May 13, 2025

Asra Minerals Limited (ASX: ASR; “Asra” or “the Company”) is pleased to announce it has executed a binding Term Sheet (“the Agreement”) to acquire the remaining 49% interest in the Mt Cutmore prospects located at the Mt Stirling Leonora North Project (“the Project”) from its joint venture partners (Ross Crew, Russell McKnight and Christopher Crew) (“the Sellers”), subject to conditions precedent (“the Acquisition”).

Highlights

- Binding Term Sheet executed to acquire the remaining 49% of the Mt Cutmore prospects located at the Mt Stirling Leonora North Project subject to conditions, delivering 100% ownership upon completion.

- Consolidation of ownership aligns with Asra’s strategic focus to unlock further value within the Leonora Gold Project.

- Acquisition will strengthen Asra’s position in the renowned Leonora gold district, proximal to major operating mines and infrastructure.

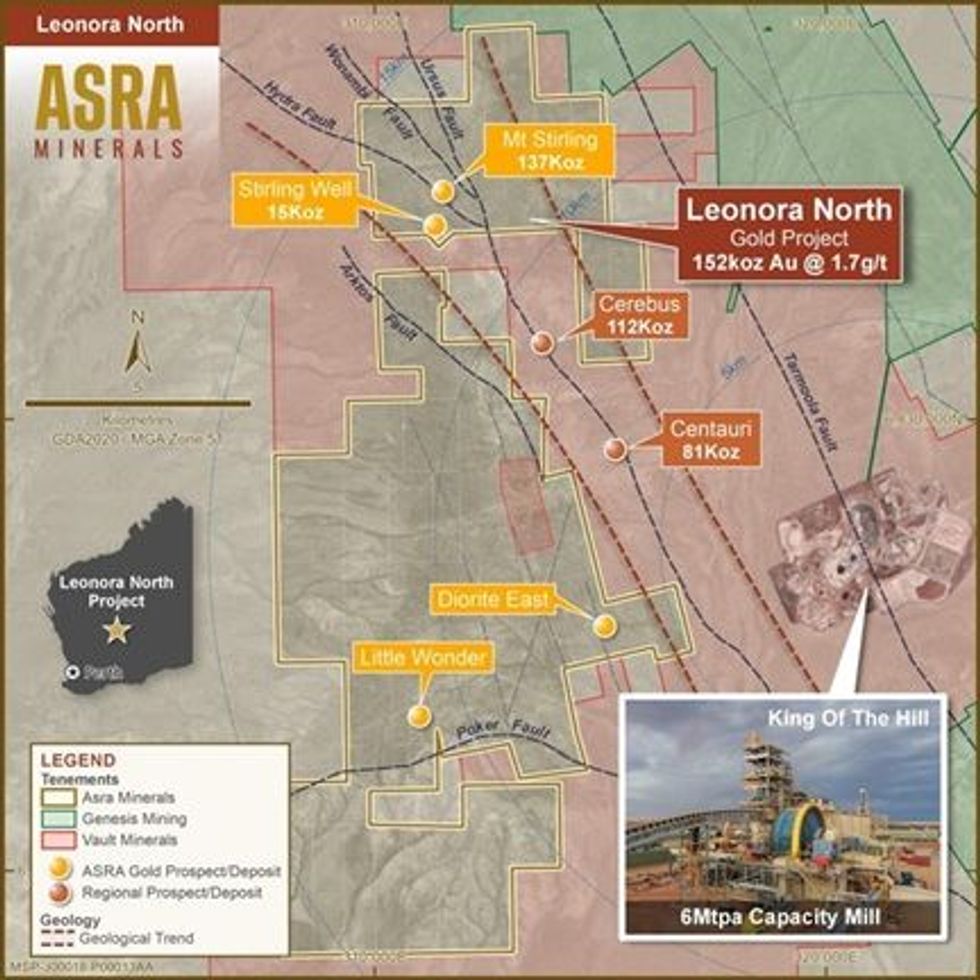

The Project is situated in the Eastern Goldfields Super terrane of the Yilgarn Craton, where the area is known for orogenic gold deposits. The Project has a JORC (2012) Mineral Resource Estimate totalling 152,000 oz at 1.7g/t Au and is located within close proximity to significant gold mines, including Vault Minerals' 6Mtpa Au King of the Hills mine and Genesis Minerals' 2Moz Leonora and Kookynie operations.1

Asra Minerals Chief Executive Officer, Paul Stephen:

“Securing 100% of the Mt Cutmore prospects within the Project will be a pivotal step for Asra. This consolidation will enhance our strategic footprint in a highly prospective and active gold region.

Following the recently announced raise and with drilling permits in hand, we will be well placed to commence drilling the compelling, high-priority targets. This transaction will streamline our portfolio and provide a clear pathway to unlock value for our shareholders through focused exploration in one of WA’s premier gold districts.”

The Transaction consideration comprises of $200,000 cash and the issue of 75,000,000 fully paid ordinary shares in Asra at a deemed issue price of $0.002 per share (“Shares”) upon satisfaction of the conditions precedent of the Agreement (refer to the summary of the Agreement below for further details). The issue of the Shares is subject to shareholder approval under ASX Listing Rule 7.1, which Asra intends to seek at its upcoming annual general meeting, scheduled to be held in late May 2025.

Mt Stirling Leonora North Project

The Mt Stirling Leonora North Project is strategically located approximately 40km northeast of Leonora within Western Australia’s Eastern Goldfields. This region is renowned for hosting numerous multi-million-ounce orogenic gold deposits and significant mining operations.

The Project is situated just 5km from Vault Minerals’ (ASX:VAU) major 6Moz King of the Hills mine and its recently expanded processing hub, which is the largest in the Leonora district. It is also proximal to Genesis Minerals’ (ASX:GMD) extensive 2Moz Leonora operations. The Project currently hosts a JORC (2012) Mineral Resource Estimate totalling 152,000 oz at 1.7g/t Au. This Mineral Resource Estimate provides a valuable foundation for the Project and future exploration efforts aimed at expansion.

Click here for the full ASX Release

This article includes content from Asra Minerals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

16h

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The Toronto-based miner said its board has authorized preparations for an IPO of a new entity that would house its premier North American gold operations,... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

05 February

TomaGold Borehole EM Survey Confirms Berrigan Deep Zone

Survey also validates significant mineralization and unlocks new targets Highlights Direct correlation with mineralization : The modeled geophysical plates explain the presence of semi-massive to massive sulfides intersected in holes TOM-25-009 to TOM-25-015. Priority target BER-14C :... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00