1911 Gold Corporation (" 1911 Gold " or the " Company ") (TSXV: AUMB) (OTCBB: AUMBF) (FRA: 2KY) is pleased to announce the assay results from eight (8) drill holes for 1,371.0 metres ("m") from the ongoing surface drill program at the recently discovered San Antonio West target at the True North Project. The True North project, including a permitted mill, camp, and tailings facility, is centrally located within the Company's 100%-owned Rice Lake Gold property in southeast Manitoba, Canada .

Highlights:

- Drilling has continued to expand the near-surface quartz vein hosted gold ("Au") mineralization on the new San Antonio West ("SAM West") target

San Antonio West Target

- Drill results confirmed the western extensions of gold mineralization within the prolific San Antonio mafic unit of 260 m down dip and 500 m along strike, including:

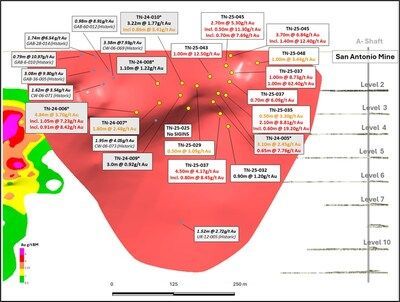

- TN-25-037: Intersected 8.73 grams per tonne (g/t) Au over 1.00 m at a downhole depth of 60.90 m , 62.40 g/t Au over 1.00 m at a downhole depth of 65.10 m , 6.09 g/t Au over 0.70 m at a down hole depth of 86.80 m and 4.17 g/t Au over 4.50 m at a downhole depth of 128.80 m , including 8.45 g/t Au over 0.80 m

- TN-25-035: Intersected 8.81 g/t Au over 2.10 m at a downhole depth of 69.00 m , including 19.20 g/t Au over 0.60 m

- TN-25-045: Intersected 6.84 g/t Au over 3.70 m at a down-hole depth of 7.50 m including 12.40 g/t Au over 1.40 m , and 5.30 g/t Au over 2.70 m at down hole depth of 29.50 m including 11.30 g/t Au over 0.50 m , and 7.69 g/t Au over 0.70 m

- TN-25-043: Intersected 12.50 g/t Au over 1.00 m at a downhole depth of 66.20 m

Shaun Heinrichs , CEO and President, stated, "These follow-up holes at the San Antonio West target show evidence of several shear structures and also higher grades as we extend drilling to depth. The results continue to show another parallel ore shoot to the San Antonio Mine vein system, similar to what we are seeing on the San Antonio Southeast target. The target potentially extends over a kilometre or more to depth. Further, the San Antonio West mineralization closes the gap between the San Antonio mine and the Cartwright resource to the west, opening that area up for potential underground mining in the future. We are currently completing a 400 metre deep hole on the SAM West target, and assays for another 7 drill holes for 1,940 metres are pending from the laboratory. We are also developing underground drill plans for this target, which will be prioritized based on our internal mine plan study."

1911 Gold has now completed thirty-nine (39) surface drill holes, for a total of 8,487.4 m on the current drill program which commenced in October 2024 and remains ongoing with new targets being generated and drill tested within prospective host rocks, and mineralized structural settings, including significant historical results. The program is continuing and is planned to include up to 30,000 m of drilling by the end of 2025.

S an Antonio West Target: Discussion of Results

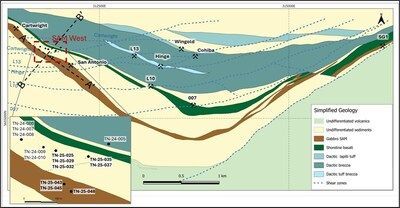

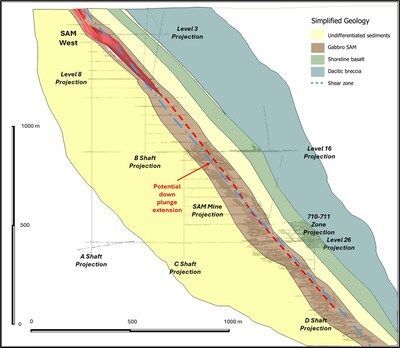

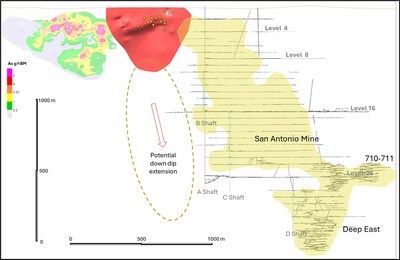

Drilling completed to date has confirmed the extensions of gold mineralization within the SAM gabbro to over 600 m west of the historically mined San Antonio zone, covering an area 500 m long and over 260 m to depth, dipping 50º to the northeast. Thirteen (13) drill holes for a total of 2,099.0 m have been completed to date on the SAM West target area.

The latest drill holes extended the footprint of mineralization 100 m to the east towards the main San Antonio zone and 100 m down dip from the results announced on February 4, 2025 (see press release entitled "1911 Gold Intersects 8.42 g/t Gold over 0.91 m and 7.23 g/t Gold over 1.05 m in Drilling at True North") .

Drill holes TN-25-035 ( 2.10 m @ 8.81 g/t Au, including 0.60 m @ 19.20 g/t Au), TN-25-037 ( 1.00 m @ 62.40 g/t Au), TN-25-045 ( 3.70 m @ 6.84 g/t Au) and TN-25-048 ( 1.00 m @ 3.44 g/t Au) tested an area over 100 m to the southeast and 100 m down dip of previously released drill hole TN-24-005 ( 3.00 m @ 2.45 g/t Au).

Drill hole TN-25-035, designed as a 200 m step-out to the east of drill hole TN-25-006 ( 4.84 m @ 3.70 g/t Au, including 1.05 m @ 7.23 g/t Au and 0.91 m @ 8.42 g/t Au), intersected 2.10 m @ 8.81 g/t Au including 0.60 m @ 19.20 g/t Au. Drilling successfully extended the gold mineralization to the east as interpreted and returned similar high-grade gold results.

Drill holes TN-25-029 and TN-25-043 ( 1.00 m @ 12.50 g/t Au) tested the up-dip extensions of the zone above and to the east of previously released holes TN-24-007 and TN-24-006 ( 4.84 m @ 3.70 g/t Au, including 1.05 m @ 7.23 g/t Au and 0.91 m @ 8.42 g/t Au).

Drilling has confirmed the existence of up to three (3) vein zones hosted within the target gabbro unit, supporting the potential to mine multiple zones on levels as conducted historically. Drill holes TN-25-035, TN-25-037, TN-25-043 and TN-25-045 intersected 3 distinct vein zones hosting high-grade gold mineralization over a vertical distance of over 200 m . TN-25-035 intersected 2.10 m @ 8.81 g/t Au including 0.60 m @ 19.20 g/t Au, TN-25-037 intersected 1.00 m @ 8.73 g/t Au and 1.00 m @ 62.40 g/t Au, 0.70 m @ 6.09 g/t Au and 4.50 m @ 4.17 g/t Au, including 0.80 m @ 8.45 g/t Au. Drill hole TN-25-045, designed as undercut of drill hole TN-25-043 ( 1.00 m @ 12.50 g/t Au), intersected 3.70 m @ 6.84 g/t Au including 1.40 m @ 12.40 g/t Au, 2.70 m @ 5.30 g/t Au including 0.50 m @ 11.30 g/t Au and 0.70 m @ 7.69 g/t Au.

Drilling on the SAM West target is continuing to test down dip extensions of the defined gold mineralization, including the continuity of the three vein zones, to a depth of 500 m . The Company is continuing to process the drill core, and results of the deeper holes will be released upon receipt of final assays.

Table 1: Significant Drill Hole Assay Results

| Target Area (name) | Drill Hole (number) | From (m) | To (m) | Interval (m) | Au (g/t) |

| SAM West | TN-25-029 | 71.70 | 72.20 | 0.50 | 3.09 |

| SAM West | TN-25-035 | 53.10 | 53.60 | 0.50 | 3.30 |

| | | 69.00 | 71.10 | 2.10 | 8.81 |

| | Including | 70.50 | 71.10 | 0.60 | 19.20 |

| SAM West | TN-25-037 | 60.90 | 61.90 | 1.00 | 8.73 |

| | | 65.10 | 66.10 | 1.00 | 62.40 |

| | | 86.80 | 87.50 | 0.70 | 6.09 |

| | | 128.80 | 133.30 | 4.50 | 4.17 |

| | Including | 128.80 | 129.60 | 0.80 | 8.45 |

| SAM West | TN-25-043 | 66.20 | 67.20 | 1.00 | 12.50 |

| SAM West | TN-25-045 | 7.50 | 11.20 | 3.70 | 6.84 |

| | Including | 8.30 | 9.70 | 1.40 | 12.40 |

| | | 29.50 | 32.20 | 2.70 | 5.30 |

| | Including | 29.50 | 30.00 | 0.50 | 11.30 |

| | and | 31.50 | 32.20 | 0.70 | 7.69 |

| SAM West | TN-25-048 | 31.90 | 32.90 | 1.00 | 3.44 |

| 1) | Intercepts above a cut-off grade of 2.25 g/t Au |

| 2) | Maximum of 2.50 m internal dilution and no top capping applied |

| 3) | Intervals represent drill core length and are considered to represent 60% to 90% of true widths |

| 4) | Full Significant Assay Results included in Table 2 |

| 5) | Drill hole Information included in Table 3 |

San Antonio West Target

The San Antonio West target is approximately 300 m west of the historically mined San Antonio zone of the True North Gold Mine. The San Antonio West target occurs within the gabbro of the San Antonio mafic unit and the intersection with the Cartwright South mineralized shear zone. The SAM gabbro hosts the majority of the known gold mineralization within the True North Mine and historically produced 1,309,351 ounces Au at an average grade of 9.33 g/t Au from San Antonio (see technical report entitled "NI 43-101 Technical Report on the True North Gold Project, Bissett, Manitoba, Canada ", prepared by Lions Gate Geological Consulting Inc. and 1911 Gold, dated December 23, 2024 , with an effective date of August 29, 2024 , available on SEDAR+ at www.sedarplus.ca ). Drilling has now confirmed gold mineralization in quartz-carbonate shear veins with sericite, chlorite, minor tourmaline alteration and up to 2% disseminated and veinlet-hosted pyrite. The target occurs as a vein system parallel to the San Antonio Mine ore body, with the same geological, alteration and mineralization characteristics. Gold mineralization has been traced over a strike length of 500 m and to 260 m down dip.

Next Steps

With the continued intersection of good gold mineralization in step-out drilling of near surface targets at the True North Gold Mine complex in the San Antonio West, and San Antonio Southeast target areas, 1911 Gold is continuing to re-open the underground workings in order to gain access to continue exploration drilling to test the resource expansion of the 2 zones located immediately to the west and east of the underground infrastructure (See April 9, 2025 press release entitled " 1911 Gold Successfully Re-Enters the True North Mine and Receives Manitoba Mineral Development Fund Grant") . The Company is also continuing to test new target areas in addition to SAM W and SAM SE and has commenced the development of a plan to re-commence production. Two drill rigs have been continuing to operate on the property and results will be released as results are received. The review and redevelopment of the high grade near surface Ogama-Rockland 43-101 mineral resource, located 25 km by road to the east of True North, is also progressing well.

Table 2: True North; Select Drill Hole Assays

| Target Area (name) | Drill Hole (number) | From (m) | To (m) | Interval (m) | Au* (g/t) |

| SAM West | TN-25-025 | No Significant Results | |||

| SAM West | TN-25-029 | 71.70 | 72.20 | 0.50 | 3.09 |

| SAM West | TN-25-032 | 167.80 | 168.70 | 0.90 | 1.20 |

| | | 177.40 | 178.30 | 0.90 | 0.71 |

| SAM West | TN-25-035 | 53.10 | 53.60 | 0.50 | 3.30 |

| | | 69.00 | 71.10 | 2.10 | 8.81 |

| | Including | 70.50 | 71.10 | 0.60 | 19.20 |

| | | 132.10 | 132.60 | 0.50 | 1.42 |

| | | 156.80 | 158.30 | 1.50 | 1.64 |

| SAM West | TN-25-037 | 60.90 | 61.90 | 1.00 | 8.73 |

| | | 64.10 | 65.10 | 1.00 | 1.78 |

| | | 65.10 | 66.10 | 1.00 | 62.40 |

| | | 86.80 | 87.50 | 0.70 | 6.09 |

| | | 127.80 | 128.80 | 1.00 | 1.43 |

| | | 128.80 | 133.30 | 4.50 | 4.17 |

| | Including | 128.80 | 129.60 | 0.80 | 8.45 |

| | | 204.70 | 206.10 | 1.40 | 0.83 |

| SAM West | TN-25-043 | 5.70 | 6.50 | 0.80 | 1.18 |

| | | 10.10 | 11.30 | 1.20 | 0.74 |

| | | 13.00 | 13.50 | 0.50 | 1.03 |

| | | 66.20 | 67.20 | 1.00 | 12.50 |

| | | 69.70 | 70.20 | 0.50 | 1.33 |

| | | 73.30 | 77.00 | 3.70 | 0.65 |

| | | 81.40 | 83.30 | 1.90 | 0.53 |

| SAM West | TN-25-045 | 5.50 | 7.50 | 2.00 | 0.89 |

| | | 7.50 | 11.20 | 3.70 | 6.84 |

| | Including | 8.30 | 9.70 | 1.40 | 12.40 |

| | | 11.20 | 12.80 | 1.60 | 0.68 |

| | | 29.50 | 32.20 | 2.70 | 5.30 |

| | Including | 29.50 | 30.00 | 0.50 | 11.30 |

| | and | 31.50 | 32.20 | 0.70 | 7.69 |

| | | 71.60 | 72.10 | 0.50 | 1.53 |

| SAM West | TN-25-048 | 28.30 | 29.20 | 0.90 | 0.96 |

| | | 31.90 | 32.90 | 1.00 | 3.44 |

| | | 33.70 | 34.90 | 1.20 | 0.67 |

| | | 39.30 | 40.50 | 1.20 | 0.81 |

| | | 45.20 | 47.00 | 1.80 | 0.62 |

| | | 55.30 | 56.10 | 0.80 | 1.75 |

| *Composites above 0.5 g/t Au and metal factor above 0.5 Au "gxm" |

Qualified Person Statement

The scientific and technical information in this news release has been reviewed and approved by Mr. Michele Della Libera , P.Geo, Vice-President Exploration of 1911 Gold, who is a "Qualified Person" as defined under NI 43-101.

Table 3: True North; Drill Hole Details

| Drill Hole | `Target (Name) | Northing* | Easting* | Elevation | Azimuth | Inclination | Depth | |

| TN-25-025 | SAM West | 5655913 | 311823 | 255 | 230 | -80 | 149.0 | |

| TN-25-029 | SAM West | 5655914 | 311826 | 255 | 186 | -69 | 167.0 | |

| TN-25-032 | SAM West | 5655913 | 311822 | 256 | 139 | -64 | 182.0 | |

| TN-25-035 | SAM West | 5655894 | 311926 | 253 | 228 | -45 | 193.0 | |

| TN-25-037 | SAM West | 5655894 | 311926 | 253 | 292 | -73 | 215.0 | |

| TN-25-043 | SAM West | 5655811 | 311852 | 248 | 285 | -49 | 164.0 | |

| TN-25-045 | SAM West | 5655811 | 311852 | 248 | 285 | -68 | 170.0 | |

| TN-25-048 | SAM West | 5655788 | 311872 | 251 | 148 | -45 | 131.0 | |

| *Coordinates are provided in UTM NAD83 Zone 15 |

Quality Assurance/Quality Controls (QA/QC)

Core samples are collected by sawing the drill core in half along the axis, with one-half sampled, placed in plastic sample bags, labelled, sealed and the other half retained for future reference. Batches are shipped to Activation Laboratories Ltd. (Actlabs), in Thunder Bay, Ontario for sample preparation and analysis. Samples are dried, crushed to 2mm and a 1 kg split is pulverized to -200 mesh. Gold analysis is completed by fire-assay with an atomic absorption finish on 50 grams of prepared pulp. Samples returning values equal or greater to 10.00 g/t are reanalysed by fire assay with a gravimetric finish. Total gold analysis (Screen Metallic Sieve) is conducted on highly mineralized samples or the presence of visible gold. Certified gold reference material samples are inserted every 20 samples and blank samples at intervals of one in every 50 samples, with additional blanks inserted after samples hosting visible gold. Repeat third-party gold analyses for 5% of all submitted sample pulps are analyzed at ALS-Chemex Laboratory, North Vancouver, Canada .

About 1911 Gold Corporation

1911 Gold is a junior explorer that holds a highly prospective, consolidated land package totaling more than 61,647 hectares within and adjacent to the Archean Rice Lake greenstone belt in Manitoba , and also owns the True North mine and mill complex at Bissett, Manitoba . 1911 Gold believes its land package is a prime exploration opportunity, with the potential to develop a mining district centred on the True North complex. The Company also owns the Apex project near Snow Lake, Manitoba and the Denton-Keefer project near Timmins, Ontario , and intends to focus on organic growth and accretive acquisition opportunities in North America .

1911 Gold's True North complex and exploration land package are located within the traditional territory of the Hollow Water First Nation, signatory to Treaty No. 5 (1875-76). 1911 Gold looks forward to maintaining open, co-operative and respectful communication with the Hollow Water First Nation, and all local stakeholders, in order to build mutually beneficial working relationships.

ON BEHALF OF THE BOARD OF DIRECTORS

Shaun Heinrichs

President and CEO

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This news release may contain forward-looking statements. Often, but not always, forward-looking statements can be identified by the use of words such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or describes a "goal", or variation of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved.

All forward-looking statements reflect the Company's beliefs and assumptions based on information available at the time the statements were made. Actual results or events may differ from those predicted in these forward-looking statements. All of the Company's forward-looking statements are qualified by the assumptions that are stated or inherent in such forward-looking statements, including the assumptions listed below. Although the Company believes that these assumptions are reasonable, this list is not exhaustive of factors that may affect any of the forward-looking statements.

Forward-looking statements involve known and unknown risks, future events, conditions, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, prediction, projection, forecast, performance or achievements expressed or implied by the forward-looking statements. All statements that address expectations or projections about the future, including, but not limited to, statements with respect to the terms of the Offering, the use of proceeds of the Offering, the timing and ability of the Company to close the Offering, the timing and ability of the Company to receive necessary regulatory approvals, the tax treatment of the securities issued under the Offering, the timing for the Qualifying Expenditures to be renounced in favour of the subscribers, and the plans, operations and prospects of the Company, are forward-looking statements. Although 1911 Gold has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

All forward-looking statements contained in this news release are given as of the date hereof. The Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except in accordance with applicable securities laws.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE 1911 Gold Corporation

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/April2025/30/c6906.html