September 29, 2024

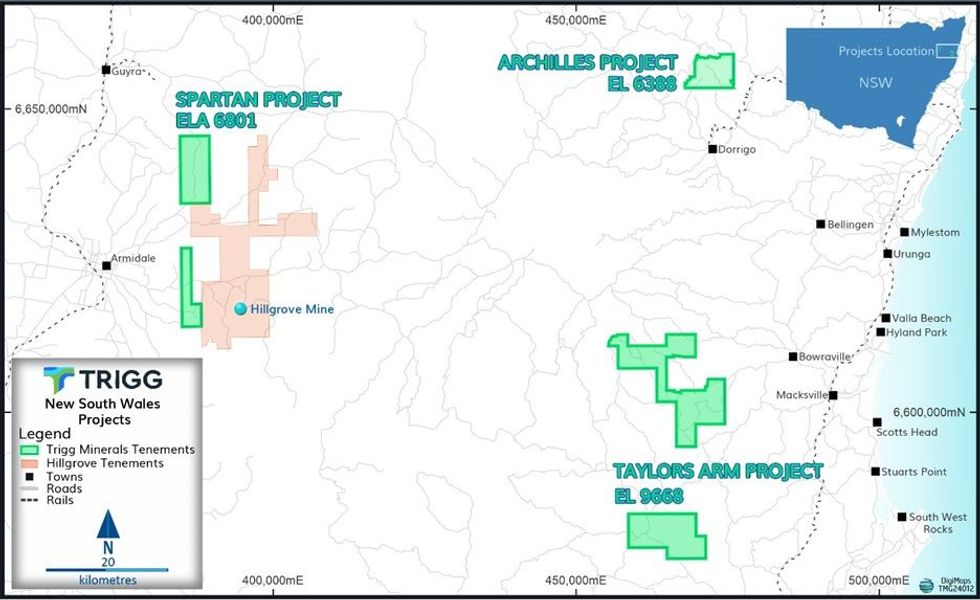

Trigg Minerals Limited (ASX: TMG) ("Trigg" or the "Company") is pleased to announce it has signed a binding purchase agreement (Sale Agreement) with private company Anchor Resources Pty Limited (Anchor Resources), to acquire the Achilles Antimony Project (Achilles) in northern New South Wales (Figure 1).

HIGHLIGHTS

- Trigg signs purchase agreement to acquire the 100% of the Achilles project which contains the globally significant high-grade and high-tonnage Wild Cattle Creek (WCC) Antimony Deposit.

- The WCC deposit is Australia highest grade undeveloped Antimony deposit and ranks among the highest-grade antimony deposits globally1.

- Significant intersections recorded by historical owners of the project include (refer to Table 2 for full results):

- 10.7m at 14.24% Sb

- 18.7m at 4.5% Sb from including 5.2m at G.8% Sb

- 10.8m at G.28% Sb

- 51.2m at 1.7% Sb including 5.5m at 4.8% Sb

- 22.5m at 3.G% Sb

- 12m at 4.3% Sb

- 10m at 5.1% Sb

- The WCC deposit is the second-largest antimony deposit1 in New South Wales, after Hillgrove, with a resource of 610 kt at 2.56% Sb, containing 15,600 tonnes of antimony. This estimate is based on a high cut-off grade of 1%, reported in accordance with JORC 2012 standards.

- Numerous ultra-high-grade drill intersections grading up to 14.45% Sb have been confirmed beyond the existing JORC resource indicating significant resource upgrades.

- The deposit is enriched from surface and open down plunge hosted by an 6km long largely untested structure.

- Historical metallurgy showed ultra-high antimony recoveries of over 95% are achievable from the WCC deposit through a low-cost conventional milling and flotation technique.

- Trigg post completion will progress further exploration for resource expansion at the WCC deposit while simultaneously advancing it’s 100% owned Taylors Arm antimony project which contains Australia’s highest ever recorded antimony grade at 63% Sb.

- 100% non-cash transaction allows Trigg to preserve its healthy cash balance for value adding exploration.

The Achilles Project hosts the globally significant high grade and high tonnage Wild Cattle Creek antimony deposit, with a JORC 2012-compliant Mineral Resource Estimate (MRE) of 610,000 tonnes at 2.56% Sb, containing 15,600 tonnes of antimony (Indicated and Inferred categories). In addition to antimony, the deposit is enriched with tungsten and gold.

Discovered in the 1890s, the project has historically produced antimony ore during several periods of operation since then, with grades up to 46% Sb reported. Anchor Resources completed the most recent work on the project from 2005 to 2016 when it completed 23 drill holes, two resource estimation studies, orientation soil geochemistry, water and noise monitoring surveys, and sponsored university research into the genesis of the Wild Cattle Creek deposit.

Trigg Minerals Executive Chair Timothy Morrison said, "Acquiring the Achilles Project, including the Wild Cattle Creek antimony deposit, is a significant bolstering of our existing portfolio and provides Trigg Minerals with an advanced project with a JORC resource and plenty of exploration upside in and around the resource. Adding to our recent acquisitions of the Taylors Arms and Spartan antimony projects, we expect Achilles to be our flagship, given its advanced state. This acquisition positions Trigg as a globally significant player in the rush to secure Antinomy supply"

PROJECT OVERVIEW

The Achilles exploration licence (EL 6388) is 40km west of Coffs Harbour, northeast New South Wales and ~11km north of Dorrigo. The Project contains the Wild Cattle Creek antimony deposit, Australia's second-largest antimony deposit after Hillgrove2 in New South Wales, with the potential for further significant expansion through ongoing exploration.

Geology

The Wild Cattle Creek deposit is in the Coffs Harbour Block of the New England Orogen, within a Late Carboniferous turbidite sequence dominated by siltstone (the Brooklana Beds). These sediments have undergone multiple deformations, regional metamorphism (up to biotite grade), and granitoid intrusions. The block is interpreted as an accretionary prism with subduction-related metamorphism dated at 318 ± 8 Ma. Mineralisation at Wild Cattle Creek is like the nearby Hillgrove antimony-gold deposit, located 80 km to the west-southwest and currently held by Larvotto Resources (ASX: LRV). Wild Cattle Creek is one of approximately 235 antimony occurrences in the New England region of New South Wales.

Click here for the full ASX Release

This article includes content from Trigg Minerals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Sign up to get your FREE

Trigg Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

12 November 2025

Trigg Minerals

Developing America’s next sources of antimony and tungsten – critical minerals essential for defence, energy and advanced technologies.

Developing America’s next sources of antimony and tungsten – critical minerals essential for defence, energy and advanced technologies. Keep Reading...

Latest News

Sign up to get your FREE

Trigg Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00