February 13, 2025

Asara Resources Limited (ASX: AS1; Asara or Company) is pleased to announce that it has signed a binding Subscription Agreement with Barbet L.L.C FZ (Barbet) to raise $2.3m (Placement) which affirms Barbet’s commitment to the Company and its flagship asset, the Kada Gold Project in Guinea (Kada).

Following completion of the Placement, Mr. Timothy Strong has stepped down as Managing Director and Mr. Matthew Sharples has been appointed Chief Executive Officer. Mr. Strong will remain on the Board as Executive Director – Corporate Strategy & Affairs.

Executive Director, Tim Strong commented:

‘’We are pleased that Barbet have continued to show their commitment to the Company and its flagship Kada project by participating in a further Placement. This Placement will allow the Company to fastrack its exploration efforts.

I am also delighted to welcome Matt Sharples to the management team. Matt, who joined the Company as a consultant in October 2024, has been instrumental in recommencing operations at Kada. Matt provides a wealth of knowledge, and an undeniable passion for Guinea and I look forward to supporting him as we move the Kada project through the value chain towards a feasibility study. Both Matt and I are confident of the resource potential of Massan and the surrounding areas which will be drill tested in the coming months.’’

Placement Details

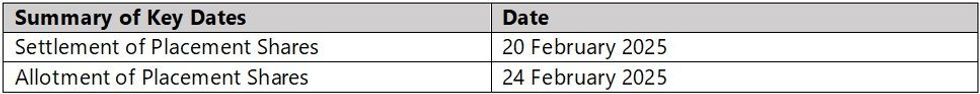

The Placement is comprised of the issue of 104,517,541 fully paid ordinary shares (Placement Shares) at an issue price of $0.022 raising $2,299,385.90 (before costs). per share. Following the Placement, Barbet holds 19.89% of the Company.

The proceeds of the Placement will be applied towards an upcoming drill program and exploration activities at Kada and general working capital. The Placement Shares will be issued under the Company’s existing placement capacity under ASX Listing Rule 7.1, and accordingly no shareholder approval is required. The Placement Shares will rank pari passu with existing securities on issue.

Executive Changes

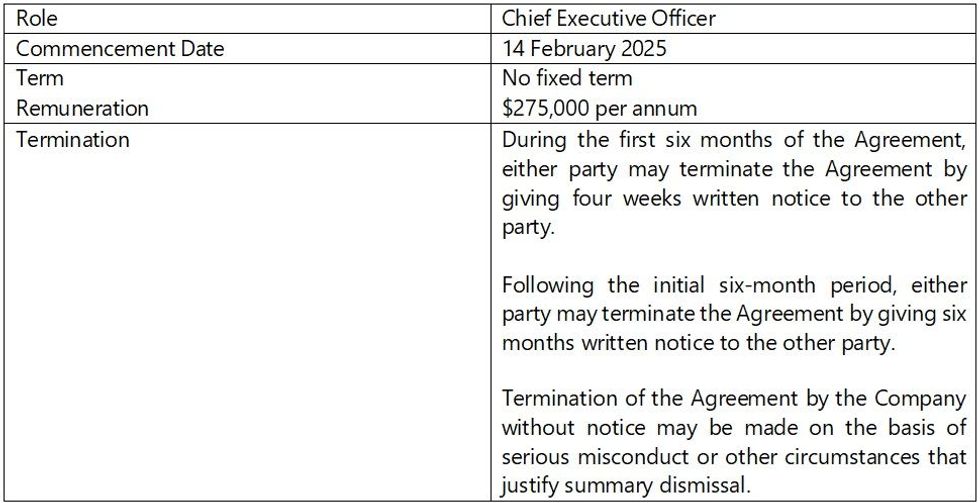

Chief Executive Officer

Matthew has been appointed Chief Executive Officer, effective 14 February 2025. Matthew Sharples is a mining professional with over 20 years of experience in mine development, investment consulting and M&A. Matt specialises in the geological evaluation and development of gold projects, with a particular focus on project development from the initial stage to production.

Matt was Co-Founder and CEO of the private mining fund Sycamore Mining. Under his stewardship, the group's flagship asset, the Kiniero Mine (Guinea), grew from a total resource base of 1.5Moz Au to 3.5Moz Au (JORC) and was sold to Robex Resources in 2022 for a project valuation of US$160m. Matt has worked worldwide in the mining and resources industry, in the UK, Africa, Asia and Australia, with Robex, Sycamore, Wood Mackenzie, Xstrata and BHP Billiton.

Matt holds an MSc in Basin Evolution and Dynamics, Royal Holloway, University of London, United Kingdom, and a BSc in Geology, University of Durham, United Kingdom. Matt is a director and shareholder of substantial shareholder, Barbet L.L.C FZ.

The material terms of Matthew Sharple’s employment agreement are as follows:

Click here for the full ASX Release

This article includes content from Asara Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Sign up to get your FREE

Asara Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

07 July 2025

Asara Resources

Advancing the next West African gold camp from the heart of Guinea’s prolific Siguiri Basin

Advancing the next West African gold camp from the heart of Guinea’s prolific Siguiri Basin Keep Reading...

5h

Byron King: Gold, Silver, Oil/Gas — Stock Ideas and Strategy Now

Byron King, editor at Paradigm Press, shares his approach to the gold and silver sectors as tensions in the Middle East intensify, also touching on oil and gas. Overall he sees hard assets becoming increasingly key as global uncertainty escalates."Own gold, own silver — physically own the metal... Keep Reading...

5h

Jaime Carrasco: Gold Going "Much Higher," Silver Force Majeure Inevitable

Jaime Carrasco, senior portfolio manager and senior financial advisor at Harbourfront Wealth Management, shares his outlook for gold and silver, saying prices must rise much higher. He also talks about how to build a strong precious metals portfolio. "We're moving from a credit-based economy, a... Keep Reading...

5h

Garrett Goggin: Gold, Silver in New Era, My Stock Strategy Now

Garrett Goggin, founder of Golden Portfolio, says although gold and silver haven't gone mainstream yet, the metals — and the mining sector overall — have entered a new era. "It's a real mind shift — it's a new era in mining right here," he said.Don't forget to follow us @INN_Resource for... Keep Reading...

15h

Nicola Mining Provides Update on NASDAQ Listing

Nicola Mining Inc. (TSXV: NIM,OTC:HUSIF) (OTCQB: HUSIF) (FSE: HLIA) (the "Company" or "Nicola") is pleased to provide an update on its proposed NASDAQ listing, which it originally disclosed in its news release of October 27, 2025. There are approximately 220 Canadian companies trading via cross... Keep Reading...

06 March

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

06 March

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

Latest News

Sign up to get your FREE

Asara Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00