December 12, 2022

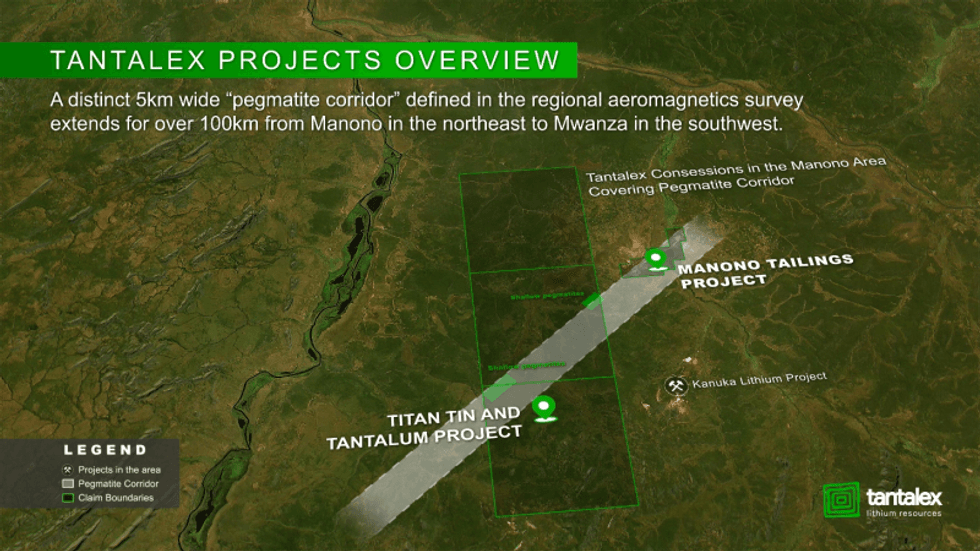

Tantalex Lithium Resources Corp. (CSE:TTX) – (FSE:DW8) – (OTC:TTLXF) (“Tantalex” or the “Corporation”), is pleased to announce that its 70% owned DRC subsidiary United Cominiere SAS has started exploration drilling on the Pegmatite Corridor which is immediately downstrike from the world’s largest undeveloped hard rock lithium resource.

Blue Sky Lithium Discovery Potential

- Drilling has commenced with the first 3 holes completed by RC drilling

- Drilling to test targets immediately downstrike from DATHCOM Mining spodumene lithium resource of 400M tons grading 1.65% Li2O. AVZ Minerals, ASX announcement, sept. 27,2021).

- A total of 20,000m of diamond and RC drilling planned over the next 9 months,

- Drill targets identified from aeromagmetiec and radiometric surveys.

The TiTan project

The Company would also like to update it’s shareholders on the progress of the TiTan plant construction which remains on schedule for a start of operations in March 2023. The access road upgrade between Manono and the Titan plant location has been completed and the teams are now busy with preparing foundation work.

The Titan plant is Projected to produce approximately 1’400 dmt of Tin concentrate and 220 dmt of Tantalum concentrate per annum.

Manono Lithium Tailings Project

The Company would also like to announce that it has appointed Novopro Projects of Montreal to conduct the Preliminary Economic Assessment (PEA) for the Phase 1 of the Manono Lithium Tailings project. The objective of the Company is to focus on bringing dumps K, G and I in the southwest of the concession into production as early as possible.

Further to the positive results received from the HLS testing, the Company has proceeded with additional metallurgical testworks for material from Dumps K and G to determine the optimal process flow sheet for the production of 6% Li2O Spodumene Concentrate (SC6).

About Tantalex Lithium Resources Corporation

Tantalex Lithium is an exploration and development stage mining company engaged in the acquisition, exploration, development and distribution of lithium, tin, tantalum and other high-tech mineral properties in Africa.

It is currently focused on developing it’s lithium assets in the prolific Manono area in the Democratic Republic of Congo; The Manono Lithium Tailings Project and the Pegmatite Corridor Exploration Program.

Qualified person

The scientific and technical content of this news release has been reviewed and approved by Mr. Gary Pearse MSc, P. Eng, who is a “Qualified Person” as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”).

Cautionary Note Regarding Forward Looking Statements

The information in this news release includes certain information and statements about management's view of future events, expectations, plans and prospects that constitute forward looking statements. These statements are based upon assumptions that are subject to significant risks and uncertainties. Because of these risks and uncertainties and as a result of a variety of factors, the actual results, expectations, achievements or performance may differ materially from those anticipated and indicated by these forward looking statements. Although Tantalex believes that the expectations reflected in forward looking statements are reasonable, it can give no assurances that the expectations of any forward looking statements will prove to be correct. Except as required by law, Tantalex disclaims any intention and assumes no obligation to update or revise any forward looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward looking statements or otherwise.

The Canadian Securities Exchange (CSE) has not reviewed this news release and does not accept responsibility for its adequacy or accuracy.

For more information, please contact:

Eric Allard

President & CEO

Email: ea@tantalex.ca

Website: https://tantalexlithium.com/

Tel: 1-581-996-3007

TTX:CC

The Conversation (0)

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00