Investor Insight

As demand for copper continues to rise, driven by global electrification trends, Los Andes Copper is well-placed to leverage its significant copper position in Chile, driven at the helm by a group of highly experienced technical and business leaders.

Overview

The global electrification trend is driving strong growth in copper demand, with experts expecting copper markets to remain in deficit through 2026 due to supply constraints and rising demand for electrification, supporting a bullish medium-term price outlook.

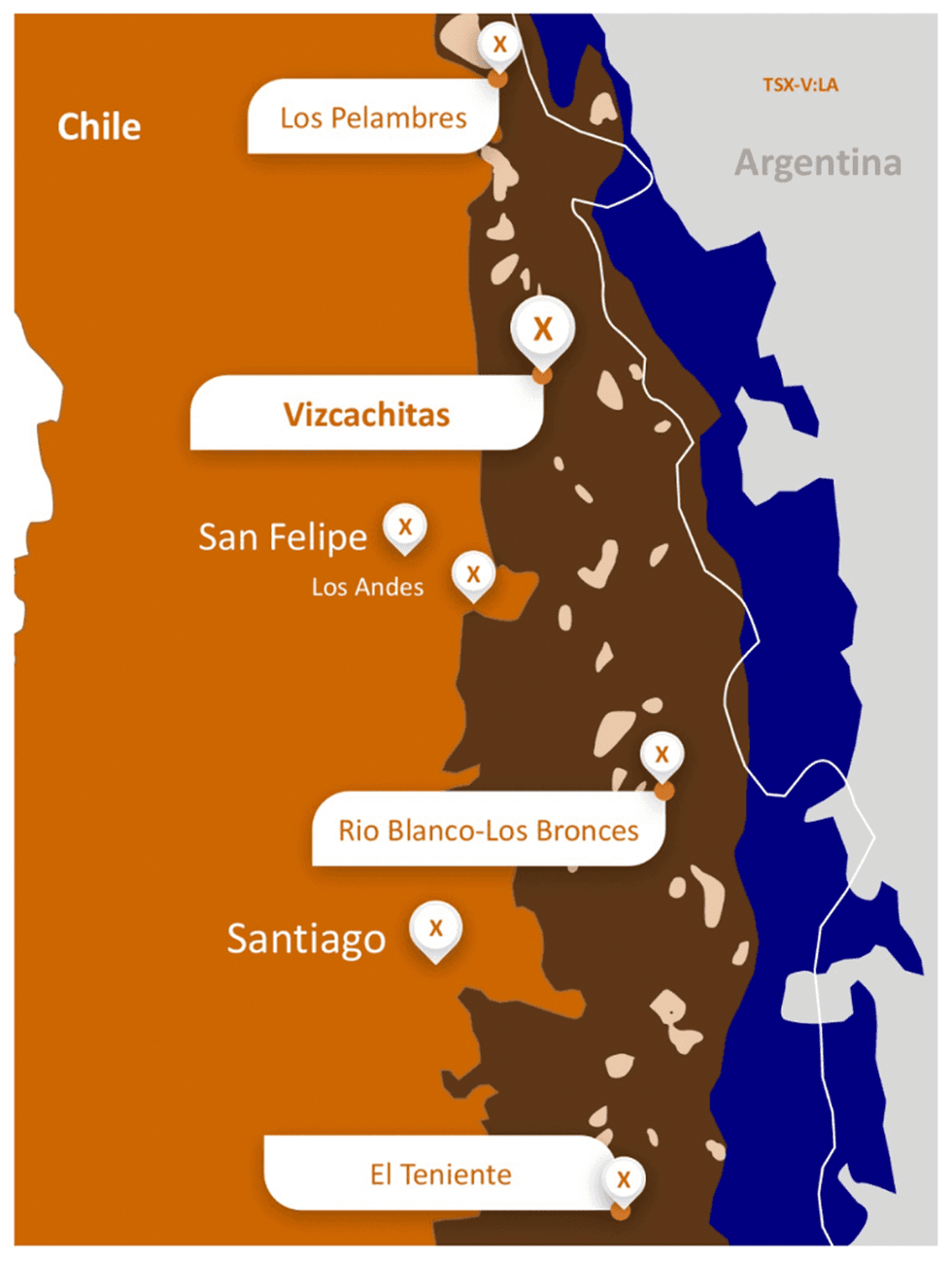

Against this backdrop, Los Andes Copper (TSXV:LA;OTCQX:LSANF) is advancing its 100 percent-owned Vizcachitas copper-molybdenum project in Chile, one of the largest undeveloped copper assets not controlled by a major mining company. Led by an experienced management team, the company is strategically positioned to play a meaningful role in supplying copper to a rapidly electrifying global economy.

The company filed a positive pre-feasibility study in 2023 indicating US$2.78 billion after-tax net present value (NPV) using an 8 percent discount rate and an internal rate of return (IRR) of 24.2 percent at US$3.68/lb copper, US$12.90/lb molybdenum and US$21.79/oz silver, with an estimated initial capital cost of US$2.44 billion. The PFS also highlighted a construction period of 3.25 years and a payback period of 2.5 years from the initial production date.

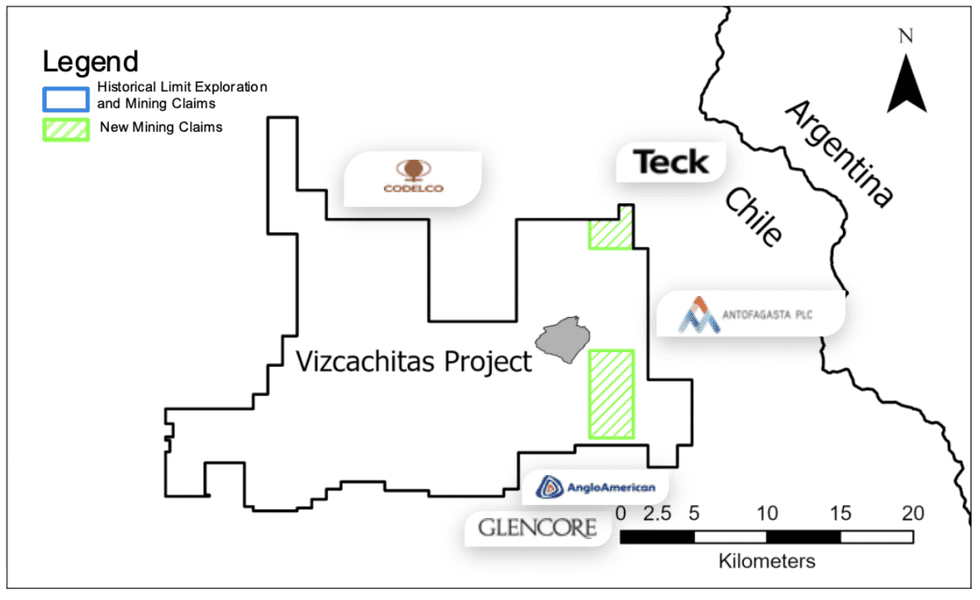

The company expanded its land package by obtaining first-priority exploration claims over new areas within and adjacent to the current property boundaries for the Vizcachitas copper project.

The claims cover an 18 sq km block within the current property boundary, and another 7 sq km block adjacent to the north-east corner of the property boundary.

The Vizcachitas project, including the claim blocks they added in April 2025 is surrounded by mining majors

Los Andes works closely with the local community to support the development of local businesses and social organizations. The company has joined the Association of Small Miners of Putaendo and has established several programs to support social organizations, local technical high schools and female entrepreneurs. Los Andes is also environmentally aware and strives to maintain an excellent ESG rating.

The company’s management team is experienced in the natural resources industry, including experts in geology, community affairs, and corporate finance.

Company Highlights

- World-Class Copper Developer: Los Andes Copper is advancing the Vizcachitas Copper Project in Chile, the largest advanced copper project in the Americas, wholly owned by a junior miner, with exceptional blue-sky exploration upside.

- Strong Financial Support: The company has secured US$34 million in strategic investment, including US$14 million from Queen’s Road Capital and US$20 million from Ecora Resources, to support ongoing development.

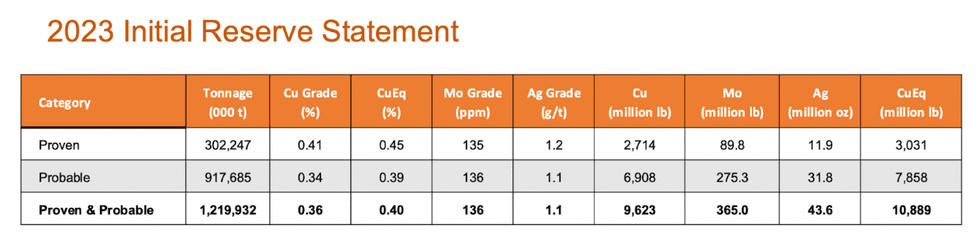

- Robust Resource & Reserve Base: Vizcachitas hosts 11 billion lbs CuEq Initial Reserves, plus 15 billion lbs CuEq measured and indicated resources and 15 billion lbs CuEq Inferred Resources (resources inclusive of reserves).

- Compelling Project Economics: The 2023 Pre-Feasibility Study outlines strong economics with a post-tax NPV₈ of US$2.78 billion and 24 percent IRR at US$3.68/lb copper, increasing to a post-tax NPV₈ of US$4.5 billion and 32 percent IRR at US$4.50/lb copper.

- Tier-1 Mining Jurisdiction: Located in Chile’s premier copper belt

and surrounded by which hosts four of the world’s largest copper mines, there is access to excellent infrastructure and operational advantages. - 100 Percent Ownership & Strategic Flexibility: The project is fully owned with no strategic encumbrances, providing maximum optionality for development or partnership.

- ESG & Community Focus: The company maintains a strong ESG profile, working closely with local communities while minimizing environmental impact throughout project development.

- Experienced Leadership: Led by a highly experienced management team with deep technical, operational, and capital markets expertise across the mining industry.

Key Project

Vizcachitas Copper Project

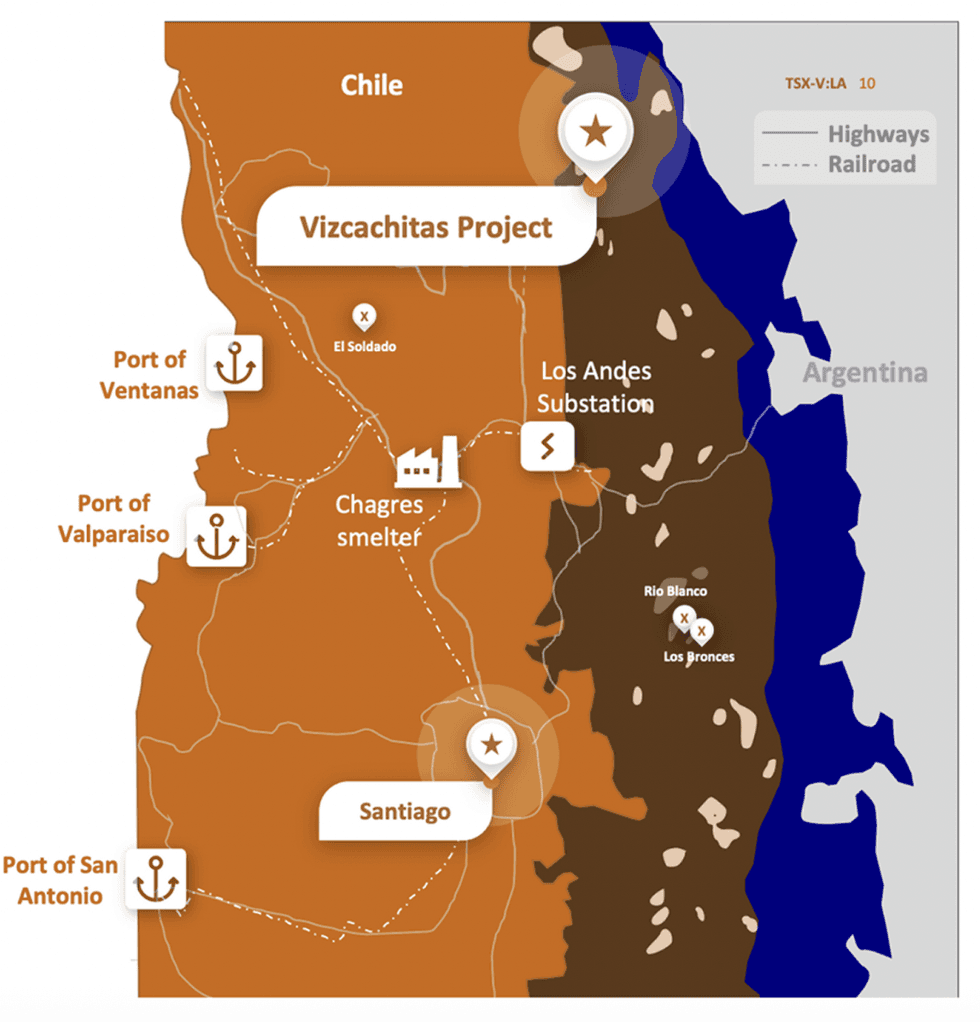

The 100-percent-owned Chilean Vizcachitas copper project is one of the largest advanced copper deposits in the Americas and the largest deposit owned 100 percent by a junior miner. The project is located in the Rio Rocin Valley, roughly 150 kilometers northeast of Santiago.

Project Highlights:

- Strong Existing Infrastructure: The project is accessed by a 124-kilometer paved highway, a nearby railway and shipping ports. Due to the presence of existing copper mines, smelting facilities are accessible by railway. Additionally, there are multiple large power substations near the project.

- Completed PFS: 2023 Pre-Feasibility Study results indicated:

- Strong Project Economics: The Vizcachitas Project boasts an after-tax NPV of US$2.78 billion (8 percent discount rate) and an impressive internal rate of return (IRR) of 24.2 percent at metal prices of US$3.68/lb copper, US$12.90/lb molybdenum, and US$21.79/oz silver. Initial capital expenditure is estimated at US$2.44 billion.

- Efficient Development Timeline: The project is expected to have a construction period of 3.25 years and a rapid payback period of just 2.5 years from the start of production.

- Resource Growth: Since the June 2019 Preliminary Economic Assessment (PEA), measured and indicated resources have increased by 16 percent to a total of 14.8 billion pounds copper equivalent (CuEq).

- Robust Resource Base:

- Measured Resources: 2.61 billion lbs copper, 84 million lbs molybdenum, and 11 million oz silver.

- Indicated Resources: 10.42 billion lbs copper, 442 million lbs molybdenum, and 43 million oz silver.

- Inferred Resources: Increased by 130 percent to 15.4 billion lbs CuEq (including 13.75 billion lbs copper, 495 million lbs molybdenum, and 55 million oz silver).

- Commitment to ESG Excellence: The Prefeasibility Study (PFS) incorporated advanced sustainable mining practices, resulting in a 50 percent reduction in water usage and a 25 percent reduction in energy consumption. The project confines operations to a single valley, uses desalinated water for sustainability, and fosters strong community partnerships.

- Strategic Royalty Agreement: Los Andes Copper secured a US$20 million royalty agreement with Ecora Resources, a leading investor in future-facing commodities. The deal grants Ecora a 0.25 percent net smelter return (NSR) royalty on open-pit operations and a 0.125 percent NSR on underground production.

- Permit to Resume Drilling: The Second Environmental Court of Chile has ruled that Los Andes Copper has fully met the conditions imposed in July 2022 and is now authorized to restart drilling activities at Vizcachitas.

Los Andes Copper plans to commence commercial operations in 2031. With a sustainable design, low water and power use and a minimal footprint, Vizcachitas is positioned to rival Chile’s top copper operations.

Management Team

Santiago Montt - CEO

With 11 years of experience in the mining sector, Santiago Montt has a law degree from the University of Chile, a J.S.D. law degree (PhD) from Yale University, and a Master's in Public Policy from Princeton University. He has worked for BHP from 2011 to 2021 in various roles: vice-president of corporate affairs for the Americas, VP of ligation (Global), VP of legal Brazil, and VP of legal copper. He is an experienced professional in the areas of stakeholder management, risk management, crisis management, project management and commercial and legal affairs.

Manuel Matta - Senior Mining and Project Consultant

Manuel Matta is a mining engineer from the University of Chile, with more than 30 years of experience in operations, planning and projects. He worked for Falconbridge and Xstrata as vice-president of projects and development where he led the expansion of the Collahuasi mine. He was also the general manager of Altonorte Smelter in Chile. Matta also worked for Barrick Gold in Chile and the Dominican Republic and was the general manager of Las Cenizas copper mines in Chile.

Antony Amberg - Chief Geologist

Anthony Amber is a chartered geologist with 32 years of diverse experience working in Asia, Africa, and South America. Amberg is a qualified person under NI 43-101. He has managed various exploration projects ranging from grassroots through to JORC-compliant feasibility studies. In 2001, he returned to Chile, where he started a geological consulting firm specializing in project evaluation and NI 43-101 technical reports. He began his career in 1986 working with Anglo American in South Africa before moving on to work for the likes of Severin-Southern Sphere, Bema Gold, Rio Tinto and Kazakhstan Minerals Corporation.

Ignacio Melero - Director of Corporate Affairs and Sustainability

Ignacio Melero is a lawyer with a degree from Pontificia Universidad Católica de Chile with vast experience in corporate and community affairs. Before Los Andes, Ignacio was responsible for community affairs at CMPC, having managed community and stakeholder affairs for a number of its pulp and forestry divisions throughout the country. Ignacio has worked for the Government of Chile, in the Ministry General Secretariat of the Presidency. He was responsible for the inter-ministerial coordination of the ChileAtiende project, a multi-service network linking communities, regional governments and public services.

Harry Nijjar - Chief Financial Officer

Harry Nijjar holds a CPA CMA designation from the Chartered Professional Accountants of British Columbia and a Bachelor of Commerce from the University of British Columbia. He is a managing director of Malaspina Consultants. Nijjar has been working with public and private companies for the past 10 years in various roles. He is also currently the CFO of Darien Business Development and Clarmin Explorations.