- IP Survey Outlines Several Significant Anomalies

- Exploration Target is Alkalic CU-AU Porphyry Style Mineralization

- Mal East Anomaly Highest Priority Target

Victory Resources Corporation (CSE:VR)(FRA:VR61)(OTC PINK:VRCFF) ("Victory" or the "Company") is pleased to announce that the results of the recently completed and extensive IP survey on its Mal-Wen project, located in south-central British Columbia, within the eastern belt of the Nicola Group

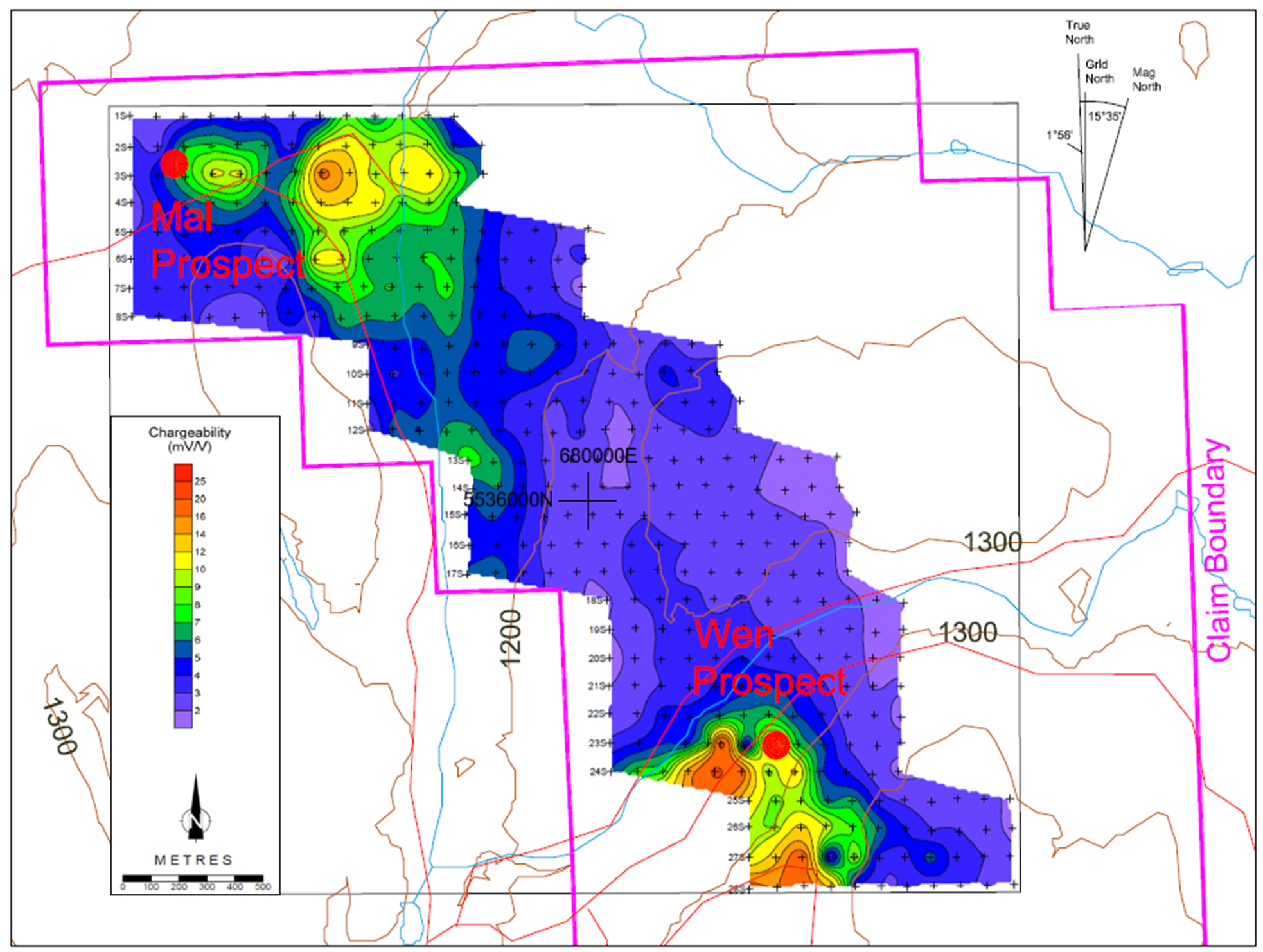

The 41.6 km IP survey, announced in November and completed in December, over the area of the Mal and Wen Prospects has outlined several significant chargeability anomalies (Figure 1 - below). The exploration target is alkalic Cu-Au Porphyry style mineralization.

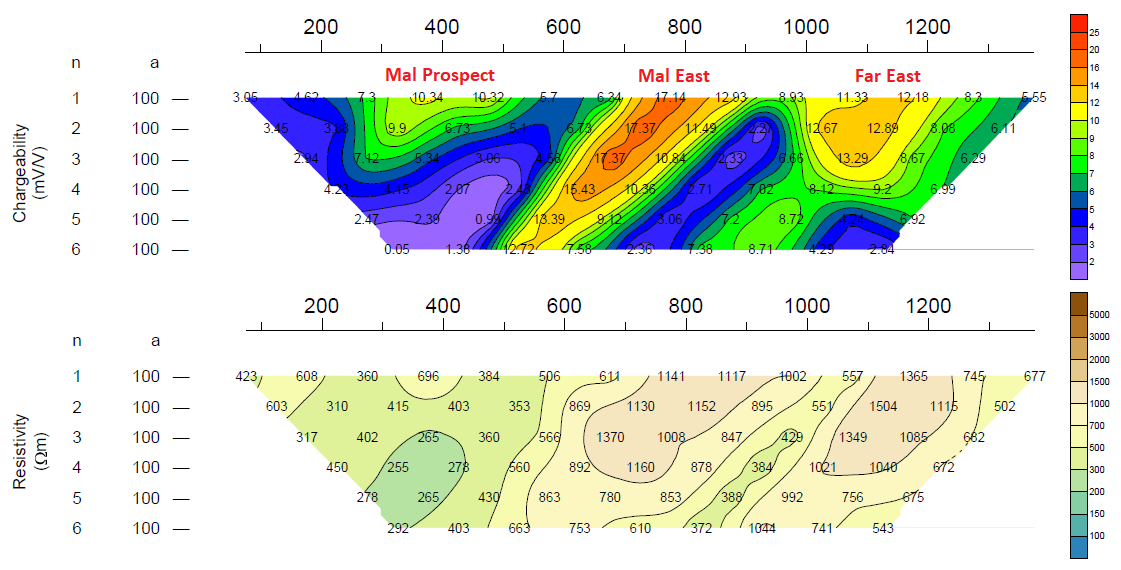

The northern anomaly (the Mal East anomaly) is the highest priority target. It features a coincident chargeability and resistivity high covering an area in excess of 500 m by 500 m in an area with little outcrop. The nature of the anomaly is similar to that associated with the Mal Prospect (approximately 500 m to the west), but considerably larger and stronger (Figure 2).

To the south, in the area of the Wen Prospect, are a pair of chargeability anomalies. The southernmost anomaly appears to be related to the mudstones mapped in that area. However, the chargeability high to the west of the Wen Prospect (the Wen West anomaly) is in an area of no outcrop and has a similar chargeability/resistivity response as the Wen Zone mineralization, though considerably larger and stronger.

None of these anomalies have been drill tested. An inversion will be performed on the data to provide more accurate drill targeting. An application to drill has been submitted and it is expected a permit will be granted by the spring.

"In light of earlier work by Victory, which determined that the Mal and Wen Prospects are essentially similar Cu-Au bearing zones that appear to be structurally linked, the Mal East IP anomaly is an excellent drill target in an area with little outcrop and no previous drilling. Similarly, the large chargeability anomaly west of the Wen Prospect is also in an area of sparse outcrop and has never been drill tested," noted Victory President and CEO, Mr. Mark Ireton.

About The Mal-Wen Exploration Property

The Mal-Wen Property consists of 7 mineral claims with a total area of 1205.97 hectares that is located about 30 km southeast of Merritt in south-central British Columbia. The Mal-Wen Property is within the eastern belt of the Nicola Group, in south-central BC, which hosts numerous alkalic porphyry deposits, including the presently producing New Afton Mine and past producers Ajax and Copper Mountain. The Mal and Wen Prospects may be peripheral expressions of a larger mineralized system that is mostly covered by overburden.

Figure 1: Mal-Wen chargeability map.

Figure 2: Mal to Mal East chargeability/resistivity pseudosection.

Scientific and technical information contained in this press release was reviewed and approved by Mr. Helgi Sigurgeirson, Victory Geologist, and a "qualified person" under NI 43-101.

For further information, please contact:

Mark Ireton, President

Telephone: +1 (236) 317 2822 or TOLL FREE 1 (855) 665-GOLD (4653)

E-mail: IR@victoryresourcescorp.com

About Victory Resources Corporation

Victory Resources Corporation (CSE:VR) is a publicly traded diversified investment corporation with mineral interests in North America. The Company is also actively seeking other exploration opportunities.

Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward Looking Statements

Certain information set forth in this news release may contain forward-looking statements that involve substantial known and unknown risks and uncertainties. All statements other than statements of historical fact are forward-looking statements, including, without limitation, statements regarding future financial position, business strategy, use of proceeds, corporate vision, proposed acquisitions, partnerships, joint-ventures and strategic alliances and co-operations, budgets, cost and plans and objectives of or involving the Company. Such forward-looking information reflects management's current beliefs and is based on information currently available to management. Often, but not always, forward-looking statements can be identified by the use of words such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "predicts", "intends", "targets", "aims", "anticipates" or "believes" or variations (including negative variations) of such words and phrases or may be identified by statements to the effect that certain actions "may", "could", "should", "would", "might" or "will" be taken, occur or be achieved. A number of known and unknown risks, uncertainties and other factors may cause the actual results or performance to materially differ from any future results or performance expressed or implied by the forward-looking information. These forward-looking statements are subject to numerous risks and uncertainties, certain of which are beyond the control of the Company including, but not limited to, the impact of general economic conditions, industry conditions and dependence upon regulatory approvals. Readers are cautioned that the assumptions used in the preparation of such information, although considered reasonable at the time of preparation, may prove to be imprecise and, as such, undue reliance should not be placed on forward-looking statements. The Company does not assume any obligation to update or revise its forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by securities laws.

SOURCE: Victory Resources Corp.

View source version on accesswire.com:

https://www.accesswire.com/684478/Victory-Announces-Mal-Wen-IP-Survey-Results