(TheNewswire)

VANCOUVER, BC TheNewswire - FEBRUARY 26 th 2025 American Salars Lithium INC. ("AMERICAN SALARS" OR THE "COMPANY") (CSE: USLI, OTC: USLIF, FWB: Z3P, WKN: A3E2NY ) announces it has signed a Mineral Claims Purchase Agreement (the "Agreement") with an arm's length vendor to acquire 100% of the Leduc East Lithium Project (the "Project") consisting of 101 mineral claims spanning approximately 6,100 hectares or 61 square kilometers.

The Project is located approximately 35km north of Gatineau, with surrounding infrastructure and accessibility for exploration. The Project is located approximately 275km southwest of Bécancour's Battery Metal Park and Lithium downstream concentrator and foundry, as well as 300km southeast of Sayona 's NAL Lithium mine, spodumene concentrator and planned foundry.

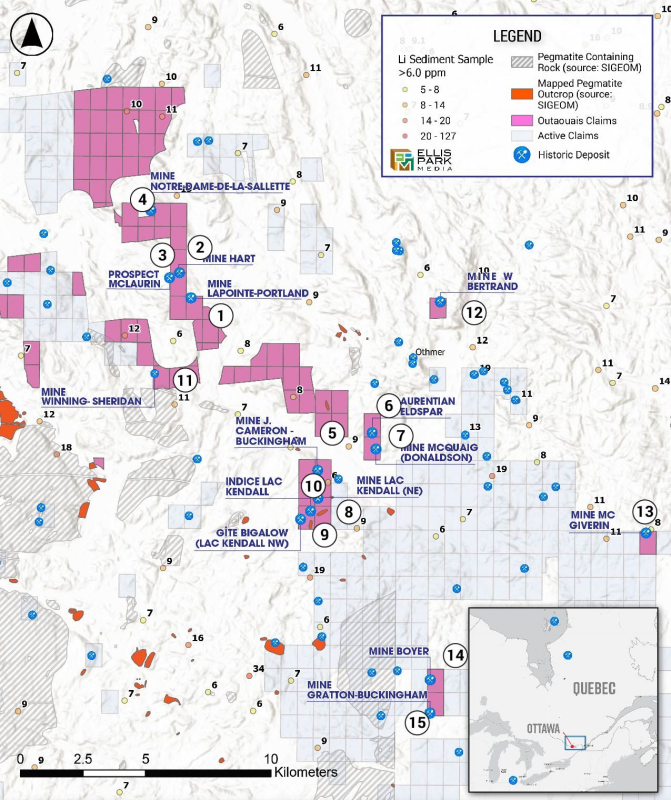

Figure 1. LeDuc East Lithium Properties (Pink)

The Leduc East Lithium Project claims cover part of an extensive belt of granitic and gneissic rocks that host pegmatitic mineralogy, with over 35 mapped pegmatites and covering 15 historical pegmatite-borne felspar showings, 13 of which are former Feldspar and Mica mines operated from the early 1900 to the 1940's.

The geologic summary for these historic mines indicate the presence of mica in the pegmatites, one possible source for Lithium (Natural Resources Quebec, Sigéom website). Moreover, of the 13 past producers, 5 produced Tourmaline, a key indicative mineral for Lithium. With the project located 4.5 km east from the historic Mine Leduc property which covers a small Lithium-bearing body (approximately 230 tonnes of 5.39% Li 2 O) from pegmatitic materials (GM62505, Geotech Exploration, 2006, non-NI 43-101 compliant ), there is strong indication of prospective lithium enrichment within our 60 km sq project area.

American Salars CEO & Director R. Nick Horsley states, "The opportunity to acquire this portfolio of past producing mines with thirty-five mapped pegmatites that were never assayed for Lithium, is an exciting proposition at these valuations. We have never been more optimistic about Lithium's future and American Salars is well positioned to capitalize on its growing demand. With highly prospective projects throughout Quebec, Nevada, Brazil and Argentina we are strategically located in some of the premier jurisdictions throughout North and South America."

The Transaction

American Salars has entered into an agreement with Quartier Minerals Ltd. of Quebec, whereby American Salars is acquiring a 100-per-cent interest in the Leduc East Lithium Project by issuing to the Vendor 50,000 common shares.

Additional projects are still being reviewed and will be subject to further disclosure once due diligence is completed and a deal is completed.

American Salars's management cautions that past results or discoveries on properties in proximity to American Salars may not necessarily be indicative of the presence of mineralization on the Company's properties.

Qualified Person

Mitchell Lavery, P.Geo. (QC), a Qualified Person as defined under NI 43-101 regulations, has reviewed the technical information that forms the basis for The Lac Simard portion of this news release, and has approved the disclosure herein.

American Salars global lithium portfolio consists of two advanced lithium resources in Argentina and our advancing USA lithium asset in Nevada.

The Company's existing portfolio of lithium deposits including two NI 43-101 Compliant Inferred Mineral Resource Estimates ("MRE") consisting of 457,000 tonnes Lithium Carbonate Equivalent ("LCE") at the Candela 2 Lithium Brine Project ("Candela") and a shared MRE at the Pocitos 1 Lithium Brine Project ("Pocitos") consisting of 760,000 tonnes LCE. The Pocitos MRE is shared with neighbouring Pocitos 2 which is not under contract or owned by USLI, however it is important to note that none of the drilling that makes up a partial basis for the MRE took place on the Pocitos 2 block. Both brine projects are located in Salta Province, Argentina.

About Pocitos 1 Lithium Deposit

WSP Australia completed an update of the NI 43-101 report initially written by Phillip Thomas QP in June 2023 and estimated on an inferred basis using a block model with 6% and 14% porosity for the clay and sand lithologies respectively and a Mineral Resource Estimate ("MRE") of 760,000 tonnes of Lithium Carbonate Equivalent ("LCE") on the combined Pocitos 1 (800 Ha) and neighbouring Pocitos 2 block (532 Ha). American Salars does not own the neighboring Pocitos 2 ground which comprises 40% of the gross land package that makes up the resource however it is notable that all drilling to date has been completed on American Salars' Pocitos 1 block.

The Pocitos 1 project is located approximately 10 kilometers from the township of Pocitos where there is gas, electricity, and accommodation. Pocitos 1 is approximately 800 hectares (1,977 acres) and is accessible by road. Collective exploration since 2017 totals over US$2.0 million in project development, including surface sampling, trenching, TEM and MT geophysics and the drilling of three wells that returned outstanding brine flow results. Locations for immediate follow up drilling have already been identified for upcoming exploration based on the most recent MT survey.

Lithium values of 169 ppm from drill hole PCT22-03 packer test assayed from laboratory analysis conducted by Alex Stewart were recorded during the project's December 2022 drill campaigns. A packer sampling system was used in HQ Diamond drill holes that were drilled to a depth of up to 409 metres. The flow of brine was observed to continue for more than five hours with all holes exhibiting exceptional brine flow rates. An NI 43-101 updated report completed by WSP Australia has been released on the Pocitos 1 project.

Ekosolve Ltd. a DLE technology company was able to produce 99.8% purity lithium carbonate and extraction was above 94% of the contained lithium in the brine i.e. 158.86ppm of lithium would have been recovered from 169ppm.

Figure 2. Drilling at Pocitos 1 Lithium Brine Project (Salta, Argentina)

Qualified Person

Phillip Thomas, BSc Geol, MBusM, FAusIMM, MAIG, MAIMVA, (CMV), a Qualified Person as defined under NI 43-101 regulations, has reviewed the technical information that forms the basis for portions of this news release regarding Argentina properties, and has approved the disclosure herein. Mr Thomas is a shareholder of American Salars lithium shares.

Shares For Debt Amendment

The Company previously announced it has settled with certain creditors of the Company (the " Creditors ") to settle a debt of $410,622.58 owing to the Creditors through the issuance to the Creditors of an aggregate of 2,933,018 common shares (each, a " Share ") at a price of $0.14 per Share (see press release dated February 20, 2025). The Company intends to reduce its debt settlement arrangements issuing 1,004,447 Shares at a price of $0.14 per share to settle outstanding indebtedness of $ 140,622.58

(the "Revised Debt Settlements").

One Creditor included in the Revised Debt Settlements intends to settle an aggregate of $23,625 of debt owing to a corporation owned by Daryn Gordon, the Company's Chief Financial Officer is considered a "related party transaction". The shares for debt transaction represents a complete settlement of the debt owing in respect to the CFO services provided to the Company by Mr. Gordon. The issuance of these shares will be completed in reliance on exemptions available under MI 61-101 from the formal valuation and minority approval requirements of MI 61-101. Specifically, the Revised Debt Settlements will be exempt from the formal valuation requirement in Section 5.4 of MI 61-101 in reliance on Section 5.5(b) of MI 61-101 as the Company, is not listed on a specified market within the meaning of MI 61-101. Additionally, the issuance is exempt from the minority approval requirement in Section 5.6 of MI 61-101 in reliance on Section 5.7(1)(a) of MI 61-101 insofar as neither the fair market value of the subject matter of, nor the fair market value of the consideration for, the shares exceeds 25% of the Company's market capitalization.

About American Salars Lithium Inc.

American Salars Lithium is an exploration company focused on acquiring and developing high-value battery metals projects to meet the growing global demand for a green energy transition. The Company has a diversified portfolio of Lithium Brine and Hardrock Lithium Projects throughout North and South America.

All Stakeholders are encouraged to follow the Company on its social media profiles on , , TikTok , and Instagram .

On Behalf of the Board of Directors,

" R. Nick Horsley "

R. Nick Horsley, CEO and Director

For further information, please contact:

American Salars Lithium Inc.

Phone: 604.740.7492

E-Mail: info@americansalars.com

Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

Disclaimer for Forward-Looking Information

Certain statements in this release are forward-looking statements, which reflect the expectations of management regarding American Salar's intention to continue to identify potential transactions and make certain corporate changes and applications. Forward looking statements consist of statements that are not purely historical, including any statements regarding beliefs, plans, expectations, or intentions regarding the future. Such statements are subject to risks and uncertainties that may cause actual results, performance, or developments to differ materially from those contained in the statements. No assurance can be given that any of the events anticipated by the forward-looking statements will occur or, if they do occur, what benefits American Salars will obtain from them. These forward-looking statements reflect managements' current views and are based on certain expectations, estimates and assumptions which may prove to be incorrect. A number of risks and uncertainties could cause actual results to differ materially from those expressed or implied by the forward-looking statements, including American Salars results of exploration or review of properties that American Salars does acquire. These forward-looking statements are made as of the date of this news release and American Salars assumes no obligation to update these forward-looking statements, or to update the reasons why actual results differed from those projected in the forward-looking statements, except in accordance with applicable securities laws.

Copyright (c) 2025 TheNewswire - All rights reserved.