- WORLD EDITIONAustraliaNorth AmericaWorld

October 22, 2023

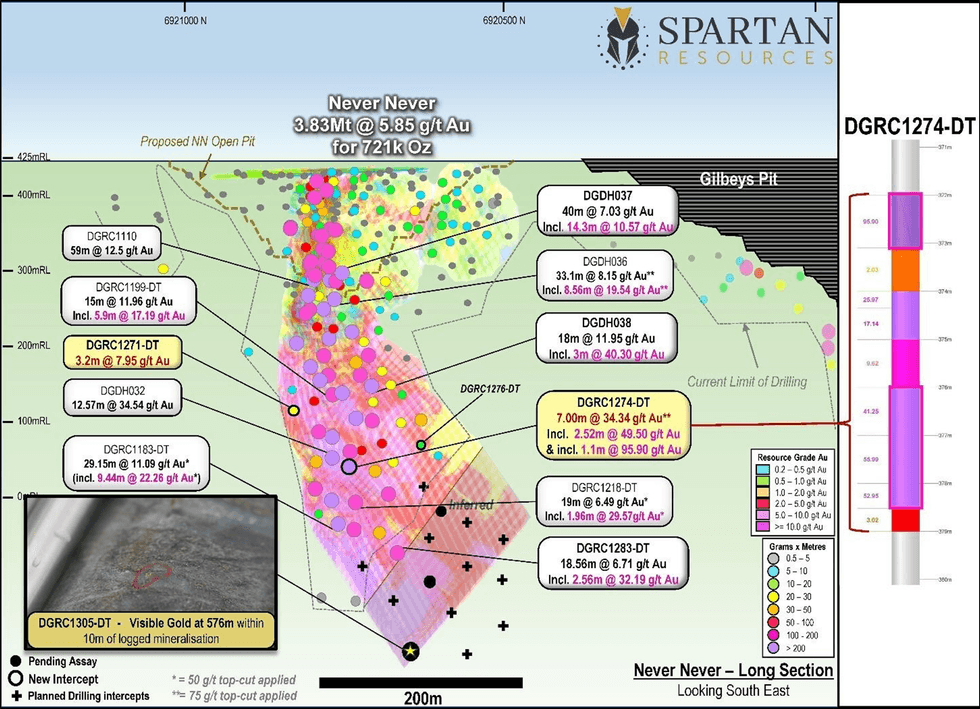

Deepest-ever intercept at 576m down-hole highlights substantial growth potential down-plunge below the current high-grade 721koz Mineral Resource

Spartan Resources Limited (“Spartan” or “Company”) (ASX: SPR) is pleased to report significant new drilling and assay information from ongoing drilling targeting the high-grade Never Never Gold Deposit at at its 100%-owned Dalgaranga Gold Project in Western Australia.

Highlights:

- Visible gold logged at 576.00m down-hole within a 10m wide mineralised zone in the deepest Never Never intercept to date in drill-hole DGRC1305-DT. Assays are expected within the next 14 days.

- The 10m intercept in DGRC1305-DT appears to be “typical” Never Never quartz-rich/fine pyrite mineralisation.

- The intercept is located 130m down-plunge of the deepest previously reported Never Never assays in drill-hole DGRC1283-DT, which returned 18.56m @ 6.71g/t, including 2.56m @ 32.19g/t, from 495.00m down-hole (see ASX: SPR release 17 October 2023)

- Ongoing diamond in-fill drilling at Never Never designed to increase confidence has returned;

- 7.00m @ 34.34g/t gold (top-cut to 75.00g/t) from 372.00m, incl. 1.00m @ 95.90g/t and 2.52m @ 49.50g/t (DGRC1274-DT)

- “Edge” diamond drilling defining the extents of the Never Never Deposit has also returned:

- 3.20m @ 7.95g/t gold from 310.30m, incl. 1.00m @ 12.29g/t (DGRC1271-DT); and

- 2.43m @ 4.89g/t gold from 377.00m (DGRC1274-DT).

- The Spartan Board has approved an increase of 7,000m and two additional rigs to the previously planned 25,000m 4-rig program. This brings total number of active rigs to six, comprising a mix of four diamond rigs and two RC rigs with a new total planned metreage of 32,000m.

- The increase in planned drilling and rigs on-site allows the Spartan geology team to:

- Accelerate planned resource diamond drilling across multiple high-grade targets, including Never Never, Four Pillars and West Winds;

- Dedicates an RC rig to the new Patient Wolf prospect for a 1,500m follow-up program; and

- Rapidly test and develop other near-surface high-grade targets.

- The acceleration of resource drilling is designed to leverage ongoing drilling success and maximise resource growth, culminating in the scheduled resource update in Q4 2023.

The recently expanded drill program (to 32,000m) is designed to accelerate targeting of extensions to known mineralisation, with the potential to further upgrade the high-grade 721,200oz Mineral Resource Estimate (MRE) for the Never Never Gold Deposit.

The expanded program and increased number of rigs also allows follow-up drilling of the recently discovered Patient Wolf gold prospect, located 1,600m north of and along-strike from the Gilbey’s/Never Never gold trend, as well as continue to test and develop a growing list of priority, near-surface, high- grade gold targets. The overall objective of the program is to grow the Company’s high-grade resource inventory within a 2km radius of the 2.5Mtpa Dalgaranga Process Plant.

Never Never Gold Deposit Update

Please Note: Visual estimates of mineral abundance should never be considered a proxy or substitute for laboratory analyses where concentrations or grades are the factor of principal economic interest. Visual estimates also potentially provide no information regarding impurities or deleterious physical properties relevant to valuations. Assays are expected withing the next 14 days.

Click here for the full ASX Release

This article includes content from Spartan Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

SPR:AU

The Conversation (0)

03 April 2024

Spartan Resources

Focused on Growing High-grade Gold Ounces in front of established infrastructure in Prolific Western Australia

Focused on Growing High-grade Gold Ounces in front of established infrastructure in Prolific Western Australia Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00