December 04, 2024

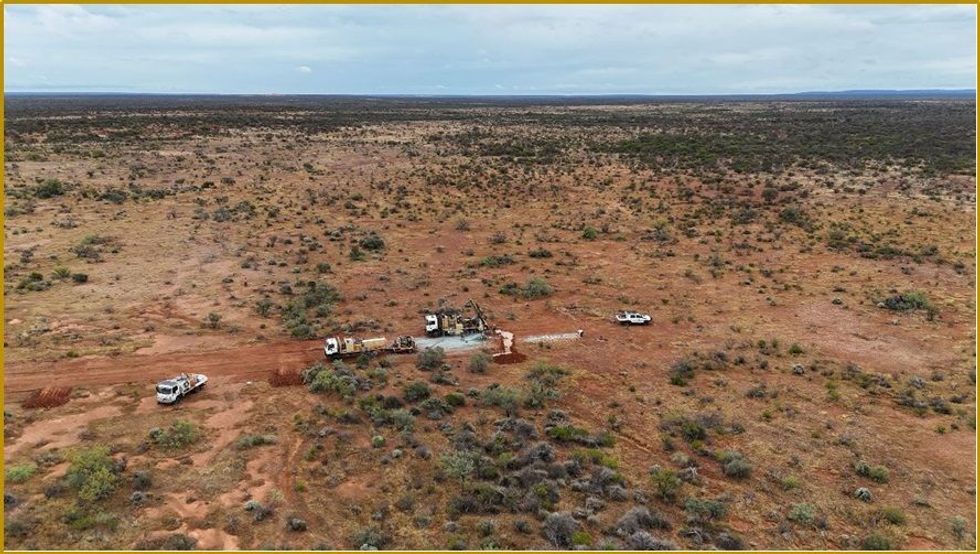

Octava Minerals Limited (ASX:OCT) (“Octava” or the “Company”), a Western Australia focused explorer of the new energy metals antimony, REE’s, Lithium and gold, is pleased to report that exploration drilling at its 100% owned Yallalong antimony project in the mid-west of Western Australia is on track and progressing as expected. In addition, the planned two metallurgical core drill holes are now complete, with samples on their way to Perth to undergo testwork in coming months.

Highlights

- Exploration drilling at the Yallalong antimony project in the mid-west of WA is on track and progressing as planned.

- Drilling at the Discovery antimony prospect, where historic drilling recorded significant high-grade intercepts including 7m @ 3.27% antimony (Sb) is almost complete.

- The rig will shortly relocate 2km north along strike to the second antimony target, Central, and commence drilling.

- Field observations have confirmed the presence of antimony mineralisation in drill holes as expected.

- Completion of two metallurgical core test holes at the Byro REE/Li project with samples to be submitted for chemical analysis followed by minerals extraction studies by CSIRO.

Octava’s Managing Director Bevan Wakelam stated; ”Drilling is going well at our Discovery antimony prospect and progressing as planned. The team onsite have observed antimony mineralisation in drill holes at the Discovery target, which we will get to the laboratory for determination of antimony grades. The results are expected to be available early in the new year. We are also looking forward to testing the second antimony target at the Central target, which has not been drilled tested before. In addition, core hole drilling is now complete at our Byro project, we are looking forward to getting the metallurgical recovery test work on these samples underway at the CSIRO.”

Discovery Antimony Target

Drilling is progressing well at the Discovery antimony target with around 75% of the planned drill holes now completed. In the next few days, the drill rig will relocate to the Central antimony target, 2km north and commence drilling 9 maiden drill holes, down to a depth of approximately 120m, the prospect at Central has not been drill tested before.

Results from the drill program are expected to be available early in the new year.

Byro REE Project

Drilling of two metallurgical core holes at the Byro Project has been completed on time and on budget and the core samples are on their way to Perth. Over the next couple of months, these samples will undergo chemical and mineralogical analysis and beneficiation tests, followed by metals extraction testwork with the CSIRO.

Click here for the full ASX Release

This article includes content from Octava Minerals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

13h

David Erfle: Gold, Silver Under Pressure, Key Price Levels to Watch

David Erfle, editor and founder of Junior Miner Junky, explains why gold and silver prices took a hit not long after war in the Middle East was announced. While the near term could be volatile, he said the long-term outlook for precious metals is strong. Don't forget to follow us @INN_Resource... Keep Reading...

13h

Tavi Costa: Gold, Silver Stocks to Rerate, "Explosive" Energy, Copper Opportunities

Tavi Costa, CEO of Azuria Capital, explains where he's looking to deploy capital right now, mentioning mining, energy and emerging markets. "When I apply macro analysis into markets, there's a few things that look exceptionally cheap today that could be extremely asymmetric," he commented.... Keep Reading...

14h

One Bullion Advances Toward Drill-Ready Targets at Botswana Gold Assets

One Bullion (TSXV:OBUL,OTCPL:OBULF) CEO and President Adam Berk shared the advantages of working in the mining-friendly jurisdiction of Botswana and big milestones ahead in 2026.Surveys are expected to commence within the next few weeks at the company's Maitengwe and Vumba projects, which will... Keep Reading...

09 March

Byron King: Gold, Silver, Oil/Gas — Stock Ideas and Strategy Now

Byron King, editor at Paradigm Press, shares his approach to the gold and silver sectors as tensions in the Middle East intensify, also touching on oil and gas. Overall he sees hard assets becoming increasingly key as global uncertainty escalates."Own gold, own silver — physically own the metal... Keep Reading...

09 March

Jaime Carrasco: Gold Going "Much Higher," Silver Force Majeure Inevitable

Jaime Carrasco, senior portfolio manager and senior financial advisor at Harbourfront Wealth Management, shares his outlook for gold and silver, saying prices must rise much higher. He also talks about how to build a strong precious metals portfolio. "We're moving from a credit-based economy, a... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00