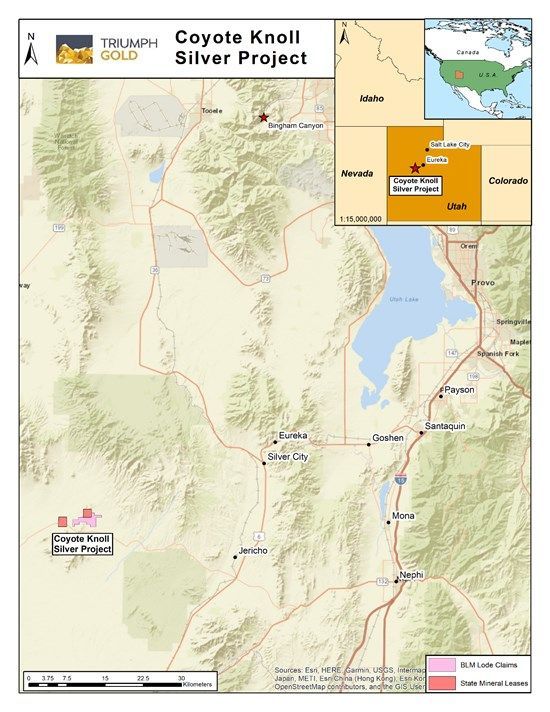

triumph gold Corp. (TSXV: TIG) (OTC Pink: TIGCF) (FSE: 8N6) ("triumph gold" or the "Company") is pleased to announce the acquisition of the Coyote Knoll Silver (Ag Gold (Au) Property, located in central Utah, approximately 40 km southwest of the prolific Tintic Mining District (Figure 1).

triumph gold has entered into an agreement to purchase the Coyote Knoll Silver-Gold property for the sum of $150,000USD and the issuance of one million common shares of the Company. Prior to one year from the date of purchase, one million common shares shall be issued to the seller; prior to two years from the date of purchase one million common shares will be issued; prior to three years from the date of purchase one million common shares shall be issued to the seller. Before four years from the date of purchase a three million dollar payment in cash or shares will be made to the seller.

Highlights:

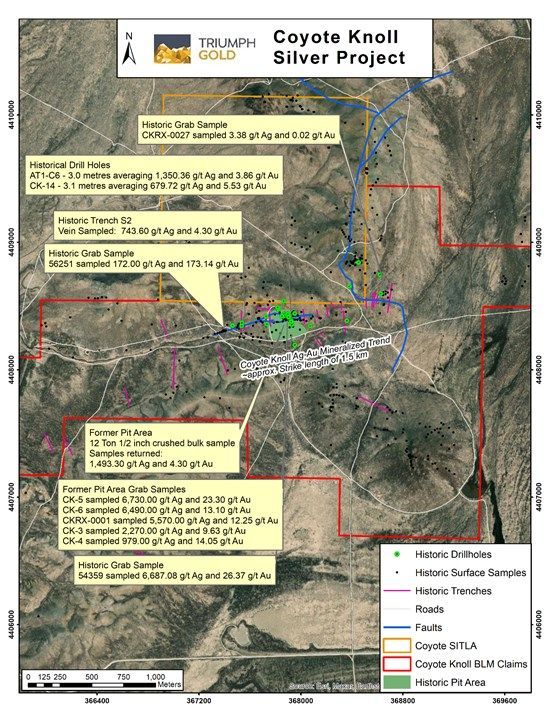

- Approximately 2,600 metres of RC drilling have been completed, highlighted by 1,350.36 g/t Ag and 3.86 g/t Au over 3.00 metres in ATC-C6 (Table 1 & 2 and Figure 2)NI 43-101 Disclosure 1.

- Historical rock samples returned silver and gold values, up to 6,730.00 g/t Ag and 23.30 g/t Au (Table 2)NI 43-101 Disclosure 2.

- Two east-west parallel veins were identified through reverse circulation (RC) drilling and exposed during mining.

- Recent surface sampling confirmed silver and gold mineralization, with grab samples returning up to 795 g/t Ag and 1.58 g/t Au (Table 4)NI 43-101 Disclosure 2.

- In 2012, a 12-ton representative bulk sample returned an average grade of 43.60 oz/ton silver and 0.13 oz/ton goldNI 43-101 Disclosure 3.

- In 1998 Phoenix Gold Resources shipped Coyote Knoll ore to Clifton Mining's mill at Gold Hill where a 1,000 ounces of silver doré was producedNI 43-101 Disclosure 4.

- A second mineralized structure, trending northwest-southeast, has been identified through surface sampling and RC drilling.

John Anderson, Chairman and CEO of triumph gold, stated:

"The Coyote Knoll acquisition represents an exciting addition to our portfolio. Located in a mining-friendly and historically significant region, the property demonstrates high-grade silver mineralization and favorable geological features, similar to those found in the Tintic Mining District. With the confirmation of epithermal silver-gold mineralization and the potential for further discovery, we look forward to advancing exploration at Coyote Knoll."

Figure 1. Coyote Knoll property location map.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5125/254408_c03b07c774e7e8a6_001full.jpg

Figure 2. Coyote Knoll drill and sample highlights.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5125/254408_c03b07c774e7e8a6_002full.jpg

Location and Geological Overview:

Coyote Knoll is located in central Utah, approximately 85 km south of Bingham Canyon Cu-Mo-Au Porphyry deposit and 40 km southwest of the city of Eureka. Eureka is historically associated with the Tintic Mining District, which has been a major producer of gold, silver, lead, and zinc from both epithermal and Carbonate Replacement Deposits (CRD). The Tintic District is known for its productive mining history and the potential for undiscovered porphyry systems.

Coyote Knoll was discovered in 1988, with subsequent exploration activities including mapping, trenching, rock sampling, and induced polarization and magnetic geophysical surveys. Follow-up work also included near-surface Reverse Circulation RC-drilling, totaling 2,606.96 metres across 33 drill holes. Highlights from historical drilling are summarized in Table 1 & 2, and surface samples are highlighted in Table 3. A 12-ton representative bulk sample was also mined from a shallow open pit, centered over the east-west (70°) trending mineralized structure. Silver and gold epithermal mineralization was exposed over approximately 60 metres within the open pit and has been delineated for 1.5 km through surface trenching, sampling, and shallow RC drilling (Figure 2).

Table 1. Historic RC drilling composite highlights

| Hole-ID | From (m) | To (m) | Interval (m) | Ag g/t | Au g/t |

| AT1-C6 | 54.10 | 57.10 | 3.00 | 1350.36 | 3.86 |

| CK-10 | 68.60 | 74.70 | 6.10 | 114.84 | 0.12 |

| AT1-C5 | 49.80 | 54.30 | 4.50 | 99.37 | 0.40 |

| CK-1 | 27.40 | 32.00 | 4.60 | 68.89 | 0.09 |

| CK-10 | 51.80 | 54.90 | 3.10 | 67.81 | 0.38 |

| CK-10 | 61.00 | 64.00 | 3.00 | 38.50 | 0.08 |

| CK-2 | 36.60 | 39.60 | 3.00 | 60.00 | 0.18 |

| CK-2 | 53.30 | 57.90 | 4.60 | 39.04 | 0.09 |

| CK-15 | 21.30 | 24.40 | 3.10 | 40.39 | 0.07 |

NI 43-101 Disclosure 1.

*Composites grades were calculated using Datashed software with >25 g/t Ag cutoff and

Table 2. Historical drill attributes for Table 1 highlights.

| Hole-ID | Easting | Northing | Elevation (m) | Depth (m) | Azimuth | Dip |

| AT1-C5 | 367,889 | 4,408,432 | 1,622 | 76 | - | -90 |

| AT1-C6 | 367,897 | 4,408,436 | 1,621 | 75 | - | -90 |

| CK-1 | 367,904 | 4,408,411 | 1,613 | 80 | 170 | -60 |

| CK-2 | 367,910 | 4,408,421 | 1,616 | 87 | - | -90 |

| CK-10 | 367,951 | 4,408,442 | 1,624 | 110 | - | -90 |

NI 43-101 Disclosure 1.

Two additional historical drill holes (CK-141. and CK-232.) have previously been reported to contain high gold values and are in proximity to the open pit. CK-14 has an intercept of 8.19g/t Au and 1,060g/t Ag over 1.52 m from 9.14 m downhole. CK-23 has an intercept of 2g/t Au and 814g/t Ag over 1.52 m from 45.72 m downhole.

- Freeport-McMoRan Gold Company, 1989-1990; Reverse Circulation Drill Hole CK-14; from NI 43-101 Technical Report on the Coyote Mine Project Juab County, Utah, USA, Arthur J. Mendenhall.

- Freeport-McMoRan Gold Company, 1989-1990; Reverse Circulation Drill Hole CK-23; from NI 43-101 Technical Report on the Coyote Mine Project Juab County, Utah, USA, Arthur J. Mendenhall.

Table 3. Historic rock sample highlights

| Sample-ID | Easting | Northing | Ag g/t | Au g/t |

| CK-5 | 367,870 | 4,408,430 | 6730.00 | 23.30 |

| 54359 | 367,924 | 4,408,270 | 6687.08 | 26.37 |

| CK-6 | 367,870 | 4,408,430 | 6490.00 | 13.10 |

| CKRX-0001 | 367,928 | 4,408,377 | 5570.00 | 12.25 |

| CK-3 | 367,870 | 4,408,430 | 2270.00 | 9.63 |

| 48396 | 367,884 | 4,408,389 | 1673.83 | 7.30 |

| 48395 | 367,933 | 4,408,423 | 1638.86 | 0.51 |

| 48382 | 367,927 | 4,408,360 | 1086.86 | 6.03 |

| CK-4 | 367,870 | 4,408,430 | 979.00 | 14.05 |

| 48380 | 367,911 | 4,408,333 | 600.69 | 1.03 |

| 54354 | 367,858 | 4,408,379 | 370.97 | 0.31 |

| 56251 | 367,411 | 4,408,309 | 172.00 | 173.14 |

| CKRX-0027 | 368,645 | 4,408,585 | 3.38 | 0.02 |

NI 43-101 Disclosure 2.

While Coyote Knoll is approximately 40 km southwest of the Tintic District the geological setting at Coyote Knoll exhibits similarities to the Tintic Mining District. Where precious metal epithermal veins at the Trixie Mine are formed within faulted quartzites and the Burgin and Tintic Standard mines are hosted in carbonate-rich stratigraphy forming CRD. During the March site visit, the Company also toured the high-grade Trixie Gold Mine to gain further insight into the regional geological setting of the Tintic Mining District. At Coyote Knoll, epithermal mineralization is located along the margin a large volcanic caldera hosting a granitic center. Veining crosscuts quartzite, carbonate-rich stratigraphy and volcanic flows. This provides an encouraging framework for the exploration of both epithermal veins and potential carbonate replacement mineralization at Coyote Knoll.

Fieldwork conducted during a March 2025 site visit confirmed the presence of epithermal-style mineralization with key geological features including:

- Silica-flooded pebble clastic fault breccia (pebble dyke), jasperoid, and chalcedony vein infill hosted within faulted quartzite.

- Mineralization consisted of native silver and silver sulphide "sulfosalt" minerals.

- Secondary northwest-trending epithermal veining represented by quartz-carbonate and jasperoid infill. This trend contains anomalous silver and elevated pathfinder elements such as arsenic (As), copper (Cu), lead (Pb), antimony (Sb), and zinc (Zn) (Table 4).

Table 4. Coyote Knoll grab sample results (March 2025 site visit)

| Sample-ID | Easting | Northing | Ag g/t | Au g/t | As ppm | Cu ppm | Pb ppm | Sb ppm | Zn ppm |

| A001051 | 367,537 | 4,408,331 | 1.23 | 25.40 | 8.90 | 11.80 | 0.85 | 4.00 | |

| A001052 | 367,905 | 4,408,383 | 0.22 | 364.00 | 9.60 | 4.50 | 2.27 | 47.00 | |

| A001053 | 367,874 | 4,408,395 | 0.31 | 207.00 | 21.50 | 11.50 | 2.61 | 147.00 | |

| A001054 | 367,839 | 4,408,395 | 795.00 | 1.58 | 61.40 | 68.40 | 177.50 | 67.60 | 24.00 |

| A001055 | 367,787 | 4,408,386 | 20.70 | 0.06 | 431.00 | 45.30 | 31.70 | 7.98 | 122.00 |

| A001056 | 368,438 | 4,408,853 | 1.23 | 29.70 | 6.60 | 9.60 | 2.85 | 8.00 | |

| A001057 | 368,424 | 4,408,894 | 0.25 | 11.40 | 19.40 | 1.80 | 0.31 | 12.00 | |

| A001061 | 367,891 | 4,408,372 | 1.86 | 381.00 | 82.80 | 38.70 | 19.65 | 36.00 | |

| A001062 | 367,898 | 4,408,367 | 1.87 | 66.30 | 27.40 | 22.40 | 1.00 | 7.00 |

NI 43-101 Disclosure 2.

National Instrument 43-101 Disclosure

The technical content of this news release has been reviewed and approved by triumph gold's Principal Geologist Marty Henning, P.Geo., a "Qualified Person" as defined in National Instrument 43-101 - Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators ("NI 43-101"). He verified the data collected during the March 2025 site visit, including sampling, analytical and test data, and the underlying technical information in this news release.

The historical data presented in this release has not been verified for accuracy and reliability with the use of current quality assurance, quality control, or chain of custody standards current with NI 43-101 best practices. See the following disclaimers for additional details.

- The Company has not done sufficient work to classify the historical drilling information as current to NI 43-101 and is not treating the historical drilling disclosure as a current mineral estimate. Historical drilling database has not been verified for accuracy or quality. The reported historical values in this release require verification through additional exploration drilling, twinned holes will be used to verify style, grade and widths of mineralization.

- Grab samples are from select surface material and may not represent true underlying mineralization and drilling is required to confirm mineralization width and grade continuity below surface. Additional sampling is required to verify historical rock sample database.

- The 12-ton bulk sample reported in 2012 has not been verified for accuracy or quality control and therefore the reported tonnage and grades are not considered a 43-101 mineral resource estimate or a pre-feasibility study. Additional exploration drilling and metallurgical studies are required to verify tonnage and concentrations of silver and gold contained beneath the mined-out area. The bulk sample values are provided to illustrate the presence of surface mineralization.

- The 1,000 ounces of silver doré, produced in 1998 reported by Phoenix Gold Resources has not been verified. This information is not considered a mineral resource estimate as there were no reported head grades or tonnage provided. Additional drilling and metallurgical studies are required to verify width, strike and plunge of the surface mineralization reported from the open pit operation at Coyote Knoll. This bulk sample information is provided to illustrate the presence of surface mineralization.

Rock samples collected during the site were located using a handheld GPS, material was sealed in heavy poly ore sample bags with a representative sample retained for future inspection. Samples were placed into a 5-gal pail and shipped to ALS Vancouver for analyses. Samples were crushed, split and pulverized using PREP-31 specifications and analyses was completed using ME-GRA22 for Ag and Au as well as ME-MS41 for a multielement output utilizing an aqua regia digest, over limit elements (Ag, Cu and Pb) were analyzed using OG46.

About triumph gold Corp.

triumph gold is a Canadian based, growth-oriented exploration and development company with a district scale land package in mining friendly Yukon. Led by an experienced management and technical team, The Company is focused on actively advancing their flagship Freegold Mountain Project using multidiscipline exploration and evaluation techniques. The Company acknowledges the Freegold Mountain, Tad Toro and Big Creek properties are situated within the traditional territory of the Little Salmon Carmack and Selkirk Nations. triumph gold is committed to ongoing engagement with local communities through communication, environmental stewardship, and local employment.

The road-accessible Freegold Mountain Project, located in the Dawson Range Au-Cu Belt, is host to three NI 43-101 Mineral Deposits (Nucleus, Revenue, and Tinta Hill). The Project is 200 square kilometers and covers an extensive section of the Big Creek Fault Zone, a structure directly related to epithermal gold and silver mineralization as well as gold-rich porphyry copper mineralization.

The Company owns 100% of the Big Creek and Tad/Toro gold-silver-copper properties situated along strike of the Freegold Mountain Project within the Dawson Range.

The Company also owns 100% of the Andalusite Peak copper-gold property, situated 36 km southeast of Dease Lake within the Stikine Range in British Columbia. The Company acknowledges the Andalusite Peak property project is situated within the traditional territory of the Tahltan Nation. triumph gold is committed to ongoing engagement with local communities through communication, environmental stewardship, and local employment.

On behalf of the Board of Directors,

Signed "John Anderson"

John Anderson, Executive Chairman

For further information about triumph gold, please contact:

John Anderson, Executive Chairman

triumph gold Corp.

(604) 218-7400

janderson@triumphgoldcorp.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains forward-looking information, which involves known and unknown risks, uncertainties and other factors that may cause actual events to differ materially from current expectation. Important factors - including the availability of funds, the results of financing efforts, the completion of due diligence and the results of exploration activities - that could cause actual results to differ materially from the Company's expectations are disclosed in the Company's documents filed from time to time on SEDAR+ (see www.sedarplus.ca). Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. The company disclaims any intention or obligation, except to the extent required by law, to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/254408