May 04, 2023

GALENA MINING LTD. (“Galena” or the “Company”) (ASX: G1A) advises that the Abra mine has resumed full production following the delays experienced in April after the significant rainfall event in late March. The mine has been re-stocked with essential consumables and mining and processing plans have been implemented for May and the remainder of the June quarter.

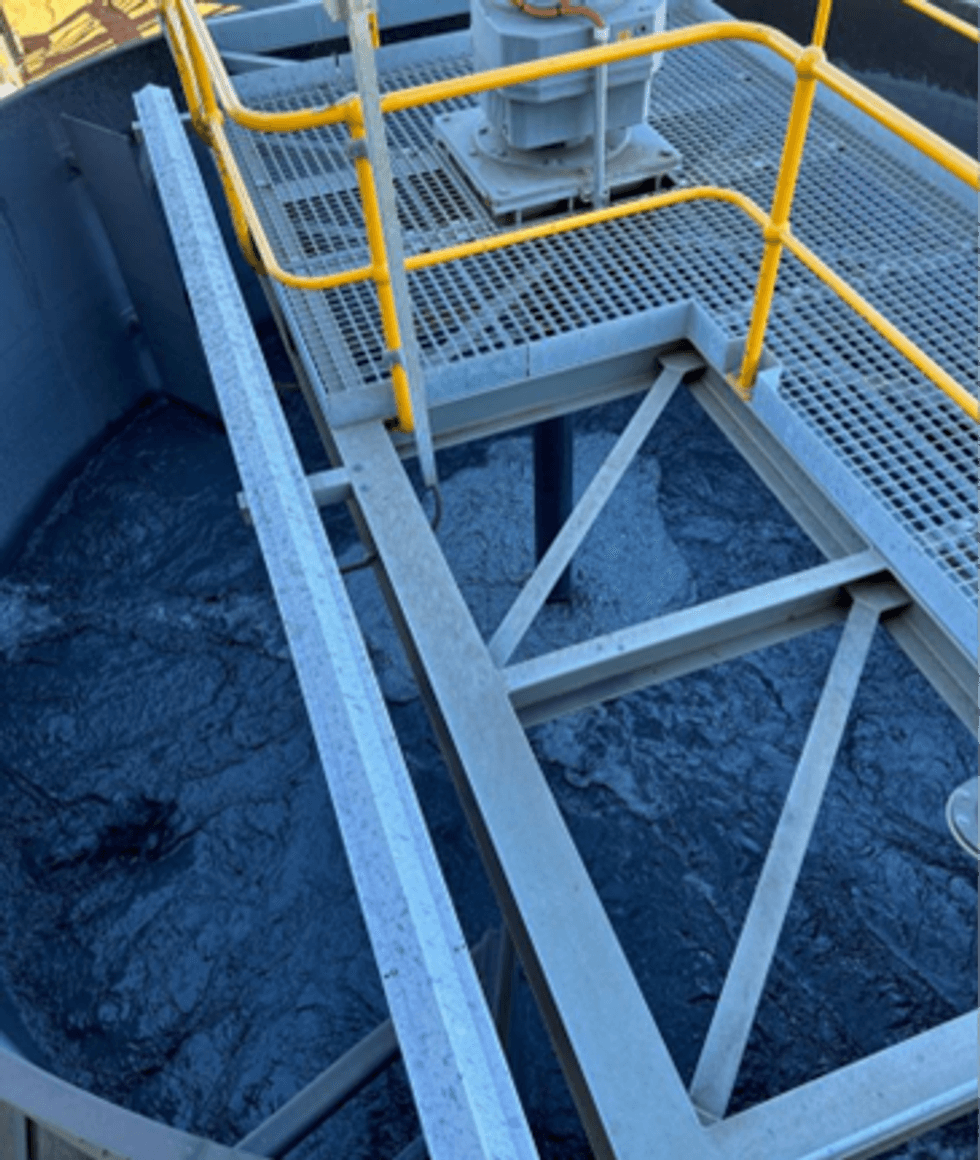

A significant rainfall event during the last week of March (+100mm) in the Gascoyne River catchment area isolated the mine by road during April. The mine reduced its activities during April and on Wednesday 3 May concentrate production recommenced, with full-scale mining activities also resumed to provide feed to the plant. During this week, two stopes were fired and loading and transport of this ore to the surface commenced to supplement the 30,000t of ore already stockpiled on the ROM pad. Plant throughput is at designed rate. The Company will provide further updates as the quarter progresses. Next shipment date will be confirmed over the next 7 days.

Managing Director, Tony James commented, “Unfortunately activities during April were limited due to the loss of the roads to site following the rain in March. This interrupted the continued ramp-up of Abra mining and processing operations. The mine has now resumed its activities and is working to a plan that pushes towards our steady state targets as quickly, as possible. All the necessary resources are in place and the working plans reflect clearly identified work programs. Everyone’s focus is now on achieving those production targets.”

The Board of Directors of Galena authorised this announcement for release to the market.

Click here for the full ASX Release

This article includes content from Galena Mining, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

G1A:AU

The Conversation (0)

12 September 2022

Galena Mining

Galena Mining CEO Tony James said, “People have been just sitting and watching how we would perform this year, a perceived difficult construction period. But we've done a great job."

Galena Mining CEO Tony James said, “People have been just sitting and watching how we would perform this year, a perceived difficult construction period. But we've done a great job." Keep Reading...

14h

When Will Silver Stocks Catch Up to the Silver Price?

The silver price remains historically high despite a recent pullback, and many silver stocks haven't kept pace. Silver's strong performance over the past year is the result of a perfect storm of factors, including an entrenched supply deficit, growing industrial demand, a weakening US dollar and... Keep Reading...

20h

BP Silver Initial Drilling Intersects Significant Mineralization Within Cosuño Lithocap

Hole CO-0001 Returns 29 Meters at 56 g/t Silver & 0.28 g/t Gold (80 g/t AgEq)

BP Silver Corp. (TSXV: BPAG) ("BP Silver" or the "Company") announces assay results ("Assays") from the first two drill holes of its eleven-hole Phase I drill program (the "Program") at the Cosuño Silver Project ("Cosuño") in Bolivia. The Company expects to release assays from the remaining nine... Keep Reading...

01 February

Andy Schectman: Gold, Silver Being Repriced, Big Money Standing for Delivery

Andy Schectman, president of Miles Franklin, weighs in on the factors moving gold and silver, emphasizing that their long-term drivers remain in place. "Nothing goes straight up without taking a breather, but you can still coexist. That can coexist with long-term bullishness, and I am hugely... Keep Reading...

29 January

Willem Middelkoop: Silver Short Squeeze Not Over, Get Ready for Metal Wars

Willem Middelkoop, founder of Commodity Discovery Fund, breaks down his outlook for silver, saying that at this point US$200 or even US$300 per ounce is in the cards for the white metal. "We're in the first innings I think of this short squeeze, so it's not over yet," he said.Don't forget to... Keep Reading...

29 January

What Was the Highest Price for Silver?

Like its sister metal gold, silver has been attracting renewed attention as a safe-haven asset. Although silver continues to exhibit its hallmark volatility, a silver bull market is well underway. Experts are optimistic about the future, and as the silver price's momentum continues in 2026,... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00