July 09, 2024

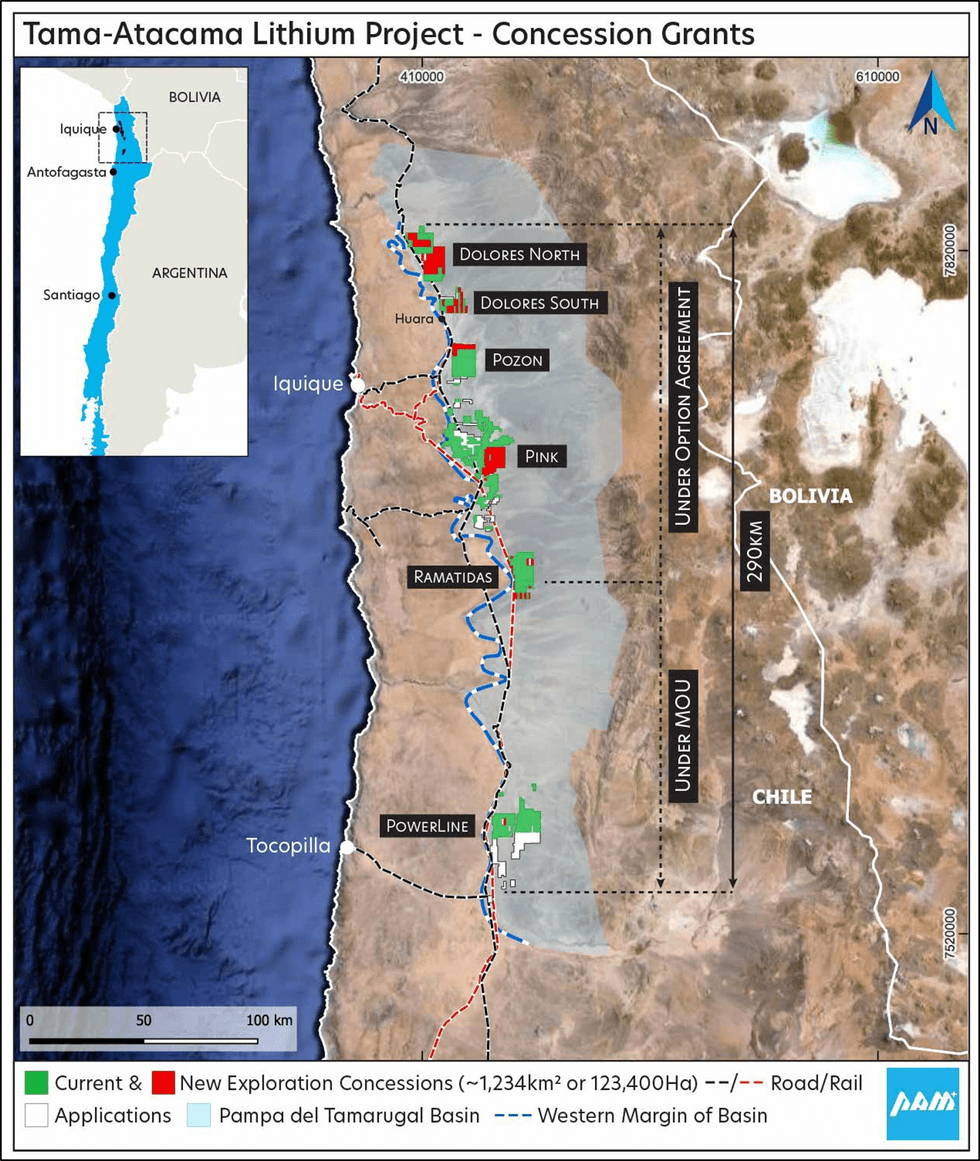

Battery and critical metals explorer and developer Pan Asia Metals Limited (ASX: PAM) (‘PAM’ or ‘the Company’) is pleased to advise that substantially all Exploration Concessions in its holdings under Option Agreement have been granted at its Tama Atacama Lithium Project, increasing the total area of granted Exploration Concessions under Option Agreements and MOU to ~1,234km2 or 123,400Ha, see Figure 1.

PAM has received confirmation that an additional net total of ~303km2 or 30,300Ha of Exploration Concessions have been granted. The majority of these granted Exploration Concessions fall within PAM’s holdings under Option Agreements 1 and 2 (see Appendix 1). The total area under Option Agreements with granted Exploration Concessions has increased by ~290Km2 to ~1,036km2 or 103,600Ha.

This is the fifth series of Exploration Concession grants, the first four being announced in January and February, 2024, see PAM’s ASX announcements dated the 12th and 29th of January, and the 5th and 12th of February, 2024, and titled ‘Tama Atacama Lithium Project – Exploration Concessions Granted’. The grant of Exploration Concessions in Chile is a judicial process, therefore one can have a high degree of confidence in the procedure for their grant.

A further net total of ~13km2 or 1,300Ha of Exploration Concessions have been granted at the southern part of the Ramatidas Lithium Prospect and the PowerLine Lithium Prospect, which are part of the ~400km2 of concessions which remain under MOU and which are under review and consideration. If progressed, these Exploration Concessions will form part of PAM’s Tama Atacama Lithium Project. The total area under MOU with granted Exploration Concessions is ~263km2 or 26,300Ha.

On the 19th of December 2023, the Chilean Congress approved Law No. 21420, bringing into effect modifications to the Chilean Mining Code. Of significance is the increase in the term of Exploration Concessions to 4 years with the possibility to extend for a further 4 years, replacing the former 2 year + 2 year licensing regime. This means that these recently granted Exploration Concessions will expire in 2027 and 2028.

Click here for the full ASX Release

This article includes content from Pan Asia Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

PAM:AU

The Conversation (0)

09 July 2023

Pan Asia Metals

First-mover Advantage in Critical Metals for Southeast Asia Market

First-mover Advantage in Critical Metals for Southeast Asia Market Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00