Ore purchase agreement to provide fast track opportunity to cash flow

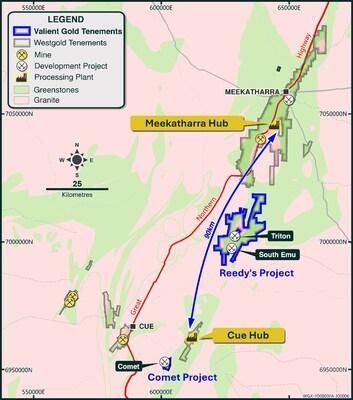

Westgold Resources Limited (ASX: WGX,OTC:WGXRF) (TSX: WGX) (Westgold or the Company), is pleased to confirm that, subject to approval from the Australian Securities Exchange (ASX), it is proceeding with the demerger and an initial public offering of its non-core Reedy's and Comet assets (Demerger Assets) in the Murchison region of Western Australia to Valiant Gold Limited (Valiant).

Highlights

- Westgold non-core assets to be spun out via a demerger and concurrent IPO in Q3, FY26 to Valiant Gold Limited (Valiant) - a new standalone ASX-listed gold company.

- Valiant to acquire the Reedy and Comet Projects – an exploration and development package including four small historic underground mines with recent production history and a combined Mineral Resources of 15.6 Mt @ 2.4 g/t Au for 1.2 Moz.

- Demerger and IPO unlocks value from assets not included in Westgold's 3 year outlook - via a dedicated, well-funded exploration and development team focused on generating early cashflow via an Ore Purchase Agreement to be entered into with Westgold.

- Valiant Board and Management team established - Derek La Ferla appointed as Non-Executive Chairman, Brendan Tritton as Managing Director and Anthony Chamberlain as a Non-Executive Director. Westgold's Chief Growth Officer, Simon Rigby, to join the Valiant Board as a Non-Executive Director and as Westgold's nominee.

- Valiant to be well funded - as part of the concurrent IPO, Valiant intends to raise $65 -$75 million (before costs), with eligible Westgold shareholders entitled to participate in a $20 million priority offer.

- Westgold to retain upside to exploration and production success - through a substantial equity holding in Valiant.

Wayne Bramwell, Managing Director and CEO of Westgold commented:

"Westgold is focused on expansion of our larger, core operating assets.

By establishing Valiant, we create an independent, well-funded gold company that can bring forward value from smaller assets such as the Comet and South Emu-Triton underground mines and unlock the exploration potential across the Reedy and Comet packages.

Valiant will have a fast-track to cashflow with an Ore Purchase Agreement (OPA) to be entered into with Westgold. This collaborative, capital efficient model is proven, as demonstrated by Westgold's investment and OPA with New Murchison Gold (ASX: NMG). This model saw NMG transition from explorer to producer, with gold production from NMG's Crown Prince deposit now delivering high grade oxide ore to Westgold's Meekatharra processing hub.

Valiant can replicate this success. With several small underground mines in care and maintenance, a range of open pit opportunities, and exploration upside, the Valiant team has multiple near-term restart and growth options to deliver near term cashflow."

Overview

Westgold proposes to demerge, by way of an asset transfer, the Demerger Assets to Valiant (Demerger). This Demerger simplifies our Murchison business, allowing Westgold to focus on its larger and higher-grade core operations across the Murchison and Southern Goldfields regions.

Concurrently with the Demerger, Valiant intends, subject to ASX approval, to undertake an initial public offering (IPO) of fully paid ordinary shares in Valiant (Valiant Shares), under a prospectus, to raise between $65 million (Minimum Subscription) and $75 million (Maximum Subscription) (before costs) at an issue price of $0.25 per Valiant Share, and to apply for admission to the official list of the ASX.

Following completion of the Demerger and IPO, Westgold will retain approximately 48% shareholding at the Minimum Subscription, and approximately 44% shareholding at the Maximum Subscription in Valiant.

In connection with the Demerger, Westgold and Valiant intend to enter into an OPA on market terms for processing ore from the Demerger Assets at the Cue and/or Meekatharra processing hubs. This access will provide a fast tracked and low capex pathway to near term gold production and cash flow to Valiant, whilst providing Westgold with additional ore not currently scheduled in Westgold's 3-year outlook.

Rationale for the Demerger

The Reedy's and Comet gold projects are 100% owned, brownfield gold assets located in the Murchison region of Western Australia. The package hosts a combined Mineral Resources of 15.6 Mt @ 2.4 g/t Au for 1.2 Moz with clearly identified exploration upside and near-term production potential under the OPA to be entered into between Westgold and Valiant.

Reedy's and Comet have historically produced ~820koz @ 3.8g/t Au and ~257koz @ 2.77g/t Au respectively, with two underground mines placed on care and maintenance by Westgold in Q1 FY23 when the gold price was ~A$2,400/oz.

Currently the Demerger Assets do not contribute any production in Westgold's Three-Year Outlook (3YO). With the creation of Valiant, the opportunity exists to bring forward value from these assets into the 3YO by establishing an independent, well-funded team dedicated to recommencing mining, drilling and resource expansion.

Westgold will demerge these assets into Valiant, creating a focused team to advance these assets and enabling Valiant to raise capital and undertake an ASX listing. The Demerger enables Valiant to leverage Westgold's proximate processing infrastructure to accelerate the restart of mining from the Demerger Assets.

Upon successful admission to ASX, Valiant will use the funds raised from its IPO to advance growth and development activities across the Demerger Assets including infill and extensional drilling, studies and mine restart activities.

The Westgold Board considers that demerging these non-core assets is a capital efficient model consistent with our corporate strategy. This model can deliver superior value for shareholders in both Westgold and Valiant, with Westgold shareholders being provided the opportunity to participate in Valiant through a priority offer allocation in the IPO.

The Demerger and IPO of the Demerger Assets is consistent with and aligned to the Company's corporate strategy to streamline Westgold's portfolio and focus on the expansion of our core operating assets.

Commenting on the Demerger Managing Director and CEO, Wayne Bramwell said:

"Westgold's approach to capital allocation is to focus on our larger and higher-grade operating assets. We see value in Comet and Reedy's, but as they are not assets of scale, they are unlikely to be redeveloped by our team in the next three years.

Demerging these assets is a capital efficient model for Westgold.

In the hands of the Valiant team these assets have a real opportunity for fast-track development and with an ore purchase agreement (OPA), a line of sight on cash flow. A dedicated, well-funded exploration and development team is the key, with Valiant's success potentially delivering early revenue to Valiant's shareholders and additional gold production into Westgold's 3YO."

Demerger

The Demerger will only proceed if certain conditions are satisfied, including (without limitation), Valiant obtaining an ASX conditional admission letter and Valiant receiving valid applications for the Minimum Subscription under the IPO.

The Demerger is expected to be completed by late March 2026.

Westgold is supporting Valiant's growth by offering an unsecured, interest-free loan of up to $3 million (Facility) to enable commencement of early work on the Demerger Assets. Valiant will repay the Facility following completion of the IPO.

This Facility will give Valiant the flexibility to progress quickly on key projects, setting the stage for future development and success.

Valiant IPO

Valiant intends to seek admission to the official list of the ASX and, for this purpose, will undertake an IPO to raise between $65 million and $75 million (before costs), at an issue price of $0.25 per Valiant Share. The offers under the IPO (IPO Offer) will comprise:

- a Priority Offer to existing eligible Westgold shareholders - to raise approximately $20 million (before costs) (Priority Offer).; and

- an institutional and broker firm offer - to raise between $45 million and $55 million (before costs) (Other Offer).

Valiant intends to use the IPO funds to advance the Demerger Assets, including drilling, studies, mine restart work and to repay the Facility. Further details in relation to the IPO Offer will be provided in the Prospectus to be lodged by Valiant in due course.

Argonaut Securities Pty Limited has been appointed Lead Manager to the IPO. Thomson Geer has been appointed as Australian legal advisor in respect of the Demerger and IPO.

Following completion of the Demerger and IPO, Westgold will retain approximately 48% shareholding in Valiant at the Minimum Subscription, or approximately 44% shareholding in Valiant at the Maximum Subscription.

Proposed Valiant Capital Structure

| Minimum Subscription ($65 million) | Maximum Subscription ($75 million) | |

| Current Valiant Shares on Issue | 100 | 100 |

| Valiant Shares Issued to Westgold in Consideration for the Demerger Assets | 240,000,000 | 240,000,000 |

| Valiant Shares Issued under the Other Offer | 180,000,000 | 220,000,000 |

| Valiant Shares Issued under the Priority Offer | 80,000,000 | 80,000,000 |

| Valiant Shares on Issue upon ASX Listing | 500,000,100 | 540,000,100 |

| Valiant Options | 2,000,000 | 2,000,000 |

| Valiant Cash Position (excl. Costs) | $65m | $75m |

| Valiant Market Capitalisation | $125m | $135m |

| Valiant Enterprise Value | $60m | $60m |

| Implied EV/Resource ($/Resource oz) | $43/oz | $43/oz |

Note: Valiant options to be issued to Valiant's advisers in connection with the IPO. Additional Valiant options and performance rights may also be issued to Valiant directors, employees, consultants and advisers. Further details of the options and performance rights to be issued by Valiant will be disclosed in the prospectus to be prepared by Valiant and to be lodged with the Australian Securities and Investments Commission in connection with the IPO.

Valiant Board and Management

Valiant has secured an experienced team with extensive experience in mineral exploration, project development, mining, legal and financing in the resources industry. The team includes two non-executive directors with suitable technical expertise.

The Valiant board and senior management includes:

Mr Derek La Ferla – Independent Non-Executive Chairman

Derek is a very experienced corporate lawyer and company director.

In addition to Valiant, Derek is chair of Chalice Mining Limited (ASX: CHN), Icon Engineering Pty Ltd, Training and Alliance Group Pty Ltd and Foodbank WA. He is a consultant with Ivanhoe Atlantic Inc. and the former chair of Sandfire Resources Limited and Poseidon Nickel Limited.

Derek is also a part time partner of Lavan, one of the largest law firms in Perth.

Mr Brendan Tritton – Managing Director

Brendan is an accomplished mining executive and engineer with extensive experience spanning technical operations, corporate strategy and leadership within the Australian resources sector. A graduate of the Western Australian School of Mines (WASM), Brendan combines deep technical foundations with strong commercial and organisational insight, enabling him to drive performance and innovation across complex mining environments.

Brendan has held senior operational and leadership roles across multiple resource projects including Mincor Resources NL's Kambalda operations. He has been recognised for his pragmatic and forward-thinking approach to mine development, team performance and stakeholder engagement. His career reflects a balance of on-the-ground mining expertise and strategic capability, positioning him to effectively bridge technical execution and corporate value creation.

Mr Simon Rigby – Non-Executive Director

Simon is a Geologist (BSc (Hons), MAIG) with more than 30 years of experience in mineral exploration, business development and executive leadership within both major and junior companies. He has worked in precious and base metals and strategic minerals throughout Australasia, Africa, Europe and the Americas.

Simon is the Chief Growth Officer of Westgold and will be appointed as Westgold's nominee on the Valiant Board.

Dr Anthony Chamberlain – Non-Executive Director

Tony holds a PhD in metallurgy from Curtin University and is an experienced mining executive with over 30 years' experience in the resources sector. Tony brings a wealth of knowledge in project development from resource optimisation, engineering, approvals, construction and operational management.

Tony has held senior operational and management roles during his 12 years at WMC Resources and BHP. Additionally, he has served in senior and executive positions at several ASX-listed junior resource companies, including Vimy Resources, BCI Minerals, Clean TeQ, Stonehenge Metals, and Crossland Strategic Metals.

Ms Joan Dabon – Company Secretary

Joan is a Chartered Secretary with over nine years' experience in company secretarial and corporate advisory services, supporting ASX and NSX listed companies across a wide range of sectors including mining & oil and gas, manufacturing, automotive, technology, renewable energy, logistics, and distribution. She was the Executive Director – Governance (West Coast) at Source Governance, where she led the governance delivery and strategic board support for a diverse client base.

Joan holds a Juris Doctor degree and is an Associate Member of the Governance Institute of Australia.

Commenting on Valiant Chairman, Derek La Ferla said:

"Valiant is poised to unlock significant value from our portfolio of historically productive gold assets and has a clear pathway to cashflow and growth. Supported by Westgold as our cornerstone shareholder and with access to their established processing infrastructure, Valiant is committed to building a resilient and sustainable gold business.

Our experienced leadership team brings the operational and corporate expertise and strategic vision necessary to drive Valiant forward, delivering returns for our shareholders and contributing to the future of gold mining in Australia."

Indicative Timetable

| Event | Indicative Date |

| Lodgement of Valiant IPO Prospectus | Mid-February 2026 |

| Priority Offer Record Date | Late February 2026 |

| Opening Date of IPO Offer | March 2026 |

| Closing Date of IPO Offer | March 2026 |

| Allotment of Valiant shares under IPO Offer | Late March 2026 |

Note: The dates shown in the table above are indicative only and may vary subject to the Corporations Act 2001 (Cth), ASX Listing Rules and other applicable laws.

This announcement is authorised for release to the ASX by the Board.

About Westgold

Westgold Resources Limited (ASX | TSX: WGX) is a leading, unhedged ASX200 gold producer with a growing portfolio of established mines and processing plants across the Murchison and Southern Goldfields, two of Western Australia's most prolific gold-producing regions.

Westgold's vision is to become the leading Australian gold company - sustaining safe, responsible and profitable production. We have a clear purpose to unearth enduring value – for our stakeholders, shareholders, people and the communities we operate in.

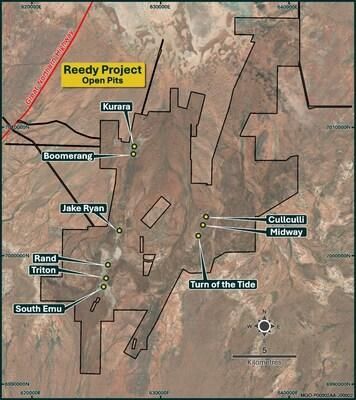

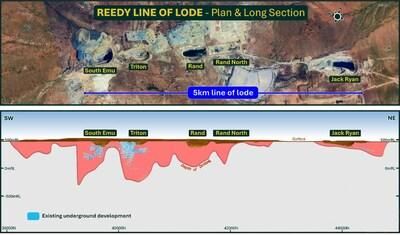

About the Reedy's Gold Project

Located between Cue and Meekatharra, the Reedy's Gold Project is a long-standing gold producer with a rich history dating back to 1901. Over 820,000oz of gold have been produced from 18 open pits and four underground mines, developed along three key mineralised shears. Recent exploration and mining, particularly from 2016 to 2022, have highlighted the project's ongoing potential, with 1.78 Mt at 2.55g/t for 146,000oz of gold produced during this period.

Reedy's extensive strike length and multiple mineralised corridors underscore its exploration upside. The project's scale and stage make it an excellent fit for an agile junior gold miner where a dedicated management team can focus on advancing both near-mine and regional targets. Under the stewardship of a new entity, Reedy's is poised to benefit from renewed investment and operational focus.

With a strong production history, robust geological fundamentals, and significant room for resource growth, Reedy's offers an attractive platform for a growth-oriented company seeking to build value through targeted exploration and efficient development.

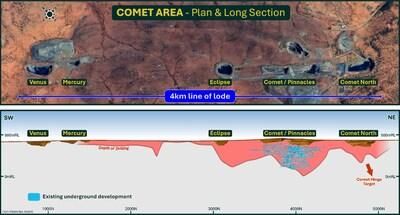

About the Comet Gold Project

The Comet Gold Project, situated 19km east-southeast of Cue in Western Australia's Murchison region, is a proven gold producer with a legacy spanning over a century. Having delivered approximately 257,000oz of gold from multiple open pits and underground operations, Comet's history is marked by phases of successful mining and ongoing exploration.

In recent years, Comet has demonstrated renewed potential through targeted drilling and modern mining methods, particularly during the 2017–2022 underground campaign, which yielded 1.41Mt at 3.17g/t for 144,000oz of gold. Metallurgical test work has confirmed strong gold recoveries, and the project's geology remains highly prospective, with several underexplored zones offering clear upside for further resource growth.

Comet's scale represents an ideal opportunity for a nimble, dedicated management team to unlock value. As part of a newly independent company, Comet will benefit from focused attention and tailored strategies, positioning it to realise its exploration potential and deliver meaningful returns. With established infrastructure nearby and a track record of production, Comet is set to become a valuable growth asset for a company with the flexibility and dedicated resources to maximise its upside.

Table 1 – Valiant Mineral Resource Estimate

| Measured | Indicated | Inferred | Total | |||||||||

| Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | |

| Comet Group | 236 | 3.07 | 23 | 2,141 | 2.39 | 165 | 1,698 | 2.39 | 130 | 4,075 | 2.43 | 319 |

| Reedy's Group | 65 | 3.37 | 7 | 3,322 | 2.53 | 271 | 8,134 | 2.34 | 612 | 11,520 | 2.40 | 890 |

| Total | 301 | 3.13 | 30 | 5,462 | 2.48 | 435 | 9,832 | 2.35 | 742 | 15,595 | 2.41 | 1,209 |

Not an Offer

This announcement is not a prospectus, product disclosure statement or other disclosure document under the Corporations Act 2001 (Cth), or other offering document under Australian law or any other law. This announcement, and the information contained in it, is provided for information purposes only and is not an offer or solicitation or an invitation or recommendation to subscribe for, acquire or buy securities of Valiant, or any other financial products or securities in any place or jurisdiction, and has not been lodged with the Australian Securities and Investment Commission (ASIC).

This announcement does not constitute investment advice and has been prepared by Westgold without taking into account the recipient's investment objectives, financial circumstances or particular needs. Each recipient must make his/her own independent assessment and investigation of Valiant and its business and assets. This announcement is in summary form and does not purpose to be exhaustive. This announcement should be read in conjunction with Westgold's periodic disclosure announcements, which are available to download at https://westgold.com.au/ along with the prospectus to be lodged by Valiant in connection with the IPO.

Investment Risk

An investment in Valiant shares is subject to investment and other known and unknown risks, some of which are beyond the control of Valiant. Those risks and uncertainties include factors and risks specific to Valiant such as (without limitation) the status of exploration and mining tenements and applications and the risks associated with the non-grant or expiry of those tenements and applications, liquidity risk, risks associated with the exploration or developmental stage of projects, funding risks, operational risks, changes to government fiscal, monetary and regulatory policies, the impact of actions of governments, the potential difficulties in enforcing agreements and protecting assets, alterations to resource estimates and the imprecise nature of resource and reserve statements, any circumstances adversely affecting areas in which Valiant operates, fluctuations in the production, volume and price of commodities, any imposition of significant obligations under environmental regulations, fluctuations in exchange rates, the fluctuating industry and commodity cycles, the impact of inflation on operating and development costs, taxation, regulatory issues and changes in law and accounting policies, the adverse impact of wars, terrorism, political, economic or natural disasters, the impact of changes to interest rates, loss of key personnel and delays in obtaining or inability to obtain any necessary government and regulatory approvals, insurance and occupational health and safety. Further information regarding the risks associated with an investment in Valiant shares will be disclosed in the notice of meeting and short-form prospectus to be lodged by Westgold in connection with the Demerger and the prospectus to be lodged by Valiant in connection with the IPO. Investors are encouraged to read the prospectus in full before deciding whether to subscribe for Valiant shares. Valiant does not guarantee any particular rate of return or the performance of Valiant, nor does it guarantee the repayment of capital from Valiant or any particular tax treatment.

Background to the Mineral Resource Estimate

Geological interpretation of individual deposits is carried out using a systematic approach to ensure that the resultant Mineral Resource Estimates are both sufficiently constrained, and representative of the expected sub-surface conditions. In all aspects of Mineral Resource Estimation, the factual and interpreted geology is used to guide the development of the interpretation. Geological matrixes were established to assist with interpretation and construction of the estimation domains.

A significant portion of the data used in Mineral Resource Estimations has been gathered from diamond core. Multiple sizes have been used. This core is geologically logged and subsequently halved for sampling. Grade control holes may be whole-cored to streamline the core handling process if required. Face sampling data is also utilised, where each development face / round is chip sampled. The sampling intervals are domained by geological constraints (e.g. rock type, veining and alteration / sulphidation etc.).

All geology input is logged and validated by the relevant area geologists, incorporated into this is assessment of sample recovery. No defined relationship exists between sample recovery and grade. Nor has sample bias due to preferential loss or gain of fine or coarse material been noted at any deposit.

Faces are nominally chipped horizontally across the face from left to right, or vertically from top to bottom, sub-set via geological features as appropriate. Diamond drilling is half-core niche sampled (or whole-cored if appropriate), sub-set via geological features as appropriate.

Samples undergo fine pulverisation of the entire sample by an LM5 type mill to achieve a 75µ product prior to splitting. QA/QC is currently ensured during the sub-sampling stages process via the use of the systems of an independent NATA / ISO accredited laboratory contractor. The sample size is considered appropriate for the grain size of the material being sampled. The un-sampled half of diamond core is retained for check sampling if required.

Sampling is analysed for gold by fire assay where a 40g – 50g sample undergoes fire assay lead collection followed by flame atomic adsorption spectrometry. Quality control is ensured via the use of standards, blanks and duplicates. The laboratory includes a minimum of 1 project standard with every 22 samples analysed. No significant QA/QC issues have arisen in recent drilling results.

After validating the drillhole data to be used in the estimation, interpretation of the orebody is undertaken to create the intervals which form the basis of the three-dimensional orebody wireframe. Wireframing is then carried out using a combination of automated modelling algorithms and manual triangulation to create an accurate three-dimensional representation of the sub-surface mineralised body.

Drillhole intersections within the mineralised body are then used to flag the appropriate sections of the drillhole database tables for compositing purposes. Drillholes are subsequently composited to allow for grade estimation. In all aspects of resource estimation, the factual and interpreted geology was used to guide the development of the interpretation.

Once the sample data has been composited, a statistical analysis is undertaken to assist with determining estimation search parameters, top-cuts etc. Analysis of individual domains is undertaken to assist with determining appropriate search parameters. Which are then incorporated with observed geological and geometrical features to determine the most appropriate search parameters.

An empty block model is then created for the area of interest. This model contains attributes set at background values for the various elements of interest as well as density, and various estimation parameters that are subsequently used to assist in resource categorisation. The block sizes used in the model will vary depending on orebody geometry, minimum mining units, estimation parameters and levels of informing data available.

Grade estimation is then undertaken. Ordinary Kriging estimation method is considered as standard, although Categorical Indicator Kriging is used in some instances. Estimation results are validated against primary input data, previous estimates and mining output.

The Mineral Resource is then depleted for mining voids and subsequently classified in line with JORC guidelines utilising a combination of various estimation derived parameters and geological / mining knowledge.

Data spacing is variable dependent upon the individual lode under consideration.

This approach considers all relevant factors and reflects the Competent Person's view of the deposit.

The cut off grades used for the reporting of the Mineral Resources Estimates is selected based upon the style of mineralisation, depth from surface of the mineralisation and the most probable extraction technique and associated costs.

Likely mining approaches have been considered at the domaining, estimation and classification steps. However, no mining dilution or ore loss has been modelled in the resource model or applied to the reported Mineral Resource Estimate. Nor has metallurgical recovery been applied to the reported Mineral Resource Estimate.

These factors are applied during the Ore Reserve generation process.

Competent/Qualified Person Statements

The information in this release that relates to Exploration results and Mineral Resource Estimates is compiled by Westgold technical employees and contractors under the supervision of Mr. Jake Russell B.Sc. (Hons), who is a member of the Australian Institute of Geoscientists and who has verified, reviewed and approved such information. Mr Russell is a full-time employee of the Company and has sufficient experience which is relevant to the styles of mineralisation and types of deposit under consideration and to the activities which he is undertaking to qualify as a Competent Person as defined in the 2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (the "JORC Code") and as a Qualified Person as defined in the CIM Guidelines and National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101"). Mr. Russell is an employee of the Company and, accordingly, is not independent for purposes of NI 43-101. Mr Russell consents to and approves the inclusion in this release of the matters based on his information in the form and context in which it appears. Mr Russell is eligible to participate in short- and long-term incentive plans of the company.

The updated MRE has an effective date of 30 June 2025 and was completed by Westgold technical employees and contractors under the supervision of Mr Jake Russell. The key inputs and assumptions are provided in Appendix C to this release including Section 1 – Sampling Techniques and Data, Section 2 – Reporting of Exploration Results, Section 3 – Estimation and Reporting of Mineral Resources and Section 4 – Estimation and Reporting of Ore Reserves.

General

Mineral Resources, Ore Reserve Estimates and Exploration Targets and Results are calculated in accordance with the JORC Code. The other technical and scientific information in this release has been prepared in accordance with the Canadian regulatory requirements set out in NI 43-101 and has been reviewed on behalf of the company by Qualified Persons, as set forth above.

This release contains references to estimates of Mineral Resources and Ore Reserves.

The estimation of Mineral Resources is inherently uncertain and involves subjective judgments about many relevant factors. Mineral Resources that are not Ore Reserves do not have demonstrated economic viability. The accuracy of any such estimates is a function of the quantity and quality of available data, and of the assumptions made and judgments used in engineering and geological interpretation, which may prove to be unreliable and depend, to a certain extent, upon the analysis of drilling results and statistical inferences that may ultimately prove to be inaccurate. Mineral Resource estimates may require re-estimation based on, among other things: (i) fluctuations in the price of gold; (ii) results of drilling; (iii) results of metallurgical testing, process and other studies; (iv) changes to proposed mine plans; (v) the evaluation of mine plans subsequent to the date of any estimates; and (vi) the possible failure to receive required permits, approvals and licenses.

Forward Looking Statements

These materials prepared by Westgold Resources Limited include forward looking statements. Often, but not always, forward looking statements can generally be identified by the use of forward looking words such as "may", "will", "expect", "intend", "believe", "forecast", "predict", "plan", "estimate", "anticipate", "continue", and "guidance", or other similar words and may include, without limitation, statements regarding plans, strategies and objectives of management, anticipated production or construction commencement dates and expected costs or production outputs.

Forward looking statements inherently involve known and unknown risks, uncertainties and other factors that may cause the Company's actual results, performance and achievements to differ materially from any future results, performance or achievements. Relevant factors may include, but are not limited to, changes in commodity prices, foreign exchange fluctuations and general economic conditions, increased costs and demand for production inputs, the speculative nature of exploration and project development, including the risks of obtaining necessary licenses and permits and diminishing quantities or grades of reserves, political and social risks, changes to the regulatory framework within which the Company operates or may in the future operate, environmental conditions including extreme weather conditions, recruitment and retention of personnel, industrial relations issues and litigation.

Forward looking statements are based on the Company and its management's good faith assumptions relating to the financial, market, regulatory and other relevant environments that will exist and affect the Company's business and operations in the future. The Company does not give any assurance that the assumptions on which forward looking statements are based will prove to be correct, or that the Company's business or operations will not be affected in any material manner by these or other factors not foreseen or foreseeable by the Company or management or beyond the Company's control.

Although the Company attempts and has attempted to identify factors that would cause actual actions, events or results to differ materially from those disclosed in forward looking statements, there may be other factors that could cause actual results, performance, achievements or events not to be as anticipated, estimated or intended, and many events are beyond the reasonable control of the Company. In addition, the Company's actual results could differ materially from those anticipated in these forward looking statements as a result of the factors outlined in the "Risk Factors" section of the Company's continuous disclosure filings available on SEDAR+ or the ASX, including, in the Company's current annual report, half year report or most recent management discussion and analysis.

Accordingly, readers are cautioned not to place undue reliance on forward looking statements. Forward looking statements in these materials speak only at the date of issue. Subject to any continuing obligations under applicable law or any relevant stock exchange listing rules, in providing this information the Company does not undertake any obligation to publicly update or revise any of the forward-looking statements or to advise of any change in events, conditions or circumstances.

Appendix B – JORC 2012 Table 1– Gold Division

Section 1: Sampling Techniques and Data

(Criteria in this section apply to all succeeding sections.)

| Criteria | JORC Code Explanation | Commentary |

| Sampling techniques

Drilling techniques

Drill sample recovery |

|

|

| Logging

|

|

|

| Sub-sampling techniques and sample preparation |

|

|

| Quality of assay data and laboratory tests |

|

|

| Verification of sampling and assaying |

|

|

| Location of data points |

|

|

| Data spacing and distribution |

|

|

| Orientation of data in relation to geological structure |

|

|

| Sample security |

|

|

| Audits or reviews |

|

|

SECTION 2: REPORTING OF EXPLORATION RESULTS

(Criteria listed in the preceding section also apply to this section.)

| Criteria | JORC Code Explanation | Commentary |

| Mineral tenement and land tenure status |

|

|

| Exploration done by other parties |

|

|

| Geology |

| |

| Comet

| ||

| Reedy's

| ||

| Drill hole Information |

|

|

| Data aggregation methods |

|

|

| Relationship between mineralisation widths and intercept lengths |

|

|

| Diagrams |

|

|

| Balanced reporting |

|

|

| Other substantive exploration data |

|

|

| Further work |

|

|

SECTION 3: ESTIMATION AND REPORTING OF MINERAL RESOURCES

(Criteria listed in section 1, and where relevant in section 2, also apply to this section.)

| Criteria | JORC Code Explanation | Commentary |

| Database integrity |

|

|

| Site visits |

|

|

| Geological interpretation |

|

|

| Dimensions |

| CGO

MGO

|

| Estimation and modelling techniques. |

|

|

| Moisture |

|

|

| Cut-off parameters |

|

|

| Mining factors or assumptions |

|

|

| Metallurgical factors or assumptions |

|

|

| Environmental factors or assumptions |

|

|

| Bulk density |

|

|

| Classification |

|

|

| Audits or reviews |

|

|

| Discussion of relative accuracy/ confidence |

|

|

SECTION 4: ESTIMATION AND REPORTING OF ORE RESERVES

(Criteria listed in section 1, and where relevant in sections 2 and 3, also apply to this section.)

| Criteria | JORC Code Explanation | Commentary |

| Mineral Resource estimate for conversion to Ore Reserves |

|

|

| Site visits |

|

|

| Study status |

|

|

| Cut-off parameters |

|

|

| Mining factors or assumptions |

|

|

| Metallurgical factors or assumptions |

|

|

| Environmental |

|

|

| Infrastructure |

|

|

| Costs |

|

|

| Revenue factors |

|

|

| Market assessment |

|

|

| Economic |

|

|

| Social |

|

|

| Other |

|

|

| Classification |

|

|

| Audits or reviews |

|

|

| Discussion of relative accuracy/ confidence |

|

|

SOURCE Westgold Resources Limited

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/December2025/14/c9856.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/December2025/14/c9856.html