Tinka Resources Limited ("Tinka" or the "Company") (TSXV:TK)(BVL:TK)(OTCQB:TKRFF) is pleased to announce results for five recent drill holes from the Ayawilca Project and to provide an update on the Company's exploration activities. All five drill holes were resource confirmation holes from West Ayawilca, and all intersected strong zinc mineralization. The Company has now successfully completed its 11,000-metre drill program at Ayawilca which commenced midway through 2022. Two drill rigs were demobilized during May 2023 and independent mining consultants have now been engaged to complete an updated mineral resource estimate

The 2022-23 drill program has significantly improved the geological model of the mineralized zinc bodies at West and South Ayawilca and improved the confidence in the continuity of mineralization. One exploration hole at South Ayawilca has results pending. The next steps for the project include an updated resource estimate to be announced during Q3 2023 and the continuation of low impact exploration.

Key Highlights - Drill hole results from West Ayawilca:

Hole A23-216

- 97.9 metres at 8.8% zinc and 16 g/t silver from 197.90 metres depth, including

- 35.8 metres at 19.0% zinc and 35 g/t silver from 260.0 metres depth, including

- 13.5 metres at 25.3% zinc and 44 g/t silver from 265.5 metres depth.

- 35.8 metres at 19.0% zinc and 35 g/t silver from 260.0 metres depth, including

Hole A23-217

- 71.9 metres at 5.5% zinc and 8 g/t silver from 186.1 metres depth, including

- 45.8 metres at 6.4% zinc and 10 g/t silver from 210.4 metres depth, including

- 4.85 metres at 15.2% zinc and 23 g/t silver from 210.4 metres depth.

- 45.8 metres at 6.4% zinc and 10 g/t silver from 210.4 metres depth, including

Hole A23-213

- 30.4 metres at 6.0% zinc from 180.0 metres depth, including

- 1.2 metres at 37.2% zinc from 207.3 metres depth, and

- 30.5 metres at 5.1% zinc from 260.0 metres depth.

Hole A22-211

- 38.15 metres at 6.3% zinc, 1.1% lead and 28 g/t silver from 151.0 metres depth, including

- 6.6 metres at 9.2% zinc, 5.2% lead and 81 g/t silver from 182.55 metres depth.

Hole A22-214

- 13.1 metres at 3.7% zinc from 243.9 metres depth

True thicknesses of these intercepts are estimated to be at least 75% of the downhole thicknesses.

Dr. Graham Carman, Tinka's President and CEO, stated: "The 2022-23 drill program has been one of the most successful drill programs since Tinka began exploring at Ayawilca. The latest results highlight the quality of the zinc mineralization at Ayawilca in terms of both grade and thickness and provide strong confidence in the geological resource."

"We have confirmed at West Ayawilca that two pipe-like sulphide bodies hosted by brecciated limestones extend through the 100-200-metre-thick limestones and are connected by massive sulphides at the base. At South Ayawilca, very high-grade massive sulphide zinc mineralization is concentrated in a folded limestone at shallower depth - this discovery has the potential to be a ‘starter mine' which could provide early payback."

"Our contention that Ayawilca is one of the best zinc exploration and development projects in the Americas has been reinforced by the recent drill program. I wish to thank our staff, our stakeholders at the project and our drilling contractor for their hard work which has enabled this drill program to be successfully completed. We now look forward to the mineral resource update for the Ayawilca Zinc Zone and Tin Zone deposits, which will be released during Q3 2023. In the meantime, low impact exploration is continuing at Ayawilca and at our nearby Silvia copper-gold project."

Discussion - Geology of the Zinc Zone Deposits at Ayawilca

A total of 11,115 metres were drilled in 33 holes at Ayawilca during the 2022-23 drill program (see Figure 1). Around 90% of the drill holes were focused at West and South Ayawilca for resource confirmation and definition purposes. Two holes were also drilled at Central Ayawilca for the dual purposes of exploration and a hydrological study.

The 2022-23 drill program has considerably improved our understanding of the geology of the Ayawilca Zinc Zone and improved the confidence in the geometry of the mineralized bodies at West and South. Two of the most important conclusions from the drilling include:

- At West Ayawilca, two pipe-like zinc sulphide bodies hosted by brecciated limestones extend through the 100- to 200-metre-thick limestone sequence along a northwest-southeast trend and are connected by massive sulphide mineralization at the base of the limestone;

- At South Ayawilca, very high-grade massive sulphide zinc mineralization is concentrated within a tightly folded limestone at relatively shallow depth - this discovery has the potential to be a ‘starter mine' which could provide early payback of capital.

West Ayawilca

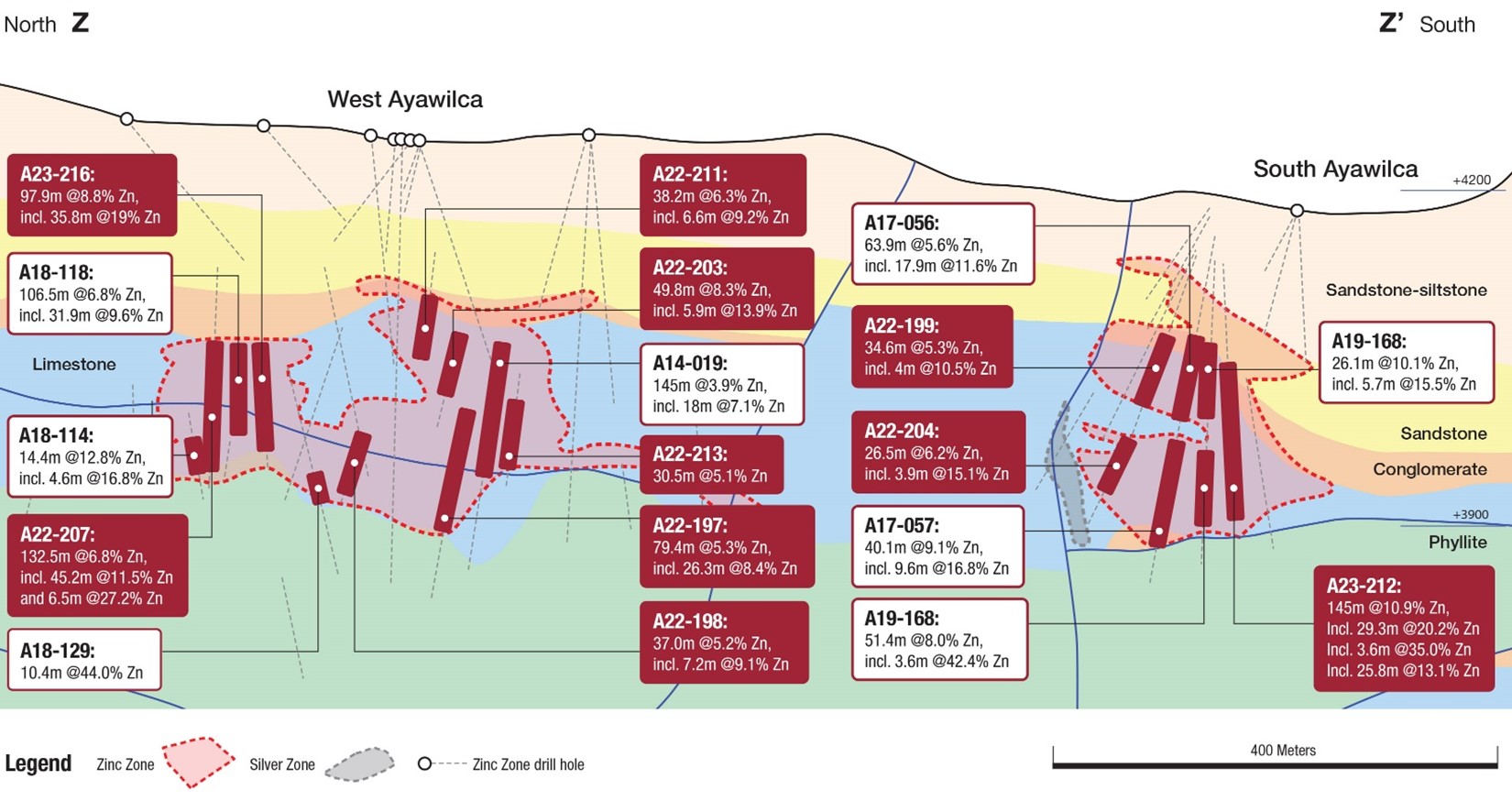

The footprint of the zinc mineralization hosted by limestones at West Ayawilca covers an area of approximately 700 metres by 300 metres projected to surface (see Figure 1). Drilling in 2022-23 focused on defining the geometry of two pipe-like breccia bodies which host continuous, semi-massive sulphide (SMS) mineralization within the limestone. The breccia bodies have surface dimensions of between 100 to 200 metres and are elongated along a northwest-southeast direction. Zinc mineralization extends over a vertical thickness of between 100 to 150 metres through the entire brecciated limestone sequence up to the overlying sandstones. The breccia bodies are connected by massive sulphide (MS) zinc mineralization at the base of the limestone.

Zinc sulphide (as sphalerite) is the dominant economic mineralization. Silver and lead (as silver sulphosalts and galena) is typically more common around the edges of the zinc bodies and in carbonate-rich veins. Iron sulphides are common including pyrite, marcasite, and pyrrhotite. Carbonate (siderite, an Fe-rich variety) is the dominant gangue mineral.

The new interpretation of the geology at West Ayawilca is the result of a redesigned drill program in 2022-23 which targeted the northwest-southeast trend rather than the late-stage east-west trending veins which outcrop. All 13 holes at West Ayawilca in the 2022-23 program were drilled on an east-west orientation (mostly angled to the west) in contrast to previous holes which were mostly orientated north-south. The improvement in vertical continuity of the mineralization is positive for the project, as it will likely lead to more cost-effective mining with less dilution.

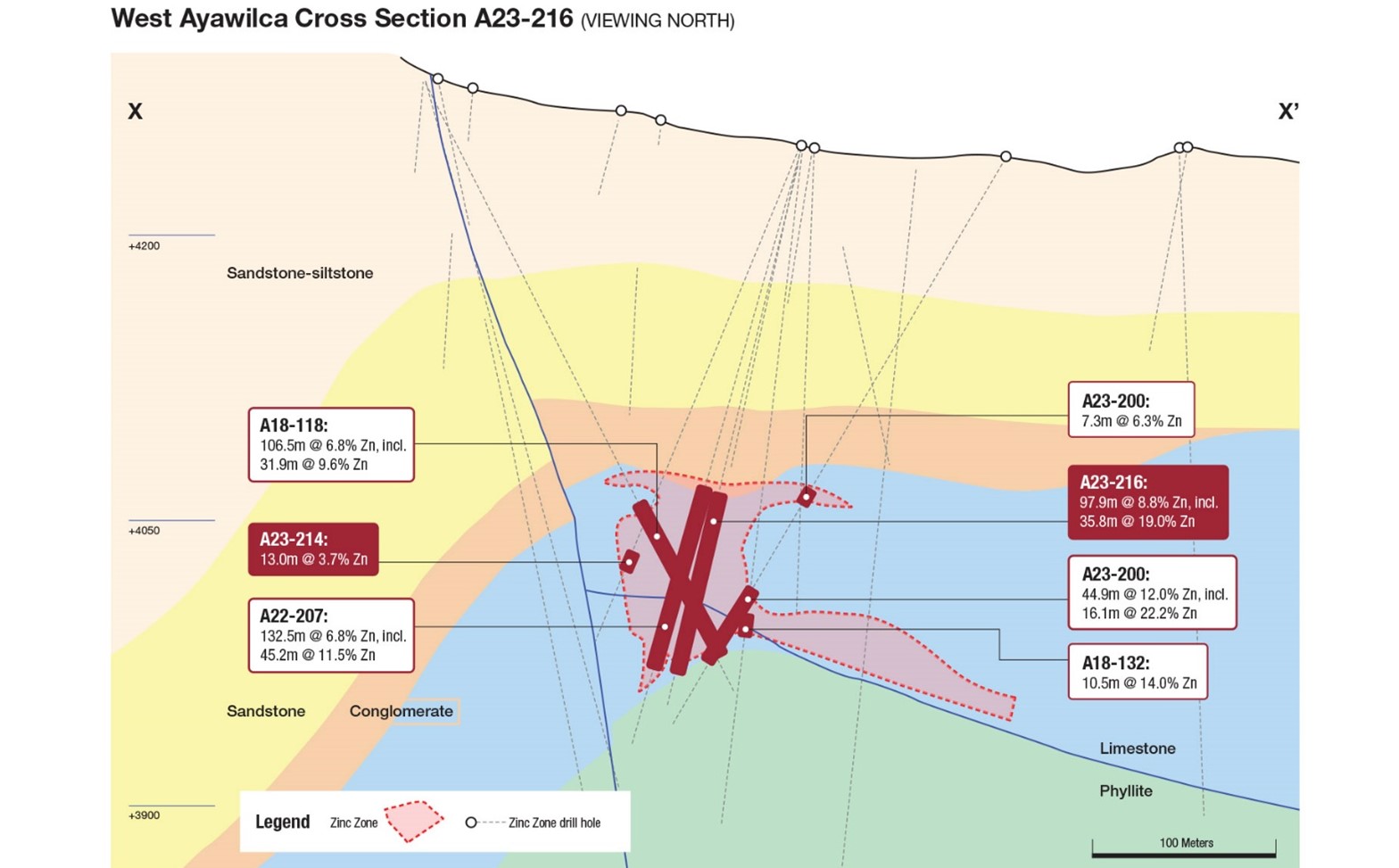

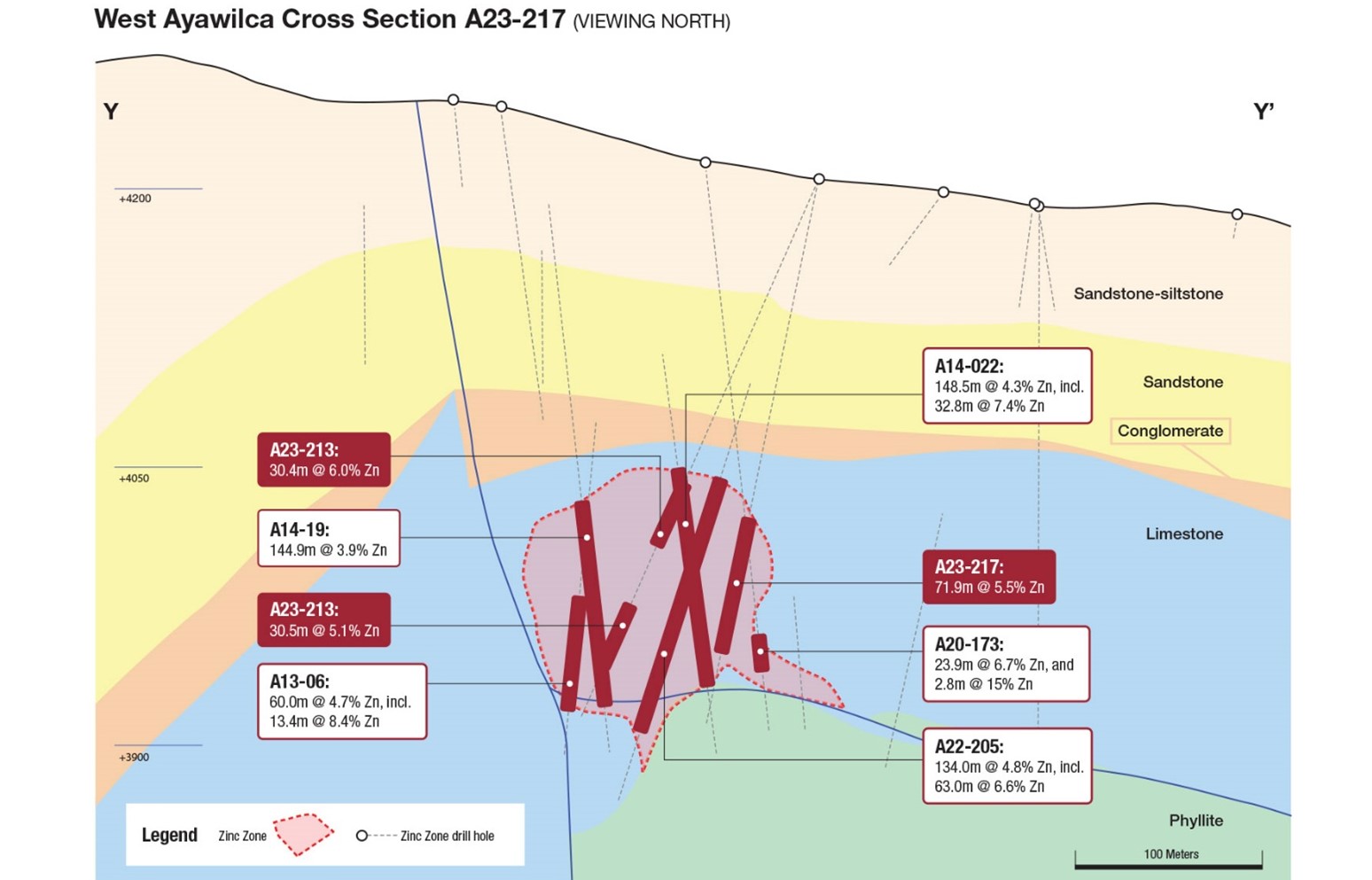

The brecciation of the limestones is interpreted to have occurred as result of karst dissolution and collapse of the limestones, possibly during the early stages of hydrothermal activity. The mineralization is focused within the hinge of a major anticline fold immediately adjacent to the Colquipucro Fault (see cross sections, Figure 2). A longitudinal section showing the geometry of the zinc mineralization along the northwest-southeast trend is shown in Figure 3.

Photographs of the typical massive sulphide zinc mineralization and the semi-massive sulphide breccia mineralization at West Ayawilca is shown in Figure 4.

South Ayawilca

The highest-grade area of zinc mineralization at the project is located at South Ayawilca. Massive sulphide (MS) mineralization has been identified over an area (projected to surface) of approximately 400 metres by 200 metres elongated in a northeast-southwest direction (see Figures 1 and 3). Very high-grade massive sulphide zinc mineralization is focused in the hinge zone of an anticline fold structure. Drill results including cross sections from South Ayawilca can be reviewed in the following disclosures - see news release January 9th 2023; and news release March 6th 2023.

Update on Exploration Activities at Ayawilca

Tinka's geologists have recently sampled manganese-altered outcrops at Ayawilca which are interpreted to be surface expressions of the Silver Zone discovery (see news release May 2nd 2023). The results of this sampling, together with the final drill hole at South Ayawilca, will be announced as soon as assays become available and interpreted.

Other news: Tinka recently received approval for the extension of the environmental permit (EIAsd) at Ayawilca for a period of three more years until May 2026. The modified and extended EIAsd has combined the two previous individual permits at Ayawilca and Colquipucro into one large permit which also incorporates several undrilled exploration targets as well as potential future mine components. The successful approval of the EIAsd is an important milestone for the project, as it will allow the Company to continue with its exploration and development plans into the medium term.

Table 1. Summary of drill hole results in this release

| Hole | From (m) | To (m) | Interval (m) | Zn % | Pb % | Ag g/t | In ppm | Sn % | Cu % | Area |

| A22-211 | 151.00 | 189.15 | 38.15 | 6.32 | 1.13 | 28 | 9 | West | ||

incl | 182.55 | 189.15 | 6.60 | 9.21 | 5.20 | 81 | 0 | 0.44 | 0.23 | |

| A23-213 | 157.50 | 159.50 | 2.00 | 10.87 | 0.36 | 33 | 7 | West | ||

| and | 180.00 | 210.40 | 30.40 | 6.00 | 0.03 | 8 | 26 | |||

incl | 207.30 | 208.50 | 1.20 | 37.17 | 0.07 | 31 | 235 | |||

| and | 260.00 | 290.50 | 30.50 | 5.06 | 0.02 | 9 | 142 | |||

| A23-214 | 243.90 | 256.95 | 13.05 | 3.71 | 0.06 | 11 | 1 | West | ||

| A23-216 | 197.90 | 295.80 | 97.90 | 8.84 | 0.03 | 16 | 145 | West | ||

incl | 260.00 | 295.80 | 35.80 | 19.00 | 0.03 | 35 | 387 | 0.19 | 0.11 | |

incl | 265.50 | 279.00 | 13.50 | 25.28 | 0.04 | 44 | 567 | 0.20 | 0.15 | |

| A23-217 | 186.10 | 258.00 | 71.90 | 5.52 | 0.04 | 8 | 129 | West | ||

incl | 210.40 | 256.20 | 45.80 | 6.43 | 0.04 | 10 | 180 | |||

incl | 210.40 | 215.25 | 4.85 | 15.20 | 0.10 | 23 | 344 | |||

| A23-219* | 212.70 | 219.00 | 6.30 | 6.05 | 0.33 | 9 | 91 | Central | ||

| and | 297.40 | 304.00 | 6.60 | - | - | - | - | 1.00 | 0.05 |

* Hole A23-219 at Central Ayawilca was primarily a hydrological hole drilled for the purposes of understanding the underground aquifer. This hole intersected minor zinc and tin mineralization, which will be incorporated into the updated resource estimate.

Note on sampling and assaying

Drill holes are diamond HQ size core holes with recoveries generally above 80% and often close to 100%. The drill core is marked up, logged, and photographed on site. The cores are cut in half at the Company's core storage facility, with half-cores stored as a future reference. Half-core was bagged on average over 1 to 2 metre composite intervals and sent to SGS laboratory in Lima for assay in batches. Standards and blanks were inserted by Tinka into each batch prior to departure from the core storage facilities. At the laboratory samples are dried, crushed to 100% passing 2mm, then 500 grams pulverized for multi-element analysis by ICPMS using multi-acid digestion. Samples assaying over 1% zinc, lead, or copper and over 100 g/t silver were re-assayed using precise ore-grade AAS techniques. Samples within massive sulphide zones were also assayed for tin using fusion and AAS finish.

Figure 1. Drill hole map of 2022-2023 holes at Ayawilca highlighting large zinc sulphide bodies (pink shade)

Figure 2. Cross sections through West Ayawilca highlighting Zinc Zone mineralization hosted by Pucara limestone

Figure 3. Longitudinal north - south section of West and South Ayawilca highlighting 2022-23 drill results in red.

Figure 4. Photographs of zinc mineralization in hole A23-216:

- Massive sulphide mineralization at the base of the limestone (sp = sphalerite, py = pyrite)

- Breccia hosted semi-massive sulphide mineralization (cl = clay and carbonate alteration)

Table 2. Drill hole details for 2022-2023 drill program including drill collar coordinate information

| Drill hole | Easting | Northing | Elevation | Azimuth | Dip | Depth m | Area | Comment |

| A22-190 | 333281 | 8845755 | 4167 | 180 | -50 | 498.95 | Central | Results reported |

| A22-191 | 333169 | 8845799 | 4182 | 180 | -55 | 478.80 | Central | Results reported |

| A22-192 | 333345 | 8845195 | 4208 | 232 | -74 | 385.90 | South | Results reported |

| A22-193 | 332766 | 8845659 | 4237 | 68 | -65 | 365.40 | West | Results reported |

| A22-194 | 333143 | 8845231 | 4226 | 135 | -73 | 380.20 | South | Results reported |

| A22-195 | 333149 | 8845353 | 4221 | 148 | -65 | 426.90 | South | Results reported |

| A22-196 | 333035 | 8845307 | 4235 | 174 | -45 | 382.10 | South | Results reported |

| A22-197 | 332912 | 8845693 | 4220 | 264 | -55 | 412.60 | West | Results reported |

| A22-198 | 332900 | 8845768 | 4222 | 265 | -53 | 451.10 | West | Results reported |

| A22-199 | 333046 | 8845067 | 4195 | 303 | -66 | 344.10 | South | Results reported |

| A22-200 | 332821 | 8845889 | 4246 | 260 | -58 | 352.00 | West | Results reported |

| A22-201 | 333342 | 8845195 | 4208 | 310 | -73 | 58.90 | South (deepening of A17-066) | Results reported |

| A22-202 | 333046 | 8845066 | 4197 | 283 | -52 | 270.15 | South | Results reported |

| A22-203 | 332839 | 8845685 | 4228 | 264 | -60 | 350.00 | West | Results reported |

| A22-204 | 333090 | 8845061 | 4196 | 307 | -60 | 334.30 | South | Results reported |

| A22-205 | 332839 | 8845685 | 4227 | 244 | -72 | 352.70 | West | Results reported |

| A22-206 | 333044 | 8845064 | 4197 | 270 | -58 | 217.30 | South | Results reported |

| A22-207 | 332710 | 8845883 | 4252 | 254 | -74 | 332.00 | West | Results reported |

| A22-208 | 333044 | 8845064 | 4197 | 270 | -70 | 282.55 | South | Results reported |

| A22-209 | 332738 | 8845927 | 4251 | 257 | -68 | 314.15 | West | Results reported |

| A22-210 | 333047 | 8845065 | 4197 | 297 | -48 | 259.80 | South | Results reported |

| A22-211 | 332785 | 8845707 | 4236 | 260 | -75 | 295.00 | West | Results here |

| A23-212 | 333047 | 8845065 | 4197 | 228 | -79 | 324.30 | South | Results reported |

| A23-213 | 332853 | 8845650 | 4225 | 258 | -65 | 316.00 | West | Results here |

| A23-214 | 332710 | 8845883 | 4252 | 255 | -67 | 287.10 | West | Results here |

| A23-215 | 333047 | 8845065 | 4197 | 180 | -80 | 295.10 | South | Results reported |

| A23-216 | 332710 | 8845883 | 4252 | 220 | -73 | 310.00 | West | Results here |

| A23-217 | 332853 | 8845650 | 4225 | 240 | -78 | 300.00 | West | Results here |

| A23-218 | 333109 | 8845020 | 4190 | 330 | -75 | 323.70 | South | Results reported |

| A23-219 | 333219 | 8845582 | 4182 | 180 | -85 | 336.80 | Central | Results here |

| A23-220 | 333047 | 8845065 | 4197 | 308 | -62 | 328.10 | South | Results reported |

| A23-221 | 333118 | 8845102 | 4207 | 332 | -69 | 400.60 | South | Results reported |

| A23-223 | 333118 | 8845102 | 4207 | 335 | -62 | 348.40 | South | Results pending |

| TOTAL | 11,115.00 |

Notes: Datum for coordinates is WGS84 Zone 18S. Azimuth is true azimuth

The Qualified Person, Dr. Graham Carman, Tinka's President and CEO, and a Fellow of the Australasian Institute of Mining and Metallurgy, has reviewed and verified the technical contents of this release.

Readers are encouraged to read the NI 43-101 Technical Report entitled "Ayawilca Polymetallic Project, Central Peru, NI 43-101 Technical Report on Updated Preliminary Economic Assessment" available for download on Tinka's website at www.tinkaresources.com. The Technical Report was prepared by Mining Plus Peru S.A.C. ("Mining Plus") as principal consultant, Transmin Metallurgical Consultants ("Transmin"), Envis E.I.R.L ("Envis"), and SLR Consulting (Canada) Ltd ("SLR").

| On behalf of the Board, "Graham Carman" | Further Information: Mariana Bermudez 1.604.685.9316 Stay up to date by subscribing for news alerts at Contact Tinka and by following Tinka on Twitter, LinkedIn and Facebook. |

About Tinka Resources Limited

Tinka is an exploration and development company with its flagship property being the 100%-owned Ayawilca zinc-silver-tin project in central Peru. The Zinc Zone deposit has an estimated Indicated Mineral Resource of 19.0 Mt @ 7.15% Zn, 16.8 g/t Ag & 0.2% Pb and Inferred Mineral Resource of 47.9 Mt @ 5.4% Zn, 20.0 g/t Ag & 0.4% Pb (dated August 30, 2021). The Ayawilca Tin Zone has an estimated Inferred Mineral Resource of 8.4 Mt grading 1.0% Sn. Tinka is recently completed an 11,000-metre resource definition drill program at West Ayawilca and South Ayawilca.

Forward Looking Statements: Certain information in this news release contains forward-looking statements and forward-looking information within the meaning of applicable securities laws (collectively "forward-looking statements"). All statements, other than statements of historical fact are forward-looking statements. Forward-looking statements are based on the beliefs and expectations of Tinka as well as assumptions made by and information currently available to Tinka's management. Such statements reflect the current risks, uncertainties and assumptions related to certain factors including, without limitations: timing of planned work programs and results varying from expectations; delay in obtaining results; changes in equity markets; uncertainties relating to the availability and costs of financing needed in the future; equipment failure, unexpected geological conditions; imprecision in resource estimates or metal recoveries; success of future development initiatives; competition and operating performance; environmental and safety risks; the Company's expectations regarding the Ayawilca Project PEA; the political environment in which the Company operates continuing to support the development and operation of mining projects; risks related to negative publicity with respect to the Company or the mining industry in general; the threat associated with outbreaks of viruses and infectious diseases, including the novel COVID-19 virus; delays in obtaining or failure to obtain necessary permits and approvals from local authorities; community agreements and relations; and, other development and operating risks. Should any one or more of these risks or uncertainties materialize, or should any underlying assumptions prove incorrect, actual results may vary materially from those described herein. Although Tinka believes that assumptions inherent in the forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein. Except as may be required by applicable securities laws, Tinka disclaims any intent or obligation to update any forward-looking statement.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

SOURCE: Tinka Resources Ltd.

View source version on accesswire.com:

https://www.accesswire.com/759930/Tinka-Drills-98-Metres-at-88-Zinc-Including-36-Metres-at-190-Zinc-at-Ayawilca-and-Provides-Exploration-Update