August 01, 2024

Proceeds will be applied to fund exploration and development activities on Brightstar’s portfolio and a fast-tracked drill out of the sandstone project being acquired by Brightstar

Brightstar Resources Ltd (ASX: BTR) (Brightstar) is pleased to announce it has received firm commitments to raise approximately $24 million (before costs) in a two-tranche share placement (Placement) to professional and sophisticated investors at $0.015 per share (New Shares). This represents a discount of:

- nil discount to the last close price as at 30 July 2024;

- 2.1% discount to the 5-day VWAP up to and including 30 July 2024; and

- 5.7% discount to the 10-day VWAP up to and including 30 July 2024.

The Placement received very strong support from a range of new and existing institutional investors, including a number of specialist gold and natural resource funds, with overall demand received for new shares strongly in excess of the $24 million Placement size.

The Placement follows:

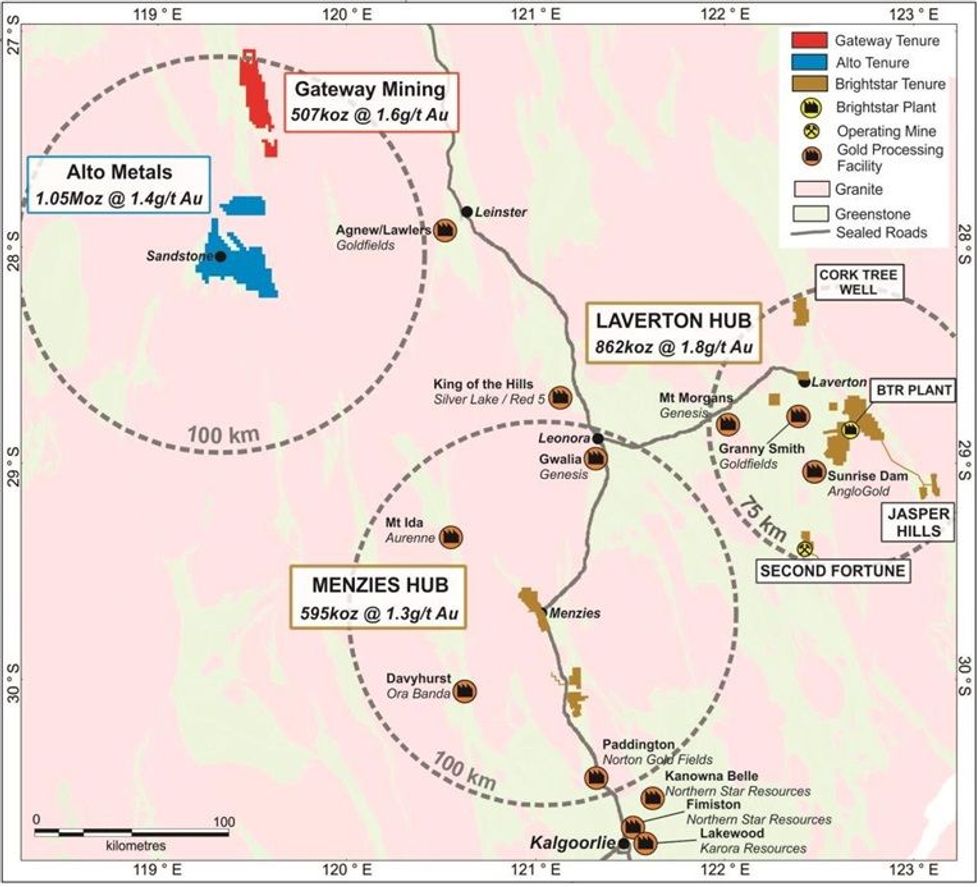

entry into a Scheme Implementation Deed with Alto Metals Ltd (ASX:AME) (Alto), pursuant to which Brightstar proposed to acquire 100% of the shares in Alto (Scheme); and Brightstar, via a newly incorporated wholly owned SPV ‘Montague Gold Project Pty Ltd’ (MGP), agreeing to acquire 100% of the gold mineral rights in the Montague East Gold Project from Gateway Mining Limited (ASX:GML) and its wholly owned subsidiary Gateway Projects Pty Ltd (GPWA) and Gateway and GPWA’s interests held in certain mining tenure in respect of the Montague East Gold Project (Montague Acquisition).

The Scheme and Montague Acquisition will consolidate highly prospective exploration ground in the Sandstone region (Sandstone Project) which will complement Brightstar’s existing production, development and exploration asset portfolio.

Brightstar’s Managing Director, Alex Rovira, said:

“This is a significant and transformational transaction for Brightstar, with the Alto Scheme and acquisition of Gateway’s Montague East Gold Project adding significant mineral endowment into our portfolio. Importantly, it adds a third development hub to Brightstar that also delivers the critical mass of gold resources that underpin a fast-tracked exploration and development phase of work to move the Sandstone hub towards monetisation. We are extremely excited to get rigs spinning at Sandstone to aggressively grow the currently defined mineral resources.

The strong support in the capital raising from well credentialled, dedicated long-only gold and natural resources- focused institutional investors is a testament to the quality of the package of assets and development plan at Brightstar, against the backdrop of a rising AUD gold price environment.”

Proceeds from the Placement will be applied to fund a fast-tracked drill out of the Sandstone Project and for general exploration and development activities on Brightstar’s portfolio.

The New Shares are expected to settle on Wednesday, 7 August 2024 and be issued and commence trading on the ASX on a normal basis on Thursday, 8 August 2024. New Shares issued under the Placement will rank equally with existing shares on issue.

Tranche One of the Placement to raise approximately $17.5m (before costs) will be conducted within Brightstar’s available placement capacity pursuant to ASX Listing Rules 7.1 and 7.1A (Tranche One) and Tranche Two, to raise approximately $6.5m (before costs), will be subject to shareholder approval to be sought at an Extraordinary General Meeting (EGM) expected to be held in mid-September 2024 (Tranche Two).

In Tranche One, a total of 1,166,666,667 New Shares will be issued. 700,000,000 of these New Shares will be issued pursuant the Company’s placement capacity under ASX Listing Rule 7.1 and a total of 466,666,667 New Shares will be issued pursuant the Company’s placement capacity under ASX Listing Rule 7.1A.

Under Tranche Two, which is conditional on the receipt of prior shareholder approval pursuant to ASX Listing Rule 7.1, the remaining 433,333,334 New Shares are proposed to be issued.

Click here for the full ASX Release

This article includes content from Brightstar Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BTR:AU

Sign up to get your FREE

Brightstar Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

08 January

Brightstar Resources

Emerging gold producer and district-scale resource developer in Western Australia

Emerging gold producer and district-scale resource developer in Western Australia Keep Reading...

03 March

Brightstar Secures US$120M Bond to Fund Goldfields Project

Brightstar Resources (BTR:AU) has announced Brightstar Secures US$120M Bond to Fund Goldfields ProjectDownload the PDF here. Keep Reading...

02 March

Results of Oversubscribed Share Purchase Plan

Brightstar Resources (BTR:AU) has announced Results of Oversubscribed Share Purchase PlanDownload the PDF here. Keep Reading...

22 February

High-grade Assays incl 4m @ 26.7g/t Au in Sandstone Drilling

Brightstar Resources (BTR:AU) has announced High-grade assays incl 4m @ 26.7g/t Au in Sandstone drillingDownload the PDF here. Keep Reading...

16 February

GNG: Preferred Contractor - Laverton Processing Plant

Brightstar Resources (BTR:AU) has announced GNG: Preferred Contractor - Laverton Processing PlantDownload the PDF here. Keep Reading...

04 February

High grade assays continue from Sandstone RC drilling

Brightstar Resources (BTR:AU) has announced High grade assays continue from Sandstone RC drillingDownload the PDF here. Keep Reading...

7h

Byron King: Gold, Silver, Oil/Gas — Stock Ideas and Strategy Now

Byron King, editor at Paradigm Press, shares his approach to the gold and silver sectors as tensions in the Middle East intensify, also touching on oil and gas. Overall he sees hard assets becoming increasingly key as global uncertainty escalates."Own gold, own silver — physically own the metal... Keep Reading...

7h

Jaime Carrasco: Gold Going "Much Higher," Silver Force Majeure Inevitable

Jaime Carrasco, senior portfolio manager and senior financial advisor at Harbourfront Wealth Management, shares his outlook for gold and silver, saying prices must rise much higher. He also talks about how to build a strong precious metals portfolio. "We're moving from a credit-based economy, a... Keep Reading...

7h

Garrett Goggin: Gold, Silver in New Era, My Stock Strategy Now

Garrett Goggin, founder of Golden Portfolio, says although gold and silver haven't gone mainstream yet, the metals — and the mining sector overall — have entered a new era. "It's a real mind shift — it's a new era in mining right here," he said.Don't forget to follow us @INN_Resource for... Keep Reading...

17h

Nicola Mining Provides Update on NASDAQ Listing

Nicola Mining Inc. (TSXV: NIM,OTC:HUSIF) (OTCQB: HUSIF) (FSE: HLIA) (the "Company" or "Nicola") is pleased to provide an update on its proposed NASDAQ listing, which it originally disclosed in its news release of October 27, 2025. There are approximately 220 Canadian companies trading via cross... Keep Reading...

06 March

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

06 March

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

Latest News

Sign up to get your FREE

Brightstar Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00