May 08, 2024

Manuka Resources Limited (“Manuka” or the “Company”) is pleased to announce it has received firm commitments from institutional and other exempt investors for up to $8 million worth of new Manuka shares (each, a New Share) via a Share Placement (“Placement”) to commence bringing the Mt Boppy Gold Mine into production within 2024.

Highlights

- Firm commitments received for $8 million to be applied towards bringing the Mt Boppy Gold Mine into production.

- Mt Boppy has an initial 5-year Mine Plan generating a forecast EBITDA of up to approximately $19 million per annum1.

- The $8 million raised will allow for the establishment of an on-site processing facility to recover gold from oxidised ore. The balance of capital required for a flotation circuit for processing of sulphide ore is to be funded from project cash flows.

- Manuka tenements in the region, including the Mt Boppy mining licenses, hold significant exploration upside. Once in production at Mt Boppy, the Company intends to aggressively explore with the aim of increasing annual gold production and extending the life of mine.

- Cash flows from Mt Boppy will support the potential restart of the Wonawinta Silver Mine, located 150km south of Mt Boppy, as a dedicated silver operation in 2025.

- The Company is targeting the release of an updated Reserve Statement for the Wonawinta Silver Mine in the current June quarter.

The Company is pursuing a staged growth strategy that is initially focused on gold and silver production and free cash flow generation from its assets in the Cobar Basin.

The Company has recently completed a sonic drilling program to firm up confidence in the Mt Boppy Resource2 and developed an initial 5-year Mine Plan that is forecast to generate an average $19 million EBITDA per annum3. The capital raising will fund the establishment and ramp up of a fit-for-purpose gold processing facility on-site at the My Boppy Gold Mine with first doré production scheduled for Q4 2024. Previously, ore mined at Mt Boppy had been transported, to and processed at, the Wonawinta Silver Mine located 150km south of Mt Boppy.

Dennis Karp, Manuka’s Executive Chairman, commented:

“We are delighted to announce this significant capital raising for the Company and look forward to launching immediately into the execution of our strategy to establish on-site processing capacity at Mt Boppy and potentially commencing gold doré production later this year.

Bringing a new processing plant at Mt Boppy online represents Stage 1 of the Company’s staged self-sustaining growth plan, that is focused initially on production and free cash generation from our Cobar Basin gold and silver projects, and subsequently development of our world-class VTM Sands Project in New Zealand.

With firm commitments toward this capital raising received and continued strength in the gold and silver markets, it is an exciting time to be a Manuka shareholder.”

Following the ramp-up of the Mt Boppy Gold Mine, the Company will look to recommence silver production at Wonawinta in 2025 with the support of cash flow generated from Mt Boppy. Previously Australia’s largest primary silver producer, the Wonawinta Silver Mine comprises an existing mine and process plant and a Resource of 38.3Mt at 41.3g/t Ag for 51Moz4 including a higher-grade component of 4.5Mt at 97 g/t Ag for 14Moz.

Wonawinta, which as recently as December 2023 was used to process ore from Mt Boppy, is currently on care and maintenance. The Company is targeting the release of an updated Reserve Statement for the Wonawinta Silver Mine in the current quarter.

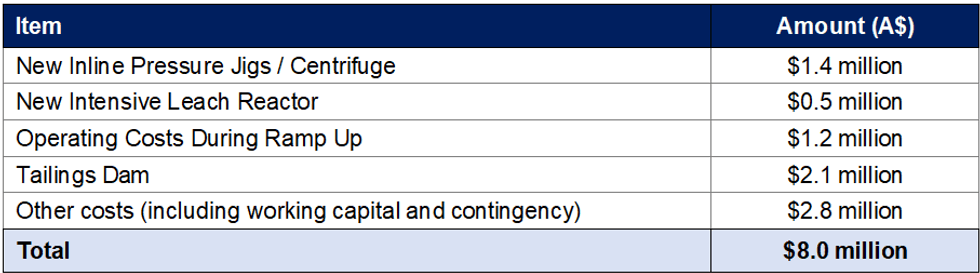

Use of Placement Proceeds

The proceeds of the Placement are proposed to be used as follows:

Placement Details

The Placement comprises the issue of approximately 133.3 million New Shares which will rank equally with the Company’s existing ordinary shares. The Placement price of $0.06 per share represents:

- a 13.0% discount to the closing price of the Company’s shares on 6 May 2024; and

- a 18.1% discount to the 5-day volume weighted average price (“VWAP”);

Each New Share issued under the Placement will come with one free accompanying option exercisable into an ordinary share in the Company at a strike price of $0.06 per share and an expiry date of 15 May 2026 (each, an “Option”). The Options are being issued for nil additional cash consideration. It is the intention for the Options to be quoted on ASX, subject to the receipt of shareholder approval, the satisfaction of all applicable ASX requirements and following the preparation and issuance of a transaction-specific prospectus.

Click here for the full ASX Release

This article includes content from Manuka Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

MKR:AU

The Conversation (0)

26 March 2025

Manuka Resources

Near-term production from both its silver and gold projects located in the Cobar Basin, Central West, New South Wales

Near-term production from both its silver and gold projects located in the Cobar Basin, Central West, New South Wales Keep Reading...

05 August 2025

Results of Fully Underwritten Entitlement Offer

Manuka Resources (MKR:AU) has announced Results of Fully Underwritten Entitlement OfferDownload the PDF here. Keep Reading...

31 July 2025

June 2025 Quarter Activities and Cashflow Reports

Manuka Resources (MKR:AU) has announced June 2025 Quarter Activities and Cashflow ReportsDownload the PDF here. Keep Reading...

29 July 2025

Maiden Mt Boppy Open Pit Ore Reserve

Manuka Resources (MKR:AU) has announced Maiden Mt Boppy Open Pit Ore ReserveDownload the PDF here. Keep Reading...

10 July 2025

Further Information to 26 June Announcement

Manuka Resources (MKR:AU) has announced Further Information to 26 June AnnouncementDownload the PDF here. Keep Reading...

08 July 2025

Reinstatement to Quotation

Manuka Resources (MKR:AU) has announced Reinstatement to QuotationDownload the PDF here. Keep Reading...

10h

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

10h

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

13h

Venezuela Gold Set for US Market in Brokered Deal

A new US-Venezuela gold deal could soon channel hundreds of kilograms of bullion from the South American nation into American refineries.Venezuela’s state-owned mining company, Minerven, has agreed to sell between 650 and 1,000 kilograms of gold dore bars to commodities trading house Trafigura... Keep Reading...

05 March

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

05 March

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

05 March

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00