The Mineral Resource at Thor is set to Expand!

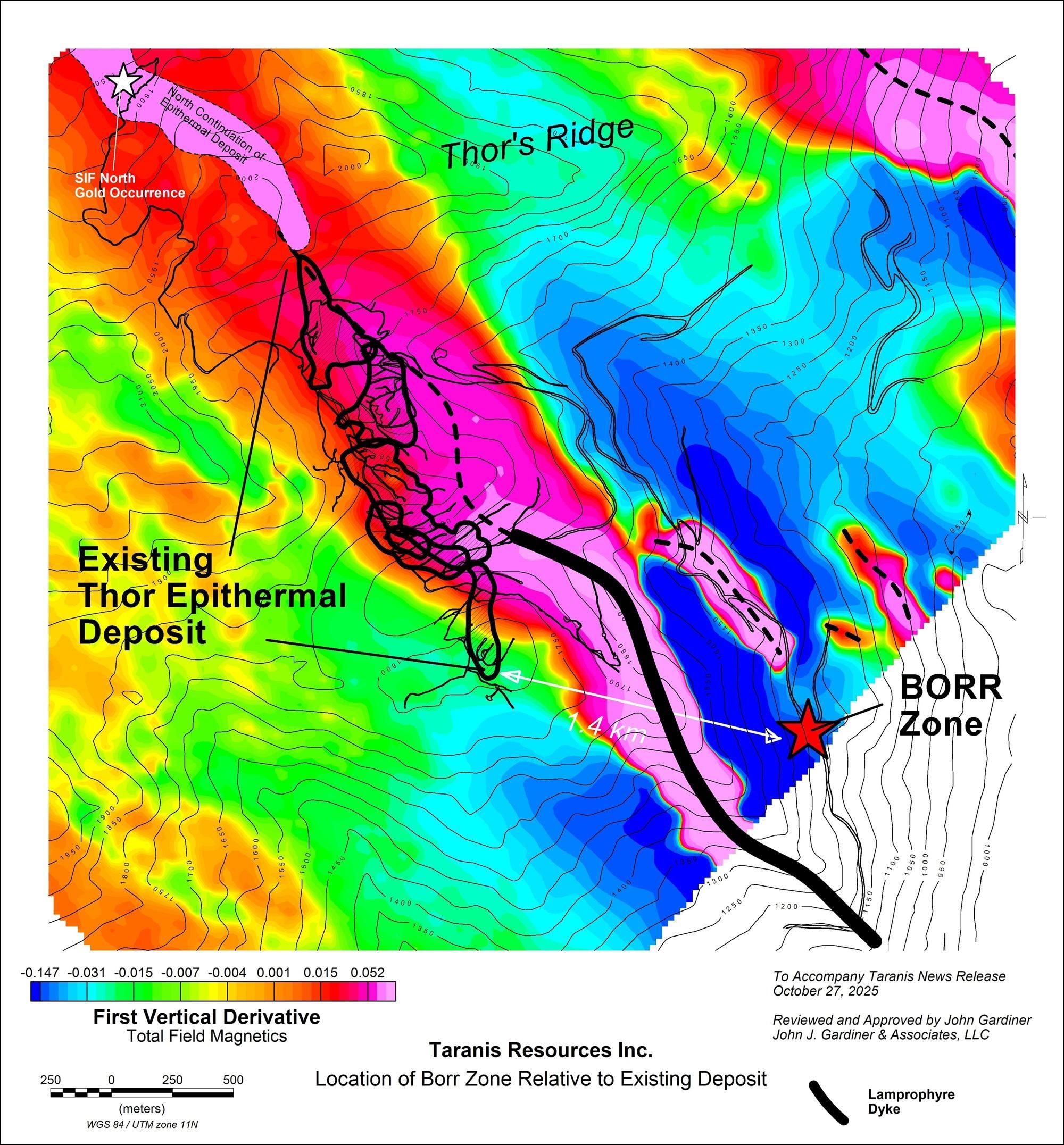

ESTES PARK, CO / ACCESS Newswire / October 27, 2025 / Taranis Resources Inc. ("Taranis" or the "Company") (TSXV:TRO,OTC:TNREF)(OTCQB:TNREF) is providing an update on exploration activities at Thor. This News Release discusses a new, near-surface area of Epithermal Precious and Base Metal Mineralization called "Borr" found 1,400m southeast of the south end of the Thor epithermal deposit. This mineralization is located under a topographic slope west of the main access road and does not outcrop. There are no historic workings located in the area, and this is a virgin discovery. Please refer to the map that accompanies this News Release that shows some of the relevant features.

Drill Hole Thor-256

Drill Hole Thor-256 was drilled to the southwest at a dip of 450 towards a deeper geophysical resistivity anomaly (Z-900/1300) located under a steep hillside. Subsequent News Releases will discuss the source of this anomaly which is in part associated with a lamprophyre dyke. Shortly after colliding with bedrock, Thor-256 intersected epithermal mineralisation hosted within metasedimentary and metavolcaniclastic rocks. There are photographs posted at www.taranisresources.com. Massive pyrite, sphalerite, galena and tetrahedrite were visibly identified in the core. The following table details the analytical results.

Thor-256 (Upper Part) | |||||||||||

From | To | Width | Ag | Cd | S | Sb | Sn | Au | Pb | Zn | Combined |

24.13 | 25.00 | 0.87 | 75.2 | 89.4 | 1.2 | 11.7 | 28.6 | 50 | 4.23 | 1.65 | 5.88 |

25.00 | 26.00 | 1.00 | 23.8 | 82.5 | 0.7 | 8.4 | 11.3 | 9 | 1.43 | 1.59 | 3.02 |

26.00 | 27.00 | 1.00 | 19.8 | 152 | 1.3 | 8 | 14.1 | 18 | 1.22 | 2.72 | 3.94 |

27.00 | 28.00 | 1.00 | 5 | 211 | 2.1 | 2.7 | 62.8 | 2 | 0.07 | 3.76 | 3.83 |

28.00 | 28.86 | 0.86 | 2.8 | 33.9 | 0.3 | 1.4 | 3.5 | 9 | 0.18 | 0.56 | 0.74 |

28.86 | 29.38 | 0.52 | 11.2 | 66.6 | 20.9 | 4.6 | 30.3 | 766 | 0.19 | 1.02 | 1.21 |

Average |

| 5.25 | 26.2 | 121.0 | 5.0 | 7.0 | 28.7 | 163 | 1.39 | 2.15 | 3.55 |

Comment

The Thor-255 epithermal intercept is the only known substantive occurrence of mineralization outside of the existing Thor NI 43-101 Mineral Resource, and it occurs on the east side of a positive aeromagnetic feature. The entire existing Thor NI 43-101 Mineral Resource occurs on the west side of the aeromagnetic feature. The Thor epithermal deposit may form an inverted ‘horseshoe-shaped' feature around the aeromagnetic anomaly. Our prior exploration work at Thor has shown that intercepts such as the Thor-256 intercept are part of much larger mineralized systems, and in the future drilling will need to move both north and south from the initial Borr intercept. The Borr area is therefore an opportunity for considerable expansion of the existing high-grade, near surface Mineral Resource.

Qualified Person

Exploration activities at Thor were overseen by John Gardiner (P. Geo.), who is a Qualified Person under the meaning of Canadian National Instrument 43-101. John Gardiner is the principal of John J. Gardiner & Associates, LLC which operates in British Columbia under Firm Permit Number 1002256. Mr. Gardiner is the President and CEO of Taranis Resources Inc. and has reviewed and approved the comments contained within this News Release.

Quality Control and Laboratory Methods

All samples for the Thor project were securely delivered to Actlabs in Kamloops, British Columbia. Analytical work was completed both at the Kamloops, and Ancaster, Ontario locations. Actlabs is ISO 17025 accredited.

Visibly (or potentially mineralized sections of core) were systematically sampled after sawing the core in-half onsite. Samples were analyzed for 42 elements by 4-Acid Digestion / Inductively Coupled Plasma - Mass Spectrometry ("ICP-MS") and for gold by 30g Fire Assay / Atomic Absorption Spectrophotometry ("AAS")

Where overlimit values were encountered in the analysis of these samples, ‘ore-grade' determinations were made using subsequent ICP analysis and gravimetric methods. As a Quality Control ("QC") measure, Taranis also submitted analytical standards into the sample stream every tenth sample in addition to the laboratory's own quality control methods.

Taranis currently has 102,421,487 shares issued and outstanding (119,972,613 shares on a fully-diluted basis).

Per: John J. Gardiner (P. Geo.),

President and CEO

For further information contact:

John J. Gardiner

681 Conifer Lane

Estes Park, Colorado 80517

Phone: (303) 716-5922

Cell: (720) 209-3049

johnjgardiner@earthlink.net

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS NEWS RELEASE.

This News Release may contain forward looking statements based on assumptions and judgments of management regarding future events or results that may prove to be inaccurate as a result of factors beyond its control, and actual results may differ materially from expected results.

SOURCE: Taranis Resources, Inc.

View the original press release on ACCESS Newswire