- WORLD EDITIONAustraliaNorth AmericaWorld

February 09, 2023

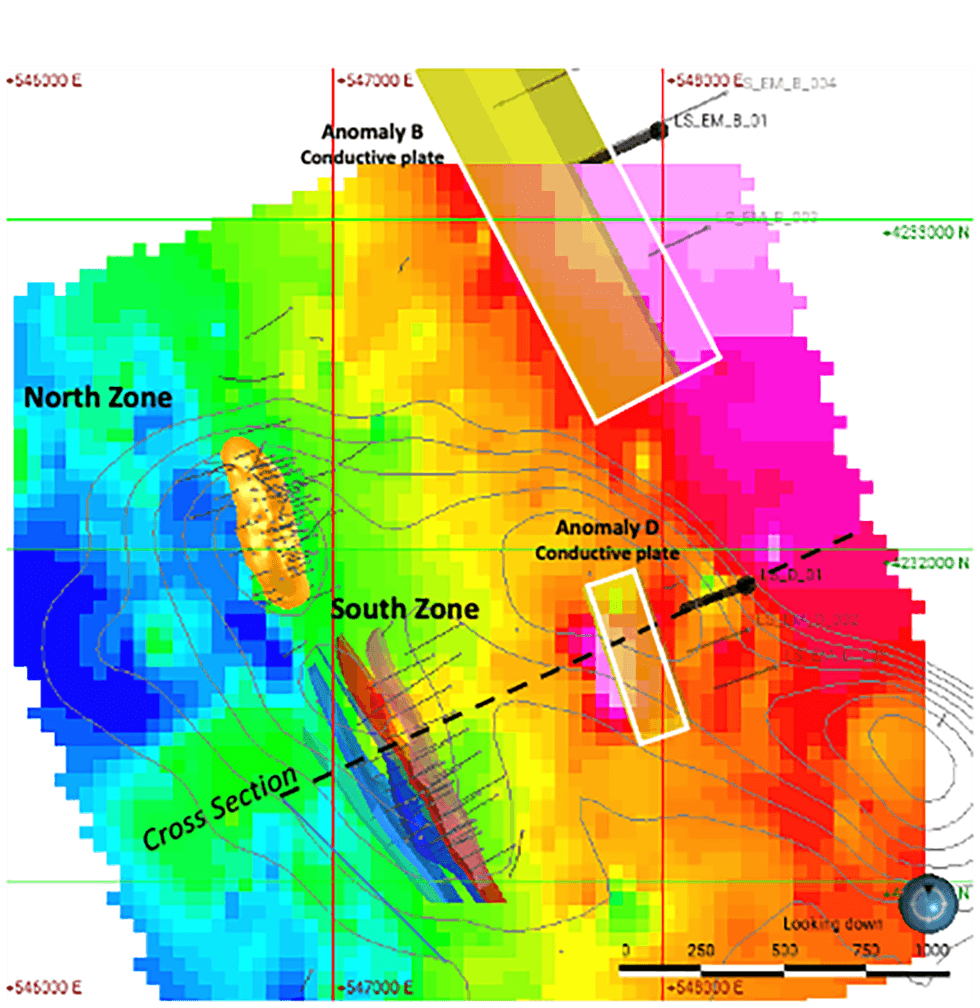

Ascendant Resources Inc. (TSX: ASND) (OTCQB: ASDRF; FRA: 2D9) (“Ascendant” or the “Company”) is pleased to announce that it has mobilized a second drill rig to commence drilling at Anomaly B. Anomaly B is a large geophysical target located approximately 1km northeast of the Venda Nova North deposit (see Figure 1.) at its Lagoa Salgada project on the Iberian Pyrite Belt (“IBP”) in Portugal.

- Drilling commenced at Anomaly B, a large geophysical anomaly with a potential strike of 1.3km, northwest of the North Zone at Venda Nova

- Drilling at Anomaly D reaches down-hole depth of 350m with evidence of proximity to sulphide mineralization

The modelled conductive plate, to be targeted by the drilling, has a strike potential of approximately 1,300m in length and 600m of down dip length. The first hole will target the central zone of the modelled conductive plate to better understand the geometry and guide additional drilling.

Drilling of Anomaly B is part of the ongoing 5,000m step-out exploration program at the Lagoa Salgado Project in the Iberian Pyrite Belt, Portugal, which is targeting additional new potential massive sulphide deposits clustered around our initial deposit, which would be similar to most other mines in the Iberian Pyrite Belt.

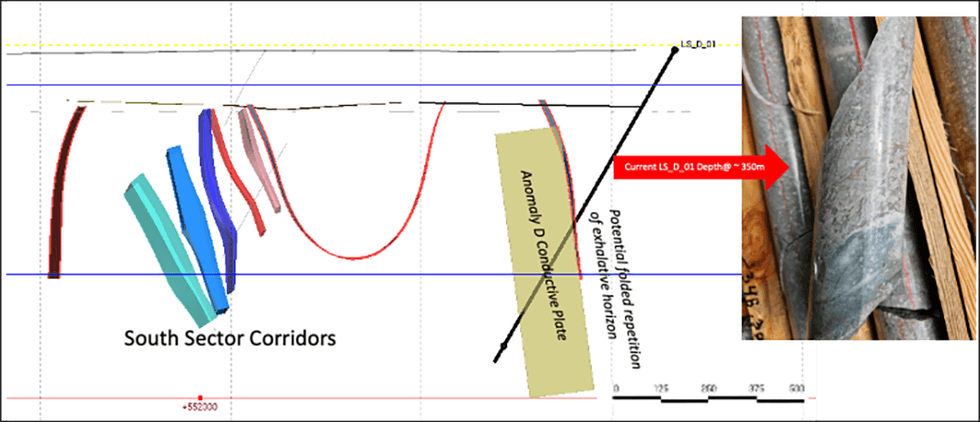

Additionally, drilling of the first step out exploration hole at Anomaly D; LS_D01, which commenced in January (see press release dated January 18, 2023) has now reached a down-hole depth of approximately 350m. Visual inspection of the core is showing evidence of disseminated sulphides which is indicative of proximity to an enhanced mineralized system. The nature of these disseminated sulphides intersected to date does not explain the strong electromagnetic signature that defines the target of Anomaly D (see Figures 1 and 2 below). The exploration team expects we are approximately 100m from the centre of the mapped conductive plate and the heart of the geophysical target at Anomaly D. We expect drilling to intersect the boundary of the conductive plate within the next week.

Mark Brennan, Executive Chairman of Ascendant stated, “It is very exciting to see progress on our step out exploration program; not only do we expect to see a strong development case presented when our Feasibility Study is completed on the existing resource in April, but this program has the capability to expand our resources materially to equal other world class mines on the IBP.” He continued, “Most mines on the IBP have a cluster of 2 or more deposits which are largely identified through geophysics. Geophysics are presenting to us optimism for a similar opportunity.”

Figure 1. Plan view of Venda Nova Geophysical Targets

Figure 2. Section showing progress of Drill hole LS_D_01 to date

About Ascendant Resources Inc.

Ascendant Resources is a Toronto-based mining company focused on the exploration and development of the highly prospective Lagoa Salgada VMS project located on the prolific Iberian Pyrite Belt in Portugal. Through focused exploration and aggressive development plans, the Company aims to unlock the inherent potential of the project, maximizing value creation for shareholders.

The Venda Nova deposit at Lagoa Salgada contains over 10.33 million tonnes of Measured and Indicated Resources @ 9.06 % ZnEq and 2.50 million tonnes of Inferred Resources @ 5.93 % ZnEq in the North Zone; and 4.42 million tonnes of Indicated Resources @ 1.50 % CuEq and 10.83 million tonnes of Inferred resources @ 1.35 % CuEq in the South Zone. The deposit demonstrates typical mineralization characteristics of Iberian Pyrite Belt VMS deposits containing zinc, copper, lead, tin, silver and gold. Extensive exploration upside potential lies both near deposit and at prospective step-out targets across the large 7,209ha property concession. The project also demonstrates compelling economics with scalability for future resource growth in the results of the Preliminary Economic Assessment. Located just 80km from Lisbon, Lagoa Salgada is easily accessible by road and surrounded by exceptional Infrastructure. Ascendant holds a 50% interest in the Lagoa Salgada project through its position in Redcorp - Empreendimentos Mineiros, Lda, ("Redcorp") and has an earn-in opportunity to increase its interest in the project to 80%. The Company's interest in the Lagoa Salgada project offers a low-cost entry to a potentially significant exploration and development opportunity, already demonstrating its mineable scale.

The Company's common shares are principally listed on the Toronto Stock Exchange under the symbol "ASND". For more information on Ascendant, please visit our website at www.ascendantresources.com.

Additional information relating to the Company, including the Preliminary Economic Assessment referenced in this news release, is available on SEDAR at www.sedar.com.

For further information, contact:

| Mark Brennan | David Ball |

| Executive Chairman, Founder | Vice President, Corporate Development |

| Tel: +1-647-796-0023 | Tel: +1-647-796-0068 |

| mbrennan@ascendantresources.com | dball@ascendantresources.com |

Forward Looking Information

This press release contains statements that constitute “forward-looking information” (collectively, “forward-looking statements”) within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements contained in this press release include, without limitation, statements regarding the business, the Project, and the exploration potential of Anomaly B,D or any other targets on the property. In making the forward- looking statements contained in this press release, Ascendant has made certain assumptions, including, but not limited to the Company’s ability to execute future drill programs and add to existing resources. Although Ascendant believes that the expectations reflected in forward-looking statements are reasonable, it can give no assurance that the expectations of any forward-looking statements will prove to be correct. Known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to general business, economic, competitive, political and social uncertainties. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Except as required by law, Ascendant disclaims any intention and assumes no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward-looking statements or otherwise.

Forward-looking information is subject to a variety of risks and uncertainties, which could cause actual events or results to differ from those reflected in the forward-looking information, including, without limitation, the risks described under the heading "Risks Factors" in the Company's Annual Information Form dated March 24, 2022 and under the heading "Risks and Uncertainties" in the Company's Management’s Discussion and Analysis for the years ended December 31, 2021 and 2020 and other risks identified in the Company's filings with Canadian securities regulators, which filings are available on SEDAR at www.sedar.com. The risk factors referred to above are not an exhaustive list of the factors that may affect any of the Company's forward-looking information. The Company's statements containing forward-looking information are based on the beliefs, expectations and opinions of management on the date the statements are made, and the Company does not assume any obligation to update such forward-looking information if circumstances or management's beliefs, expectations or opinions should change, other than as required by applicable law. For the reasons set forth above, one should not place undue reliance on forward-looking information.

ASND:CA

The Conversation (0)

29 March 2023

Ascendant Resources

District-scale Polymetallic Project in the Prolific Iberian Pyrite Belt

District-scale Polymetallic Project in the Prolific Iberian Pyrite Belt Keep Reading...

31 December 2025

Zinc Stocks: 5 Biggest Canadian Companies in 2025

Zinc companies saw support in 2025 as prices for the base metal rebounded during the second half of the year. By the end of December, zinc had crossed above the US$3,000 per metric ton (MT) level. However, zinc still faces headwinds — its biggest demand driver is its use in the production of... Keep Reading...

30 December 2025

Electric Royalties Announces Interest Conversion Under Convertible Credit Facility

VANCOUVER, BC / ACCESS Newswire / December 30, 2025 / Electric Royalties Ltd. (TSXV:ELEC,OTC:ELECF)(OTCQB:ELECF) ("Electric Royalties" or the "Company") announces that Gleason & Sons LLC (the "Lender") has elected to convert C$420,000.00 of accrued interest on the principal amount of the... Keep Reading...

16 December 2025

Korea Zinc Unveils US$7.4 Billion Plan for First US Zinc Smelter in Decades

Korea Zinc (KRX:010130) plans to invest US$7.4 billion to build a zinc smelter and critical minerals processing facility in the US, marking the first new US-based zinc smelter since the 1970s.The world’s largest zinc smelter said the facility will be built in Tennessee and will produce... Keep Reading...

08 December 2025

Electric Royalties Provides Update on Critical Metals Royalty Portfolio

VANCOUVER, BC / ACCESS Newswire / December 8, 2025 / Electric Royalties Ltd. (TSXV:ELEC,OTC:ELECF)(OTCQB:ELECF) ("Electric Royalties" or the "Company") is pleased to provide an update on key royalties in its portfolio, adding to the December 2, 2025 announcement of royalty revenues and other... Keep Reading...

02 December 2025

Electric Royalties: Several Copper Royalties Make Strides and Copper Royalty Revenues Rise

VANCOUVER, BC / ACCESS Newswire / December 2, 2025 / Electric Royalties Ltd. (TSXV:ELEC,OTC:ELECF)(OTCQB:ELECF) ("Electric Royalties" or the "Company") is pleased to provide an update on growing revenues and progress within its copper royalty portfolio.Electric Royalties CEO Brendan Yurik... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00