May 27, 2024

Miramar Resources Limited (ASX:M2R, “Miramar” or “the Company”) is pleased to advise that it has received Programme of Work (POW) approval for drilling at the 100%-owned Trouble Bore nickel (Ni) copper (Cu), cobalt (Co) and platinum group element (PGE) Project in the Gascoyne region of WA.

- POW approval received for drilling at the Trouble Bore Ni-Cu-Co-PGE Project

- EIS co-funded drilling will test late-time airborne and ground EM anomalies at Trouble Bore and Mount Vernon for Norilsk-style Ni-Cu-Co-PGE mineralisation

Trouble Bore is one of several tenements which make up the Company’s 100% owned, district-scale Bangemall Project.

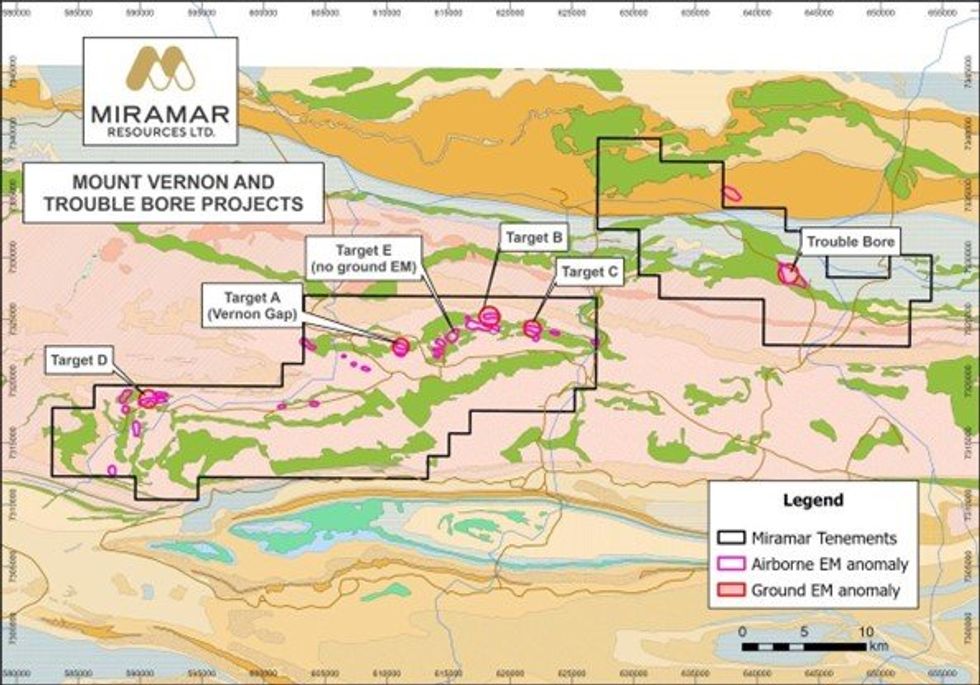

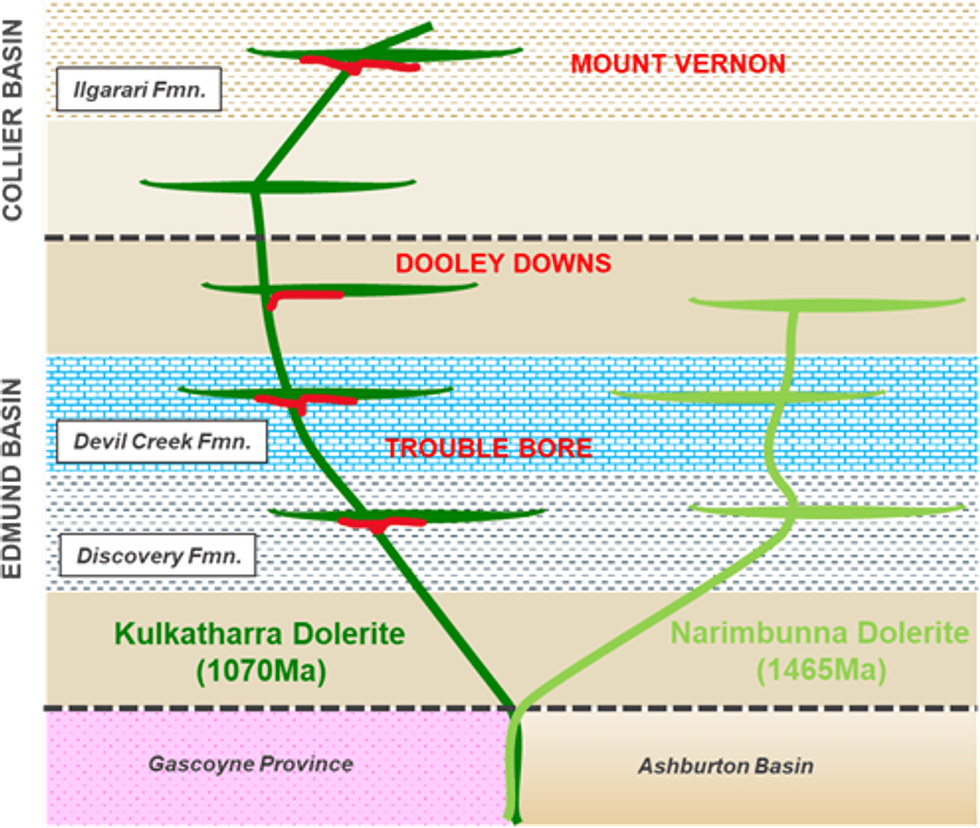

The Company has now received POW approvals for Exploration Incentive Scheme (EIS) co-funded RC drilling at both the Trouble Bore and Mount Vernon Projects which will test Norilsk-style Ni-Cu-Co-PGE targets associated with Kulkatharra Dolerite sills and highlighted by airborne and ground electromagnetic (EM) surveys (Figure 1).

Miramar’s Executive Chairman, Mr Allan Kelly, said the Company’s Bangemall Project represents the opportunity for discovery of an entirely new nickel-copper province in WA.

“Geoscience Australia, GSWA and the CSIRO have all identified the potential for Norilsk-style Ni-Cu-Co- PGE mineralisation within the Kulkatharra Dolerite sills, which are the same age as the Nebo-Babel deposits in the West Musgraves,” Mr Kelly said.

“At Mount Vernon and Trouble Bore, EM surveys have highlighted a number of highly conductive late-time EM anomalies where these dolerite sills intrude into sulphide and/or sulphate-rich sediments,” he said.

“At Trouble Bore, we also see evidence of a potential feeder dyke which is an important component of this type of deposit,” he added.

“We look forward to getting on the ground and testing the fantastic opportunity we have outlined,” he said.

Upcoming work programme

Miramar’s initial aim is to show “proof of concept” of the Company’s Bangemall Ni-Cu-Co-PGE deposit model by identifying Ni-Cu sulphide mineralisation.

The Company will now work towards obtaining heritage approvals and planning for the maiden drilling programme.

Click here for the full ASX Release

This article includes content from Miramar Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

copper-stocksasx-m2rresource-stocksgold-stocksasx-stocksgold-explorationnickel-stockscopper-investingcopper-explorationnickel-exploration

M2R:AU

The Conversation (0)

06 February 2024

Miramar Resources

Aiming to create shareholder value through the discovery of world-class mineral deposits

Aiming to create shareholder value through the discovery of world-class mineral deposits Keep Reading...

30 January

Top 5 Canadian Mining Stocks This Week: Vangaurd Mining Gains 141 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released November’s gross domestic product (GDP) data on Friday (January... Keep Reading...

30 January

Quarterly Activities and Cashflow Report

Redstone Resources (RDS:AU) has announced Quarterly Activities and Cashflow ReportDownload the PDF here. Keep Reading...

23 January

Freeport-McMoRan Plans 2026 Grasberg Restart After Deadly Mud Rush

Freeport-McMoRan (NYSE:FCX) is preparing to bring one of the world’s most important copper assets back online, laying out plans for a phased restart of the Grasberg mine in Indonesia following a deadly mud rush that halted operations late last year.The Arizona-based miner said remediation and... Keep Reading...

22 January

Red Metal Resources Closes First Tranche of Financing

RED METAL RESOURCES LTD. (CSE: RMES) (OTC Pink: RMESF) (FSE: I660) ("Red Metal" or the "Company") announces that it has closed the first tranche of its previously announced non-brokered private placement financing (the "Offering") (see news releases dated January 7, 2026, and January 19, 2026)... Keep Reading...

22 January

Questcorp Mining and Riverside Resources Chip Channel Sample 30 Meters @ 20 g/t Gold and 226 g/t Silver at the Mexican Union Project

Questcorp Mining Inc. (CSE: QQQ) (OTCQB: QQCMF) (FSE: D910) (the "Company" or "Questcorp") along with its partner Riverside Resources Inc. (TSXV: RRI) (OTCQB: RVSDF) (FSE: 5YY0) ("Riverside"), is pleased to report a high grade interval of 20.2 g/t gold and 226 g/t silver with 2.7% zinc over a 30... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00