February 26, 2023

Commenting on Orroroo results, Executive Chairman Ben Phillips states: “We are excited by the results of the downhole geophysical survey and cannot understate the implications this has for the potential of a greenfields discovery in the Walloway basin. Typically, sandstone uranium mineralisation is hosted in flat and planar tabular bodies close to surface, and as a consequence, the best discoveries typically occur early in the life cycle of defining a new fertile sedimentary basin. We have rapidly and successfully confirmed the potential of the Walloway via the novel approach of reviewing gamma anomalies in historical wells drilled by the oil and gas industry, and overlooked by the minerals industry. Norfolk have 100% ownership of a very large basin area in Australia’s leading uranium resource state. Norfolk has presented favourable uranium occurrences at depths potentially suitable for in-situ extraction technology. We look forward to working with our stakeholders to accelerate our exploration efforts, leveraging modern geophysics for rapid delineation of potential paleochannels followed by high-impact drilling.”

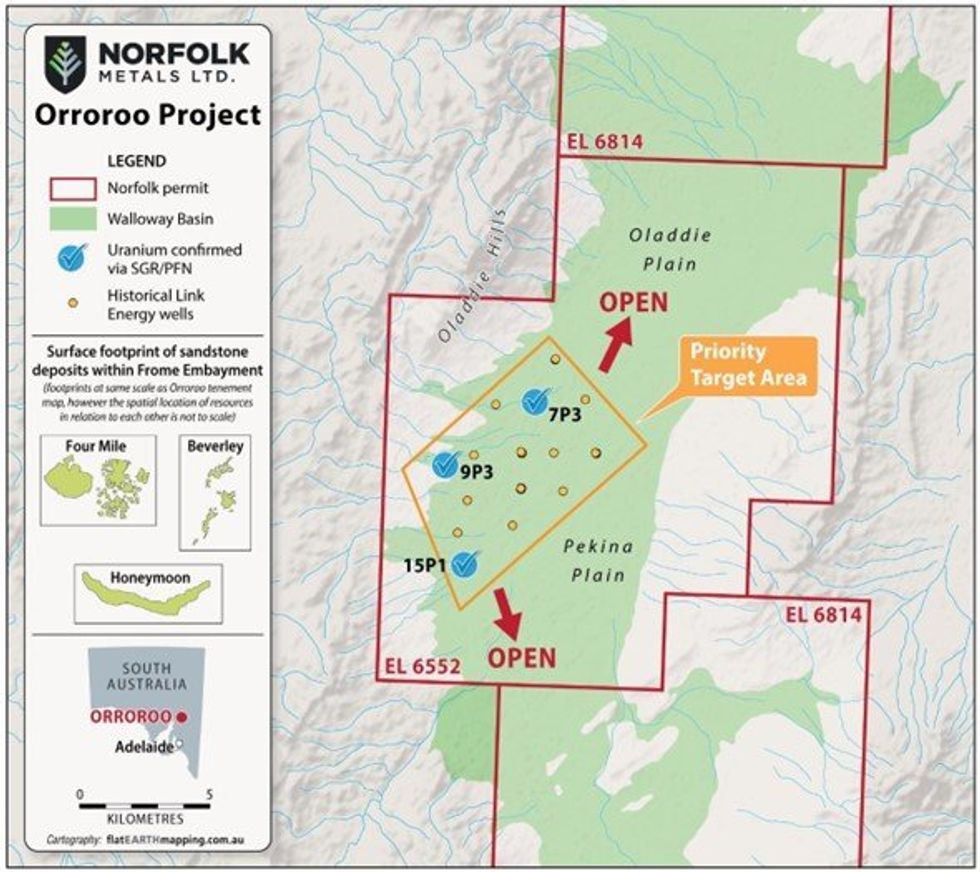

- Norfolk Metals LimitedMetals Limited succeeds in confirming uranium occurrences at three targets tested (via PFN or Spectral Gamma) in the Walloway Basin providing important proof of concept for the prospectivity of the Walloway Basin for sediment hosted uranium deposits.

- These early results are considered significant and demonstrate the potential to unlock a new uranium province in South Australia, a leading jurisdiction for the discovery and development of world-class sandstone hosted uranium deposits (e.g. Beverley, Four Mile and Honeymoon).

- The downhole geophysical survey in historical exploration wells (undertaken by Linc Energy) returned a peak uranium reading of 650ppm pU3O8 within an interval of 192ppm pU3O8 over 0.5m from 112.59m via PFN survey in well 7P3.

- Depths of confirmed uranium occurrences at 100-113m are potentially suitable for proven in-situ recovery methods1.

- Confirmed uranium occurrences are located over 5km apart with remainder of the basin untested for uranium (well 15P1 to 7P3). The Company’s previous understanding of the extent of uranium occurrences, is limited to historical drilling by Linc Energy.

- The Walloway Basin has never been explored for uranium despite being the same age as sediments of the Frome Embayment which is host to Beverley, Four Mile and Honeymoon uranium resources.

- Norfolk Metals is a first-mover in the Walloway Basin and controls 100% interest in two exploration licences covering 659 square kilometres.

- The Company plans to accelerate exploration to a campaign of geophysics and roadside drilling to rapidly follow up on these initial results and target potential roll-front style uranium mineralisation.

Orroroo Exploration

Downhole Geophysical Survey Summary

Norfolk is pleased to report the downhole geophysical survey conducted at the Orroroo Project has been completed. Spectral Gamma and Prompt Fission Neutron (PFN) well logs recorded during the survey will be utilised for further exploration planning; however, at this stage the program is considered successful having confirmed the following;

1. Uranium occurrences in all three target zones (wells) of which the depths are potentially suitable for proven in-situ recovery methods (refer to reference 1. on page 1 of this announcement)

2. Uranium peak reported at 650ppm pU3O8 within an interval of 192ppm pU3O8 over 0.5m from 112.59m via PFN in well 7P3; and,

3. Uranium recorded from this survey at expected target depths obtained from historical holes supports the proposed “oxidised tails or interface zones” of roll-front uranium style mineralisation theory proposed by the Norfolk geology team.

Click here for the full ASX Release

This article includes content from Norfolk Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

03 August 2021

Norfolk Metals

ASX-listed uranium explorer

ASX-listed uranium explorer Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00