November 27, 2023

Longest continuous pegmatite interval reported from the ongoing, recently-enhanced 2023 drilling programme

Atlantic Lithium Limited (AIM: ALL, ASX: A11, OTCQX: ALLIF, “Atlantic Lithium” or the “Company”), the African-focused lithium exploration and development company targeting to deliver Ghana’s first lithium mine, is pleased to announce that multiple broad intervals of visible spodumene have been observed in drilling outside of the current Mineral Resource Estimate1 (“Resource” or “MRE”) at the Company’s flagship Ewoyaa Lithium Project (“Ewoyaa” or the “Project”) in Ghana, West Africa.

Highlights

- Multiple broad intervals of visible spodumene reported in drilling outside of the current MRE1, significantly increasing the potential for a resource upgrade.

- Longest reported continuous pegmatite interval in the 2023 drilling programme to date of 106m in hole GRC1020 from 6m at the Dog-Leg extension target on the northern tip of the Ewoyaa Main deposit.

- Visible coarse-grained spodumene fragment intervals reported at shallow depths in holes:

- GRC1017: 51m interval of 25-30% visual estimated spodumene modal abundance from 83m

- GRC1020: 74m interval of 20-25% visual estimated spodumene modal abundance from 39m and a 41m interval of 20-25% visual estimated spodumene modal abundance from 137m

- GRC1021: 24m interval of 15-25% visual estimated spodumene modal abundance from 93m

- Coarse-grained, P1-type spodumene pegmatite is preferred for the Dense Media Separation (“DMS”) process flowsheet considered in the Definitive Feasibility Study for the Project (refer announcement of 29 June 2023).

- Resource drilling ongoing; completion of the enhanced 26,500m planned programme (refer announcement of 7 November 2023) targeted for Q2 2024.

NOTE: Visual estimates of mineral abundance should never be considered a proxy or substitute for laboratory analyses where concentrations or grades are the factor of principal economic interest. Visual estimates also potentially provide no information regarding impurities or deleterious physical properties relevant to valuations.

Commenting, Neil Herbert, Executive Chairman of Atlantic Lithium, said:

“In line with our aim of delivering an increased resource at the Ewoyaa Lithium Project, we are very pleased to report broad intervals of visible, coarse-grained spodumene in multiple drill holes near surface and outside of the current MRE footprint. These intervals further improve our confidence in delivering an updated MRE upon completion of the current drilling programme in Q2 2024.

“We are excited to have intersected our longest pegmatite interval in the 2023 drilling programme to date. Located outside of the current Resource footprint and occurring only 6m from surface, the interval includes highlight intersections of visible coarse-grained spodumene over 74m from a depth of 39m and over 41m from a depth of 137m, respectively.

“The coarse-grained, P1-type nature of the spodumene fragments observed in Reverse Circulation drilling chips is very encouraging as it performs favourably in DMS-only processing, as planned at the Ewoyaa Lithium Processing Plant, with good recoveries.

“We look forward to providing further updates from the ongoing drilling programme in due course.”

Broad Intervals of Visible Spodumene

Drilling outside of the current MRE1 has intersected multiple intervals of pegmatite, including multiple broad intervals of coarse-grained visible spodumene at the Dog Leg prospect extension (refer Figure 1 and Figure 3). The drilling forms part of the ongoing resource infill and extensional programme, which was recently increased from 18,500m to 26,500m of planned drilling, due for completion in Q2 2024 (refer announcement of 7 November 2023).

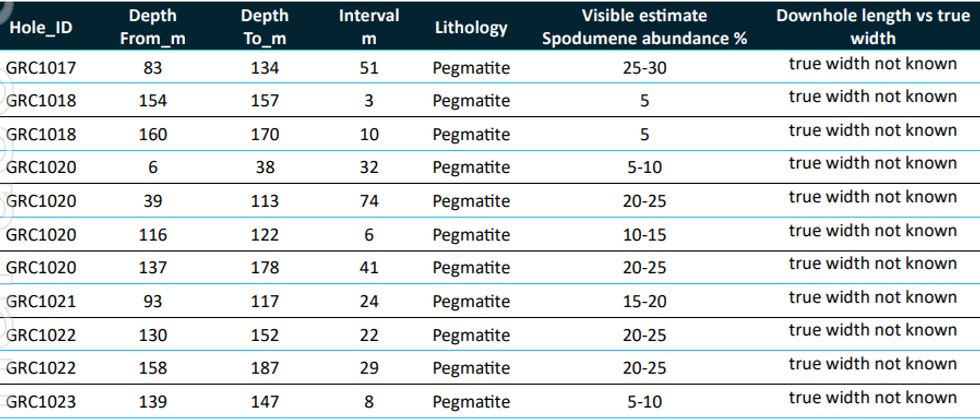

Highlight logged pegmatite intervals with visible estimates of spodumene modal abundance in RC drill chips are summarised in Table 1 below, with all logged intervals and collar details reported in Table 2 and Table 3.

The drilling reported herewith is located at the Dog-Leg extension target on the northern tip of the Ewoyaa Main deposit, at the confluence of the Ewoyaa Main trend and the Ewoyaa North-East trend (refer Figure 2 and Figure 6).

A similar structural setting occurs further north at the Ewoyaa Main Sill deposit where the north-south trending Ewoyaa Main trend intersects the east-west trending Grasscutter trend and is significant as it results in flat lying sill geometry mineralisation. A similar pattern is emerging here at the Dog-Leg prospect with drilling evidence pointing to a potential flat lying geometry which may result in additional resource growth (refer Figure 4, Figure 5 and Figure 6).

Anticipated timing for assay receipt and review is approximately 2 to 3 months from the date of this announcement.

Click here for the full ASX Release

This article includes content from Atlantic Lithium, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

A11:AU

The Conversation (0)

05 February

Acquisition of “Thompson Falls” High-Grade Antimony Project Adjacent to America’s only Antimony Smelter

Red Mountain Mining Limited (ASX: RMX, US CODE: RMXFF, or “Company”), a Critical Minerals exploration and development company with an established portfolio in Tier-1 Mining Districts in the United States and Australia, is pleased to announce the Company’s newly-acquired Thompson Falls Antimony... Keep Reading...

26 November 2025

Long State Funding Update

Atlantic Lithium (A11:AU) has announced Long State Funding UpdateDownload the PDF here. Keep Reading...

31 October 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Atlantic Lithium (A11:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

20 October 2025

Pronounced Lithium-in-soil Anomalies

Atlantic Lithium (A11:AU) has announced Pronounced Lithium-in-soil AnomaliesDownload the PDF here. Keep Reading...

03 September 2025

Corporate Funding Update

Atlantic Lithium (A11:AU) has announced Corporate Funding UpdateDownload the PDF here. Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00