Andean Precious Metals Corp. (TSX: APM) (OTCQX: ANPMF) ("Andean" or the "Company") is pleased to report its third quarter operational results for the quarter ended September 30, 2025. The Company is also providing notice that it will release its third quarter 2025 financial results after market close on Tuesday, November 11, 2025. The Company will host its third quarter 2025 earnings conference call and webcast on Wednesday, November 12, 2025, at 9:00 am Eastern Time.

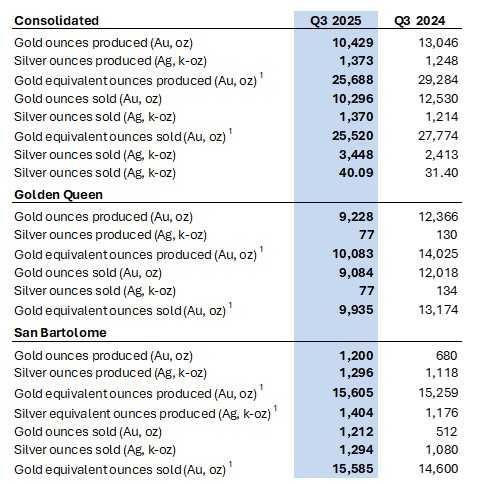

Alberto Morales, Executive Chairman and CEO, commented: "The Company's consolidated gold equivalent production increased from 24,341 oz in Q2 to 25,688 oz in Q3, driven by a strong increase in silver production at San Bartolome. Silver equivalent production at San Bartolome increased as forecast, from 1.092 million oz in Q2 to 1.404 million oz in Q3. At Golden Queen, the migration of fine ore particles impacted the permeability of a designated high-grade leach cell scheduled for processing. To resolve this challenge, the cell underwent reconditioning, and the leaching solution was administered at a reduced rate to mitigate further particle migration. The operations team utilized this situation to optimize ore blending protocols and adjust the strategy for applying the leaching solution. This delayed the timing of the leaching process, which resulted in gold equivalent production of 10,083 oz in Q3 versus 12,213 oz in Q2. We expect the Q3 production shortfall to be incremental to our future quarterly production. Golden Queen has returned to operating within expected parameters, with gold production increasing from late September through early October and showing a stabilizing trend.

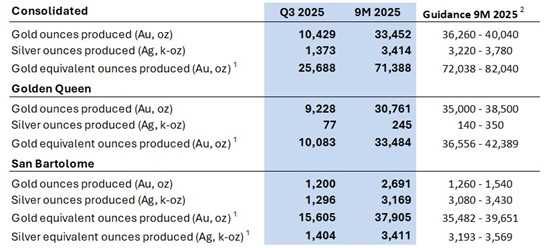

Consolidated gold equivalent production for the first nine months of this year is slightly below guidance, with strong silver output helping to offset lower-than-expected gold production. As we move toward year-end, Andean is operating closer to the lower range of its annual production guidance, with expectations for a solid fourth quarter supported by continued strength from San Bartolome and stabilizing performance at Golden Queen.

Notably, Andean achieved record realized prices in the third quarter at $3,448 per ounce of gold and $40.09 per ounce of silver, further strengthening our financial results and balance sheet and positioning us for a strong finish to the year. We look forward to providing a full update with our Q3 financial results after market close on November 11, with our conference call the following morning."

Production Summary

Operational Results

(1) Beginning in 2025, gold equivalent ounces of silver produced or sold in a quarter are computed using a consistent ratio of silver price to the gold price and multiplying this ratio by silver ounces produced or sold during that quarter. The Company is using a conversion factor of 90 using a price assumption of $2,500 per ounce of gold and $27.78 per ounce of silver.

(2) The production targets for the nine-month period ending September 30, 2025 are 70% of annual production for San Bartolome and Golden Queen. The Company expects 30% of annual production for San Bartolome and Golden Queen to occur in the fourth quarter of 2025. Refer to the Q1 2025 Production news release dated April 15, 2025 for additional details regarding the Company's 2025 production guidance.

Q3 2025 Conference Call and Webcast

Wednesday, November 12, at 9:00 AM ET

Participants may listen to the webcast by registering via the following link https://www.gowebcasting.com/14383

Participants may also listen to the conference call by calling North American toll free 1-800-715-9871, or 1-647-932-3411 outside the U.S. or Canada.

An archived reply of the webcast will be available for 90 days at: https://www.gowebcasting.com/14383 or the Company website at www.andeanpm.com.

About Andean Precious Metals

Andean is a growing precious metals producer focused on expanding into top-tier jurisdictions in the Americas. The Company owns and operates the San Bartolome processing facility in Potosí, Bolivia and the Golden Queen mine in Kern County, California, and is well-funded to act on future growth opportunities. Andean's leadership team is committed to creating value; fostering safe, sustainable and responsible operations; and achieving our ambition to be a multi-asset, mid-tier precious metals producer.

For more information, please contact:

Amanda Mallough

Director, Investor Relations

amallough@andeanpm.com

T: +1 647 463 7808

Caution Regarding Forward-Looking Statements

Certain statements and information in this release constitute "forward-looking statements" within the meaning of applicable U.S. securities laws and "forward-looking information" within the meaning of applicable Canadian securities laws, which we refer to collectively as "forward-looking statements". Forward-looking statements are statements and information regarding possible events, conditions or results of operations that are based upon assumptions about future economic conditions and courses of action. All statements and information other than statements of historical fact may be forward-looking statements. In some cases, forward-looking statements can be identified by the use of words such as "seek", "expect", "anticipate", "budget", "plan", "estimate", "continue", "forecast", "intend", "believe", "predict", "potential", "target", "may", "could", "would", "might", "will" and similar words or phrases (including negative variations) suggesting future outcomes or statements regarding an outlook.

Forward-looking statements in this release include, but are not limited to, statements and information regarding the Company's production, expectations for 2025 and the Company's release of its third quarter 2025 financial results. Such forward-looking statements are based on a number of material factors and assumptions, including, but not limited to: the Company's ability to carry on exploration and development activities; the Company's ability to secure and to meet obligations under property and option agreements and other material agreements; the timely receipt of required approvals and permits; that there is no material adverse change affecting the Company or its properties; that contracted parties provide goods or services in a timely manner; that no unusual geological or technical problems occur; that plant and equipment function as anticipated and that there is no material adverse change in the price of silver, price of gold, costs associated with production or recovery. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements, or industry results, to differ materially from those anticipated in such forward-looking statements. The Company believes the expectations reflected in such forward-looking statements are reasonable, but no assurance can be given that these expectations will prove to be correct, and you are cautioned not to place undue reliance on forward-looking statements contained herein.

Some of the risks and other factors which could cause actual results to differ materially from those expressed in the forward-looking statements contained in this release include, but are not limited to: risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits and conclusions of economic evaluations; results of initial feasibility, pre-feasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Company's expectations; risks relating to possible variations in reserves, resources, grade, planned mining dilution and ore loss, or recovery rates and changes in project parameters as plans continue to be refined; mining and development risks, including risks related to accidents, equipment breakdowns, labour disputes (including work stoppages and strikes) or other unanticipated difficulties with or interruptions in exploration and development; the potential for delays in exploration or development activities or the completion of feasibility studies; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; risks related to commodity price and foreign exchange rate fluctuations; the uncertainty of profitability based upon the cyclical nature of the industry in which the Company operates; risks related to failure to obtain adequate financing on a timely basis and on acceptable terms or delays in obtaining governmental or local community approvals or in the completion of development or construction activities; risks related to environmental regulation and liability; political and regulatory risks associated with mining and exploration; risks related to the uncertain global economic environment; and other factors contained in the section entitled "Risk Factors" in the Company's MD&A for the three and six months ended June 30, 2025.

Although the Company has attempted to identify important factors that could cause actual results or events to differ materially from those described in the forward-looking statements, you are cautioned that this list is not exhaustive and there may be other factors that the Company has not identified. Furthermore, the Company undertakes no obligation to update or revise any forward-looking statements included in this release if these beliefs, estimates and opinions or other circumstances should change, except as otherwise required by applicable law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/270587