- WORLD EDITIONAustraliaNorth AmericaWorld

November 27, 2023

Pivotal Metals Limited (ASX:PVT) (‘Pivotal’ or the ‘Company’) is pleased to advise it has received oversubscriptions and firm commitments for a $2.5 million placement (Placement) at $0.016 per share, being a 5.6% discount to the 5 day VWAP. The offer was oversubscribed and scale backs were applied.

Highlights

- Firm commitments for $2.5m Placement received, endorsing the value proposition in Pivotal’s 100% owned Quebec Cu-Ni-PGM projects.

- Placement combined with existing cash to:

- Redeem $1m of convertible notes, which were subject to either discounted conversion, or repayment by 14 March 2024.

- Execute on 2024 exploration work program which includes 8,000 diamond drilling, geophysics, metallurgical testwork and a resource update.

- Fully fund ‘non flow-through’ qualifying expenditure into 2025.

- Introduction of new funds and a strategic high net worth investor.

- All Directors participated in the Placement for a total scaled back allocation of $235k (subject to shareholder approval).

The Company was delighted to work with Morgans Financial Ltd as Lead Manager for the Placement, welcoming new interest in the Company’s assets and endeavours from its extensive client base.

Managing Director, Mr Fairhall said:

“This successful placement sets Pivotal up for an exciting 2024. Early repayment of the convertible note prevents the overhang of dilutive equity conversions, and the decision to replace that note with strong primary equity demand was a purposeful one. Allocation of the Placement was focussed on high-net-worth investors and long-term holders of the Company’s shares, to strengthen the Company’s position and register.

With a very strong balance sheet shareholders now enjoy a cleared path for extensive news flow through 2024, as Horden Lake is drilled and advanced for the first time in over a decade.

We remain very grateful to our loyal shareholders, particularly those that participated in the offer and warmly welcome our new shareholders.”

Catalysts and Work Program

The Company has commenced an extensive work program on its Canadian Cu-Ni-PGM projects, with the majority of focus on its 100% owned Horden Lake project, which already hosts a 28mt at 1.5% CuEq inferred and indicated resource1.

The Horden Lake exploration program is of particular importance, as it represents:

- The first since Pivotal acquired Horden Lake in late-2022 from private ownership,

- The first on the project in over 10 years; and

- The first within an ASX listed company.

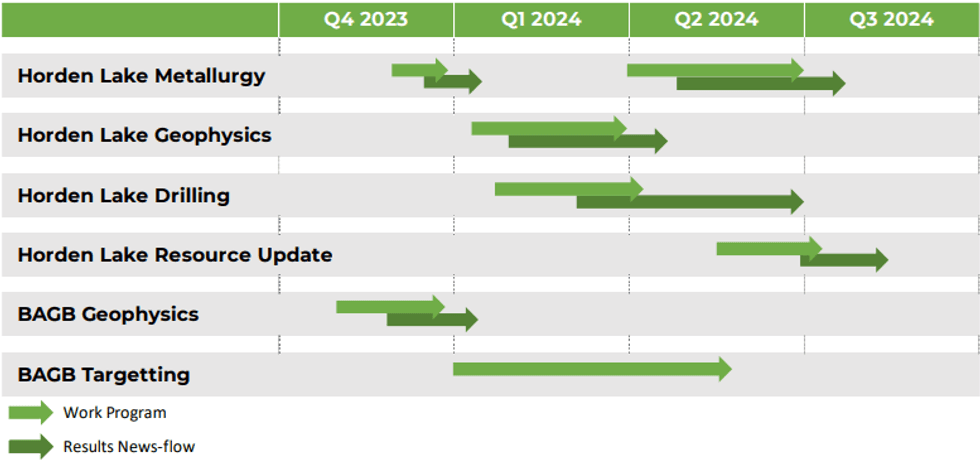

Key catalysts over the next 2-3 quarters are as follows:

- 8,000m diamond drilling on Horden Lake, targeting grade and tonnage upside.

- Downhole EM survey at Horden Lake, targeting massive sulphide extensions below open mineralisation.

- Metallurgical testwork to optimise a flowsheet for maximum net smelter return from contained metals.

- Horden Lake resource update.

- Geophysics results from BAGB surveys recently completed, and ongoing interpretation and targeting.

Refer to the Company’s ASX announcement dated 3 October 2023 “Exploration and Development Work Program for Quebec Projects” for additional information.

Placement Details

As of the date of this release, the Company has received firm commitments to a raise $2.5m through the issuance of 156,250,000 new shares at $0.016/share; representing a 5.6% discount to the 5 day VWAP and 20% discount to the last traded share price on 23 November 2023.

The shares will be issued in two tranches. Tranche 1 will comprise the issuance of 132,187,500 shares which fall within the existing capacity under ASX Listing Rules 7.1 and 7.1A, approved at the Company’s AGM on 21 November 2023. Settlement of Tranche 1 is expected to take place on or around 4 December 2023, with allotment and quotation of new shares expected to occur on 5 December 2023.

Click here for the full ASX Release

This article includes content from Pivotal Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

PVT:AU

The Conversation (0)

18 January 2024

Pivotal Metals

Investing in metals for a sustainable energy transition.

Investing in metals for a sustainable energy transition. Keep Reading...

5h

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to begin... Keep Reading...

13h

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI,OTC:FNICF) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to... Keep Reading...

23 February

Ni-Co Energy Inc. Files Preliminary Prospectus for Proposed Initial Public Offering

Ni-Co Energy Inc. (“Ni-Co Energy” or the “Company”) is pleased to announce that it has filed a preliminary prospectus (the “Preliminary Prospectus”) with the securities regulatory authorities in the provinces of Québec, Ontario, Alberta, and British Columbia in connection with its proposed... Keep Reading...

12 February

Bahia Metals Corp. Completes Initial Public Offering of $5,750,000, with Full Exercise of Over-Allotment Option

Bahia Metals Corp. (CSE: BMT) ("Bahia" or the "Company") is pleased to announce that it has successfully completed its initial public offering (the "IPO") of 11,500,000 units of the Company (the "Units") at a price of $0.50 per Unit, inclusive of the full exercise of the 15% over-allotment... Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00