October 30, 2024

xReality Group Limited (ASX:XRG) (xReality) is pleased to provide the following Quarterly Activities Report and Appendix 4C for the quarter ending 30th September 2024 together with an Operational Update.

Key Highlights

- Highest Cash Receipts for any quarter on record to date

- Cash receipts of $4,303,251, up 40% on Q4.

- Continued rapid sales growth of Operator XR (Enterprise) across US and Australian markets during the quarter:

- Annual Recurring Revenue increased 38% to $3.04M

- Total Contract Value increased 73% for the quarter to $6.2M

- 190 qualified and active sales opportunities with a total sales pipeline of $27.2M

- $5.6m Contract awarded for US Department of Defence Project

- Entertainment Sector revenue increase of 16% on Q4 2024

Operational Update by Business Sector:

Operator XR – Enterprise Software and Technology

Operator XR continues to make significant progress across the USA. On the 11th of September the company announced that it had been awarded a $5.6m AUD contract to deliver a new immersive training capability to the United States Department of Defence (USDOD). This project along with the signing of multiple new police departments and other agencies across Australia and the US has resulted in a substantial increase in Annual Recurring Revenue and Total Contract Value during the Quarter. Cash receipts from the USDOD project will be received over a period of 20 months.

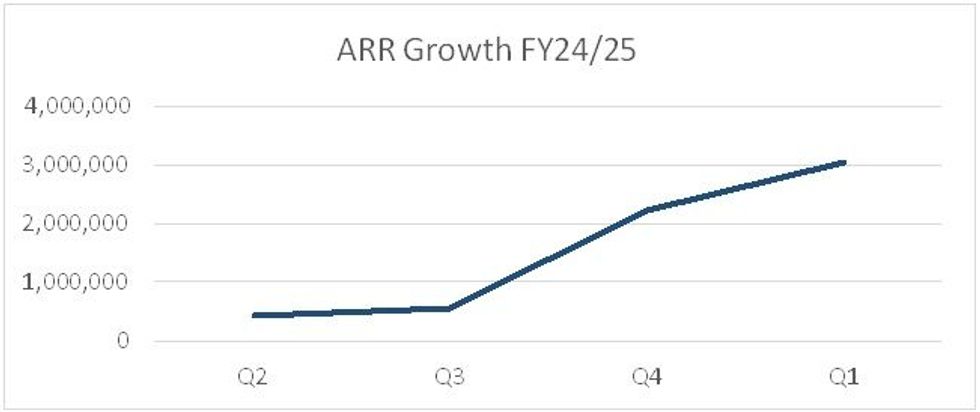

Operator XR Annual Recurring Revenue (ARR)

- Total ARR = $3,041,695 (compared to $2.2m for FY24)

- ARR increase in Q1 = $831,653 (38%)

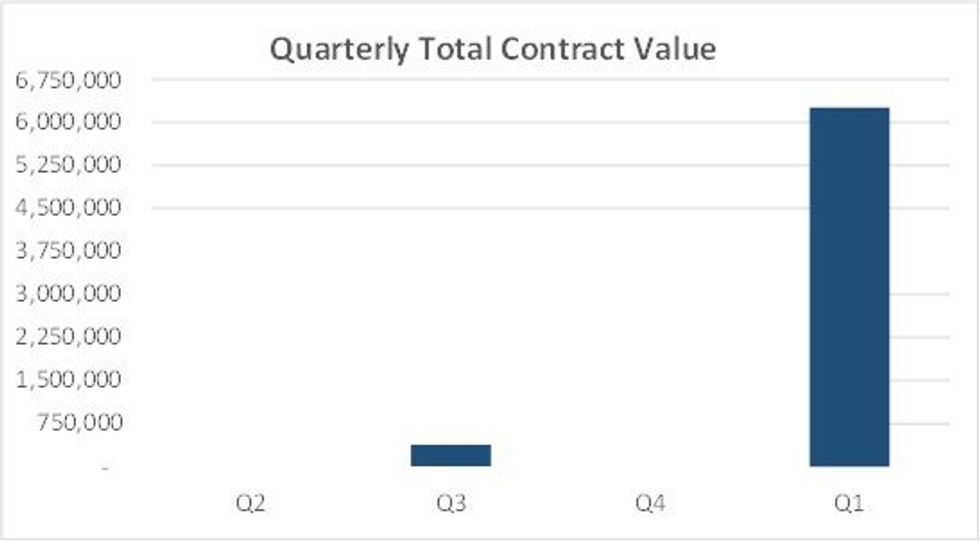

- Operator XR Growth in Sales

- Total Contract Value Q1 $6,248,604 an increase of 73% on Q4 FY24

- Marketing Activities

- During the quarter, Operator XR developed a strong pipeline of leads through focused digital marketing, and exhibiting at relevant trade shows, including:

- IACP conference in Boston, USA, October 24

- INL conference in Greece, September 24

- Land forces, Australia, September 24

- Upcoming major events include:

- I/ITSEC, Florida, USA, December 24

- Operator XR will be presenting at the conference as part of Team Defence Australia (AUSTRADE)

- Shot Show, Las Vegas, USA January 25

- Other Media exposure for Operator XR throughout the period included coverage on major news networks within Australia, USA and Japan.

- During the quarter, Operator XR developed a strong pipeline of leads through focused digital marketing, and exhibiting at relevant trade shows, including:

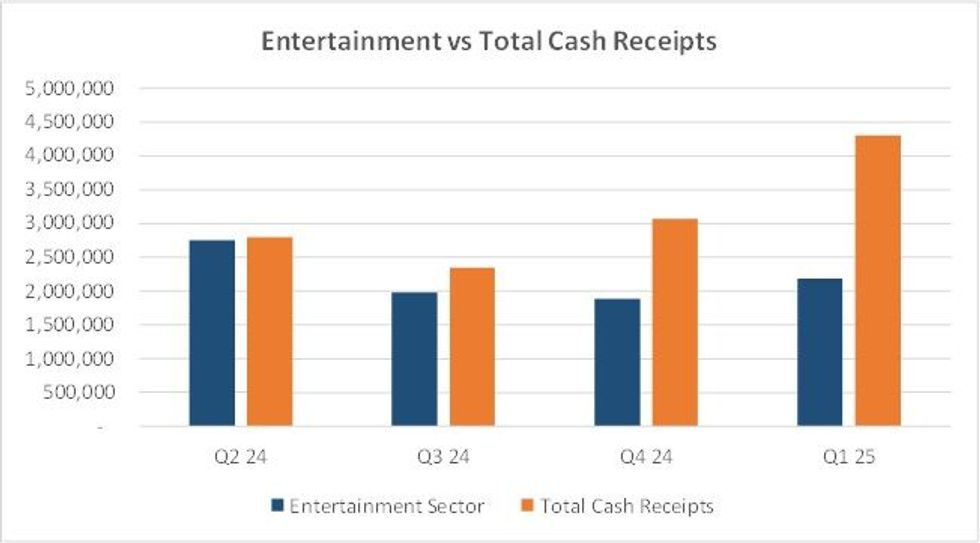

Entertainment Sector – iFLY and Freak Entertainment

Cash Receipts for Q1 $2.18m an increase of 16% on Q4 2024

XRG’s portfolio of Entertainment businesses have experienced a strong quarter, with an increase of sales across the sector of 16% from Q4 2024. The increase in cash receipts was attributed to the iFLY businesses in Sydney and the Gold Coast which outperformed last quarter by over $300k, reflecting a stronger retail market and return to our inbound tourism trade.

Corporate Activity

On the 11th of October the Company secured an additional short-term working capital facility of $500,000 through its senior debt holder, Causeway Financial. The purpose of the additional drawdown was to increase inventory, accelerate the delivery of future projects and meet future orders.

Cash Flow Analysis

Cash receipts for the quarter totalled $ 4,303,251. Net cash from operating activities for the period totalled $535,039. The Company invested $957,671 in XR product development, hardware and corporate facilities. The Company repaid $75,000 of debt and is current with all debt covenants.

Closing Cash position at the end of the quarter totalled $1,501,640.

Related parties’ expenses of $124,871 comprise of salaries and superannuation paid to executive directors and fees paid to non-executive directors.

Click here for the full ASX Release

This article includes content from xReality Group, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

XRG:AU

The Conversation (0)

03 July 2024

XReality Group

Focused on XR products for law enforcement, defence, entertainment and enterprise markets

Focused on XR products for law enforcement, defence, entertainment and enterprise markets Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00