May 31, 2022

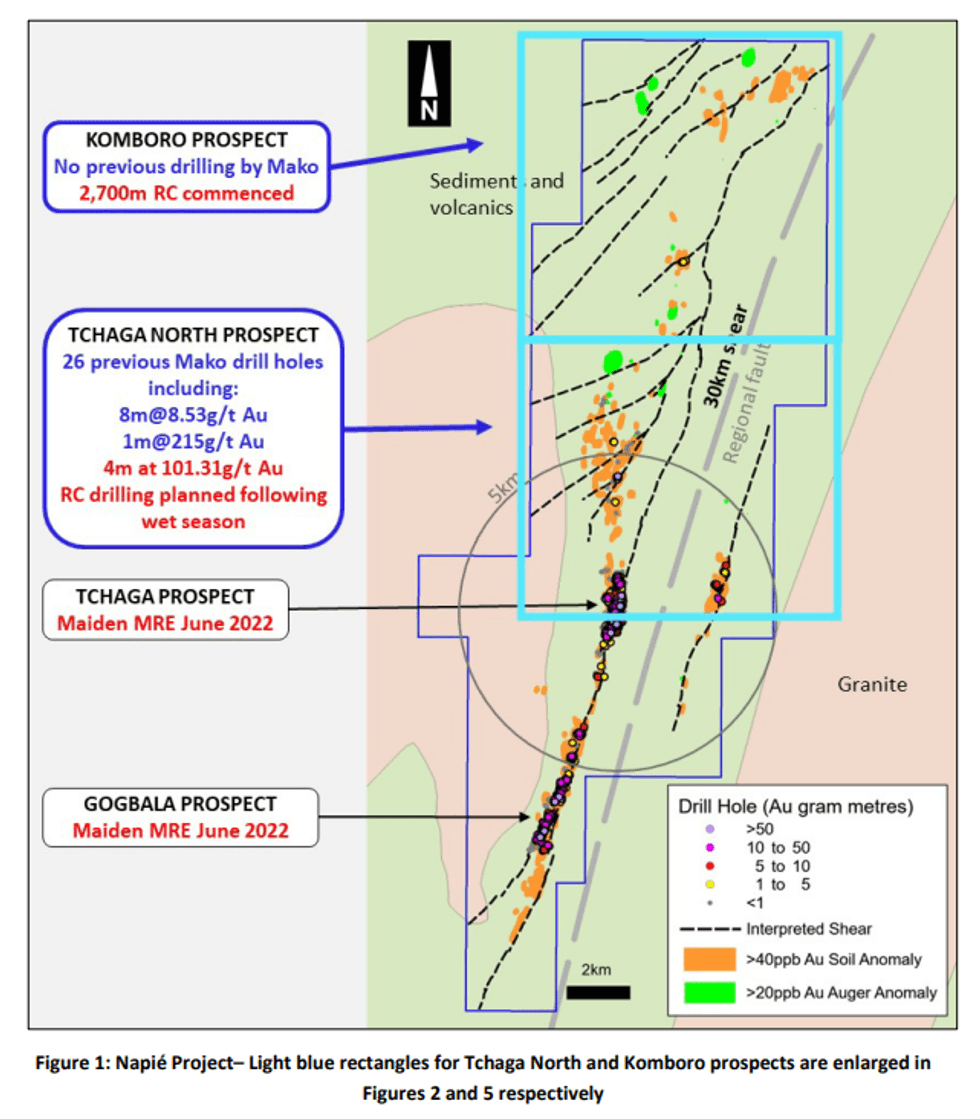

Mako Gold Limited (“Mako” or “the Company”; ASX:MKG) advises that it has received all assay results from the recent shallow aircore (AC) drilling program from the Tchaga North and Komboro prospects, within the Company’s flagship Napié Project in Côte d’Ivoire1 . Tchaga North and Komboro are located on a +23km soil anomaly and coincident 30km-long Napié Fault (Figure 1). The average depth of the holes is 28m with all holes ending within the oxide zone. Samples were composited to 4m intervals.

HIGHLIGHTS

- Aircore (AC) drill results received from Tchaga North Prospect with assays up to 4m at 101g/t Au

- Tchaga North and Komboro are high priority regional prospects located on the +23km soil anomaly and coincident 30km-long Napié Fault at Mako’s flagship Napié Gold Project in Côte d’Ivoire

- RC drilling planned at Tchaga North on 2km-long high-priority target following wet season

- 2,700m drill program commenced at Komboro Prospect at Napié Project

- High-priority targets identified from AC drilling, geological mapping and rock chip sampling and 9km-long current and historic artisanal mining sites

- No previous RC drilling on zone of artisanal mining

- Strategy for drilling Komboro and Tchaga North is to identify new areas for resource drilling following maiden Mineral Resource Estimate (MRE) on Tchaga and Gogbala prospects to underpin broader strategy of identifying a multi-million-ounce deposit on the Napié Project

- Maiden MRE for Tchaga and Gogbala on track for delivery by mid-June 2022

Mako’s Managing Director, Peter Ledwidge commented:

“We are delighted with the results of aircore drilling at the Tchaga North Prospect with assays up to 4m at 101g/t Au. The results received from the aircore drilling in conjunction with our mapping and rock chip sampling has identified a 2km-long high-priority mineralised area which we will RC drill test following the current wet season.

Drilling has commenced at the highly prospective Komboro Prospect within the growing expanse of our Napié Project. We are very excited by the compelling targets we are drilling, which are generated from geological mapping, rock chip sampling and aircore drilling.

Recent geological mapping has identified new and historic artisanal sites which intermittently align over a 9km strike length, largely the focus of our current drilling program at Komboro, underpinning our belief in the district scale potential at Napié”.

Intervals above 0.25g/t Au cut-off are reported in Appendix 1.

A table and map of the drill hole locations are shown in Appendix 2.

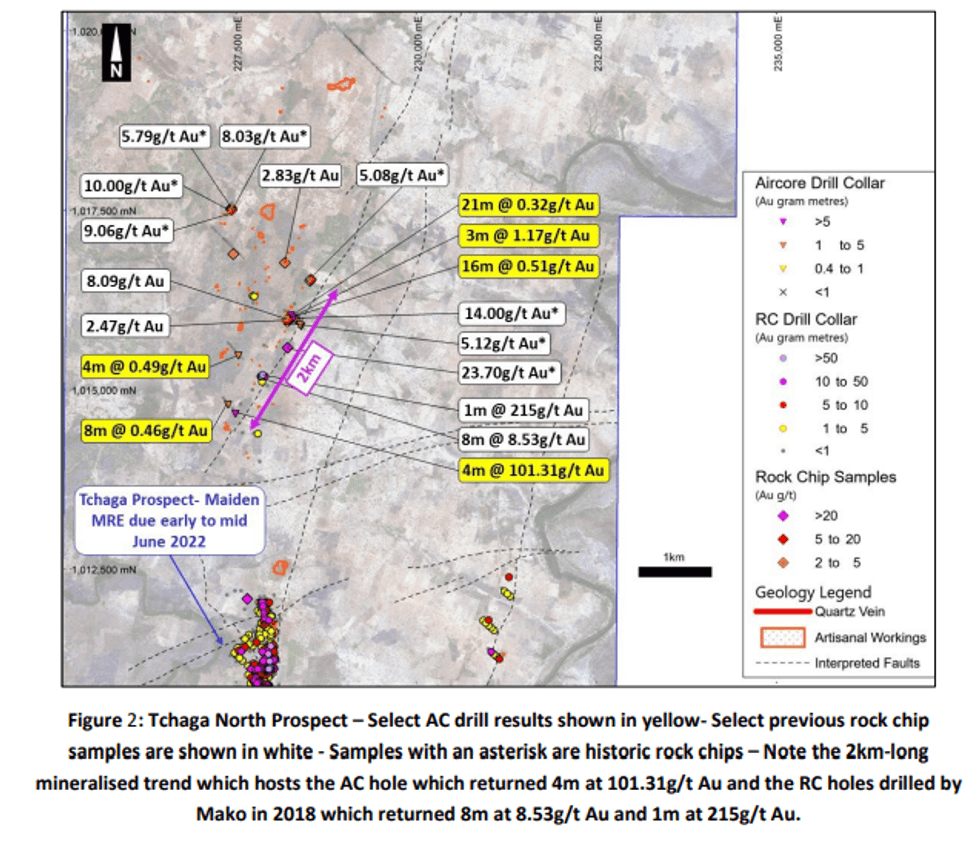

Results have been received from 151 shallow AC holes drilled on six targets at Tchaga North from a costeffective scout drilling program1 .

A 2km-long gold mineralised zone (purple arrow on Figure 2) has been identified where AC drilling returned up to 4m at 101.31g/t Au and previous RC drilling by the Company in 2018 returned 8m at 8.53g/t Au and 1m at 215g/t Au with visible gold2 (Figures 3 and 4). This zone lies 2km north of the Tchaga Prospect on our Napié Project which continues to deliver district scale potential.

In addition, historic rock chip sampling in the 2km mineralised zone returned results which include 23.70g/t Au, 14.00g/t Au, 8.09g/t Au and 5.12g/t Au3 .

Click here for the full ASX Release

This article includes content from Mako Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

MKG:AU

The Conversation (0)

24 August 2021

Mako Gold

Exploring High-Grade Gold Deposits in Côte d'Ivoire

Exploring High-Grade Gold Deposits in Côte d'Ivoire Keep Reading...

14h

Investor Presentation

Aurum Resources (AUE:AU) has announced Investor PresentationDownload the PDF here. Keep Reading...

15h

Dr. Adam Trexler: Physical Gold Market Broken, Crisis Unfolding Now

Dr. Adam Trexler, founder and president of Valaurum, shares his thoughts on gold, identifying a key issue he sees developing in the physical market. "There's a crisis in the physical gold market," he said, explaining that sector participants need to figure out how to serve investors who want to... Keep Reading...

15h

Trevor Hall: Bull Markets Don’t Always Mean Big Returns

Clear Commodity Network CEO and Mining Stock Daily host Trevor Hall opened his talk at the Vancouver Resource Investment Conference (VRIC) with a strong message: It is still possible to go broke in a bull market.“I want to start with the simple but uncomfortable truth: most investors don't lose... Keep Reading...

16h

How Near-term Production is Changing the Junior Gold Exploration Model

Junior gold companies have traditionally been defined by exploration: identifying prospective ground, drilling to delineate a resource and, ideally, monetising that discovery through a sale or joint venture with a larger producer. While this model has delivered success in the past, changing... Keep Reading...

16h

Gold Exploration in Guinea: An Emerging Opportunity in West Africa

While much of West Africa’s gold exploration spotlight has historically fallen on countries like Ghana and Mali, Guinea is increasingly emerging as a quiet outlier — a country with proven gold endowment, expansive underexplored terrain and a growing number of active exploration programs. Despite... Keep Reading...

09 February

Armory Mining To Conduct a Series of Airborne Geophysics Surveys at the Ammo Gold-Antimony Project

(TheNewswire) Vancouver, B.C. TheNewswire - February 9, 2026 Armory Mining Corp. (CSE: ARMY) (OTC: RMRYF) (FRA: 2JS) (the "Company" or "Armory") a resource exploration company focused on the discovery and development of minerals critical to the energy, security and defense sectors, is pleased to... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00