April 20, 2025

A recent research report by Terra Studio highlights Castle Minerals’ (ASX:CDT) investment value proposition as a gold exploration company with significant potential in Ghana's gold-rich region. With an enterprise value of just AU$3.4 million, Terra Studio considers Castle Minerals significantly undervalued given its promising drill results, strong government support for its graphite project, and potential for continued discoveries amid record-high gold prices.

The Terra Studio report from April 14, 2025, outlines several compelling reasons why Castle Minerals presents an attractive investment opportunity.

Key Highlights from the Report:

Strategic Location and Recent Discoveries

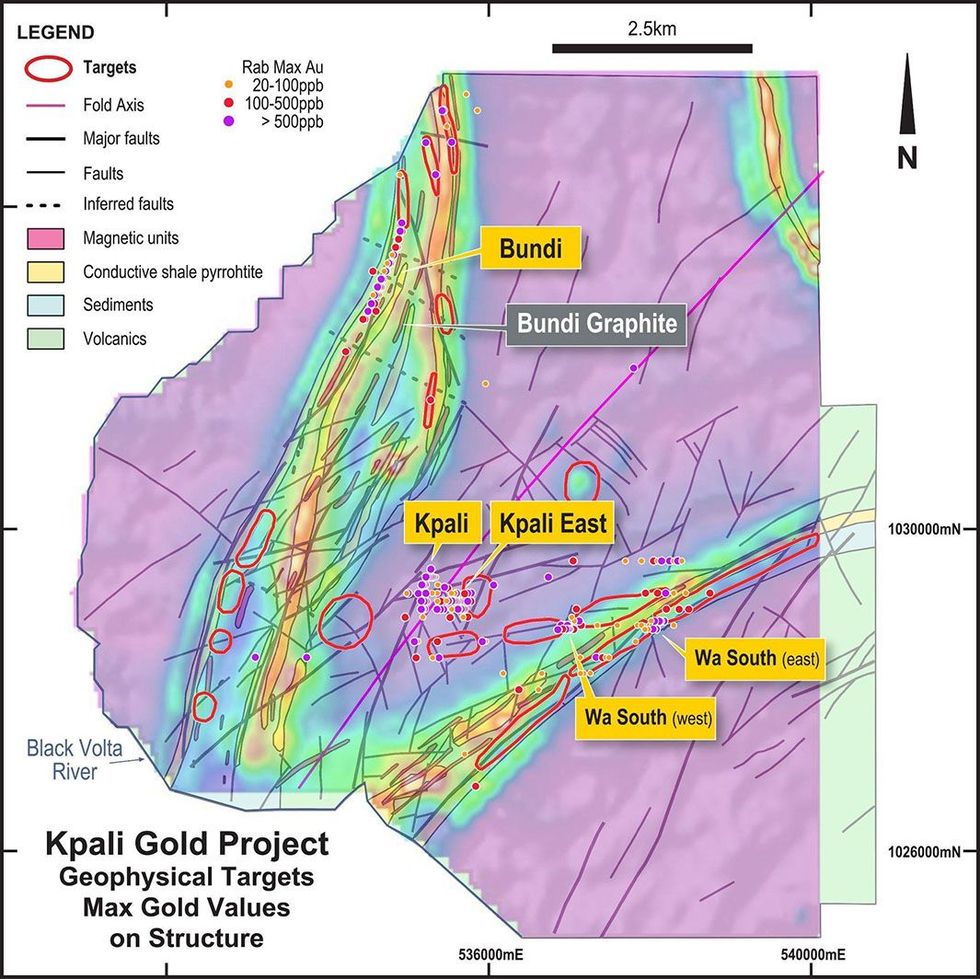

Castle's projects are located in northern Ghana, which hosts several major gold deposits including Cardinal Resources' 5.1 Moz Namdini deposit. The company's Kpali gold project has confirmed robust mineralization with impressive drill results including 12 m at 8.29 grams per ton (g/t) gold and 9 m at 4.81 g/t gold, while the Kandia gold project has demonstrated promising continuity with results like 7 m at 3.36 g/t gold.

Geological Advantage

The report emphasizes that Castle's Kpali area sits at the convergence of two major fertile greenstone belts and three regional-scale structures that host multi-million-ounce deposits in the region – a geological setting similar to higher-valued projects in West Africa.

Strong Leadership and Financial Position

The company is led by Stephen Stone, who previously grew the nearby Black Volta gold project to 2.80 million ounces of mineral resources. Following a recent AU$3 million placement, Castle Minerals is well-funded to continue its exploration activities.

Castle also owns the Kambale graphite project, one of the highest-grade graphite projects in Africa with a mineral resource of 22.4 million tonnes at 8.6 percent total graphitic carbon. The Ghanaian government has expressed strong support, with the country's sovereign fund signing a term sheet to invest approximately US$2 million to advance the project.

For the full analyst report, click here.

This content is intended only for persons who reside or access the website in jurisdictions with securities and other applicable laws which permit the distribution and consumption of this content and whose local law recognizes the scope and effect of this Disclaimer, its limitation of liability, and the legal effect of its exclusive jurisdiction and governing law provisions [link to Governing Law section of the Disclaimer page].

Any investment information contained on this website, including third party research reports, are provided strictly for informational purposes, are general in nature and not tailored for the specific needs of any person, and are not a solicitation or recommendation to purchase or sell a security or intended to provide investment advice. Readers are cautioned to seek the advice of a registered investment advisor regarding the appropriateness of investing in any securities or investment strategies mentioned on this website.

CDT:AU

The Conversation (0)

01 October 2025

Cote D'Ivoire Soils Underway and Ghana Auger Well Advanced

Castle Minerals (CDT:AU) has announced Cote D'Ivoire Soils Underway and Ghana Auger Well AdvancedDownload the PDF here. Keep Reading...

01 September 2025

Target Defining Auger Campaign Commenced at Kandia

Castle Minerals (CDT:AU) has announced Target Defining Auger Campaign Commenced at KandiaDownload the PDF here. Keep Reading...

31 August 2025

CDT moves to 100% Mineralis to secure Cote d'Ivoire Earn-In

Castle Minerals (CDT:AU) has announced CDT moves to 100% Mineralis to secure Cote d'Ivoire Earn-InDownload the PDF here. Keep Reading...

21 August 2025

Castle to Acquire Extensive Cote d'Ivoire Footprint

Castle Minerals (CDT:AU) has announced Castle to Acquire Extensive Cote d'Ivoire FootprintDownload the PDF here. Keep Reading...

19 August 2025

Trading Halt

Castle Minerals (CDT:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

3h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

9h

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

17h

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

03 March

Blackrock Silver Receives First of Three Key Permits for the Tonopah West Project

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the issuance by the Nevada Department of Environmental Protection (NDEP), through the Bureau of Air Pollution Control, the Class II Air Quality and Surface Disturbance... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00