July 04, 2023

Oceana Lithium Limited (ASX:OCN) (Oceana or the Company) is pleased to announce that it has entered an exclusive six-month option agreement (Option) to acquire 100% of 207 mineral claims covering an area of 104.4km2 in the James Bay lithium province in central Québec, Canada (see Figures 1 and 2). To fund exploration on the project, the Company has received firm commitments from new and existing sophisticated investors in an oversubscribed placement to raise approximately $4.1 million through the issue of 12.9 million new shares at $0.32 per share.

Highlights

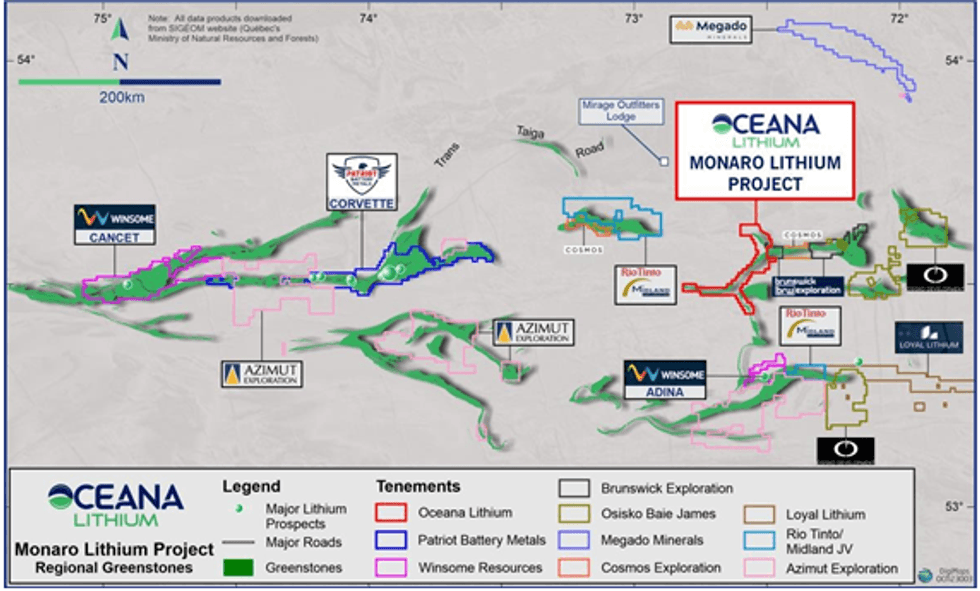

- Exclusive six-month option secured to purchase 100% of the Monaro Lithium Project covering 104km2 of highly prospective Archean rocks in James Bay area, Québec, Canada. Project area includes 40km of contiguous greenstones known to host lithium-caesium-tantalum (LCT) type mineralisation.

- Located in one of the world’s most prolific lithium provinces, hosting major deposits including Allkem’s James Bay Deposit, Nemaska’s Whabouchi Deposit, and Critical Elements’ Rose Deposit. The area has also recently attracted major Rio Tinto, with a significant commitment in exploration and related expenditures to the area*.

- Monaro shares the same geological setting as Winsome Resources’ recent Adina lithium discovery located 30km to the south-east.

- Québec Government database Sigéom reports an identified pegmatite as well as the government mapped Tilly pegmatite suite on the Monaro Project area. Over 30 large linear targets with surface signs of pale outcrop, some up to 1.25km in length, have been identified from high resolution satellite imagery, some related to magnetic highs and lineaments. An additional 30 remote sensing targets within the project area have also been selected for priority investigation.

- Firm commitments received from new institutions and existing significant shareholders in an oversubscribed placement to raise approximately $4.1m at $0.32 per share will underpin exploration at Monaro; concurrent exploration is to continue at the Solonópole project in Brazil where a fully funded drilling campaign is underway, with first batch of assays due in 6- 8 weeks, and at the Napperby Project in Australia.

Oceana Chairman, Gino Vitale, commented:

“The acquisition of the highly prospective Monaro Lithium Project is a clear opportunity to create additional value for Oceana investors and complements our existing portfolio in Brazil and Australia. Recent outstanding exploration results announced by Patriot Battery Metals1, Winsome Resources2 and Allkem3, in similar geological settings in James Bay demonstrate the potential for additional world class lithium discoveries in the district.

The area has also attracted the attention of Rio Tinto, which recently entered an option agreement under which it may acquire a 70% interest in a number of lithium exploration properties, including the Galinée property that is proximal to Monaro, by spending up to C$65m4. The identification of potential pegmatites within anomalous bedrock lithium zones at Monaro is thus very positive and provides a basis for serious investigation.

Oceana has worked with the vendors to bring together, for the first time in one consolidated package, over 40km of contiguous Archean greenstones with geological features considered to be favourable for the hosting of LCT-type lithium mineralisation. Importantly, the package includes known pegmatites and features extensive greenstone- granite contact zones where some of the major discoveries in the area have been found and, subject to access clearance from local authorities, we look forward to commencing the summer exploration campaign.

Proceeds from the oversubscribed placement, which was well supported by new institutions and existing significant shareholders, will allow Oceana to fund the exploration program whilst continuing with exploration on the Solonópole lithium project in Brazil, where we recently commenced our maiden drilling program with significant pegmatite intercepts identified. The Company is now uniquely placed, having three very attractive lithium projects, two of which are strategically located to potentially feed the growing North American battery metal and EV markets.”

James Bay has emerged as a prolific lithium province, hosting major deposits including Allkem’s James Bay Deposit (MRE 40Mt at 1.4% Li2O)5, Nemaska’s Whabouchi Deposit (MRE 56Mt at 1.4% Li2O)6, and Critical Elements’ Rose Deposit (MRE 34Mt at 0.9% Li2O)7 . The area has also recently attracted major Rio Tinto, with a C$65m commitment in exploration and related expenditures to the area with local partner Midland Exploration7.

Monaro Lithium Project Overview

The Monaro Lithium project area is located in the western portion of the Duhesme Lake metavolcano- sedimentary greenstone belt that can be traced about 40km along strike and 4-5km across (see Figures 1 and 3).

The sequence is sandwiched between granitic intrusions (and/or granitic gneisses) and the contacts are traceable on a magnetic geophysical map. Monaro is located some 30km north of Winsome Resources’ Adina lithium project and approximately 100km east of Patriot Battery Metals’ Corvette lithium project.

Click here for the full ASX Release

This article includes content from Oceana Lithium, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

OCN:AU

The Conversation (0)

12 March 2024

Oceana Lithium

Large-scale, highly prospective, pre-discovery projects in Brazil and Australia

Large-scale, highly prospective, pre-discovery projects in Brazil and Australia Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00