel/Lake View Shear/Quartz Reef (see Figure 2 and Table 2 for description of Long Tunnel).

- Geochemistry suggests late NE trending faults are a control on mineralisation. Potentially focusing 2nd generation Au bearing veins along these later structures causing wide, intercepts of mineralisation (see Figure 2 and Figure 3).

- Several samples of elevated lithium (>100ppm) proximal to Lake View/Long Tunnel trend (see Figure 7). More anomalies may exist, but sampling of Lithium was limited to this sampling program and not historic data.

Click here for the full ASX Release

This article includes content from Labyrinth Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

LRL:AU

The Conversation (0)

31 August 2023

Labyrinth Resources

Developing underexplored gold assets in the prolific Canadian Abitibi Gold Belt and the Yilgarn Craton of Western Australia.

Developing underexplored gold assets in the prolific Canadian Abitibi Gold Belt and the Yilgarn Craton of Western Australia. Keep Reading...

7h

Additional Strong Assays Results Extend High-Grade Antimony Mineralisation at Oaky Creek

Red Mountain Mining Limited (ASX: RMX, US CODE: RMXFF, or “Company”) a Critical Minerals exploration and development company with an established portfolio in Tier-1 Mining Districts in the United States and Australia, is pleased to announce that it has received continued strong assay results... Keep Reading...

15h

Jeffrey Christian: Gold, Silver Prices to Rise, Risk Highest Since WWII

Jeffrey Christian, managing partner at CPM Group, sees gold and silver prices continuing to rise as global political and economic risks persist. "We look at the world right now and we see a world where the risks and uncertainties are greater now than at any time since Pearl Harbor. December... Keep Reading...

15h

Precious Metals Price Update: Gold, Silver, PGMs Volatile on Oil Spike, Fed Rates

Precious metals prices are responding to the impact of the US-Iran war, as well as inflation data.The war has weighed on the precious metals market for much of this past week. An oil price surge past US$100 per barrel increased the threat of inflation and strengthened the US dollar, softening... Keep Reading...

23h

Pan African To Acquire Emmerson Resources in US$218 Million Gold Deal

South African gold producer Pan African Resources (LSE:PAF) has agreed to acquire Australian explorer Emmerson (LSE:EML) in an all-share transaction valued at approximately US$218 million.The acquisition will be carried out through a scheme of arrangement under which Pan African will acquire 100... Keep Reading...

11 March

American Eagle Announces Exercise of Participation Rights by South32 and Teck, Updates Details of Recently Announced Financing

Highlights: South32 and Teck will maintain their equity ownership in American Eagle Gold.Including Eric Sprott's private placement, American Eagle Gold's cash balance will increase by $34 million to more than $55 million upon close of this financing.Eric Sprott, South32 and Teck are the sole... Keep Reading...

10 March

David Erfle: Gold, Silver Under Pressure, Key Price Levels to Watch

David Erfle, editor and founder of Junior Miner Junky, explains why gold and silver prices took a hit not long after war in the Middle East was announced. While the near term could be volatile, he said the long-term outlook for precious metals is strong. Don't forget to follow us @INN_Resource... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00