- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

February 26, 2025

A junior explorer with projects in tier-one jurisdictions, Adavale Resources (ASX:ADD) focuses on gold and copper alongside valuable uranium and nickel licences. The transformative acquisition of assets in the prolific Lachlan Fold Belt in New South Wales puts the company on a growth trajectory, presenting a compelling investment opportunity for savvy investors.

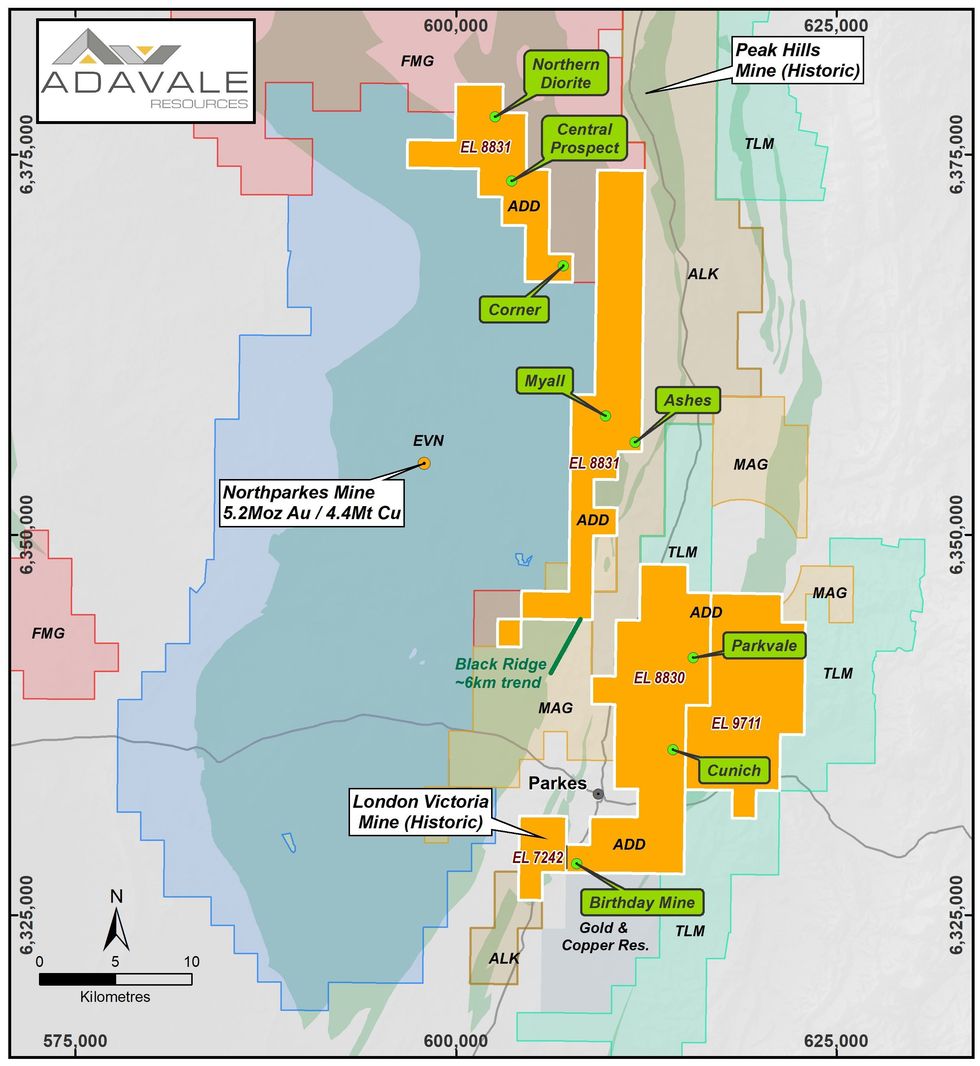

The company's portfolio spans 354.15 sq km and comprises four tenements: EL7242, EL8830, EL8831 and EL9711. The acquisition of these assets represents a transformational opportunity, strategically positioning Adavale Resources in one of the world’s richest gold and copper belts.

Adavale Resources recently acquired a 72.5 percent interest in the Parkes project, located in the highly prospective Lachlan Fold Belt of New South Wales. Adavale’s flagship project encompasses 354.15 sq km across four tenements in the Lachlan Fold Belt, a region that has produced over 80 million ounces (Moz) of gold and 13 million tonnes (Mt) of copper historically. The London-Victoria gold mine (EL7242) is a cornerstone of this portfolio, with historical production of 200,000 ounces of gold at an average grade of 2 grams per ton (g/t). London-Victoria (EL7242) also recently received a successful renewal until November 2030.

Company Highlights

- A junior explorer, with projects in tier-one jurisdictions; focused on gold and copper, Adavale also holds valuable uranium and nickel licences .

- The January 2025 acquisition of the Parkes project in the Lachlan Fold Belt, spanning 354.15 sq km, strategically positions Adavale to expand on the historic orogenic gold resource (124 koz gold) and make a major epithermal and/or porphyry gold and copper discovery in this tier-1 mining jurisdiction. The Lachlan Fold Belt assets are strategically located near world-class mining operations, including Cadia, Northparkes and Cowal.

- The company’s extensive uranium tenements span 4,959 sq km across the Flinders Ranges and Eyre Peninsula, regions known for hosting tier-one uranium deposits.

- Adavale’s nickel projects in Tanzania’s East African Nickel Belt are strategically located adjacent to the Kabanga nickel project — the world’s largest undeveloped high-grade nickel sulphide deposit.

- Drilling and resource-definition programs in 2025 will target key gold, copper and uranium assets, building on the company’s diversified growth strategy.

This Adavale Resources profile is part of a paid investor education campaign.*

Click here to connect with Adavale Resources (ASX:ADD) to receive an Investor Presentation

ADD:AU

The Conversation (0)

16 November 2025

Major Resource Growth Uncovered at London Vic

Adavale Resources (ADD:AU) has announced Major Resource Growth Uncovered at London VicDownload the PDF here. Keep Reading...

31 October 2025

Quarterly Activities and Cashflow Report

Adavale Resources (ADD:AU) has announced Quarterly Activities and Cashflow ReportDownload the PDF here. Keep Reading...

26 October 2025

Transformational Appointment to Drive Gold & Copper Growth

Adavale Resources (ADD:AU) has announced Transformational Appointment to Drive Gold & Copper GrowthDownload the PDF here. Keep Reading...

21 October 2025

100% Native Title Consent for Marree Project Achieved

Adavale Resources (ADD:AU) has announced 100% Native Title Consent for Marree Project AchievedDownload the PDF here. Keep Reading...

24 September 2025

Wide Gold Intercepts Confirm Open Mineralisation

Adavale Resources (ADD:AU) has announced Wide Gold Intercepts Confirm Open MineralisationDownload the PDF here. Keep Reading...

27m

Boundiali Resource Grows to 3Moz - Indicated Up 49%

Aurum Resources (AUE:AU) has announced Boundiali Resource Grows to 3Moz - Indicated Up 49%Download the PDF here. Keep Reading...

1h

High-grade Assays incl 4m @ 26.7g/t Au in Sandstone Drilling

Brightstar Resources (BTR:AU) has announced High-grade assays incl 4m @ 26.7g/t Au in Sandstone drillingDownload the PDF here. Keep Reading...

1h

High-Grade Gold in Initial White Dam Drilling Results

Pacgold (PGO:AU) has announced High-Grade Gold in Initial White Dam Drilling ResultsDownload the PDF here. Keep Reading...

20 February

Top 5 Canadian Mining Stocks This Week: Belo Sun is Radiant with 109 Percent Gain

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.On Tuesday (February 17) Canadian Prime Minister Mark Carney announced the creation of... Keep Reading...

20 February

Gold and Silver Stocks Dominate TSX Venture 50 List

This year's TSX Venture 50 list showcases a major shift in sentiment toward the mining sector. The TSX Venture 50 ranks the top 50 companies on the TSX Venture Exchange based on annual performance using three criteria: one year share price appreciation, market cap growth and Canadian... Keep Reading...

19 February

Ole Hansen: Next Gold Target is US$6,000, What About Silver?

Ole Hansen, head of commodity strategy at Saxo Bank, believes US$6,000 per ounce is in the cards for gold in the next 12 months; however, silver may not enjoy the same price strength. "If gold moves toward US$6,000, I would believe that ... silver at some point will struggle to keep up, and... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00