August 05, 2024

Proceeds of successful capital raising will help fund follow up work to refine drilling targets

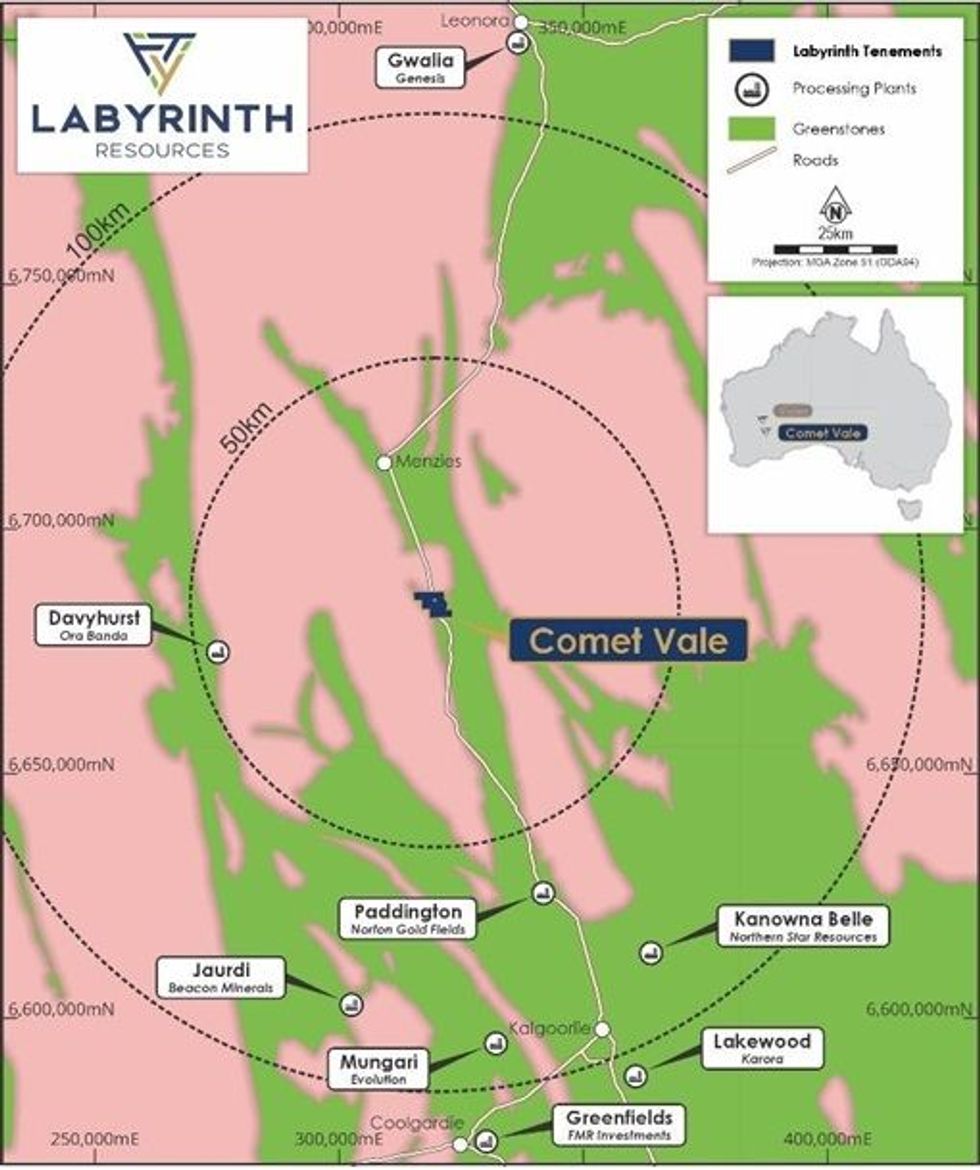

Labyrinth Resources Limited (ASX: LRL) (‘Labyrinth’ or ‘the Company’) is pleased to report highly promising gold and copper assays from soil sampling and rock chips at its Comet Vale Project in WA (see Figure 1).

More than 500 soil samples and 11 rock chip samples were collected. These results, combined with historic data, have defined several compelling drilling targets outside the mine area at Comet Vale.

In July 2024, Labyrinth entered into an option to acquire 100% of the property from Sand Queen Gold Mines Pty Ltd (‘SQGM’). The additional 49% interest has been the key to commencing dedicated exploration activity. Labyrinth intends to use some of the proceeds of its recent successful capital raising to undertake further exploration work with the aim of refining the targets ahead of a drilling campaign.

Labyrinth Chief Executive Jennifer Neild said: “We have strategically positioned ourselves in the prolific Goldfields region of Western Australia, with proven gold assets that have the potential for further high-grade mineralisation.”

“These assays are indicative of this potential. We are seeing cohesive trends in both primary and associated indicator elements. The overlap of these anomalies have added weight to positions of interpreted faults and have established several high priority target areas.”

“We now have extensive data that Comet Vale may host a large mineralised system with areas of high-grade gold and potentially copper.”

Details of sampling results:

The two campaigns of soil sampling were the first full geochemical analysis completed at Comet Vale. On the eastern side of the highway, a small number of rock chips were taken to support mapping observations. Many of the higher grades exist around Long Tunnel Prospect, where shallow tungsten and gold workings exist. It is unknown the extent of activites, refer to Table 2 for a summary.

- High Au, Cu, Co, Ag and Ni rock chips (Table 1) included:

- 63.1g/t Au, 3.27 % Cu and 59g/t Ag (SE of Long Tunnel);

- 13.9g/t Au, 0.35% Cu and 0.36 % Ni (South of Long Tunnel);

- 2.62g/t Au in a 3m wide, N-S quartz reef, within porphyry and ultramafic schist (Figure 6);

- 2.10g/t Au, 17.57% Fe and 1.14% S (gossan SW of Long Tunnel); and

- 0.25% Cu, 0.38% Ni, 0.04% Co and 1.4g/t Ag (New gossan, chalcopyrite and bornite sighted).

- “Golden Triangle” - High Au, Cu and W are concentrated at the cross-section of the Rambo Trend and Long Tunnel/Lake View Shear/Quartz Reef (see Figure 2 and Table 2 for description of Long Tunnel).

- Geochemistry suggests late NE trending faults are a control on mineralisation. Potentially focusing 2nd generation Au bearing veins along these later structures causing wide, intercepts of mineralisation (see Figure 2 and Figure 3).

- Several samples of elevated lithium (>100ppm) proximal to Lake View/Long Tunnel trend (see Figure 7). More anomalies may exist, but sampling of Lithium was limited to this sampling program and not historic data.

Click here for the full ASX Release

This article includes content from Labyrinth Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

LRL:AU

The Conversation (0)

31 August 2023

Labyrinth Resources

Developing underexplored gold assets in the prolific Canadian Abitibi Gold Belt and the Yilgarn Craton of Western Australia.

Developing underexplored gold assets in the prolific Canadian Abitibi Gold Belt and the Yilgarn Craton of Western Australia. Keep Reading...

18h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

19h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

04 March

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00