Investment Insight

Walker Lane Resources (TSXV:WLR) is positioned as a high-upside, low-overhead explorer focused on unlocking value in North America's most exciting mineral belts. With a clean and tightly held capital structure, a strategic rebrand, and one of the most qualified technical-financial teams in the junior mining space, WLR offers investors:

- Exceptional value, leverage potential that could result from a high-grade discovery

- A diversified exploration portfolio that supports year-round exploration and will result in active news flow

- Multiple Tier 1 analogs across flagship projects

- A focus on exploring and drilling high grade gold and silver projects in established and leading mineral jurisdictions that have supportive permitting regimes

In a market hungry for discovery stories and premium-grade assets, WLR stands out for its strategic discipline, operational tempo, and potential to generate significant value from early-stage exploration success.

Overview

Walker Lane Resources (TSXV:WLR), formerly known as CMC Metals, is a North American exploration company strategically focused on discovering and monetizing high-grade, scalable gold, silver and polymetallic deposits. With a recently consolidated and tightly held capital structure, the company is designed for efficiency, leverage to discovery, and maximized investor value.

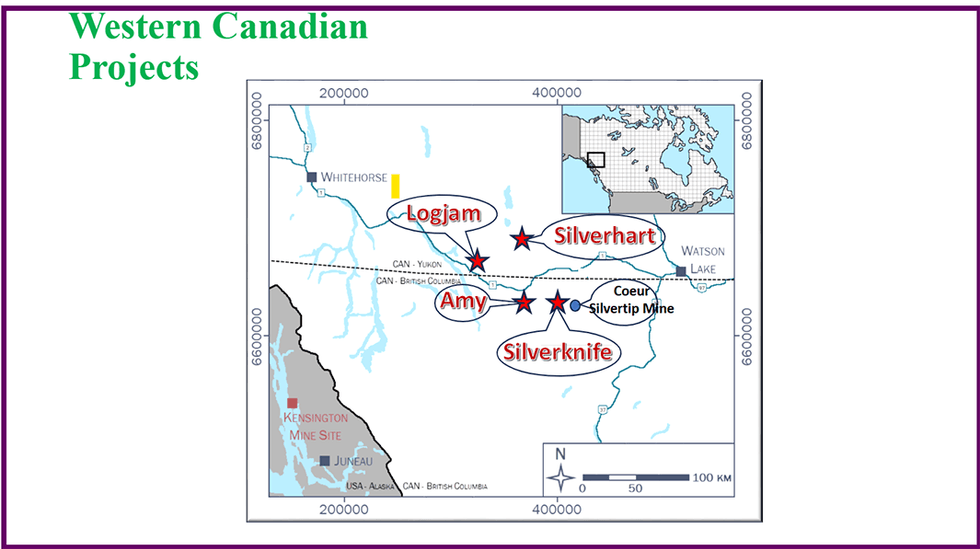

Walker Lane Resources holds a diversified and complementary portfolio of early-stage to early- advanced stage exploration projects across two of the most prolific mining regions in North America: the Walker Lane Trend in Nevada, USA, and the mineral-rich terrains of British Columbia and the Yukon. By aligning its exploration schedule with seasonal conditions—working in Nevada during the fall, winter, and spring, and in northern Canada during the summer—WLR can maintain continuous, year-round exploration and news flow.

At the core of WLR's strategy is a disciplined capital approach emphasizing putting “money onto the ground” and a well-defined and value-generating vision: to uncover high-value mineral assets and position them for monetization or strategic acquisition, rather than long-term development.

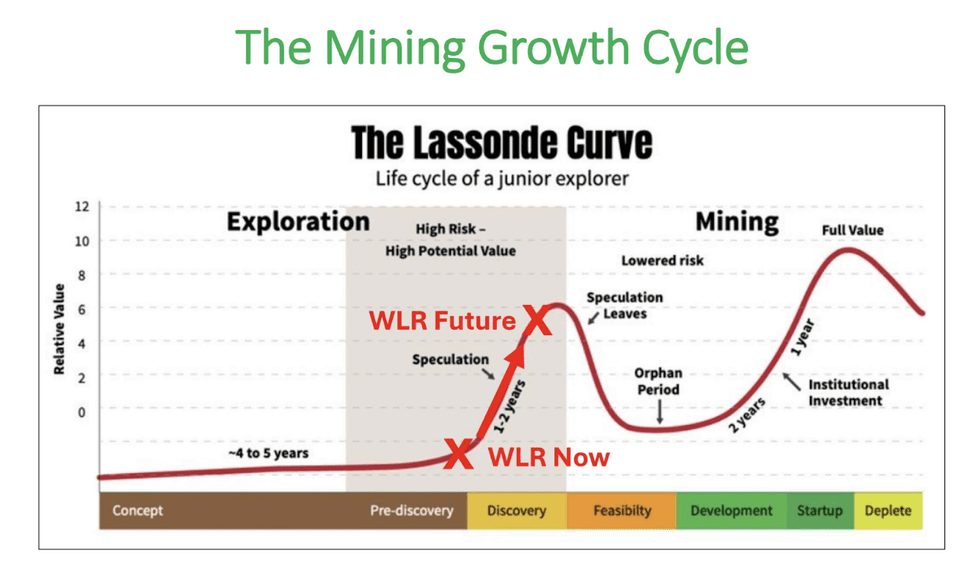

Walker Lane Resources is advancing along the mining growth cycle, moving from pre-discovery into the discovery phase where value creation accelerates. The company’s strategy is clear: build high-grade, advanced-stage assets that generate steady news flow, minimize dilution, and maximize shareholder value.

Recent steps include selling its Bishop, CA gold facility, securing a $6M option deal with Coeur Mining on its Silverknife Property in BC (with potential for another $3M), and plans to evaluate small-scale mining with sorting technology and a First Nations partnership at its Silver Hart Project in Yukon to generate medium-term cash flow.

As shown on the Lassonde Curve, WLR is positioned at the inflection point where discovery drives rapid value growth — setting the stage for short-term gains and long-term opportunity.

Vision and Strategy

Walker Lane Resources’ vision is to become a leading exploration company recognized for generating high-quality discoveries in top-tier jurisdictions. By focusing on projects with historical high-grade mineralization, underexplored potential, and favorable geological settings, the company seeks to create value through the drill bit and position its assets for acquisition or joint venture.

WLR’s strategy avoids costly development pipelines and instead leans into its core strengths: geoscience excellence, operational agility, capital discipline, and leveraging its advisory network for project advancement and strategic exposure.

Company Highlights

- Strategic Jurisdictions: Focused on Nevada's Walker Lane Trend—one of the most active and lucrative exploration corridors in the United States.

- Year-Round Exploration - Year-Round Project Work and News Flow: Seasonal dual-hemisphere operations provide constant catalysts, supporting sustained market engagement.

- Tight Share Structure: Post-consolidation structure ensures every dollar works harder for shareholders.

- Tier-1 Assets in Canada and USA: Two cornerstone properties with scalable, high-grade mineral potential (Tule Canyon - NV; Amy - B.C.), drilling planned for both projects in 2025, each with compelling surface results, historical workings, significant geological databases, and high-impact resource potential.

- Pipeline Assets in Canada and USA: Cambridge (NV) to be advanced to a drill decision by early 2026 and exploration efforts to be conducted at Silver Mountain-NV and Logjam – Yukon to advance them towards an eventual drill decision.

- Experienced Technical and Financial Team: Geologists, drill company operators, and financiers with a track record of exploration success and capital markets access.

- Clear Focus - Shareholders First: WLR is led by career explorers focused on discovery, value creation, and strategic exit or partnership opportunities.

Former Dark Secret Mine - Tule Canyon Property

Project Portfolio Overview

Walker Lane Resources operates seven key projects:

- Tule Canyon, Nevada (Gold-Silver)

- Amy, British Columbia (Silver-Lead-Zinc)

- Cambridge, Nevada (Gold)

- Silverknife, British Columbia (Silver-Lead-Zinc)

- Silver Hart, Yukon (Silver-Lead-Zinc)

- Silver Mountain, Nevada (Silver-Copper)

- Logjam, Yukon (Gold-Silver-Lead-Zinc)

These assets represent a mix of CRD-style and epithermal systems, each with historic mineralization, multiple mineralized zones, and district-scale exploration upside. Combined, they provide year-round operational capacity and a steady flow of exploration results.

Flagship Projects

Tule Canyon (Nevada)

Located in the heart of Nevada’s Walker Lane Trend—one of the hottest exploration corridors in the United States—Tule Canyon is a high-potential gold-silver mesothermal or orogenic target. The area contains extensive old workings, two former mines (Eastside and Dark Secret) developed to shallow depths, numerous high-grade surface samples in five identified zones, and has seen no modern drilling.

Highlights:

- Drill ready – geophysical targets defined under former mines and mineral showings

- Past production both placer and hard rock

- Mesothermal high grade gold and silver mineralization coincident with positive alteration and geophysical signatures over a 5km structural corridor

- Widespread gold and silver mineralization with surface grabs up to 31.8 g/t gold and 4,320 g/t silver and chip samples 40 meters @0.469 g/t gold

Tule Canyon exemplifies Walker Lane Resources' focus on high-grade opportunities in Tier 1 jurisdictions. The project’s location offers good infrastructure, year-round exploration potential, proximity to major producing mines and toll mills, and a supportive permitting regime

Former Eastside Mine – Tule Canyon Property

Amy (British Columbia)

The Amy project is a silver-lead-zinc carbonate replacement deposit (CRD) system in northern BC, in the same mineral district and in close proximity to Coeur Mining’s Silvertip Mine – one of the world’s highest-grade underground silver-lead-zinc-critical mineral deposits.

Historical drilling, two adits, and extensive surface work has identified high-grade silver-lead-zinc-antimony mineralization over a projected strike length of 2.7 kilometers in over 20 known veins at the Amy Prospect. Additional areas of prospectivity are also yet to be explored with modern exploration methods. The property geology is highly prospective for a high grade CRD discovery(ies).

Highlights:

- Drill program planned to test historic and newly interpreted targets

Proximal to Silvertip, one of the highest-grade silver-polymetallic-critical mineral mines globally, located within an extensive mineral district with the potential to host additional CRD deposits that typically form in clusters - A considerable database of geological, geochemical and geophysical data that is being used to identify guide future exploration efforts

- Historical grades* and recent surface sampling results comparable to Silvertip Mine grades

- The high-grade nature of this potential deposit is demonstrated from historical sampling of the east drift in the 4450 adit that produced 19.08 oz/t silver, 0.64% lead and 7.78 percent zinc along a strike length of 35 feet in a vein with a width of 5 feet*.

* Note these historic results have not been verified by Walker Lane Resources Ltd. or its Qualified Person and therefore should not be relied upon

Adit at 4200 level – Amy Prospect

Samples from Amy

Amy is not just a satellite play—it’s a serious contender in a prolific CRD belt. Its potential for discovery and monetization is amplified by its strategic location, very high-grade potential, road accessibility, and growing interest from major miner Coeur Mining Inc. who are a potential ready buyer as they have negotiated a right of first refusal for the property with Walker Lane Resources.

Pipeline Projects

Cambridge (Nevada)

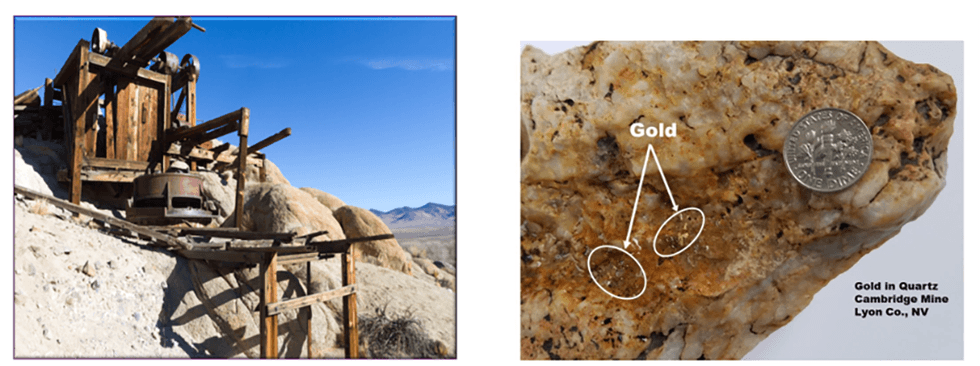

Cambridge is a historically mined, mesothermal high-grade gold project that features visible, museum-class gold mineralization. The gold mineralization occurs in veins within shears and is associated with copper, lead, antimony and other sulfides. The project is underexplored, despite extensive old workings and documented historic production.

Highlights:

- Grab sampling on the property collected 68 samples of which 20 (29 percent) of the samples assayed greater than 5 g/t gold indicating potential for widespread average to high grade mineralization

- Recent geophysical work (total magnetic and radiometric surveys) identified magnetic trends coincident with known bedrock gold mineralization

- Geochemical soil surveys identified numerous gold-in-soil anomalies

- Limited modern exploration, providing strong first-mover advantage

- Favorable location within the Walker Lane Trend

Cambridge offers compelling blue-sky potential. It reinforces WLR’s Nevada strategy and is a prime candidate for detailed mapping, trenching, old mine dump recoveries, and is a near term candidate for possible future drilling.

Former Cambridge Mine and gold samples, Walker Lane Gold Trend, Nevada

Silver Mountain (Nevada)

Silver Mountain comprises of two claim areas close to Tule Canyon, that contain vein-hosted high-grade mesothermal to deep epithermal silver targets. The property has been subjected to historical small-scale mining and chip samples have produced 0.6 meters of 1,415 g/t silver and 0.48 percent copper.

Silver Hart (Yukon)

Silver Hart features high-grade surface CRD-style mineralization in the northern part of the Rancheria Silver District that is host to the Silvertip Mine Deposit. Plans are to evaluate known open-pittable deposits for small scale seasonal mining utilizing ore sorting technologies to transport upgraded ore concentrates to a mill for processing.

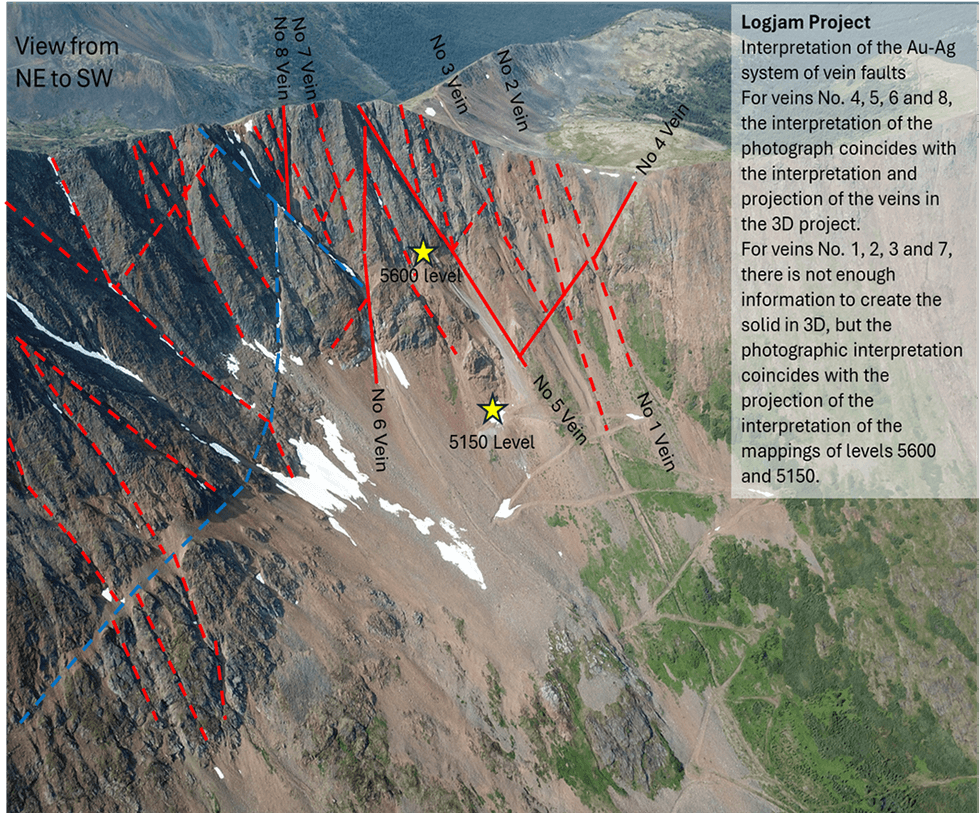

Logjam (Yukon)

Logjam is a high-grade gold-silver-polymetallic epithermal target that is road accessible. It consists of numerous high-grade epithermal gold veins with significant silver and base metal content occur over a large areal width. It has two former adits where significant intercepts of mineralization have been reported but are not yet verified.

Logjam Project, south-central Yukon.

Silverknife (British Columbia)

Located immediately adjacent to the Silvertip Mine, Silverknife is a high-grade silver-lead-zinc target with known mineralization and geophysical anomalies. The property has been optioned to Coeur Mining Inc. who are the operator of the property and who are required to incur approximately $6 million in expenditures and payments by 2027 to earn a 75 percent interest in the property and additional expenditures and/or payments up to $3 million to earn the remaining 25 percent interest. Walker Lane Resources retains a net smelter royalty right of 1 percent on the property.

In 2025, Walker Lane Resources launched a fully funded drill campaign at its Silverknife Property through Coeur Silvertip Holdings, a subsidiary of Coeur Mining. This initial program will test the potential western extension of known geology and mineralization in the Silverknife Central Zone, with five holes totaling 1,200 meters.

Year-Round Exploration and News Flow

One of Walker Lane Resources’ key advantages is its ability to maintain year-round exploration. By operating in Nevada during the fall, winter, and spring, and shifting to BC and Yukon during the summer, the company maximizes news flow, maintains operational momentum, and improves capital efficiency.

This continuous cycle of exploration activity supports investor engagement and facilitates data-driven decision-making across the portfolio.

Silver Bowl Adit – Silver Mountain Property

Management and Advisory Team

Walker Lane Resources is led by a deeply experienced team whose backgrounds are directly aligned with the company’s exploration-focused mandate.

Kevin Brewer - Director, CEO and Interim Chairman

Kevin Brewer is a veteran geologist and mining executive with over 25 years of experience in mineral exploration, project development, and corporate leadership. He holds multiple degrees in geology and business and has led exploration and evaluation programs for gold, silver, base metals, and critical minerals across North America. Kevin is known for his deep technical expertise, strategic capital management, and his experience in advancing exploration projects from the grassroots stage through to preliminary feasibility assessment. He is a “hands-on” leader and the driving force behind Walker Lane’s vision for focused, cost-effective exploration and disciplined project development.

Douglas Coleman - Director and Corporate Secretary

Douglas Coleman is president and founder of Mexico Mining Center and Discoveries Conference and a geologist for 40 years with considerable experience with exploration management and mineral deposits in Mexico and southern United States. Previously operated a mineral consultancy firm with drilling and logistical services and has worked with numerous exploration companies.

Jose Manuel Delgado Canedo - Director and Chief Financial Officer

Jose Manuel Delgado Canedo is a lawyer and chartered accountant specializing in providing services to the mining sector in Mexico.

Cesar Symonds - Project Geologist

Cesar Symonds has a Bachelors in Geology from the Universidad de Sonora. He has 15 years of experience with a variety of mineral exploration and mining companies including Compania Minera Condor, First Majestic Silver, Sonoro Metals, and CMC Metals. Symonds is a specialist in epithermal, porphyry and carbonate replacement deposits.

Debra Olafson - Paralegal

Debra Olafson has over 30 years of paralegal experience and assisting mining companies deal with regulatory and corporate filings, and transactions.

This integrated technical-financial team model enables the company to move quickly from concept to drill with strong oversight, minimal overhead, and a laser focus on discovery.