February 13, 2025

Asara Resources Limited (ASX: AS1; Asara or Company) is pleased to announce that it has signed a binding Subscription Agreement with Barbet L.L.C FZ (Barbet) to raise $2.3m (Placement) which affirms Barbet’s commitment to the Company and its flagship asset, the Kada Gold Project in Guinea (Kada).

Following completion of the Placement, Mr. Timothy Strong has stepped down as Managing Director and Mr. Matthew Sharples has been appointed Chief Executive Officer. Mr. Strong will remain on the Board as Executive Director – Corporate Strategy & Affairs.

Executive Director, Tim Strong commented:

‘’We are pleased that Barbet have continued to show their commitment to the Company and its flagship Kada project by participating in a further Placement. This Placement will allow the Company to fastrack its exploration efforts.

I am also delighted to welcome Matt Sharples to the management team. Matt, who joined the Company as a consultant in October 2024, has been instrumental in recommencing operations at Kada. Matt provides a wealth of knowledge, and an undeniable passion for Guinea and I look forward to supporting him as we move the Kada project through the value chain towards a feasibility study. Both Matt and I are confident of the resource potential of Massan and the surrounding areas which will be drill tested in the coming months.’’

Placement Details

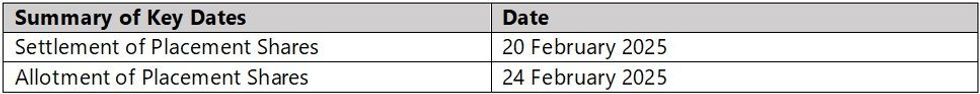

The Placement is comprised of the issue of 104,517,541 fully paid ordinary shares (Placement Shares) at an issue price of $0.022 raising $2,299,385.90 (before costs). per share. Following the Placement, Barbet holds 19.89% of the Company.

The proceeds of the Placement will be applied towards an upcoming drill program and exploration activities at Kada and general working capital. The Placement Shares will be issued under the Company’s existing placement capacity under ASX Listing Rule 7.1, and accordingly no shareholder approval is required. The Placement Shares will rank pari passu with existing securities on issue.

Executive Changes

Chief Executive Officer

Matthew has been appointed Chief Executive Officer, effective 14 February 2025. Matthew Sharples is a mining professional with over 20 years of experience in mine development, investment consulting and M&A. Matt specialises in the geological evaluation and development of gold projects, with a particular focus on project development from the initial stage to production.

Matt was Co-Founder and CEO of the private mining fund Sycamore Mining. Under his stewardship, the group's flagship asset, the Kiniero Mine (Guinea), grew from a total resource base of 1.5Moz Au to 3.5Moz Au (JORC) and was sold to Robex Resources in 2022 for a project valuation of US$160m. Matt has worked worldwide in the mining and resources industry, in the UK, Africa, Asia and Australia, with Robex, Sycamore, Wood Mackenzie, Xstrata and BHP Billiton.

Matt holds an MSc in Basin Evolution and Dynamics, Royal Holloway, University of London, United Kingdom, and a BSc in Geology, University of Durham, United Kingdom. Matt is a director and shareholder of substantial shareholder, Barbet L.L.C FZ.

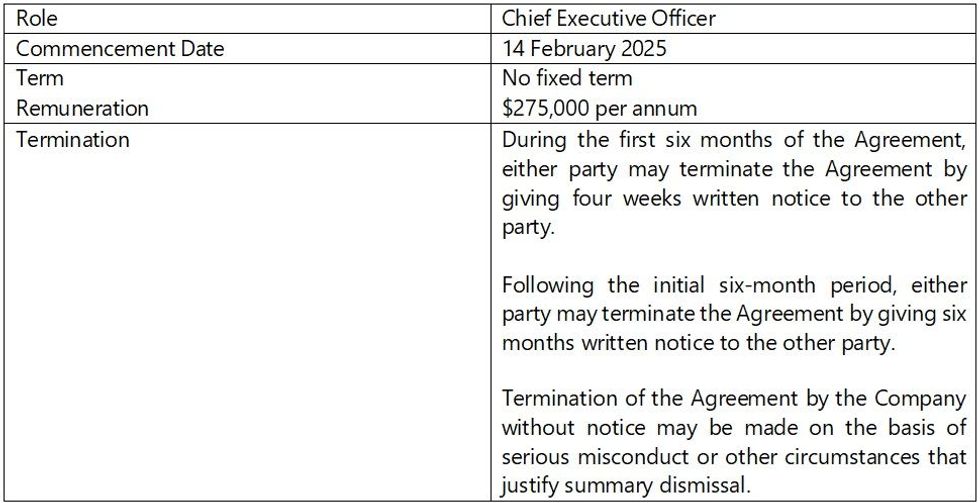

The material terms of Matthew Sharple’s employment agreement are as follows:

Click here for the full ASX Release

This article includes content from Asara Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Sign up to get your FREE

Asara Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

07 July 2025

Asara Resources

Advancing the next West African gold camp from the heart of Guinea’s prolific Siguiri Basin

Advancing the next West African gold camp from the heart of Guinea’s prolific Siguiri Basin Keep Reading...

20 February

Top 5 Canadian Mining Stocks This Week: Belo Sun is Radiant with 109 Percent Gain

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.On Tuesday (February 17) Canadian Prime Minister Mark Carney announced the creation of... Keep Reading...

20 February

Gold and Silver Stocks Dominate TSX Venture 50 List

This year's TSX Venture 50 list showcases a major shift in sentiment toward the mining sector. The TSX Venture 50 ranks the top 50 companies on the TSX Venture Exchange based on annual performance using three criteria: one year share price appreciation, market cap growth and Canadian... Keep Reading...

19 February

Ole Hansen: Next Gold Target is US$6,000, What About Silver?

Ole Hansen, head of commodity strategy at Saxo Bank, believes US$6,000 per ounce is in the cards for gold in the next 12 months; however, silver may not enjoy the same price strength. "If gold moves toward US$6,000, I would believe that ... silver at some point will struggle to keep up, and... Keep Reading...

19 February

Kinross’ Great Bear Gold Project Accelerated Under Ontario’s 1P1P Framework

Ontario is moving to accelerate one of Canada’s largest emerging gold projects, cutting permitting timelines in half for Kinross Gold's (TSX:K,NYSE:KGC) Great Bear development in the Red Lake district.The province announced that Great Bear will be designated under its new One Project, One... Keep Reading...

19 February

Massan Indicated Conversion Programme Continues to Deliver

Asara Resources (AS1:AU) has announced Massan indicated conversion programme continues to deliverDownload the PDF here. Keep Reading...

Latest News

Sign up to get your FREE

Asara Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00