March 31, 2025

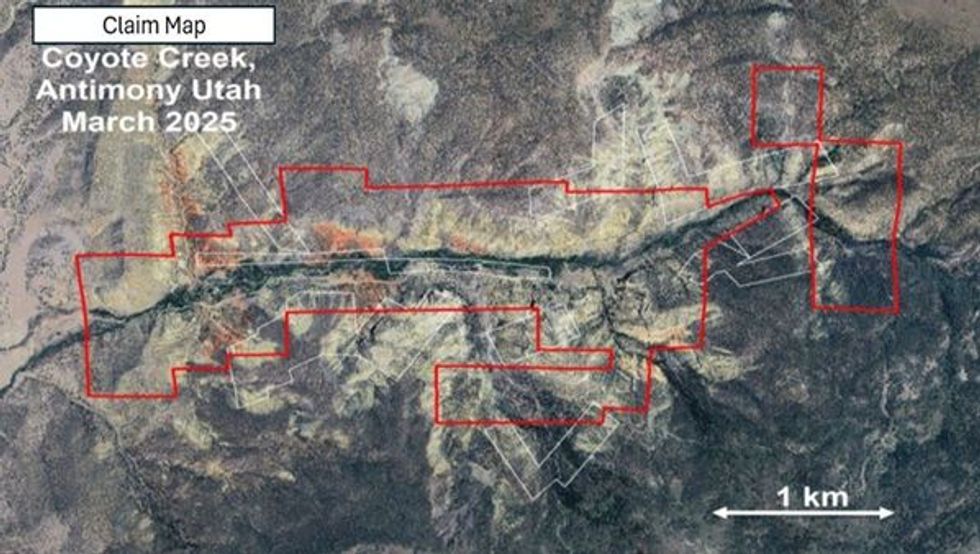

EV Resources Limited (ASX:EVR) (“EVR” or “the Company”) has reached agreement with a resources private investor based in the USA, for the acquisition of 49 unpatented claims (“The Claims”) over the Coyote Creek Antimony Project.

Highlights:

- EVR has reached agreement with a private US Investor to acquire 49 unpatented claims over the Coyote Creek Antimony Project in Utah, USA.

- The claims cover both old workings and waste from historical antimony mining up to the 1920’s.

- A historical non JORC resource estimate of 12.7 million metric tons grading 0.79% Antimony was estimated by the Utah Geological and Mineral Survey in 1975.

- The historical estimate above is not reported in accordance with the JORC Code. A competent person has not done sufficient work to classify the historical estimates as mineral resources or ore reserves in accordance with the JORC Code, and it is uncertain that following evaluation and/or further exploration work that the historical estimates will be able to be reported as mineral resources or ore reserves in accordance with the JORC Code.

- The USA currently has no operating antimony mine and imports all its antimony concentrates.1

The USA imports all of its antimony concentrates at present1 and the Coyote Creek Project appears to have the potential to become a domestic supplier of antimony at a time of well documented supply shortages.

This acquisition follows EVR’s recent announcement of the proposed acquisition of 70% of Los Lirios, an open pit antimony mine in Oaxaca state Mexico. The Coyote Creek Project fits with EVR’s preference to develop an Americas antimony division based upon open pit mining opportunities. (See ASX announcement “Acquisition of Los Lirios Antimony Mine (EVR 70%) Mexico” dated 28th January 2025).

Background to Coyote Creek Antimony Project

The demand for raw materials for the defense effort during the 2nd World War prompted a review of the Coyote Creek Project, and field work including trenching was conducted between November 1941 and February 1942.

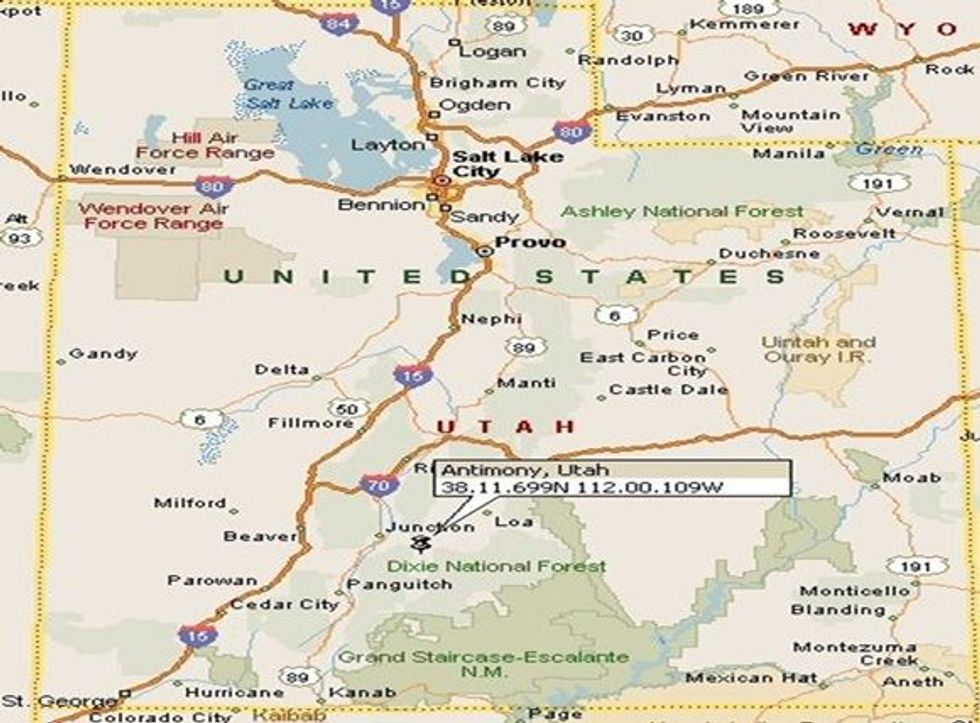

Location

The Coyote Creek claims are located in Garfield County, Utah, 11km east of the town named Antimony. The Canyon in which it is located is referred to variously as Coyote Creek Canyon or Antimony Canyon. Access to the project is via paved roads and then unpaved forestry roads navigable with a low clearance vehicle.

Click here for the full ASX Release

This article includes content from Ev Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00