December 15, 2022

Tantalex Lithium Resources Corp. (CSE:TTX) – (FSE:DW8) – (OTC:TTLXF) (“Tantalex” or the “Corporation”), is pleased to announce a Maiden Mineral Resource Estimate for its majority owned Manono Lithium Tailings project in the Democratic Republic of Congo.

KEY HIGHLIGHTS

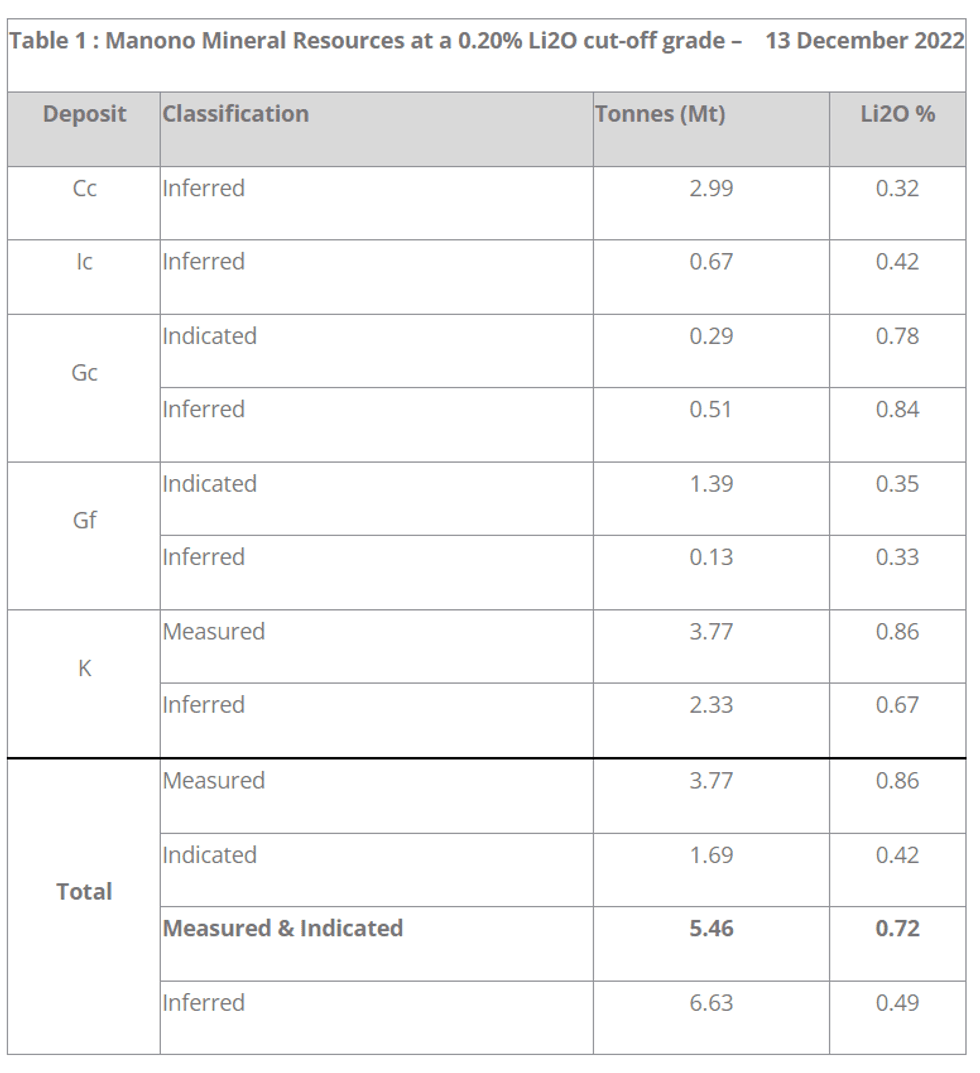

- 5,46 million tonnes at 0,72%Li2O in the Measured and Indicated category;

- 6.63 million tonnes in total Inferred Mineral Resources at a grade of 0,49%Li2O

- Lithium contained in spodumene and amenable for production of 6% Li2O Spodumene Concentrate (SC6)

- Mineral Resource defined by 11 922 m of drilling in a total of 368 drillholes

- Quick path to production: material on surface, already crushed; no strip ratio, low mining costs

MANONO TAILINGS MINERAL RESOURCE STATEMENT

The Mineral Resource was estimated using the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Best Practice Guidelines and is reported in accordance with the 2014 CIM Definition Standards, which have been incorporated by reference into National Instrument 43-101 – Standards of Disclosure for Mineral Projects (NI 43-101).

A summary of the Mineral Resource estimates per deposit as well as the total Measured, Indicated and Inferred Mineral Resources is shown in Table 1.

The Mineral Resource is classified into the Measured, Indicated and Inferred categories and is reported at a cut-off grade of 0.20% lithium oxide (Li2O). The cut-off grade and reasonable prospects for eventual economic extraction (RPEEE) were determined using the following assumptions:

- Mining will be undertaken using bulldozers and loaders.

- Mining cost: USD 2.17 per tonne of rock

- Mining Recovery: 99%

- Processing cost: USD 11.18 per tonne processed (RoM)

- Revenue Royalty: 3%

- Payability: 98.5%

- Process Recovery LiO: 50% to 70%

- Lithium Price: 4 000 USD/tonne (SC6 – Spodumene Concentrate)

The assessment to satisfy the criteria of RPEEE is a high-level estimate and is not an attempt to estimate Mineral Reserves.

Eric Allard, President and CEO commented: ‘’ With this Mineral Resource Estimate, Tantalex Lithium now enters a select group of near-term lithium producers. Our relatively easy and low-cost mining process gives us an incredible advantage on our speed to market compared to other lithium peers.

With SC6 lithium prices likely set to remain above $4,000 USD/t for the next 6-8 years, our focus is now to bring an initial production of 100,000 tons per annum of SC6 to market by 2025. With no offtake agreements yet entered into, our project is currently attracting important offtaker interest.’’

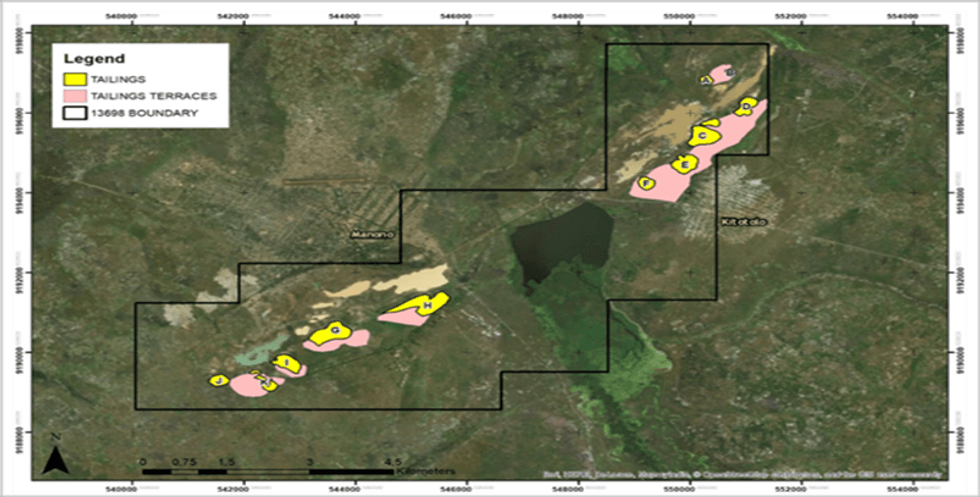

The Manono Tailings Project is composed of eleven technogenic deposits made up of the reject LCT (Lithium-Caesium-Tantalum) pegmatite material processed at the Manono-Kitotolo mine from 1919 to the mid-1980s.

Tailings from the Manono-Kitotolo mine were deposited on ground adjacent to the various open pits. The coarse tailings were deposited over several years into raised heaps that reach, in some dumps, a maximum height of 70 m above surface. The fine tailings material was deposited into flat terraces adjacent to the coarse tailings dumps.

Geology and Mineralization

The lithium mineralization is contained within technogenic deposits, consisting of eleven individual tailings dumps, of which five form part the Mineral Resource, namely Cc, Ic, Gc, Gf and K. The tailings deposits consist of a combination of processed pegmatite, laterite and clay material sourced from the historical Manono-Kitolo mine which operated from 1919 to the mid-1980s. The deposits vary in shape and size, with Cc, Ic and Gc being lobate in shape, extending 815 m by 580 m for the Cc dump, 530 m by 315 m for the Ic dump and 500 m by 320 m for the Gc dump. The height of each dump varies, with some stacked up to 78 m high above the surrounding planes. The Gf and K dumps occupy a larger footprint, with the Gf extending 760 m by 530 m, up to a maximum thickness of 33m, while the K dump has an extent of 700 m by 630 m, up to a maximum depth of 24 m. The K dump contains stacked tailings located in the northeast and eastern portions with a maximum vertical thickness of 45 m. Spodumene is the main lithium bearing mineral.

Many of the tailings deposits are composite in nature, consisting of layers of pegmatite, laterite and/or clay layers. These layers were deposited by mechanical means, including most of the deposits denoted as “fines”, for the exception of the Hf and Gf deposits. These are assumed to have formed due to the settling of fine material in standing ponds of water as evidenced by the presence of clay layers in these deposits.

Figure 2 is a photograph of the coarse material (1 mm to 5 mm gravel size) that represents the dominant tailings dump material in the Project area.

Few deposits appear to consist of a single material type, the exception to this being the K dump which is primarily composed of pegmatite. Figure 3 shows the white, pegmatite tailings and the partially vegetated cone-like feature of the stacked K dump tailings, looking south.

Sampling and Mineral Resource estimation techniques

The Mineral Resource estimate was based on geochemical analyses of samples obtained by aircore drilling undertaken by Tantalex from September 2021 to July 2022. A total of 368 drillholes have been drilled across nine tailings deposits, totaling 11 922.24 metres of drilling. The majority of the drillholes were collared on the K dump, with 2 120 metres drilled from 156 drillholes. Fifty drillholes were collared on the Gf dump, 34 on the Ic dump, 25 on the Gc dump and 20 drillholes were collared on the Ic dump.

Due to the nature and angle of repose of the stacked tailings, drilling on the slopes was not possible. Hence a majority of the material in the slopes has been included in the inferred category.

Samples were taken in one metre intervals and composited to three metres. Three sample preparation protocols were used during the drilling campaign. The first protocol was used early in the programme and involved crushing the sample down to 2 mm using a roll crusher, after which a 200 g sub-sample was obtained from a Jones Riffle splitter. This 200 g sample was then sub-sampled by the cone-and-quartering method to obtain a 100 g sample which was pulverised to better than 80% passing 75 μm. The crushing, splitting and pulverising were carried out on-site by Tantalex. The second sample preparation protocol involved the crushed 200 g sub-sample being prepared on-site and then transported to the Congolese Analytical Laboratory (COAL) in Lubumbashi where the sub-sample was pulverised to 85% passing 75 μm. For the third protocol in the latter part of the project, 400 g of sample were submitted to COAL where it was crushed to a 2 mm size fraction using a benchtop jaw crusher and then pulverised to 85% passing 75 μm.

The samples were subjected to a quality assurance and control (QAQC) programme consisting of the insertion of certified reference materials (CRMs), blanks and the inclusion of coarse duplicates. The primary laboratory assay results were confirmed by duplicate samples assayed at a second laboratory. Check samples selected by the QP were used for further confirmation of the lithium assay values and the QP is satisfied that the results are of sufficient accuracy and precision for use in Mineral Resource estimation.

Three-dimensional volumes of the tailings were constructed using drill hole data. The lithium grades were estimated into block models using ordinary kriging for the low-lying material of the K dump. The stacked material of the K dump and the Cc, Gc, Gf and Ic dumps were estimated using inverse distance weighting. Average densities were assigned to each material type.

Metallurgical Testing

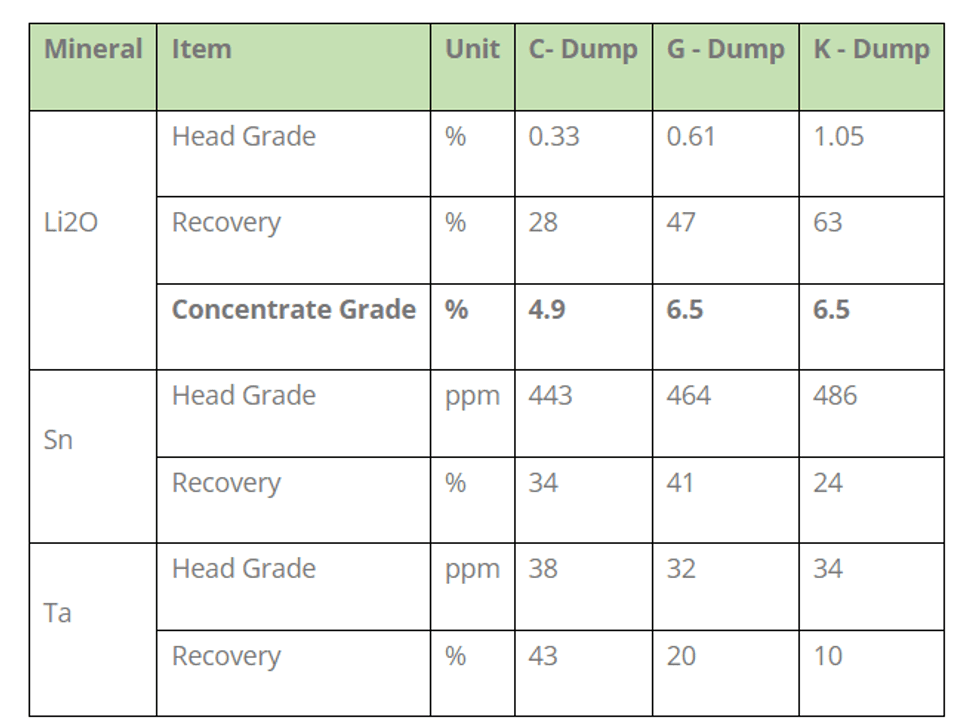

A summary of the HLS results is available in 2. The HLS test produced concentrate grades of 6.5% Li2O spodumene at overall recoveries across the size range of 47% and 63% for G-dump and K-dump respectively. The testwork did not produce a SC6 product from the C-dump this requiring further investigation. These results are for all the dump material with a PSD smaller than 5mm.

The lithium recoveries increased with size fraction while the tin and tantalum required further liberation to improve recoveries.

Table 2: HLS Summary Results

Filling of Report

The NI43-101 compliant technical report (“Report”) will be filed on SEDAR within the next 45 days.

The Qualified Person for the Mineral Resource estimate is Mr. Rui Goncalves (BSc Hons, MSc (Eng.)) who is a geologist with 13 years of experience in base and precious metals exploration, mining geology and Mineral Resource estimation. He is a Senior Mineral Resource Consultant for The MSA Group (an independent consulting company), is registered with the South African Council for Natural Scientific Professions (SACNASP) and is a Member of the Geological Society of South Africa (GSSA). Mr. Goncalves has the appropriate qualification and experience to be considered a “Qualified Person” for the style and type of mineralisation and activity being undertaken as defined in National Instrument 43-101 Standards of Disclosure of Mineral Projects.

Neither Mr. Goncalves nor any associates employed in the preparation of the Mineral Resource report (“Consultants”) have any beneficial interest in Tantalex Lithium Resources Corporation. These Consultants are not insiders, associates, or affiliates of Tantalex. The results of the report are not dependent upon any prior agreements concerning the conclusions to be reached, nor are there undisclosed understandings concerning any future business dealing between Tantalex and the Consultants. The Consultants are to be paid a fee for their work in accordance with normal professional consulting practices.

Qualified person

Mr. Rui Goncalves, Pr. Sci Nat, is the Qualified Person and has reviewed and approved this press release. The information in this press release that relates to the estimate of the Mineral Resources for the Manono Tailings Project is based upon, and fairly represents, information and supporting documentation compiled by Mr. Goncalves.

About Tantalex Lithium Resources Corporation

Tantalex Lithium is an exploration and development stage mining company engaged in the acquisition, exploration, development and distribution of lithium, tin, tantalum and other high-tech mineral properties in Africa.

It is currently focused on developing its lithium assets in the prolific Manono area in the Democratic Republic of Congo; The Manono Lithium Tailings Project and the Pegmatite Corridor Exploration Program.

Cautionary Note Regarding Forward Looking Statements

The information in this news release includes certain information and statements about management's view of future events, expectations, plans and prospects that constitute forward looking statements. These statements are based upon assumptions that are subject to significant risks and uncertainties. Because of these risks and uncertainties and as a result of a variety of factors, the actual results, expectations, achievements or performance may differ materially from those anticipated and indicated by these forward looking statements. Although Tantalex believes that the expectations reflected in forward looking statements are reasonable, it can give no assurances that the expectations of any forward looking statements will prove to be correct. Except as required by law, Tantalex disclaims any intention and assumes no obligation to update or revise any forward looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward looking statements or otherwise.

The Canadian Securities Exchange (CSE) has not reviewed this news release and does not accept responsibility for its adequacy or accuracy.

For more information, please contact:

Eric Allard

President & CEO

Email: ea@tantalex.ca

Website: www.tantalexlithium.com

Tel: 1-581-996-3007

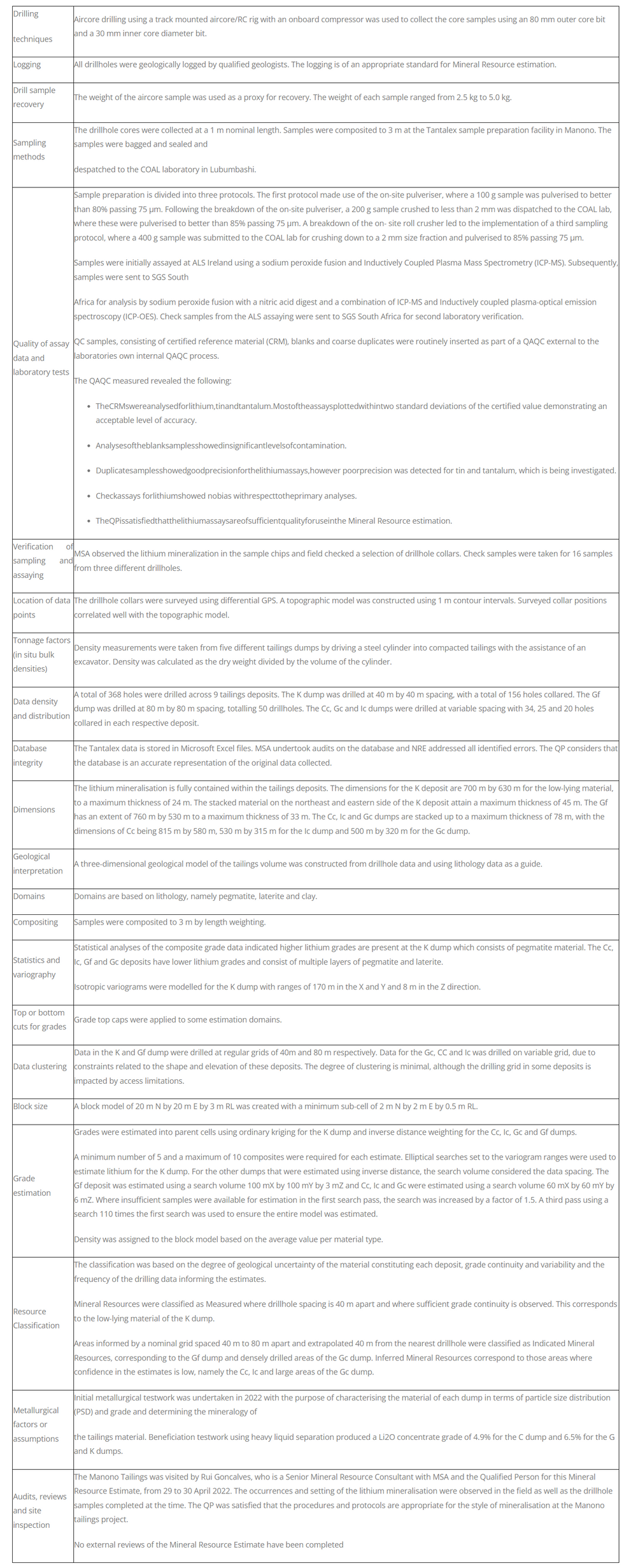

APPENDIX 1: CHECK LIST OF ASSESSMENT AND REPORTING CRITERIA

TTX:CC

The Conversation (0)

27 February

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00